Italy is one of Europe’s most important packaging hubs. The country combines strong materials expertise, global machinery brands, and a large base of converters supplying food, beverage, and household categories.

For retailers, producers, and distributors, the market is moving fast. Sustainability rules from Brussels, supermarket commitments, and technology upgrades all shape what happens next. In 2026, several companies stand out for their impact and visibility in the Italian market.

This report looks at the key packaging suppliers Italy relies on in 2026, covering converters, recyclers, and machinery manufacturers with a strong footprint in the sector.

Italy’s Packaging landscape In 2026

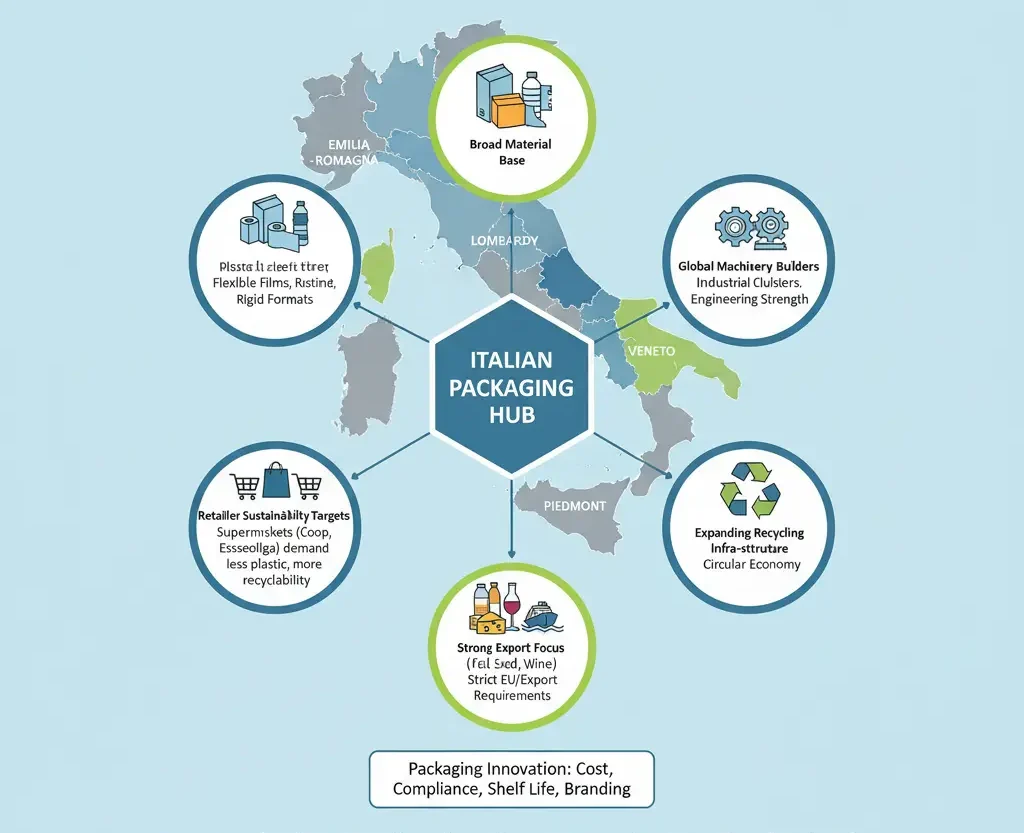

Italy’s packaging sector is broad and deeply rooted. The country has long been known for its engineering strength, industrial clusters, and specialised converters. Key regions such as Emilia-Romagna, Lombardy, Veneto, and Piedmont host companies that supply Europe’s biggest brands.

Several structural factors make Italy a significant packaging hub:

- Italy has a strong base in plastics, paper, flexible films, and rigid formats.

- Major global machinery builders operate from Italian industrial centres.

- Recycling infrastructure is expanding, supported by national and EU policies.

- Large supermarket groups encourage suppliers to switch to mono-materials.

Italy is a major exporter of fresh produce, pasta, dairy, preserved foods, and wine — all requiring advanced packaging.

Retailers such as Conad, Coop Italia, Esselunga, Selex, and MD have specific goals for packaging reduction and recyclability. Export-focused producers — especially those shipping to Germany, France, the UK, and the Netherlands — must meet strict requirements on material choices.

This puts packaging suppliers in a central role. Innovation now shapes cost, compliance, shelf life, and branding. Below are the key packaging suppliers Italy tracks most closely in 2026.

Gualapack

Gualapack is one of Italy’s top flexible packaging specialists with global reach. The company is known for its spouted pouches and high-performance laminates used across baby food, sauces, fruit purées, snacks, and ready-to-eat products.

Gualapack’s strength also comes from its integrated model, offering both pouches and spouts. Many Italian and European producers rely on this structure for quality and consistency.

In recent years, Gualapack has expanded its work on recyclable pouches and mono-material solutions. These formats help retailers and brands respond to EU requirements and their own sustainability programmes.

Italy’s private-label market, especially in fruit snacks and convenient squeezable formats, gives the company wide visibility. The shift towards lightweight packaging and easier recyclability keeps Gualapack firmly at the centre of Italy’s flexible packaging landscape.

ILPA Group

ILPA Group is another major name in Italy’s packaging sector. It is well known for rigid plastic packaging, fresh produce trays, and food-safe materials.

The group includes several divisions with strong expertise in rPET and rPP. Italian supermarkets, especially in fruit and vegetable categories, are increasing their use of recycled-content trays. ILPA’s scale and continuous material development make it a central player in this segment.

In 2026, the focus remains on mono-material trays, lighter formats, and expanding rPET capacity to meet EU circularity demands.

Aliplast

Aliplast is one of Italy’s leading recycling and circular-economy companies. It operates across collection, processing, and regeneration of plastics. Many Italian manufacturers rely on Aliplast for stable supplies of recycled materials that meet food-grade and industrial requirements.

The company plays a key role in Italy’s transition toward circularity. As the EU’s Packaging and Packaging Waste Regulation moves forward, demand for certified recycled content continues rising. Aliplast supports this demand by offering recycled polyethylene (rPE), recycled polypropylene (rPP), and other materials used in bottles, films, trays, and industrial packaging.

Aliplast also works with producers and retailers on closed-loop projects, where waste from operations is collected, processed, and turned back into usable material. These systems help companies reduce emissions, control costs, and meet corporate sustainability targets.

In 2026, Aliplast expands both its recycling capacity and its partnerships with FMCG companies across Italy. Its focus on material quality and traceability makes it an essential partner in Italy’s packaging landscape.

Sacmi

Sacmi is one of Italy’s global leaders in packaging machinery. It supports beverage, closures, digital printing, and food processing lines used worldwide.

For Italian producers upgrading automation or preparing for tighter energy and waste targets, Sacmi’s machinery advancements matter. The company works across high-performance lines, lightweight cap systems, and inspection technology.

In 2026, Sacmi’s innovation pipeline includes improvements in digitalisation, sustainability-focused design, and packaging consistency for high-volume processors.

European And Multinational Suppliers Active In Italy

Italy’s market is also shaped by strong European and multinational packaging groups that operate locally or supply into Italian retailers and producers.

Key groups include:

Amcor – Large footprint in flexible packaging with strong customer base in Italy.

Berry Global – Rigid plastics, closures, and household products.

Smurfit Kappa – Corrugated and paper solutions for Italy’s food, beverage, and fresh-produce sectors.

DS Smith – Fibre packaging, shelf-ready formats, and retail-ready corrugated solutions.

Stora Enso – Paper-based materials aligned with EU recyclability targets.

These companies often collaborate with Italian converters or supply directly to producers exporting to major European markets.

Why Packaging Innovation Matters For Italy In 2026

Several factors are reshaping Italy’s packaging market:

Retailer sustainability targets: Supermarkets such as Coop Italia, Conad, Esselunga, and Selex have set specific goals to cut plastic, increase recyclability, and reduce unnecessary packaging. Suppliers must adapt quickly.

EU Packaging and Packaging Waste Regulation (PPWR): The upcoming regulation increases pressure on mono-material solutions, recycled content, and clear disposal instructions. Italian producers exporting beyond Italy must comply with strict rules.

Machinery upgrades and automation: Italian factories continue modernising equipment to keep energy use stable while increasing output. Machinery suppliers like Sacmi play a crucial role here.

Strong export dependency: Italy exports significant volumes of food: pasta, sauces, tomatoes, fresh produce, olive oil, cheese, and wine. Export markets — especially in Northern Europe — demand packaging that fits recycling systems and sustainability rules.

Circular economy development: Recycling systems and closed-loop partnerships expand. Recyclers like Aliplast ensure consistent supply of high-quality secondary materials.

Consumer expectations: Italian shoppers increasingly prefer simpler, lighter packaging. While price remains important, clear recycling instructions and less plastic influence purchasing decisions.

These pressures combine to push the Italian market toward cleaner materials, better performance, and more efficient recycling systems. Packaging suppliers Italy relies on must balance cost, quality, compliance, and sustainability.

Looking Ahead: What To watch In 2026 And 2027

Italy’s packaging market will keep changing through 2026 and 2027 as new EU rules and retailer targets take effect. The biggest shifts will come from mono-material films that fit existing recycling systems, and lighter rigid trays for fresh produce and dairy. More suppliers are also investing in advanced mechanical recycling to secure better-quality secondary materials. Machinery upgrades and digital inspection tools will help factories improve consistency and reduce downtime.

Fibre-based options such as paper punnets, fibre lids, and compostable nets will grow in specific categories. At the same time, retailers and suppliers will expand closed-loop partnerships to recover materials and cut waste. With strong engineering and machinery expertise, Italy is well placed to lead Europe’s next phase of packaging transition, supported by companies like Gualapack, ILPA Group, Aliplast, Sacmi, and major global players.

Editor’s Note: Information in this article is based on publicly available company reports, Italian industry associations, and supplier announcements from verified manufacturing and trade sources.