Across the UK, supermarkets are re-engineering how they work.

From packaging and logistics to store energy use, the shift toward sustainability is no longer optional — it’s built into every business plan.

The supermarket sustainability strategy in 2025 goes far beyond recycling bins or reusable bags.

It now means reducing total emissions, tackling food waste, and investing in new systems that save both energy and money.

Tesco, Marks & Spencer, and Aldi are among those leading the transition.

Each retailer is setting hard targets for carbon reduction, renewable energy, and packaging reform.

These targets are audited, tracked, and — increasingly — tied to investor confidence.

The result is a quieter revolution happening inside warehouses, depots, and cold rooms.

Sustainability is reshaping how food moves through the UK’s grocery system.

Editor’s Note:

This article draws on verified information from Tesco PLC’s Sustainability and ESG Report 2025, Marks & Spencer Group’s Plan A Progress Update 2025, and Aldi UK’s Corporate Responsibility Report 2025.

Additional context was reviewed from The Guardian, The Grocer, Retail Gazette, Cold Chain News, and The Food Foundation.

All figures and examples reflect published data and operational updates from the UK grocery sector up to Q4 2025.

Supermarket Sustainability Strategy: What’s Changing In 2025

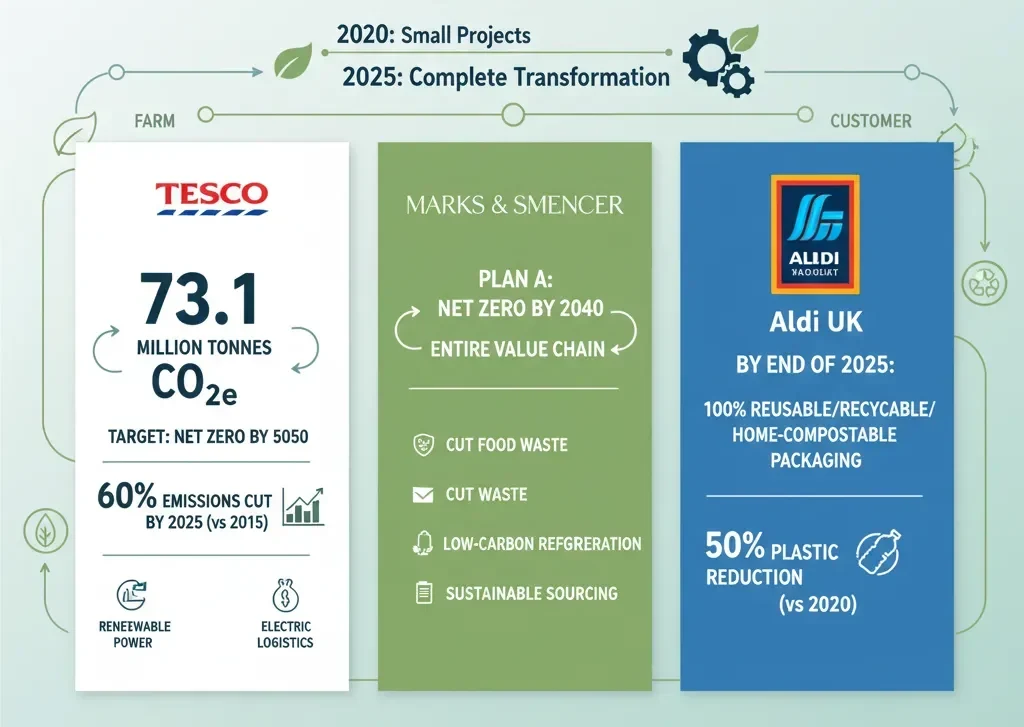

The 2025 landscape looks different.

Supermarkets are shifting from small environmental projects to complete transformation strategies.

Tesco reports a total footprint of 73.1 million tonnes of CO₂e across its global operations and supply chain.

It is targeting net zero by 2050, with a 60% reduction in direct (Scope 1 and 2) emissions by 2025 compared with 2015.

These numbers are backed by major investments in renewable power and logistics electrification.

Marks & Spencer’s “Plan A” aims for net zero by 2040, covering the entire value chain — from farm to customer.

Its focus includes cutting food waste, switching to low-carbon refrigeration, and expanding sustainable sourcing.

Aldi UK’s goals are equally concrete.

By the end of 2025, it plans for 100% of own-label packaging to be reusable, recyclable, or home-compostable, and a 50% reduction in plastic use versus 2020 levels.

Together, these commitments illustrate how the supermarket sustainability strategy has matured.

Retailers now align environmental goals with operational efficiency, supply-chain resilience, and brand trust.

What’s new in 2025 is measurement.

Supermarkets no longer talk about sustainability — they report it in tonnes, kilowatt-hours, and supplier compliance rates.

Packaging Reduction And Refill Pilots

Packaging remains the most visible face of sustainability.

It’s the area where customers see immediate change and where regulators keep tightening the rules.

Tesco’s packaging reduction has already cut 2.5 billion pieces of plastic from its UK own-label products since 2019.

That includes 200 million fewer delivery bags, 31 million lids removed from dips, and 10 million plastic punnets replaced in produce.

Marks & Spencer has committed to removing 1 billion units of plastic from its Food division by 2028.

Trials include recyclable food trays, laser-etched fruit to replace stickers, and simplified film packaging for ready meals.

Aldi is also making steady progress.

Its stores now feature clearer recycling symbols, simplified pack designs, and refill trials for household cleaning products.

As of mid-2025, more than half its plastic packaging already includes recycled content.

This packaging focus sits at the heart of every supermarket sustainability strategy.

UK regulations — from Extended Producer Responsibility fees to the upcoming Deposit Return Scheme — now directly affect cost structures.

For supermarkets, cutting packaging is not just about image; it’s financial logic.

Less material means lower compliance fees and lighter transport loads.

Refill and reuse models are re-emerging after years of trial.

Tesco’s pilot “loop” stations, once paused, are being reintroduced in selected high-footfall stores with simpler packaging returns.

M&S and Waitrose are following similar paths, proving that refill models can work if integrated smoothly into standard shopping trips.

Critics point out the uneven pace.

Most progress remains in private-label categories, while branded goods often lag.

Still, refill and reduction are now central pillars of the supermarket sustainability strategy, not side experiments.

Energy Efficiency And Refrigeration Upgrades

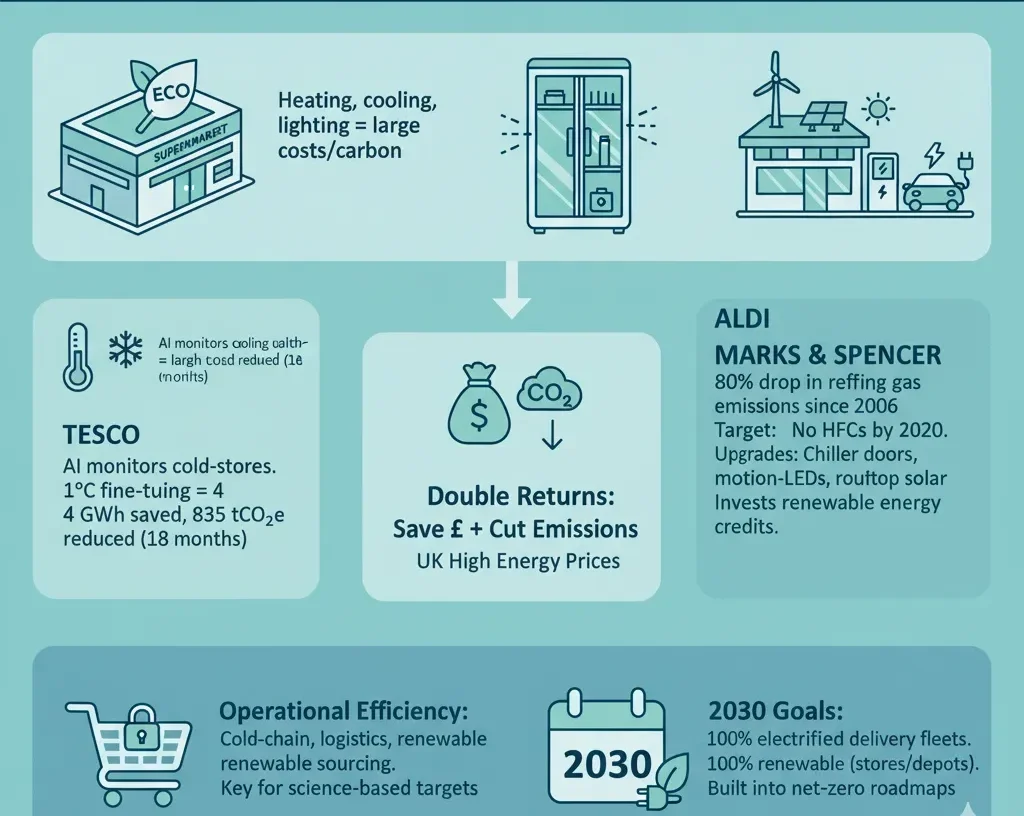

Energy efficiency is another powerful lever.

Heating, cooling, and lighting make up one of the largest cost and carbon lines in supermarket operations.

Tesco has rolled out advanced AI systems to monitor cold-store temperature across eight distribution centres.

By fine-tuning refrigeration set-points by 1 °C, it achieved 4 GWh in energy savings and reduced emissions by 835 tCO₂e within 18 months.

Marks & Spencer reports an 80% drop in refrigeration gas emissions since 2006 and plans to eliminate all HFC refrigerants by 2030.

The chain is fitting stores with doors on chillers, motion-sensing LED lighting, and rooftop solar where feasible.

Aldi’s new store format incorporates CO₂ refrigeration systems, lower-consumption chillers, and electric-vehicle charging points.

It also invests in renewable energy credits to balance residual emissions.

For retailers, these upgrades deliver double returns.

Every kilowatt saved cuts emissions and saves money — an advantage magnified by the UK’s high energy prices.

This operational side of the supermarket sustainability strategy often goes unnoticed by shoppers, but it drives real carbon reductions.

Cold-chain optimisation, efficient logistics, and renewable sourcing are now as important as packaging to meet science-based targets.

By 2030, the major UK grocers aim for fully electrified delivery fleets and 100% renewable electricity in stores and depots.

That milestone is already built into corporate net-zero roadmaps.

Sourcing, Food Waste, And Carbon Targets

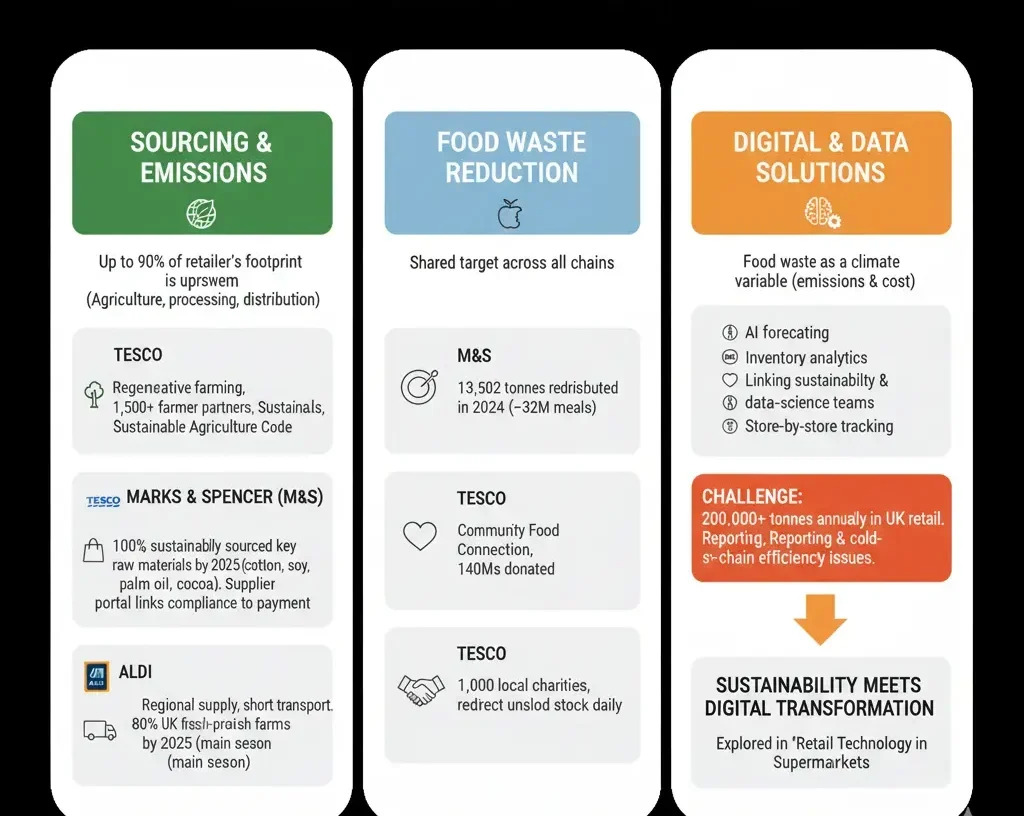

The biggest emissions challenge lies upstream — in the supply chain.

Agriculture, processing, and distribution account for up to 90% of a retailer’s total footprint.

Tesco’s sourcing strategy focuses on regenerative farming and supplier partnerships to reduce fertilizer use, soil erosion, and water waste.

It works with more than 1,500 farmers under its Sustainable Agriculture Code to standardise reporting on land and carbon impact.

Marks & Spencer’s Plan A requires 100% sustainably sourced key raw materials by 2025, including cotton, soy, palm oil, and cocoa.

The retailer’s supplier portal tracks progress in real time and links compliance to payment terms.

Aldi’s sourcing model emphasises regional supply and short transport routes.

By 2025, 80% of its UK fresh-produce range will come from British farms during the main season.

Food waste remains a shared target across all chains.

M&S redistributed 13,502 tonnes of edible surplus food in 2024, equal to nearly 32 million meals.

Tesco, through its Community Food Connection, has donated over 140 million meals since the programme began.

Aldi collaborates with 1,000 local charities to redirect unsold stock daily.

Despite progress, Food Foundation data show that industry-wide food waste still exceeds 200,000 tonnes annually in UK retail.

Accurate reporting and cold-chain efficiency remain sticking points.

The supermarket sustainability strategy is evolving to treat food waste not as a side metric but as a climate variable — tied directly to emissions and cost.

AI forecasting and inventory analytics are now part of the solution.

Retailers are linking sustainability teams with data-science units to track waste patterns store by store.

This is where sustainability meets digital transformation — an area explored in Retail Technology in Supermarkets.

Carbon Data And Reporting

Transparency has become a competitive factor.

Investors, NGOs, and customers expect verifiable carbon data, not marketing slogans.

Tesco and M&S now disclose annual carbon data aligned with the Science Based Targets initiative (SBTi).

Each publishes Scope 1–3 performance, renewable-energy percentages, and intensity metrics.

Aldi’s reporting follows the Greenhouse Gas Protocol and includes supply-chain emissions for the first time in 2025.

This represents a major shift for discount retailers, signalling that ESG standards are no longer limited to premium brands.

Analysts say this data race will only intensify.

Retailers that cannot show audited progress risk exclusion from sustainability-linked financing and procurement frameworks.

Carbon accounting, once a technical exercise, is now part of brand credibility.

It determines access to investors, suppliers, and even planning approvals for new facilities.

As the UK’s Sustainability Disclosure Requirements (SDR) roll out in 2026, supermarkets must report environmental and social data with the same rigour as financial statements.

The supermarket sustainability strategy now belongs in the annual report, not just the CSR brochure.

ESG Expectations And Investor Pressure

The conversation around sustainability has moved from ethics to economics.

Fund managers assess supermarkets on ESG risk as closely as they do on profit margins.

Tesco, M&S, and Aldi all highlight sustainability metrics in their investor presentations.

They show carbon savings, circular-packaging milestones, and community programmes as indicators of long-term stability.

Institutional investors increasingly use sustainability data to price corporate bonds.

A credible supermarket sustainability strategy can directly reduce financing costs by qualifying a company for green or transition-linked loans.

For supermarkets, this adds accountability.

Targets once voluntary are now measured quarterly and tied to executive pay.

Missed milestones risk shareholder pushback and media scrutiny.

The direction is clear: ESG integration has become part of financial performance.

Retailers that manage sustainability well are rewarded with investor trust and consumer loyalty.

Those that lag face reputational and regulatory risk.

The 2025 turning point is cultural — sustainability is no longer a department; it’s how decisions are made.

Looking Ahead

The next phase of the supermarket sustainability strategy will demand more collaboration.

Retailers, suppliers, and policymakers must align targets to keep food affordable and sustainable.

The sector is expected to accelerate renewable-energy procurement, expand refill systems, and adopt data-driven waste management.

Technology, logistics, and supplier engagement will define success more than slogans.

By 2030, UK grocery chains are likely to operate on fully renewable electricity, run low-carbon fleets, and achieve measurable reductions in packaging waste and food loss.

The transition is already underway — but pressure will rise as climate-reporting laws tighten.

For shoppers, this transformation will appear through quieter changes: lighter packs, refill stations, smaller fridges, and more local sourcing.

Behind the scenes, the shift is deeper — a re-engineering of how the supermarket business works.

The supermarkets that master sustainability will be those that treat it as a structural change, not a marketing theme.

In 2025, the supermarket sustainability strategy defines not just brand image, but long-term survival.