The Asia fresh produce market continues to change. The shift is not loud or sudden. It is steady. Shoppers across Asia are adjusting how they buy fruit and vegetables, where they buy them, and what they prioritize. Retailers are responding by refining sourcing, improving cold-chain reliability, expanding convenience formats, and using digital touchpoints more effectively.

Grocery culture in Asia is diverse. Countries differ in climate, cuisine, agricultural systems, and levels of retail development. Yet, several patterns are emerging across regions. These patterns are shaping how fresh produce is grown, distributed, and sold in 2026.

Note: This article is based on ongoing trade discussions, retailer observations, and regional market reporting across Asia, including insights commonly covered in AsiaFruit and FruitNet.

We are not making anything up. The goal is to present a clear, practical picture of how consumption of fresh produce is shifting across Asian markets in 2026.

The Move Toward Quality And Freshness Consistency

In many Asian cities, shoppers visit supermarkets or markets more frequently than in Western regions. Produce is bought to be eaten soon — sometimes the same day. This means shoppers look closely at freshness, appearance, firmness, and shelf life—the visual and tactile experience matters.

Consumers have also become more critical of consistency. If a supplier or retailer delivers unpredictable quality, shoppers switch. The loyalty is not guaranteed. It is earned every week.

Retailers are reacting to this by:

-

Developing closer relationships with growers

-

Increasing direct sourcing

-

Improving quality control and cold chain timing

-

Reducing handling steps

This is visible in both premium and mainstream retail settings.

Origin Is Becoming A Stronger Story

Across Asia’s fresh produce markets, shoppers increasingly want to know where fruit and vegetables come from. For some, origin is linked to trust. For others, it is related to taste or cultural familiarity. The original signal can be a country, a region, or even a specific production zone.

Examples of consumer preferences visible across markets:

-

In cities with growing middle-class households, imported fruit can signal prestige or reliability.

-

In markets with strong local agriculture, domestic origin signals freshness and cultural connection.

-

In countries where climate impacts are raising supply variability, controlled-environment and greenhouse-grown produce signal stability.

Origin identity is not one message across Asia. It is a local interpretation of trust.

Fresh Produce As A Symbol Of Health And Daily Well-Being

Across Asia, fresh produce is closely linked to health, family care, and a balanced approach to meals. In many households, cooking with vegetables is a daily practice, not an occasional choice.

In recent years, many consumers have become more deliberate about “eating cleaner.” They are not looking for complicated health claims. They want:

-

produce that feels fresh

-

easy to prepare

-

and that supports everyday health

Parents often purchase fruit for children’s lunchboxes. Young adults choose cut fruit or small packs for workplace or on-the-go snacks. Older shoppers frequently evaluate vegetables based on ease of cooking and the ability to support traditional dishes.

Health is not a trend.

It is a habit embedded in daily life.

Convenience Is Quietly Growing

Convenience formats in Asia are not replacing home cooking. Instead, they are shortening preparation time. This is especially evident in cities with long commutes or dual-income households.

Categories growing steadily:

-

Washed and ready-to-cook vegetables

-

Mixed salad bowls

-

Pre-cut fruit packs

-

Stir-fry mixes designed for 10-minute meals

Convenience is not marketed loudly. It grows because it is useful.

In highly urban areas, convenience can be the difference between cooking at home and ordering delivery. This is shaping how retailers merchandise refrigerated produce.

The Rise Of Online And Hybrid Purchase Behavior

Online grocery adoption in Asia has grown faster than in many other regions. In some cities, ordering fresh produce through apps or online platforms is now routine. But this does not replace physical retail. Instead, it creates a hybrid behavior:

-

Shoppers buy staple produce online for convenience.

-

They buy “special” or “freshness-critical” produce in person.

This hybrid approach influences how retailers stock, price, and promote produce.

Online convenience pairs with offline trust.

Supermarket vs Traditional Market Dynamics

Traditional markets remain a key part of the Asia fresh produce market. They offer:

-

personal relationships with sellers

-

the ability to inspect produce directly

-

cultural routines around shopping

However, supermarkets and modern grocery formats are gaining share in areas where:

-

cold chain is improving

-

Price expectations are stabilizing

-

Shoppers value convenience, air-conditioning, and predictability

Both formats will continue to coexist — but the balance shifts as urbanization increases and household routines change.

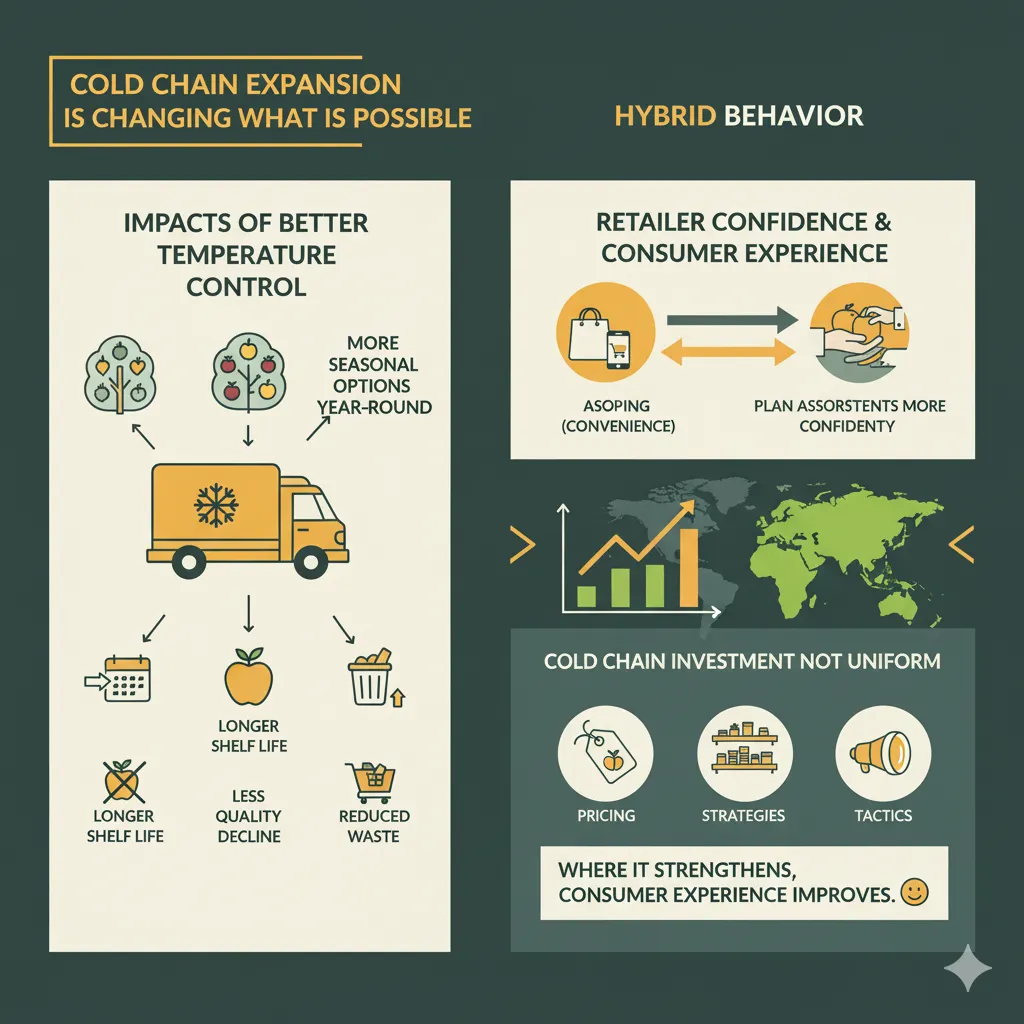

Cold Chain Expansion Is Changing What Is Possible

Cold chain improvements across Asia are slowly transforming which produce can be sold consistently. Better temperature control from farm to shelf means:

-

longer shelf life

-

less visible quality decline

-

reduced waste

-

More seasonal options are available year-round

This allows retailers to plan assortments more confidently.

Cold chain investment is not uniform across Asia.

But where it strengthens, consumer experience improves.

Price Sensitivity Remains Strong

Price remains a deciding factor. When produce prices rise rapidly, many consumers react immediately:

-

switching varieties

-

choosing different formats

-

reducing quantity

-

shifting between retail channels

Promotions still play a significant role in driving basket decisions. In regions where wages have not kept pace with the cost of living, price clarity is critical.

Retailers that communicate simple, transparent value perform better.

Younger Shoppers Think Differently

Younger consumers in Asia bring new behavior patterns:

-

They are less tied to one store

-

They experiment more with imported produce

-

They are more likely to try convenience formats

-

They are influenced by visual exposure (mobile, videos, short-form content)

However, they are careful spenders.

They will try something new if the price is reasonable and the quality holds.

This generation is shaping the future of category development.

What This Means For Retailers

Retailers who want to grow their share in the Asia fresh produce market should focus on:

-

Consistency first

Reliability builds loyalty. -

Clear origin messaging

Tell the story simply — not as marketing language, but as clarity. -

Convenience that respects daily cooking patterns

Make life easier, don’t replace culture. -

Smooth online + in-store integration

Let customers move between both without friction. -

Pricing logic that feels fair and stable

Value-based pricing performs better than aggressive promotional swings.

What This Means For Suppliers

Suppliers who want to maintain and grow their presence in Asian markets should:

-

Strengthen partnerships with reliable cold chain and distribution operators

-

Communicate product quality in simple, practical terms

-

Support retailers with forecasting and planning

-

Offer formats suited to cooking habits, meal sizes, and household rhythms

Shoppers in Asia reward suppliers who respect their needs, not trends.

Looking Ahead

Asia’s fresh produce market will continue to grow, but not in one uniform direction. Each country, city, and demographic group adjusts for its own lifestyle, environment, budget, and culture.

What ties the region together is not sameness — it is a shared emphasis on freshness, practicality, and trust.

By 2026, the markets that perform strongest will be those that:

-

Communicate the origin clearly

-

maintain reliable quality

-

improve access through logistics

-

and make everyday life easier without changing cultural identity

The future of fresh produce in Asia is not about chasing novelty.

It is about delivering what feels right, every day, for the consumer who shops with intention.