In 2025, grocery retail is shifting fast as artificial intelligence and new in-store technologies begin to reshape how people choose products, move through aisles and pay at the checkout. The change is no longer theoretical. It is happening now, and AI & tech are changing supermarket shopping 2025 in ways that feel visible to both shoppers and retailers.

Supermarkets across major regions are treating technology not as a pilot but as a core part of store operations. Rising costs, labour shortages and pressure on margins are forcing retailers to modernise how shops run. At the same time, customers want shorter trips, quicker payment and more personalised offers — not more complexity. These two forces have collided with a third: the technologies themselves have matured. Smart carts work better than they did a few years ago. Shelf sensors now detect stock in real time. Digital price labels update across thousands of SKUs instantly. When all of this connects with richer data and strong AI forecasting models, the result is a new supermarket experience.

For retailers, the moment feels decisive. They know this shift is broad — from store layout, to supply chain, to how promotions are targeted. And the pace is picking up. This article looks at the technologies shaping the biggest gains and challenges for supermarkets in 2025.

Smart Carts And Cashier-less Checkout

Smart shopping carts have moved from early trial to regular use in several markets. These carts carry cameras, small scanners and weight sensors that identify items as soon as shoppers place them inside. Some give on-screen suggestions for related items or cheaper alternatives. Others guide shoppers aisle-by-aisle to complete their list.

The biggest promise is simple: skip the checkout line. When the trip is done, customers walk out, and payment happens automatically through the retailer’s app. Trials in Europe and the US show that shoppers appreciate the time saved — especially for mid-sized baskets. Some supermarket pilots report that smart carts can cut total trip time by 20–25%, mainly by removing checkout queues and reducing backtracking in aisles. For retailers, the value sits in both speed and insight. Smart carts record movement patterns, dwell time and product-discovery behaviour. Those signals help stores improve layouts and refine categories.

In 2025, these carts are proving most useful in busy urban stores, where checkout queues often push customers away. The technology is not perfect, but it is improving month by month.

Electronic Shelf Labels And Dynamic Pricing

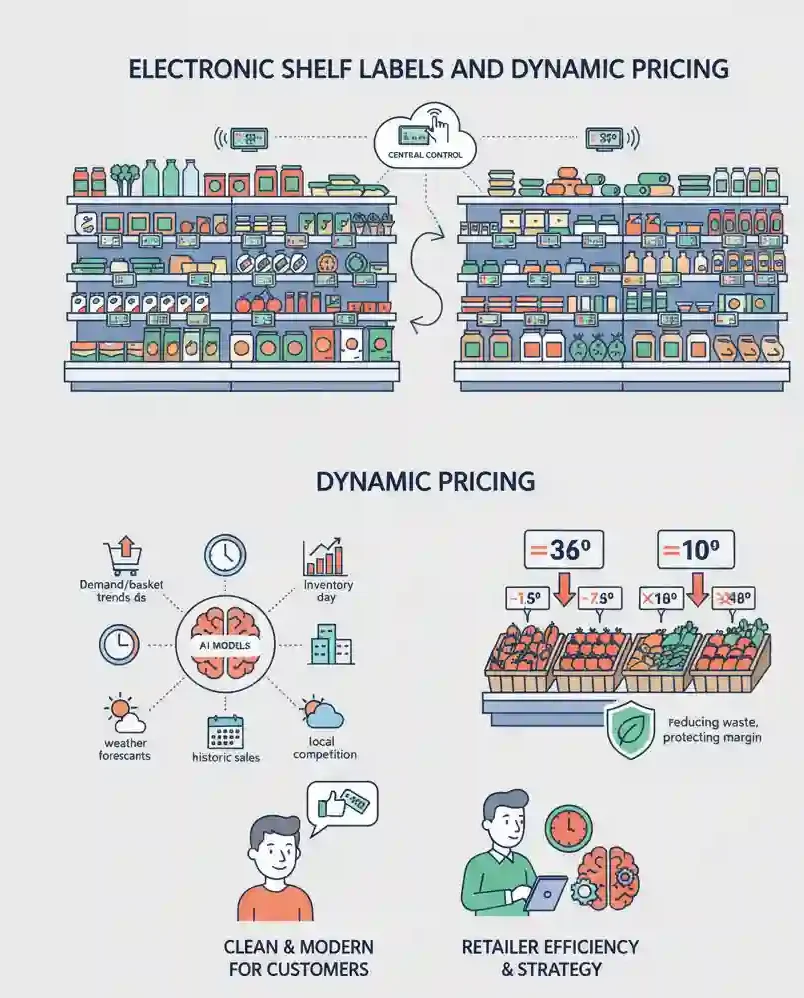

The shift to digital shelf labels is one of the biggest operational changes happening across supermarket chains this year. Small electronic tags replace printed paper labels and are controlled centrally, allowing prices to update within seconds.

Dynamic pricing — adjusting prices based on demand, time of day, inventory levels or local competition — is emerging behind these labels. AI models analyse historic sales, current basket trends and even weather forecasts to suggest better price points. Fresh departments see clear benefits: markdowns on products nearing expiry can be automated, reducing waste while protecting margin.

Early European trials suggest that dynamic pricing linked to ESLs can reduce food waste in fresh categories by 15–18% during peak periods.

For customers, digital labels feel clean and modern. For retailers, they reduce labour hours spent on re-ticketing and open the door to pricing strategies that were not realistic with paper.

AI-driven Inventory And Supply-chain Optimisation

Forecasting is changing fast. AI tools now predict daily demand with much higher accuracy than traditional systems. They look at seasonality, promotions, local events, competitor activity and even road traffic patterns.

This helps supermarkets cut out-of-stocks, adjust orders earlier and manage freshness more tightly. In produce, bakery and chilled categories, the gains are visible. Some chains report forecast accuracy improvements of more than 30% when switching from manual planning to AI-driven models, especially in short-life categories. Retailers that once struggled with small daily gaps can now step in before the shelf goes empty.

Supply chains also benefit from AI routing tools that optimise delivery windows and warehouse flows. With labour tight and fuel costs unsettled, these models bring discipline to logistics. Many chains now treat AI forecasting as essential infrastructure — as fundamental as their core store systems.

Personalisation And Shopper Engagement

Technology in 2025 is not only about automation. It is also bringing more personal interactions into the store.

Apps now deliver real-time offers as customers enter. Digital signage shifts messaging based on the time of day or the demographic mix in front of a screen. Some retailers test mobile-guided shopping routes for specific diets or lifestyle needs. In some Asian markets, personalised recipe suggestions appear when a shopper scans a product.

The aim is relevance. Retailers want promotions that feel meaningful, not repetitive. Customers want deals that match the way they shop. When AI gets this balance right, engagement rises. But it requires careful data management and clear communication.

Ethical, Privacy And Workforce Considerations

As AI expands across grocery retail, questions follow it. Customers want to know what data is collected and who can access it. Clear, simple communication is becoming a competitive advantage. Some supermarkets now publish easy guides explaining how sensors work and what information is captured.

Workforce impact is also part of the conversation. Automation removes some routine tasks but creates new roles in maintenance, tech oversight and service support. Retailers generally lean toward a blended model — letting technology handle repetitive tasks while staff focus on helping shoppers.

The underlying message is steady: technology should make the store feel more human, not more distant.

Regional Snapshots And Retailer Examples

Across Europe, the UK remains one of the quickest adopters of electronic shelf labels. Several major chains have rolled out tens of thousands of tags in 2025, with early signs showing smoother promotional updates and fewer ticketing errors.

In Germany, smart cart pilots are expanding in high-traffic city stores. Retailers there aim to refine accuracy and build trust before scaling up.

In the US, computer-vision checkout systems are moving into larger formats, not only convenience stores. Retailers want faster throughput at peak hours, and early results show better flow and shorter queues.

The pattern is the same across regions: supermarkets are shifting from testing to transformation.

What Grocery Retailers Must Do Now

For supermarket chains, the priority is building the groundwork that makes these technologies reliable.

“AI is moving from an optional upgrade to a core part of store infrastructure,” says one senior retail technology consultant. “The retailers making the fastest progress are those treating data capability as a frontline skill, not a back-office function.”

They need strong sensor networks, modern shelf infrastructure and stable in-store connectivity. Without this, even advanced AI tools cannot perform properly. Data capability matters just as much. Retailers must train staff to understand analytics, check accuracy and read model outputs with a critical eye.

The smartest strategy is to pilot in a controlled number of stores, gather evidence and scale gradually. Pilots should track both operational improvement and customer response. Technology that helps operations but irritates shoppers rarely survives.

Retailers also need a firm privacy stance. Shoppers accept data usage when it brings clear benefits but not when it feels unclear. Transparent policies build long-term trust.

Store formats will evolve too. As smart carts and dynamic pricing mature, layouts may shift to support faster movement and easier navigation.

And through all of this, human service must remain part of the experience. Technology can support staff, but it cannot replace the value of a helpful person on the shop floor.

Conclusion

AI and technology will continue speeding up after 2025. The tools entering supermarkets today will look basic within a few years. Retailers that invest early, think transparently and design human-centred experiences will set the pace. Shoppers will expect smoother trips, faster checkout and more relevant choices — and the stores that deliver that standard will lead the next era of grocery retail.