Italy remains one of Europe’s most important fresh-produce economies.

High domestic production, strong export demand, and intense supermarket competition are all shaping the market going into 2025.

Fresh produce Italy continues to show resilient consumer demand, even as inflation and weather pressures shift buying behaviours. Retailers, growers, and distributors are adjusting their strategies to protect value and maintain quality across the season.

This outlook brings together the latest verified figures and market signals across fruit, vegetables, exports, retail pricing, and shopper trends.

Italy’s Fresh Produce Market Structure

Italy produces over 24–25 million tonnes of fruit and vegetables annually, according to ISTAT and ISMEA.

The country remains Europe’s second-largest fruit producer after Spain and a leading vegetable grower.

Production is concentrated in regions such as:

-

Sicily and Calabria (citrus, grapes, tomatoes)

-

Emilia-Romagna (pears, stone fruit, kiwifruit)

-

Apulia (table grapes, vegetables)

-

Veneto and Trentino (apples)

The core crops shaping the fresh produce Italy market include:

-

Apples

-

Table grapes

-

Citrus

-

Kiwifruit

-

Tomatoes

-

Leafy vegetables

-

Zucchini, aubergine, peppers

-

Stone fruits (peaches, nectarines, apricots)

Italy is also the world’s leading kiwifruit exporter, with over 500,000 tonnes produced annually, mostly for EU markets.

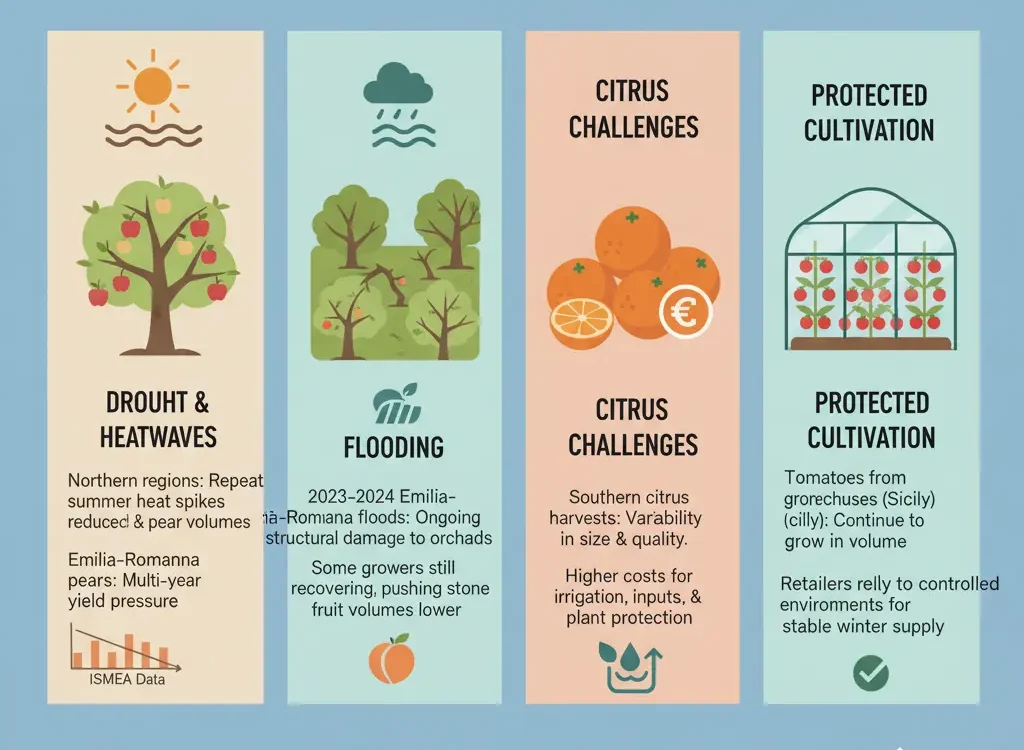

Weather, Production, And Supply Pressures In 2024–2025

The last two seasons have shown how vulnerable fresh produce Italy is to climate conditions.

Drought and heatwaves

Northern regions recorded repeat summer heat spikes, reducing apple and pear volumes.

Emilia-Romagna’s pear sector has been impacted for multiple years, with ISMEA noting continued pressure on yields.

Flooding

The 2023–2024 floods in Emilia-Romagna created ongoing structural damage to orchards.

Some growers are still recovering, pushing certain stone fruit volumes lower.

Citrus challenges

Southern citrus harvests have experienced variability in both size and quality.

Producers report higher costs for irrigation, inputs, and plant protection.

Protected cultivation

Tomatoes from protected greenhouses in Sicily continue to grow in volume.

Retailers rely on these controlled environments to stabilise supply during winter months.

These weather pressures are reshaping retailer sourcing plans and accelerating investment in climate-resilient farming.

Exports: Italy’s Strength In Europe

Fresh produce Italy exports remain one of the country’s strongest agricultural segments.

Key products exported

-

Table grapes

-

Kiwifruit

-

Citrus

-

Apples

-

Leafy vegetables

-

Processed tomatoes (fresh-adjacent category)

Main export markets

-

Germany

-

France

-

Austria

-

Switzerland

-

Poland

-

Middle East (for table grapes and kiwifruit)

Table grapes exceed 600,000 tonnes in annual production, with a growing share moving into premium seedless varieties like Sugraone, Autumn Crisp, and Arra.

Kiwifruit exports remain stable despite disease pressures (Psa and brown marmorated stink bug).

Italy continues to be Europe’s largest supplier.

Apples, especially from Trentino-South Tyrol, maintain strong volumes into Germany and Austria.

Retail Market Dynamics And Shopper Behaviour

Supermarkets in Italy — including Coop, Conad, Esselunga, Carrefour, Lidl, and MD — are competing heavily in fresh produce.

Key retail developments:

1. Strong focus on everyday value

Inflation affected household budgets in 2024–2025, driving demand for private-label fruit and vegetables.

2. Local sourcing marketing

Retail banners highlight regional Italian supply to build consumer trust.

Products like Sicilian oranges, Apulian grapes, and Trentino apples receive strong in-store promotion.

3. Growth in convenience formats

Cut fruit, ready salads, and pre-washed vegetables continue to rise.

Cold chain quality in these lines has improved, supporting higher margins.

4. Organic slowdown but stable premium demand

Organic fruit and vegetables saw softer growth in 2023–2024.

However, high-value organic apples, citrus, and tomatoes still perform well in northern regions.

5. Rising interest in sustainable packaging

Retailers reduce plastics where possible, especially in apples and salads.

Paper-based and compostable trays are becoming more common.

Category Breakdown: Fruit Trends

Apples

Italy remains one of the EU’s top apple producers with around 2 million tonnes annually.

Trentino-South Tyrol leads with high-quality varieties such as Gala, Golden, Red Delicious, and Fuji.

Demand remains stable, but competition from Polish imports puts pricing pressure on retailers.

Table grapes

The strongest export performer in the fresh produce Italy market.

Recent years have seen rapid expansion of seedless varieties, helping Italy defend share against Spain and Chile.

Citrus

Sicilian blood oranges (Tarocco, Moro, Sanguinello) maintain strong seasonal recognition.

Lemons from Sicily remain a key domestic favourite.

Kiwifruit

Production fluctuates due to climate and disease pressure, but Italy remains a global leader with significant European export volumes.

Stone fruits

Weather remains the biggest driver.

Peaches and nectarines have seen reduced availability in some seasons.

Category Breakdown: Vegetable Trends

Tomatoes

Italy grows more than 6 million tonnes of tomatoes, mostly in the processing sector.

However, fresh-market tomatoes — cherry, date, vine, San Marzano — remain a core retail segment.

Sicilian greenhouse tomatoes continue to gain volume.

Leafy greens

Bagged salads and fresh-cut mixes are strong performers.

Northern regions lead production with controlled-environment farming.

Peppers, aubergines, zucchini

Prices remain sensitive to energy and input costs, especially in greenhouse production.

Potatoes and onions

Stable, with competition from Spain, France, and the Netherlands shaping wholesale prices.

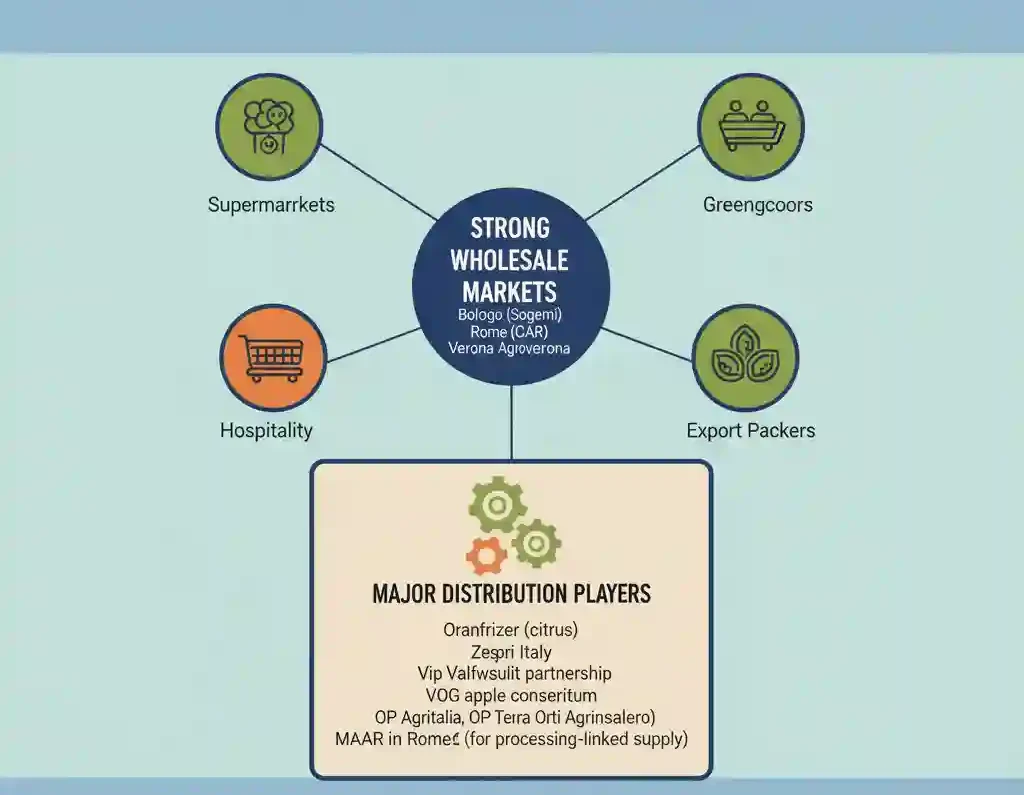

Wholesale and Distribution Structure

Italy’s fresh produce flows through strong wholesale markets:

-

Bologna (CAAB)

-

Milan (Sogemi)

-

Rome (CAR)

-

Turin (Caat)

-

Verona (Agroverona)

These markets supply supermarkets, greengrocers, hospitality, and export packers.

Major distribution players include:

-

Oranfrizer (citrus)

-

Zespri Italy (kiwifruit partnership)

-

Apofruit

-

Vip Val Venosta (apples)

-

VOG apple consortium

-

OP Agritalia, OP Terra Orti, OP Agrinsalerno

-

MAAR in Rome

-

Conserve Italia (for processing-linked supply)

The system is complex but efficient, with strong cooperatives connecting growers to retail buyers.

Input Costs And Price Movements

Fresh produce Italy faces sustained cost pressure:

-

Higher labour costs

-

Irrigation and water management expenses

-

Packaging costs increasing in some materials

-

Transport and cold chain energy bills

-

Plant protection costs rising due to EU regulatory changes

These challenges mean retailers must balance affordability with fair returns for growers.

Wholesale prices fluctuate heavily depending on weather and quality, especially for tomatoes, peppers, and leafy crops.

Sustainability And Innovation

Sustainability work across fresh produce Italy is becoming more practical and technology-driven. Southern regions are relying more on drip irrigation and precision water systems to keep yields stable during long, dry seasons. Growers are also planting climate-resilient varieties, including heat-tolerant stone fruit and apple types that cope better with disease pressure. Retailers continue to cut single-use plastics, moving apples into cardboard punnets, tomatoes into fibre trays, and citrus into compostable nets where possible. Digital tools are spreading quickly too, with more sensors, forecasting platforms, and controlled greenhouse environments appearing in Sicily and Northern Italy to manage crop stress and improve consistency.

Retail Outlook For 2025

Fresh produce Italy is expected to remain stable in volume but competitive in pricing.

Key expectations:

-

Supply improvements in apples and kiwifruit after challenging seasons

-

Continued strength for premium Italian seedless grapes

-

Higher demand for local citrus and seasonal specialties

-

More investment in greenhouse capacity

-

Supermarkets leaning on promotions to protect footfall

-

Convenience and pre-cut products expanding share

Despite weather risks, Italy’s position in European fruit and vegetable supply remains solid.

Why It Matters For Retailers And Suppliers

The fresh produce Italy market matters because it sits at the centre of Europe’s fruit and vegetable supply. Italy is one of the biggest sources of grapes, apples, citrus, and kiwifruit, and retailers across the EU rely on these products to bridge seasonal gaps. Climate pressure is now reshaping availability, costs, and long-term planning for growers and buyers.

Export performance also feeds directly into supermarket pricing and promotions inside Italy, especially in high-volume categories. At the same time, shoppers are moving toward affordability, trusted quality, and more convenient formats. For buyers, suppliers, and distributors, understanding these shifts is key when planning 2025 sourcing and promotional activity.