Tyson Foods Q4 2025 Results show that the company ended its financial year with higher sales and stronger adjusted profits. The U.S.-based protein producer said it achieved steady growth across chicken, pork, and prepared foods despite cost pressure in beef.

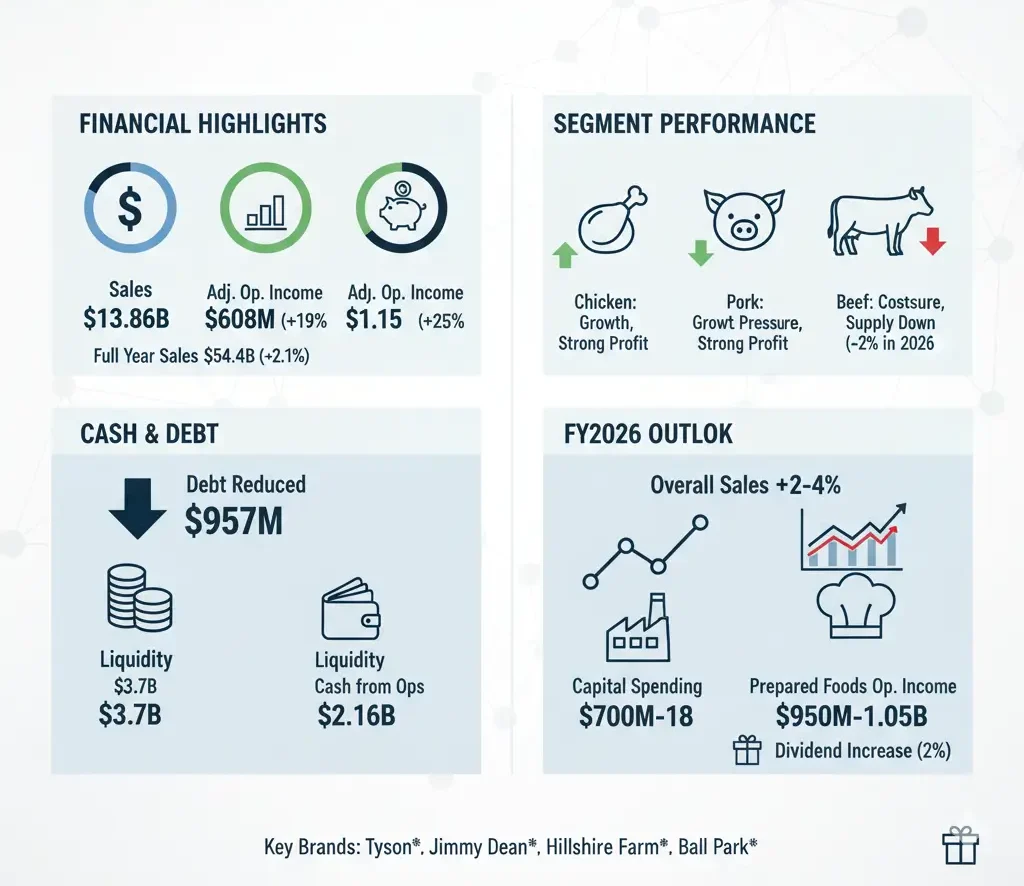

Tyson Foods reported sales of $13.86 billion for the fourth quarter, up 2.2% from the same period last year. Excluding legal accrual adjustments, sales were up 4.8%. Adjusted operating income reached $608 million, an increase of 19% year over year. Adjusted earnings per share rose 25% to $1.15.

For the full fiscal year 2025, total sales reached $54.4 billion, up 2.1% from the previous year. Adjusted operating income climbed 26% to $2.29 billion, while adjusted earnings per share rose 33% to $4.12. The company said this performance showed the strength of its multi-protein, multi-channel model serving both retail and food service customers.

Tyson Foods Q4 2025 Results also showed continued discipline in spending. The company generated $2.16 billion in cash from operations, reduced total debt by nearly $957 million, and ended the year with liquidity of $3.7 billion.

The company’s beef segment faced challenges as cattle supply tightened and costs increased. Tyson expects domestic beef production to fall by around 2% in fiscal 2026. In contrast, chicken and pork are expected to grow modestly next year, with stronger adjusted operating income from both categories.

For fiscal 2026, Tyson Foods expects overall sales to rise 2% to 4%, supported by improved pricing, mix, and demand in chicken and prepared foods. The company forecasts capital spending between $700 million and $1 billion to support efficiency and maintenance projects.

In its prepared foods business, Tyson anticipates adjusted operating income of $950 million to $1.05 billion in the next fiscal year. The company continues to invest in new product innovation and branded value growth through key lines like Tyson®, Jimmy Dean®, and Hillshire Farm®.

Tyson also increased its quarterly dividend, raising the Class A share payout to $0.51 and Class B to $0.459. The new rate represents a 2% increase year over year, continuing the company’s long record of returning cash to shareholders.

CEO Donnie King said the company’s progress reflected strong execution and focus on operational excellence. He added that Tyson remains committed to improving the controllable parts of the business and meeting customer needs across all protein types.

Tyson Foods employs around 133,000 people and supplies meat and prepared foods to supermarkets and restaurants worldwide. Its portfolio includes Tyson®, Jimmy Dean®, Ball Park®, Aidells®, Wright®, and State Fair® brands.

Why It Matters

Tyson Foods is one of the world’s largest suppliers to the grocery and food service industry. Its financial results and production forecasts directly affect supermarket pricing, protein availability, and private-label sourcing.

Editor’s Note:

This article is based on verified information from Tyson Foods’ official site,