Private label, or “own-brand”, products have become a defining feature of German supermarkets. What once started as a low-price alternative has grown into one of the country’s strongest retail categories.

As of 2024, private label products represent around 36 percent of total grocery retail sales in Germany. This makes Germany one of the largest private label markets in Europe, although still slightly behind the UK and the Netherlands.

Supermarkets and discounters are the driving force. Aldi, Lidl, REWE, and Edeka together control most of the grocery sector, and each of them has made private label the core of their assortment. Aldi and Lidl, for instance, offer more than 80 percent of their range under own-brand names.

REWE Beste Wahl and Edeka Gut & Günstig dominate full-range supermarket shelves, combining price appeal with growing focus on quality. These lines now extend across almost every grocery category—from fresh produce and frozen food to personal care, beverages, and premium ready meals.

Private labels have evolved from “cheap alternatives” into trusted supermarket brands. Shoppers now associate them with good value, reliable quality, and sustainability.

How Discounters Built Private label Dominance

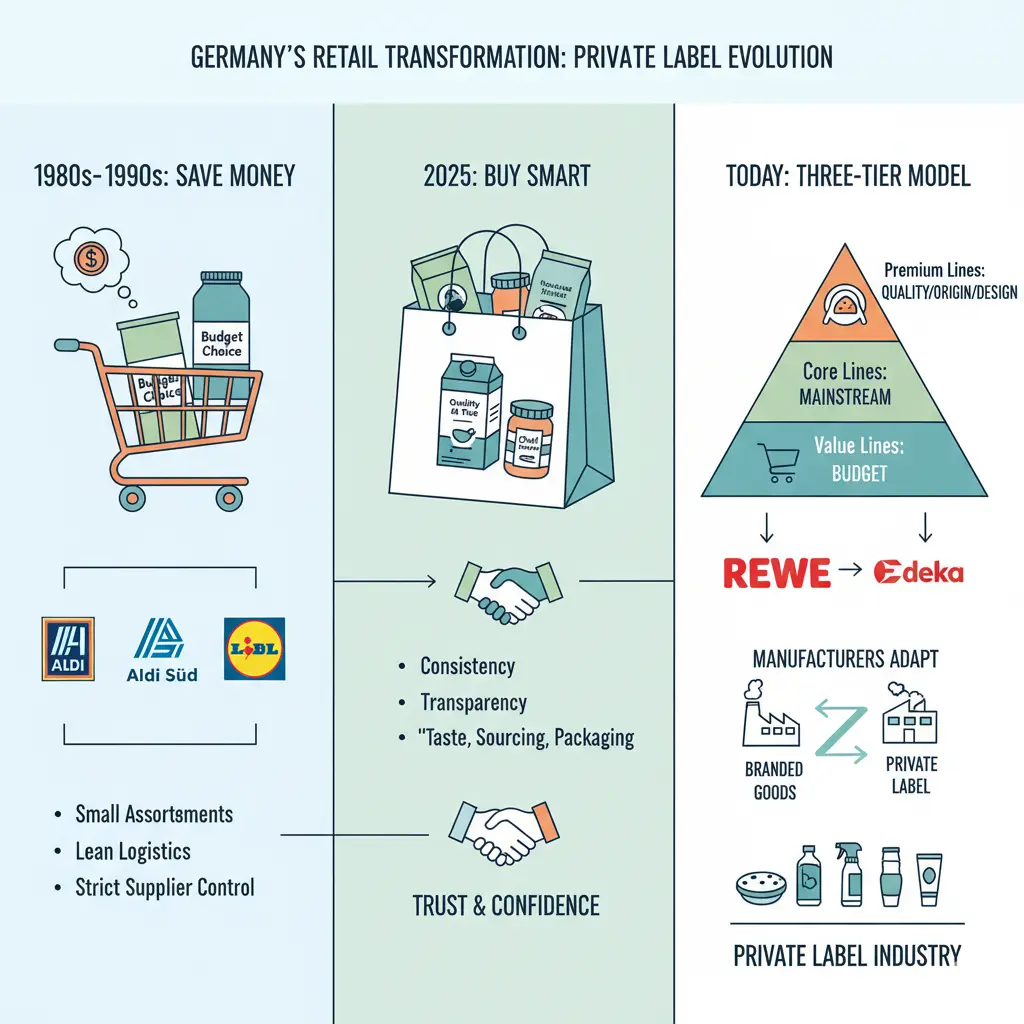

Germany’s discount model was the foundation of this transformation. Aldi Nord, Aldi Süd, and Lidl built their entire business around private label efficiency—small assortments, lean logistics, and strict supplier control.

By focusing on quality rather than brand name, discounters changed how consumers think about store brands. In the 1980s and 1990s, buying private label meant saving money; by 2025, it often means buying smart.

Discounters taught shoppers to trust consistency and transparency. Products had to meet strict standards for taste, sourcing, and packaging. The result: loyalty built not around logos, but around confidence.

As discount retail gained popularity, full-line supermarkets had to respond. REWE and Edeka began building private label portfolios that could compete on every tier:

-

Value lines for budget shoppers.

-

Core lines for mainstream categories.

-

Premium lines for customers seeking taste, origin, and design quality.

This three-tier model now defines the structure of private label in German grocery. It allows retailers to reach every income group and shopping mission—from weekly baskets to impulse purchases.

Manufacturers adapted too. Many long-standing German food producers now operate as contract manufacturers for multiple retailers. They supply branded goods to one chain and private label to another, often from the same plant. This dual structure keeps factories running at high capacity and helps retailers manage costs.

Private label manufacturing has become an industry in its own right—covering food, drinks, household, and personal care.

Premiumisation And Sustainable Packaging Trends

Private label in Germany is no longer only about low price—it’s about values, presentation, and sustainability.

German retailers now invest heavily in premiumisation, introducing upscale own-brands that compete directly with national products. REWE’s “Beste Wahl Bio” line and Edeka’s “Naturgut” brand focus on organic and responsibly sourced ingredients. Aldi has extended its “Zurück zum Ursprung” range, which promotes origin transparency and environmentally friendly farming.

Packaging design has also evolved. Store brands today use modern typography, soft colours, and simple design—similar to high-end consumer brands. The goal is clear communication, not low-budget styling.

Sustainability sits at the centre of this evolution. German shoppers expect retailers to reduce packaging waste and increase recyclability. All major supermarket groups have published packaging roadmaps aiming to make private label packaging recyclable, reusable, or compostable within the next few years.

Private label products are often the testing ground for packaging innovation. Because retailers control these products end-to-end, they can implement new materials quickly—recycled plastics, paper-based trays, lighter bottles, and refill systems.

Packaging has moved from being a cost item to a strategic tool for differentiation.

Consumer Perception And Buying Behaviour

German consumers’ attitudes towards private labels have shifted profoundly.

Research shows that over 60 percent of shoppers in Germany now buy more private label products than they did a year ago. The reasons include better quality, more local sourcing, and economic pressure from inflation.

Importantly, trust has replaced price as the biggest driver. Surveys show that consumers view private label as just as dependable as national brands. They appreciate that these products are often made in Germany and backed by retailers they already know.

In sectors such as dairy, bakery, frozen food, and household goods, own-brand penetration exceeds that of many national labels. This change has forced well-known manufacturers to innovate faster and defend their shelf space through promotions or new product lines.

The shift is visible in store design too. Private label products are now placed in premium positions, with dedicated displays, sustainability icons, and QR codes for sourcing transparency. What once filled the bottom shelf now anchors the centre of the aisle.

Impact On Suppliers And Industry Structure

Private label growth reshapes every layer of the supply chain.

German suppliers face growing demand for retailer-controlled production. Many have specialised in developing private label formulations under tight confidentiality. Others have pivoted into co-development partners, designing exclusive innovations for supermarket lines.

This model has benefits and risks. It offers stable volume and long-term contracts, but it reduces brand independence. For smaller producers, private label partnerships can provide entry to major supermarket networks without building consumer marketing budgets.

Meanwhile, competition for contracts remains intense. Retailers tend to work with a limited number of certified suppliers, focusing on quality assurance and logistics precision. This creates pressure for continuous improvement in efficiency, packaging, and sustainability compliance.

The packaging sector benefits directly from this evolution. With private labels expanding into every price tier, demand for high-quality, recyclable, and lightweight materials continues to rise.

Private label And sustainability: Germany leads The Way

Sustainability gives German retailers another edge. The country’s environmental standards are among the strictest in Europe, and supermarkets use private label to demonstrate leadership.

Aldi Süd and Aldi Nord have both committed to 100 percent recyclable packaging for own-brands by 2026. Lidl follows a similar path, with ambitious goals for reducing plastic use. REWE and Edeka focus on sustainable sourcing and reducing carbon footprints across their private label supply chains.

German shoppers notice these efforts. Sustainability marks—organic certification, carbon-neutral logos, or local-origin stamps—are now familiar on private label packaging. This visibility strengthens consumer trust and brand recognition.

The rise of sustainability-linked packaging has also influenced supplier strategy. Packaging converters, material specialists, and recycling companies increasingly align their R&D with private label needs, supporting retailers with scalable, compliant innovations.

Why It Matters

Private label growth in German supermarkets is not only a retail story—it’s a structural shift across the fast-moving consumer goods industry.

-

Retailers gain stronger control of pricing, assortment, and margin.

-

Suppliers must adapt to new production models and tighter specifications.

-

Consumers get more choice, better value, and greener options.

The competitive pressure created by private label success has raised quality standards for the entire market. National brands can no longer rely on reputation alone—they must justify their premium positioning through innovation, performance, or emotional connection.

At the same time, own-brand strength gives retailers a powerful tool in negotiations. With solid private label ranges, supermarkets can resist supplier price increases and offer consistent value even in inflationary cycles.

Private labels also allow faster adaptation to trends: plant-based, protein-rich, sugar-reduced, or plastic-free products can move from idea to shelf much faster than through a traditional brand pipeline.

For packaging producers and sustainability professionals, this dynamic makes the German supermarket sector one of the most forward-looking in Europe.

The Outlook For 2026 and beyond

Industry analysts expect private label share in Germany to keep climbing gradually, potentially surpassing 38 percent within two years. Economic conditions remain uncertain, but value-oriented shopping behaviour is here to stay.

Future growth will come from premiumisation, innovation, and sustainability, not just lower price points. Retailers are expected to:

-

Expand organic and fair-trade ranges.

-

Push digital transparency tools, such as QR-based traceability.

-

Invest in recyclable and refill packaging systems.

-

Strengthen loyalty programmes linked to private label tiers.

For suppliers and packaging firms, opportunities are significant. Those who can deliver flexibility, design expertise, and verifiable sustainability credentials will become key partners to Germany’s leading retailers.

Private label is no longer the background of the shelf. It has become the main stage of German grocery retail.

Note: This article is based on verified information and official publications from:

-

NielsenIQ (Global Private Label Trends, 2024)

-

Private Label Manufacturers Association (PLMA) (European Market Share Update 2025)

-

Euromonitor International (Grocery Retail in Germany, 2025)

-

USDA Foreign Agricultural Service (Germany Retail Foods Report 2025)

-

FachPack Report 2024 (Private Labels and Sustainable Packaging Trends)

-

Company disclosures from Aldi Süd, Aldi Nord, Lidl, REWE Group, and Edeka Group

All data and references were reviewed in November 2025.