Getting a product listed in a UK supermarket is one of the biggest milestones for any food or consumer-goods brand.

But the process depends on knowing how to reach the right decision-makers — the buyers who manage categories, run supplier reviews, and negotiate listings.

The top supermarket groups in the UK — Tesco, Sainsbury’s, Asda, Aldi, Lidl, Morrisons, Waitrose, Co-op, M&S, and Iceland — all have formal processes for suppliers to contact buying teams.

Their systems combine category alignment, compliance checks, and online supplier portals.

In 2025, as procurement becomes more digital and data-driven, clear and professional approaches are essential.

Understanding the structure of supermarket buyer contacts UK can help suppliers get noticed, make relevant pitches, and meet compliance standards faster.

Editor’s Note:

This article is based on verified company sourcing information from the supplier and trade sections of major UK retailers including Tesco, Sainsbury’s, Asda, Morrisons, Aldi, Lidl, Co-op, Waitrose, Iceland, and Marks & Spencer.

Additional insight was drawn from FWD, The Grocer, and official supplier-onboarding documentation.

No personal contact data is included — only structural formats and verified process details. And all infographic images are provided as illustrations to help you understand the topic better.

lets Start With Understanding Supermarket Buyer Contacts UK

Every uk major retailer organises its buying structure differently, but most follow a similar model:

-

Head of Buying or Trading Director: Sets overall category strategy and pricing direction.

-

Category Buying Manager: Responsible for range selection, supplier negotiation, and promotional planning.

-

Assistant Buyer or Junior Buyer: Supports category admin, data analysis, and sample review.

-

Technical and Quality Managers: Assess product safety, packaging, and sustainability compliance.

A strong understanding of this hierarchy makes all the difference.

Approaching a supermarket without identifying the correct department or buyer level can mean a pitch never reaches review.

In the UK, the best way to begin contact is through official supplier application portals.

Most major chains no longer accept unsolicited emails.

Instead, they direct new suppliers to structured digital submission systems.

Main Retailer Entry Points

Tesco PLC

-

Supplier applications handled via the Tesco Supplier Network (a dedicated onboarding portal).

-

Prospective partners submit a category proposal, sustainability credentials, and compliance documentation.

-

Buyers are organised by key categories: grocery, fresh produce, frozen foods, bakery, household, and non-food.

Sainsbury’s and Argos

-

Managed through the Sainsbury’s Supplier Portal.

-

Submissions must include GS1-compliant barcodes, ingredient specifications, and proof of accreditation (e.g., BRCGS).

-

Buyers work within cross-category “food trading” and “non-food trading” divisions.

Asda Stores Ltd.

-

Operates a central Asda Supplier Onboarding platform for both branded and own-label products.

-

Buyers are grouped by department: grocery, produce, chilled, bakery, beverages, frozen, and GM (non-food).

Morrisons Supermarkets Ltd.

-

Uses its Supplier Exchange and technical approval system.

-

Category buyers are supported by in-house manufacturing teams — a unique structure in UK retail.

-

New suppliers are asked to register company details and category interests before a buyer review.

Aldi UK & Ireland

-

All contact goes through the Aldi Supplier Application page.

-

Buyers are based regionally (England, Scotland, Ireland) but follow national category control.

-

Aldi expects clear cost transparency and volume readiness.

Lidl GB

-

Supplier applications handled via the Lidl Connect system.

-

Buyers are assigned by product type, with additional teams for logistics and packaging innovation.

Waitrose & Partners

-

Prospective partners apply through John Lewis Partnership Procurement.

-

Buyers look for premium differentiation, sustainability proof, and consistent supply.

Co-op Group

-

Runs its Co-op Supplier Information Centre.

-

Buying divisions include food, beverages, ethical sourcing, and community-led products.

Marks & Spencer Food

-

Operates its Supplier Exchange portal.

-

Buyers are supported by product-development specialists to review innovation, quality, and brand alignment.

Iceland Foods

-

Supplier Registration handled via the company website under “Become a Supplier.”

-

Focuses heavily on frozen innovation, packaging, and logistics capability.

These official portals are the correct first contact routes for supermarket buyer contacts UK.

Each uses internal triage systems that route proposals to category buyers for review.

Buyer Departments By Retailer

Although every chain has unique structures, buyers in UK supermarkets are usually divided into four core departments:

1. Food and Grocery

-

Covers dry goods, ambient, bakery, cereals, and snacks.

-

Handled by Category Managers with responsibility for range and supplier cost negotiation.

2. Fresh Produce and Protein

-

Includes fruit, vegetables, meat, poultry, fish, and deli.

-

Requires suppliers to show provenance, sustainability, and temperature-control compliance.

3. Drinks (Alcohol and Soft Beverages)

-

Buyers in this area look for quality, packaging appeal, and promotional innovation.

-

Many UK supermarkets use dedicated beverage buying teams separate from grocery.

4. Non-Food and Household

-

Includes health & beauty, cleaning, paper, and general merchandise.

-

Buyers often report to trading directors responsible for cross-category commercial targets.

Large retailers such as Tesco, Sainsbury’s, and Asda have specialised sub-teams within each area — for example, vegan ready meals, ethnic cuisine, craft beer, or eco-cleaning products.

Understanding which department fits your product is the first step to finding the right supermarket buyer contacts UK.

How Supplier Onboarding Works

Supermarket buying teams follow a structured supplier-approval process before any product reaches shelves.

While details vary by retailer, most UK chains use these key steps:

-

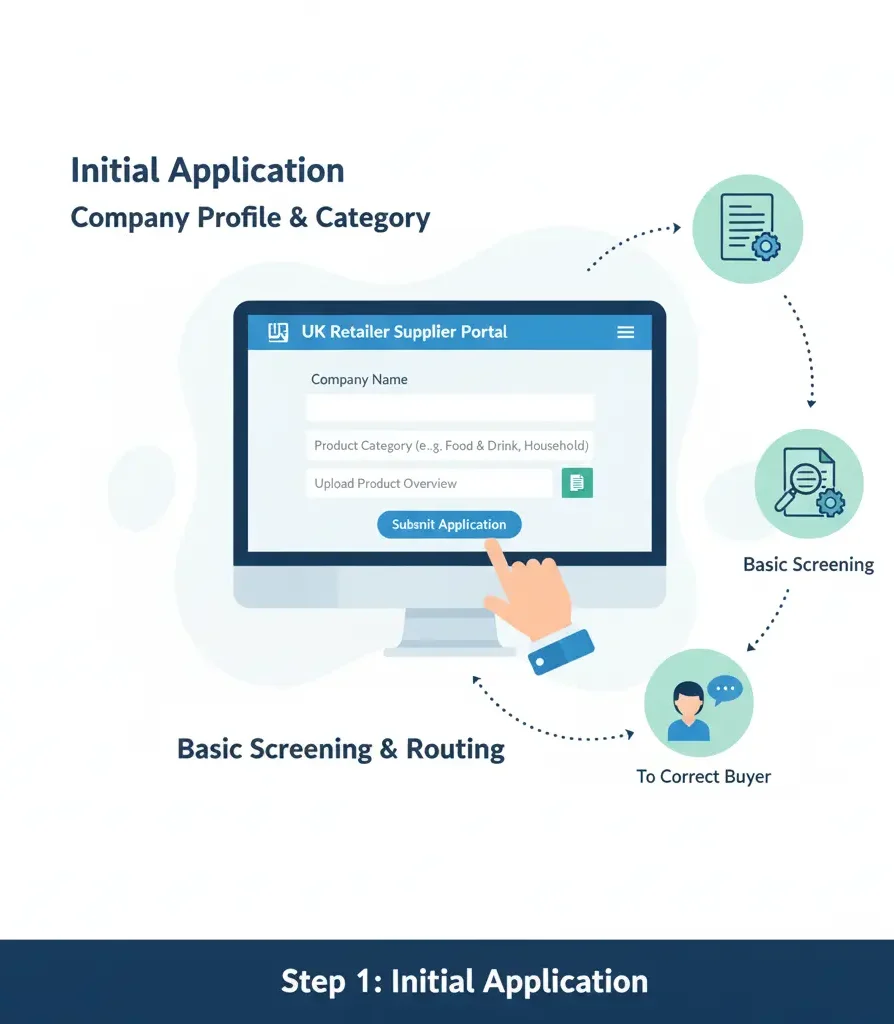

Initial Application

-

Supplier submits a short company profile, category, and product overview via the retailer’s portal.

-

Basic screening ensures the submission goes to the correct buyer.

-

-

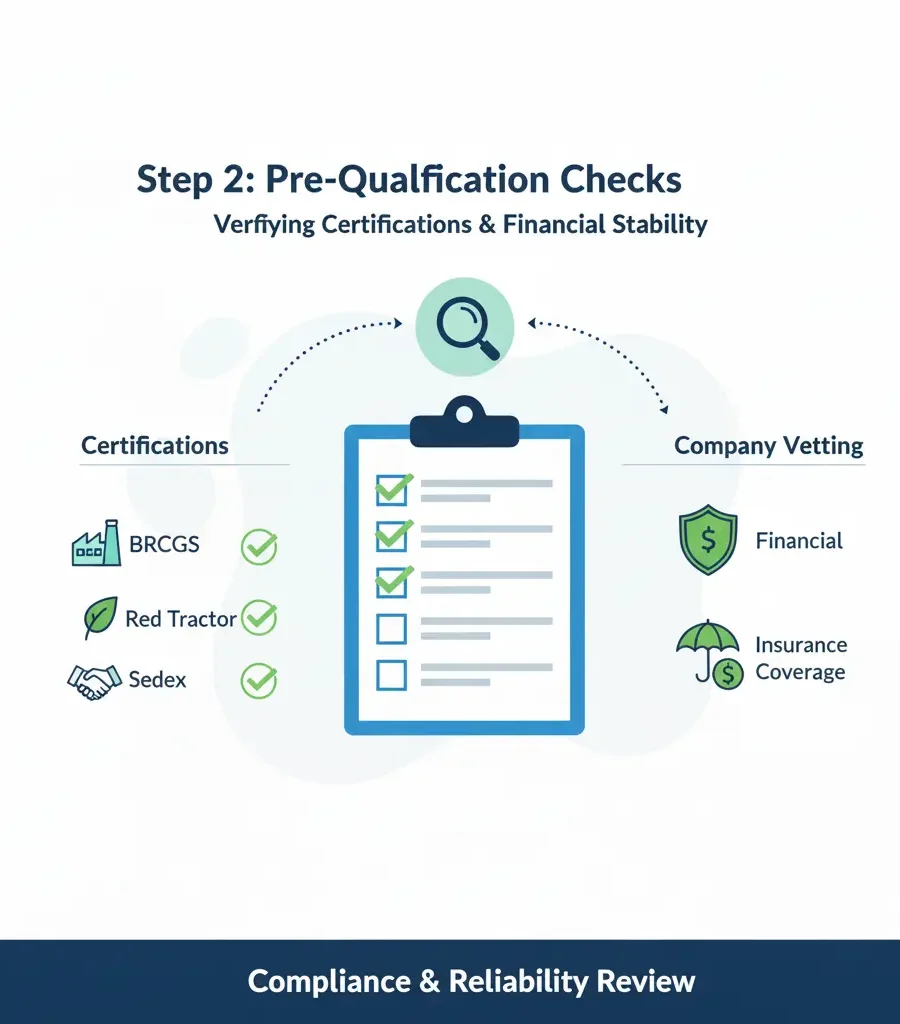

Pre-Qualification Checks

-

Retailers verify certifications such as BRCGS, Sedex, or Red Tractor (for fresh produce).

-

Financial stability and insurance coverage are also reviewed.

-

-

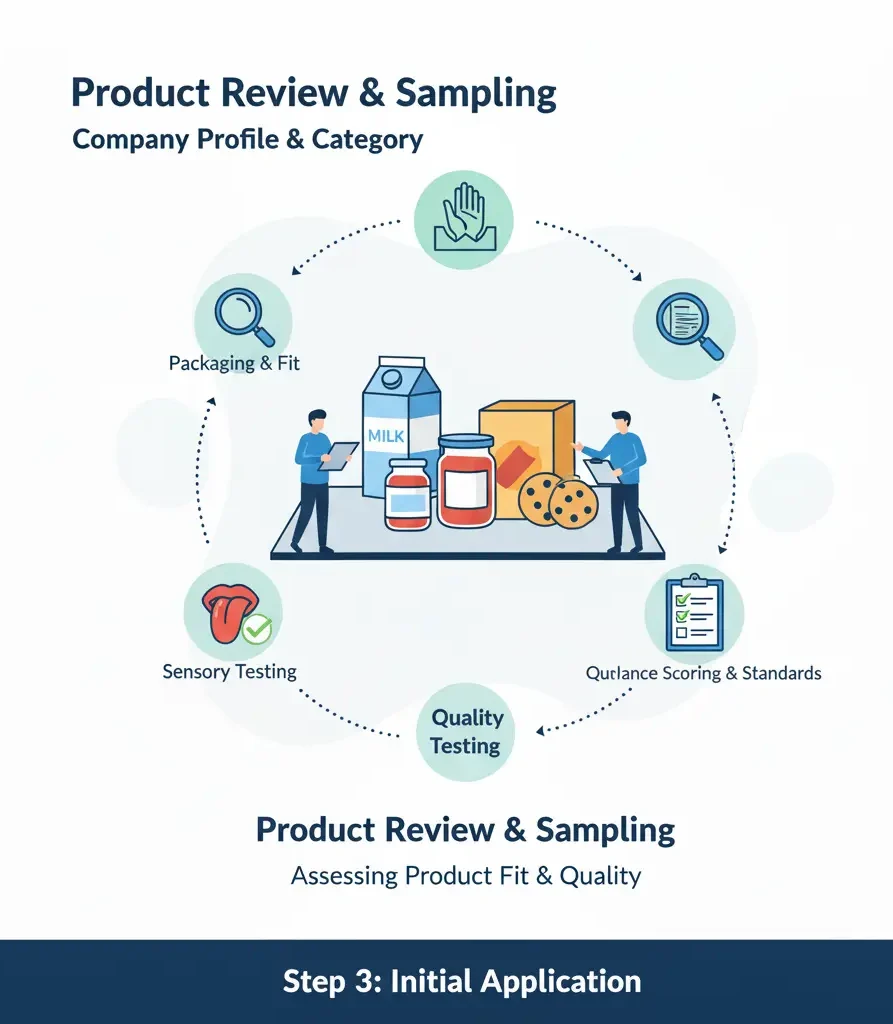

Product Review & Sampling

-

The buyer or technical team assesses product fit, packaging, and commercial terms.

-

Samples are often required for sensory testing or quality scoring.

-

-

Negotiation & Listing Proposal

-

Pricing, promotional support, and distribution volumes are discussed.

-

Retailers increasingly expect ESG data — carbon footprint, recyclable packaging, and labour standards.

-

-

Contract & Launch

-

Final stage covers barcoding, EDI setup, and delivery scheduling.

-

Products then appear in selected stores or online pilots.

-

For small brands, it’s common to start with regional listings before scaling nationally.

For larger suppliers, supermarket buyers look for evidence of capacity, reliability, and compliance readiness.

These structured systems help buyers filter credible opportunities — a crucial insight for anyone exploring supermarket buyer contacts UK.

Tips To Approach Supermarket Buyers Successfully

Reaching supermarket buyers requires preparation, precision, and persistence.

Here are practical steps that help suppliers make a strong first impression:

-

Research the retailer’s category strategy.

Understand their price tiers (value, core, premium) and how your product fits. -

Use official channels first.

Avoid cold emails. Submissions via portals are logged and tracked. -

Keep the pitch short and clear.

Focus on your unique selling point, target consumer, and production capacity. -

Show compliance readiness.

Buyers prioritise suppliers already certified for food safety and traceability. -

Include strong packaging and visuals.

First impressions count — attach mock-ups or final designs that match retailer style. -

Know your numbers.

Buyers expect detailed cost breakdowns, lead times, and promotional margins. -

Follow up professionally.

A polite reminder after 3–4 weeks is acceptable if you’ve received no response. -

Leverage trade events.

Fairs like IFE London, Speciality & Fine Food Fair, and PLMA Amsterdam are where supermarket buyers scout innovation.

By using the same professional standards as large suppliers, smaller brands can still get the attention of key supermarket buyer contacts UK.

Example Contact Formats (Structure Only)

Retailers keep individual buyer details private for GDPR reasons, but most follow similar internal structures.

Here are general examples of how contact references appear within corporate systems:

| Department | Typical Buyer Title | Contact Format |

|---|---|---|

| Grocery | Category Buyer – Ambient Foods | firstname.lastname@retailer.co.uk |

| Fresh Produce | Senior Buyer – Fruit & Vegetables | firstname.lastname@retailer.co.uk |

| Beverages | Trading Manager – Soft Drinks & Water | firstname.lastname@retailer.co.uk |

| Non-Food | Category Manager – Household Care | firstname.lastname@retailer.co.uk |

Note: These are format examples only — not real addresses.

Retailer domains are usually standardised (e.g. @sainsburys.co.uk, @tesco.com, @waitrose.co.uk).

All first contact should go through the retailer’s supplier portal before any direct communication.

Why Trade Media Visibility Helps Suppliers Connect

Getting noticed by supermarket buyers takes more than one email submission.

Trade visibility plays a major role in buyer awareness.

When products appear in recognised B2B publications — such as Global Supermarket News, The Grocer, or Retail Gazette — it signals credibility.

Buyers often review trade coverage when scouting new suppliers or evaluating category trends.

Suppliers that maintain a visible professional profile — website, packaging awards, sustainability case studies, and verified media mentions — tend to gain faster traction.

For small producers, publishing supplier stories, sustainability updates, or award recognitions in trade media can indirectly reach supermarket buyer.

Visibility builds trust.

It also helps future discussions at trade fairs and sourcing events, where buyers already know the brand story.

Conclusion

Supermarket buyer engagement is changing fast.

Most retailers now use structured digital portals and sustainability criteria to screen potential suppliers.

At the same time, buyers remain open to innovation — provided suppliers follow the right approach.

Understanding the structure of supermarket buyer contacts UK — who manages what, how portals operate, and what documentation is needed — is essential for any company aiming to grow through retail partnerships.

As digital procurement becomes the norm, professionalism, preparation, and persistence remain the best ways to stand out.

Visibility in the right B2B channels completes the picture — making it easier for genuine suppliers to connect with genuine buyers.