French Fresh Produce continues to play a central role in daily food habits. The country has a strong culinary culture built around fresh fruits and vegetables, seasonal cooking, and regionally distinct growing traditions. But the environment around fresh produce has changed. Weather patterns, cost pressures, retail strategies, and shopper expectations are reshaping how produce is grown, moved, and sold.

These changes are not dramatic or explosive. They are gradual. Yet, they are meaningful for the way the French fresh produce market will look and feel in 2026.

Note: This article is based on market observations and agricultural reporting from FranceAgriMer, combined with ongoing trade discussions within the French food retail sector. We are not making anything up.

The goal is to present a clear, practical view of the market for suppliers, retailers, and fresh produce teams working in France.

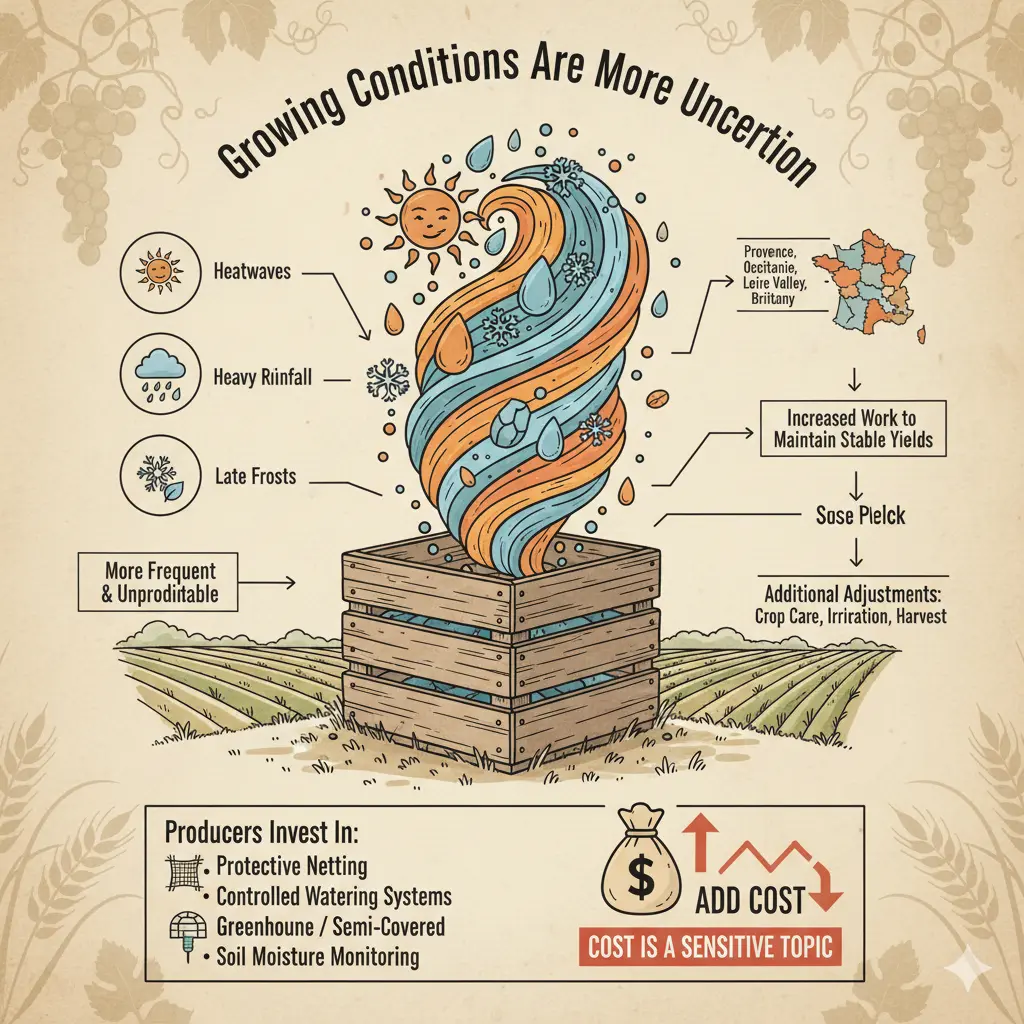

Growing Conditions Are More Uncertain

Producers across France have faced more irregular growing conditions in recent years. Heatwaves marked some seasons, while others saw heavy rainfall or late frosts. None of these is new individually. What is new is how often they occur and how unpredictable they have become.

According to market updates from FranceAgriMer, growers in regions such as Provence, Occitanie, the Loire Valley, and Brittany have had to make additional adjustments to crop care, timing, irrigation, and harvest planning. The work to maintain stable yields has increased.

Some producers have invested in:

-

Protective netting

-

Controlled watering systems

-

Greenhouse or semi-covered farming

-

Soil moisture monitoring

These systems help, but they also add cost. And cost is already a sensitive topic across the supply chain.

Domestic And Imported Produce Work Together

France has always had a mix of domestic and imported produce. That balance is continuing, but the strategy around it is evolving.

Domestic supply remains the core of the French fresh produce identity. It carries trust, familiarity, and cultural value. When a product is in season and French-grown, retailers consistently highlight it. Signage in stores increasingly focuses on region-level identity, not just “Origine France”. Labels such as “Hautes-Alpes”, “Bretagne”, or “Val de Loire” help shoppers make emotional and culinary connections.

But some categories cannot be year-round or broadly sourced from French growers. Bananas, citrus, tropical fruits, counter-seasonal berries, off-season tomatoes, and certain leafy greens still require imports. This is normal. It is not seen as a weakness. It is part of how the French market remains consistent across the year.

What is changing is how retailers balance these origin sources. There is a quiet push toward:

-

Domestic first

-

Nearby European supply the second

-

Global supply where needed

The tone is subtle, neither nationalistic nor aggressive. It is simply practical.

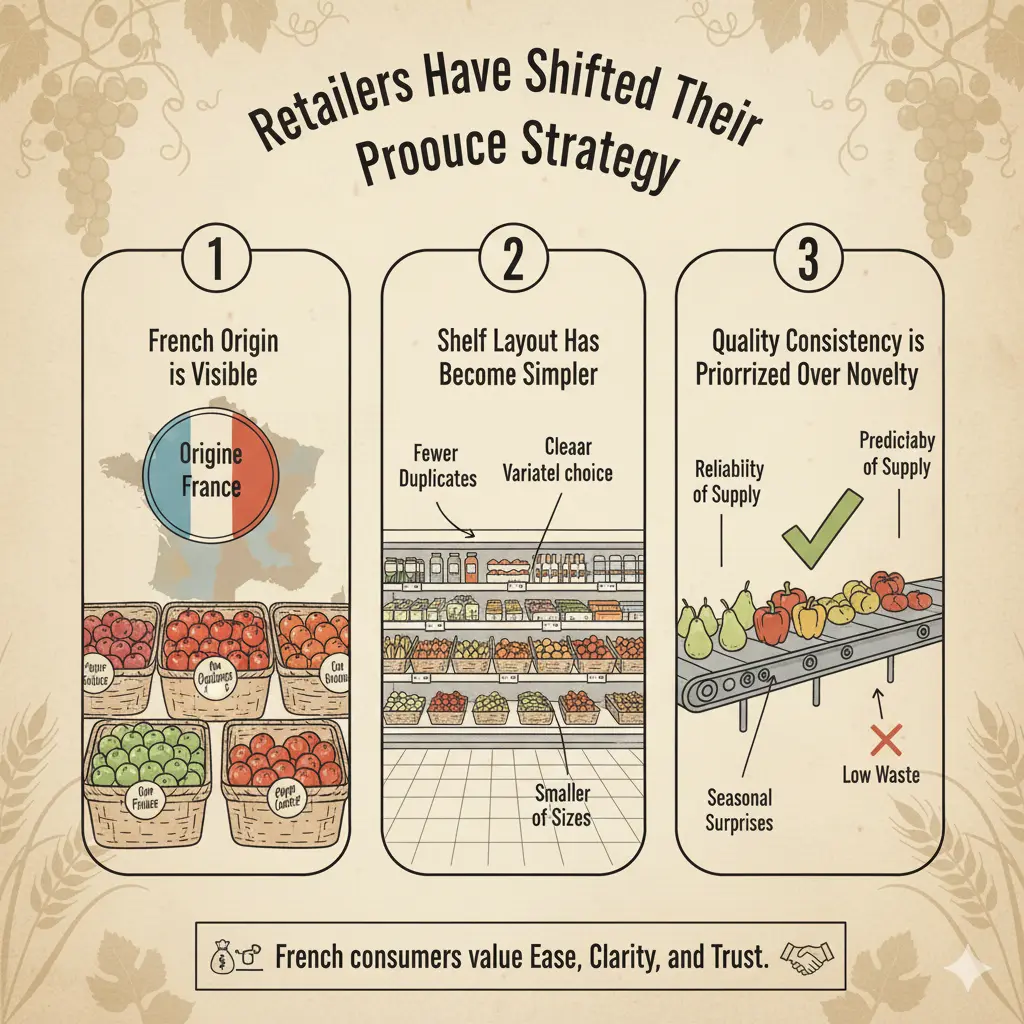

Retailers Have Shifted Their Produce Strategy

Supermarkets in France are not using the same fresh produce strategies they used ten years ago. Category managers and buying teams have adjusted shelf planning, supplier contracts, pricing tiers, and promotional rhythm.

Three apparent shifts can be seen:

1) French origin is visible

Not in every SKU — but where it exists, it is highlighted. Retailers do not need to shout “local”; French consumers already know how to read regional labels.

2) Shelf layout has become simpler

Instead of overwhelming displays, many produce sections now favor clarity: fewer duplicates, clearer varietal choice, and a smaller range of sizes.

3) Quality consistency is prioritized over novelty

Retailers are more focused on reliability of supply, predictable quality, and low waste. Significant seasonal surprises are less common.

This approach reflects the market’s maturity. French consumers already understand fresh produce. They value ease, clarity, and trust more than constant new product concepts.

Consumer Demand Is Changing Quietly

French consumers still see fruits and vegetables as essential. However, the way they buy them is shifting.

Households are making more frequent but smaller purchases. Shoppers avoid waste and buy what they need for two or three days at a time. Many choose stores close to their home or workplace rather than doing one big weekly shop.

Younger consumers — particularly students and working young adults — behave differently from older households. They do not have long-standing loyalty to one retailer. They choose based on convenience, familiarity with neighborhoods, and perceived freshness.

But across all age groups, two expectations stand out:

-

Clear pricing

-

Freshness that lasts at home for several days

If freshness fails, trust declines quickly.

If pricing feels unclear, shoppers switch retailers.

Produce is emotional.

Seasonality Still Matters In France

Seasonal eating has cultural depth in France. Many households still look forward to the first strawberries of spring, summer tomatoes, autumn apples, and winter citrus.

Retailers are aware of this emotional rhythm. Seasonal displays are more than just product promotions; they are cultural touchpoints.

But there is a shift happening. Seasonal produce is increasingly supported by:

-

Storage capacity improvements

-

Greenhouse and semi-covered farming

-

Cross-European supply alignment

This means that the transition between seasonal periods is smoother — but it also means the line between “peak season” and “available but not peak” is blurrier.

Retailers must communicate carefully to maintain authenticity.

Convenience Formats Are Growing Slowly But Surely

Pre-washed salads, ready-to-cook vegetables, cut fruit mixes, and small snack packs are gaining traction. The growth is not explosive, but it is steady.

The main appeal is life simplification, not indulgence. Many French households still cook daily. Convenience produce does not replace cooking — it shortens prep time.

Growth is strongest in:

-

Urban areas

-

Households with two working adults

-

Younger consumer groups

-

School lunch boxes and workplace snacks

This segment will likely keep expanding, slowly but steadily.

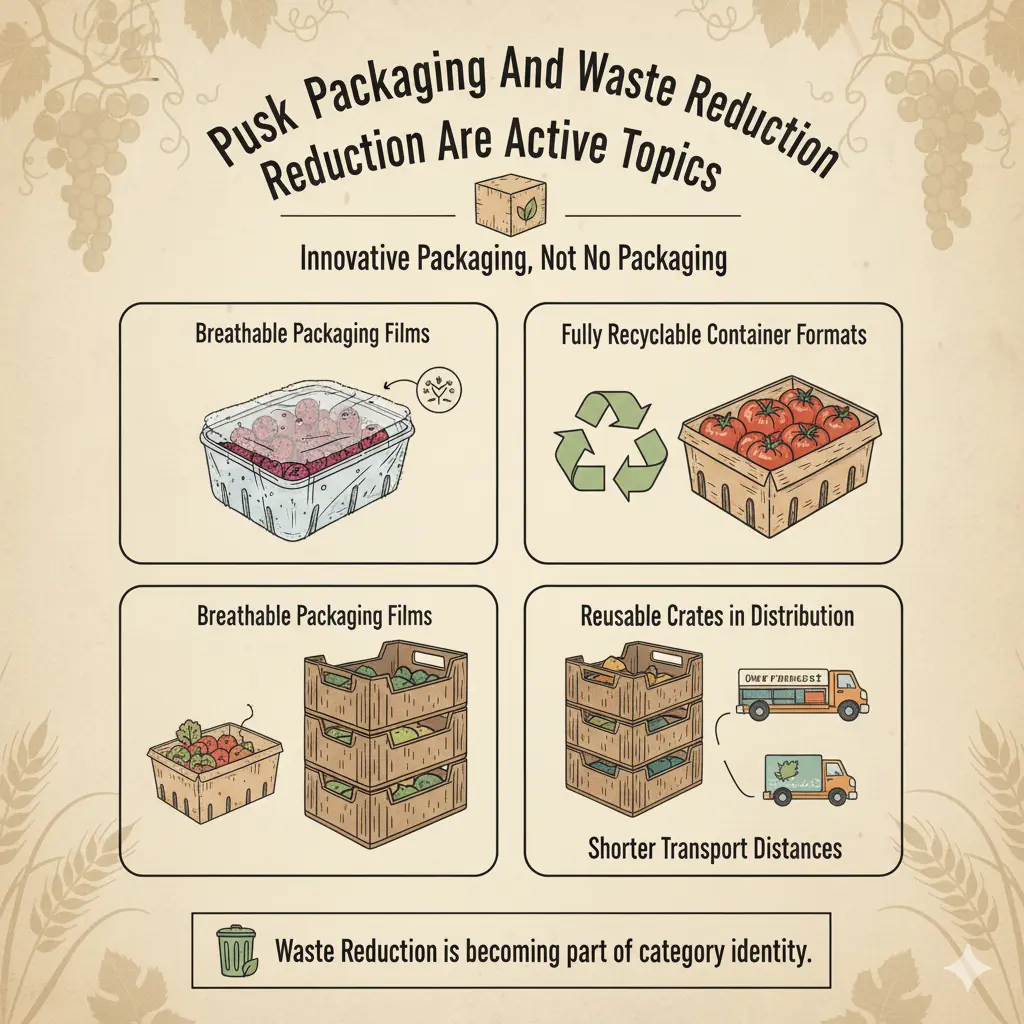

Packaging And Waste Reduction Are Active Topics

France has strong social awareness around waste. Retailers and suppliers are adjusting packaging formats to reduce unnecessary material and improve recyclability.

But packaging cannot simply disappear. Produce needs protection, moisture control, and shelf-life stability. The discussion is about innovative packaging, not no packaging.

Retailers and growers are testing:

-

Breathable packaging films

-

Fully recyclable container formats

-

Reusable crates in distribution

-

Shorter transport distances to reduce spoilage

Waste reduction is becoming part of category identity.

Wholesale Markets Still Play A Central Role

Large wholesale markets such as Rungis remain essential for the French produce system. Early-morning trading, regional sourcing networks, and long-term importer relationships work together to ensure reliable supply.

This system is not being replaced by direct retail sourcing; instead, both structures coexist. The flexibility offered by wholesale hubs remains valuable when weather or logistics disrupt planned supply.

What Success Looks Like For Retailers And Suppliers

The French fresh produce market in 2026 rewards companies that:

-

Work closely with growers

-

Maintain consistent product quality

-

Communicate the origin honestly

-

Respect seasonal rhythms

-

Keep pricing reasonable and clear

-

Manage waste through careful forecasting

There is no single breakthrough strategy.

The winners will be those who do the fundamentals well, every week, every season.

Looking Forward

The French fresh produce market is not moving fast, but it is moving with intention. Change is guided by practicality, not trend cycles. The core values of freshness, trust, and region remain.

By 2026, fresh produce in France will likely feel:

-

Slightly more local where possible

-

Slightly more convenient for everyday routines

-

Slightly more stable in pricing and availability

-

Slightly more honest in how it is communicated to shoppers

Not dramatic.

Not disruptive.

But meaningful.

Fresh produce in France is evolving in a quiet, grounded, realistic way — and that is exactly why the changes matter.