Germany is one of the hardest grocery markets for new suppliers to enter.

Large retailers run structured buying systems, strict onboarding, and detailed category reviews.

For many manufacturers and exporters, finding supermarket buyer contacts Germany is the first challenge.

This guide explains how buying teams work, how suppliers can approach them, and the best trade fairs to meet retail decision-makers in person.

It also links naturally to Trade Events Germany, Supermarket Suppliers Germany, and your /contact/ page for follow-ups.

Supermarket Buyer Contacts Germany: How Procurement Works

German grocery retailers use a category management model.

Buyers are responsible not just for purchasing, but also for pricing, range planning, promotions, and supplier negotiations.

Most buyers sit inside large group headquarters:

-

EDEKA – regional cooperatives + national buying through EDEKA Zentrale

-

REWE Group – central buying in Cologne, supported by regional structures

-

Schwarz Group (Lidl, Kaufland) – highly centralised buying

-

Aldi Nord & Aldi Süd – strict, centralised category teams

-

Netto Marken-Discount – category managers based in Maxhütte-Haidhof

-

Globus – combination of central and local buying

Buyers typically work inside small category teams.

Each team covers one product area: fresh produce, meat, bakery, beverages, dry grocery, personal care, household, frozen, or non-food.

What Buyers Do Inside German Supermarkets

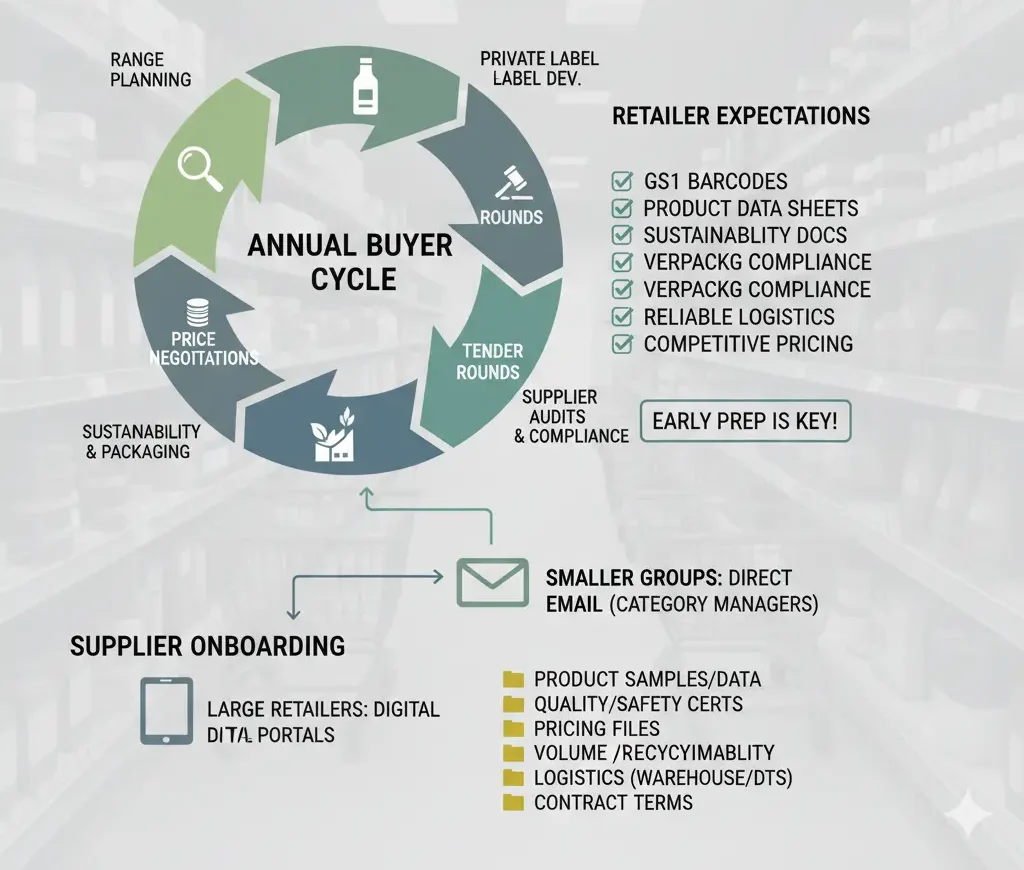

Buyers in Germany follow a predictable annual cycle:

-

Range planning

-

Private label development

-

Tender rounds

-

Price negotiations

-

Promotional planning

-

Sustainability and packaging checks

-

Supplier audits and compliance

Most grocery retailers in Germany expect:

-

GS1 barcodes

-

Detailed product data sheets

-

Sustainability documentation

-

Packaging compliance (VerpackG)

-

Reliable logistics partners

-

Competitive pricing

This makes early preparation essential for anyone searching for supermarket buyer contacts Germany.

Supplier onboarding

Onboarding processes vary by retailer, but typically include:

-

Product samples and data sheets

-

Quality and safety certifications

-

Pricing files

-

Volume commitments

-

Packaging details and recyclability compliance

-

Logistics arrangements – warehouse or direct-to-store

-

Contract terms

Large retailers use digital supplier portals.

Smaller regional groups may request direct email contact with category managers.

For deeper background on the supplier landscape, see Supermarket Suppliers Germany, which explains the main producers and private-label manufacturers across the country.

Steps To Approach German Retail Buyers

Germany’s retail sector does not respond well to cold emails.

Buyers receive hundreds of supplier messages every week.

To break through, suppliers must follow a structured process.

1. Understand the retailer’s format

Every chain has a different price position and assortment strategy.

Suppliers should study:

-

Discounters (Aldi, Lidl, Netto Marken-Discount)

-

Full-range supermarkets (EDEKA, REWE)

-

Hypermarkets (Kaufland, Globus)

Each format works with different packaging, pack sizes, and price architecture.

Aldi and Lidl prefer compact ranges and private label.

EDEKA and REWE accept more branded products and regional suppliers.

2. Prepare a German-standard product file

Before contacting any buyer, prepare:

-

EAN barcode

-

Nutritional table in German

-

Ingredients in German

-

Transport packaging specs

-

Shelf life

-

Minimum order quantities

-

Suggested retail price range

-

Recommended placement (category flow)

-

Sustainability information (plastic, recyclability, energy use)

Buyers will not move forward without complete documentation.

3. Show logistics capability

Germany has strict delivery rules.

Retailers require dependable logistics partners capable of servicing national or regional warehouses.

Suppliers should clarify:

-

EU warehouse location

-

Delivery frequency

-

Pallet formats

-

Lead times

-

Transport certifications

If logistics are unclear, buyers will not open discussions.

4. Use the correct contact method

Most supermarket buyer contacts Germany are not publicly listed.

However, suppliers can reach buyers through:

-

Supplier onboarding portals

-

Central procurement email addresses

-

Regional offices (EDEKA and REWE cooperatives)

-

Introductions through trade fairs

-

Brokerage agents

-

Service providers who specialise in German retail entry

Direct cold messaging to named buyers is discouraged.

Success rates are higher through structured introductions.

5. Match your offer to market demand

German buyers focus on:

-

Strong margin

-

Proven sales performance

-

Clear differentiation

-

Private label capability

-

Sustainability benefit

-

Packaging reduction

-

Competitive shelf price

Suppliers should highlight only the points that matter.

Long presentations rarely work.

6. Follow up professionally

If a buyer asks for more data:

-

Respond fast

-

Keep everything short

-

Provide updated documents

-

Avoid over-selling

Once a buyer is interested, they will request samples and start internal checks.

7. Build long-term trust

German retail prefers long-term supply partners.

Buyers expect:

-

Transparent pricing

-

Consistent quality

-

Reliable delivery

-

Commitment to sustainability

Suppliers who perform well often expand into multiple categories or private label lines.

For direct communication support, you can direct readers to your /contact/ page.

Trade Fairs As Entry Points For Suppliers

Trade fairs are the easiest places to meet decision-makers in person.

Most supermarket buyer contacts Germany attend these events for discovery and sourcing.

Below are the top fairs where German retail buyers are consistently active.

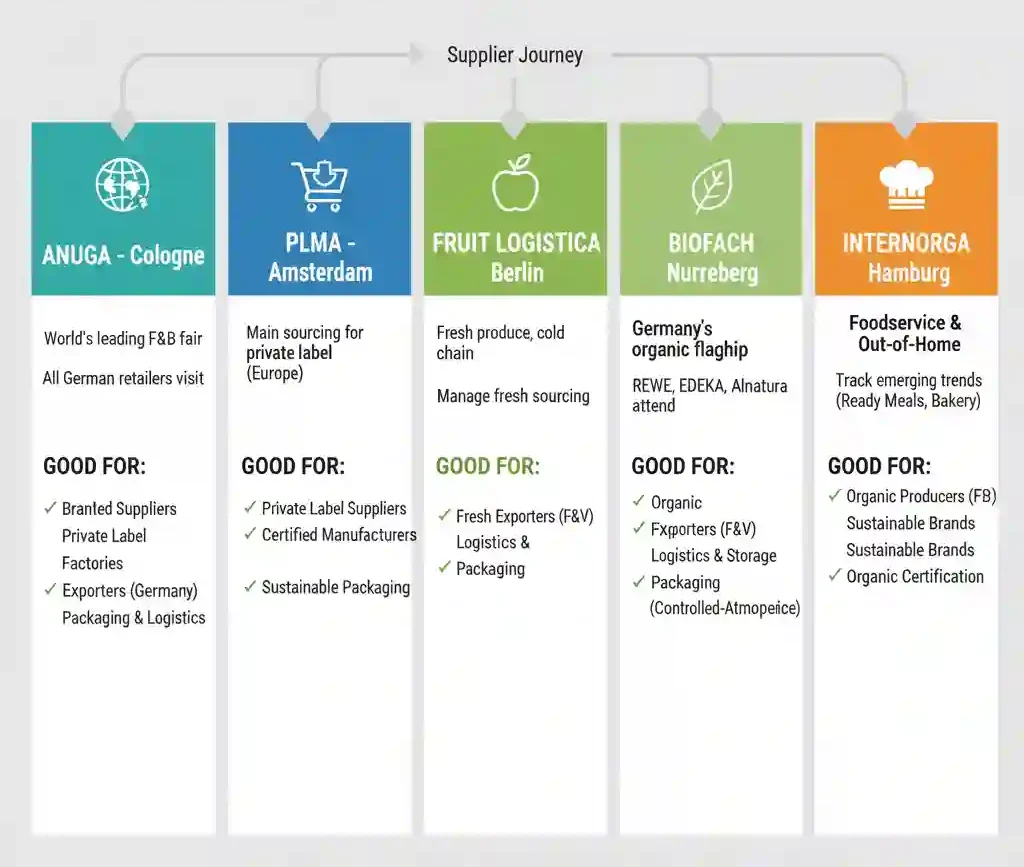

ANUGA – Cologne

The world’s leading food and beverage fair.

Almost all German retailers visit ANUGA to find new suppliers, compare categories, and review private-label manufacturers.

Good for:

-

Branded suppliers

-

Private label factories

-

Exporters entering the German market

-

Packaging and logistics partners

PLMA – Amsterdam

Even though it takes place in the Netherlands, German buyers attend in high numbers.

PLMA is the main sourcing event for private label across Europe.

Good for:

-

Private label suppliers

-

Manufacturers with strong certifications

-

Sustainable packaging innovations

Fruit Logistica – Berlin

Focused on fresh produce, cold chain, and global exporters.

German supermarket buyers attend to manage fresh-category sourcing.

Good for:

-

Fresh fruit and vegetable exporters

-

Logistics and storage providers

-

Controlled-atmosphere packaging suppliers

BioFach – Nuremberg

Germany’s flagship organic trade fair.

Buyers from REWE, EDEKA, Dennree, and Alnatura attend every year.

Good for:

-

Organic food and beverage producers

-

Sustainable brands

-

Organic certification specialists

Internorga – Hamburg

Focused on foodservice and out-of-home.

Retail buyers visit to track emerging trends, especially ready meals and bakery.

Why Trade Events Are Effective

German retail buyers prefer meeting suppliers face to face.

A short meeting at ANUGA or PLMA gives buyers a better sense of:

-

Your product quality

-

Your packaging

-

Your pricing

-

Your scale

Most early contracts in Germany start with conversations at trade fairs.

For more industry context, readers can visit Trade Events Germany, which provides full coverage of retail and packaging exhibitions.

How To Build A Strong First Impression

Suppliers looking for supermarket buyer contacts Germany should prepare the following before any fair or email:

-

Clear product samples

-

Simple price file

-

1–2 page company profile

-

Sustainability certifications

-

Packaging information

-

Short pitch (30 seconds)

German buyers value clarity, not long speeches.

If the offer is strong, they will follow up.

Working With Agents And Distributors

Some suppliers prefer to work through market-entry specialists.

These companies already know buyer structures and can help with:

-

Translating documents

-

Presenting products

-

Arranging meetings

-

Managing onboarding

Agents are common in:

-

Fresh produce

-

Ethnic foods

-

Beverages

-

Non-food household items

-

Frozen foods

When choosing an agent, suppliers should check:

-

Commission structure

-

Existing retail clients

-

Logistics capability

-

Category experience

-

Reference suppliers

Regional Buying Structures In Germany

EDEKA

A mix of regional cooperatives shapes the buying landscape:

Hamburg, Nord, Südwest, Hessenring, Rhein-Ruhr, and more.

Some products are bought centrally through EDEKA Zentrale.

Others are sourced by regional organisations.

REWE Group

A central buying team in Cologne runs most categories.

Some regional adjustments exist, but decision-making remains centralised.

Schwarz Group (Lidl, Kaufland)

Highly centralised procurement.

Suppliers usually deal with category managers at group level.

Aldi Nord & Aldi Süd

Both groups have their own buying offices.

They specialise in private label and seasonal tenders.

Globus

Combination of central procurement and local buying for store-specific assortments.

Understanding these structures helps suppliers target the right level for their product.

Final Guidance For Suppliers

Germany is a disciplined retail market.

Buyers expect professionalism, strong documentation, and competitive pricing.

Finding supermarket buyer contacts Germany becomes easier when suppliers:

-

Prepare full data

-

Show clear differentiation

-

Use the right trade fairs

-

Follow buying procedures

-

Build long-term credibility

For support connecting with retail teams, readers can reach out through your /contact/ page.