Spain’s supermarket market is moving quickly in 2025. The structure that looked stable for years is now shifting as shoppers change how they buy food and as retailers adjust their strategies. Mercadona remains the number-one chain, but the gap with competitors feels more dynamic than before.

Shoppers are more price-aware, more selective about fresh food, and more open to private label. These changes match the wider patterns seen across Europe in Supermarket Trends 2025, where value, convenience and quality are the three main drivers in food retail.

Carrefour, DIA, Lidl and Aldi are reacting fast. They are testing new store formats, rolling out technology and reshaping their private-label lines. Spain is becoming one of the most interesting markets in Europe because it mixes price pressure, strong fresh categories and very loyal regional habits.

Mercadona: Still the Market Leader, Still Setting The Pace

Mercadona continues to shape how modern grocery works in Spain. Its decisions in ready meals, pricing, private label and store operations influence the whole market.

Premium Ready Meals Now a Key Traffic Driver

Mercadona has invested heavily in ready meals during the past few years. In 2025, this category grows even faster. More shoppers now want quick meals that taste fresh but cost less than restaurant takeaway.

The chain continues to expand pasta bowls, rice dishes, salads, grilled meals, sushi, bakery snacks and cold ready-to-eat products. For many families, these items replace lunch out or mid-week treats. This is similar to trends seen in Northern Europe and in other reports like Fresh Produce Trends Europe, where quality and speed often matter more than traditional long cooking.

These ready meals are produced through close supplier partnerships, which helps Mercadona keep the same taste and quality across regions. The consistency is one reason the format works so well.

Private Label Growing In Quality and Structure

Mercadona’s Hacendado, Deliplus and Bosque Verde brands continue to grow. In 2025, the chain expands private label into new premium frozen meals, snacks, sauces, oils and home-care.

More important is the tier structure. Mercadona uses three clear groups:

• core value — low everyday price

• mid-tier quality — still cheaper than national brands

• premium — chef-style or high-standard products

This mirrors broader patterns we track in Private Label Europe, where tier clarity helps shoppers decide quickly without feeling overwhelmed. Spanish households appreciate this structure because budgets shift from week to week.

Pricing Architecture: Stability Over Promotions

Mercadona keeps its “everyday low price” system. Instead of heavy promotions, prices stay stable and predictable. This reduces shopping stress. It also protects trust, which is important as inflation, energy costs and rent pressures still affect many families.

In 2025, Spanish shoppers compare prices more than before. But they also avoid stores with too many price swings. Mercadona benefits from this preference for simplicity.

Carrefour Spain: Multi-Format Strategy and Stronger Technology

Carrefour has a different approach. It uses big hypermarkets, mid-size supermarkets and urban convenience stores to reach very different types of customers. In 2025, Carrefour Spain focuses heavily on technology and store upgrades.

New Formats for Urban Life

Carrefour Express keeps expanding in large cities. These stores focus on ready meals, bakery, cold drinks, snacks and top-up missions. Many people in Madrid, Barcelona and Valencia now stop in these stores several times a week.

Carrefour Market stores get stronger fresh sections, more local products and clearer private-label shelves. Layouts feel more open, faster to navigate and easier for trolleys.

Hypermarkets still appeal to families doing large weekend shops. They remain strong in certain regions because customers can combine food, household, baby goods and electronics in one trip.

Sustainability Becoming a Competitive Tool

Carrefour has made sustainability part of its identity in Spain. This includes:

• refill stations for some household goods

• eco-labelled private-label items

• strong waste-cutting plans in fresh sections

• more seasonal and local produce

• recyclable and simpler packaging

These steps help Carrefour stand out when shoppers want both value and responsibility. It also matches patterns seen in many European markets through Retail Technology 2025, where sustainability and tech often work together.

Technology Improving the Customer Journey

Carrefour is investing in:

• digital shelf labels

• app coupons and personalised offers

• improved click-and-collect

• better self-checkout

• real-time inventory tools

All of this makes the shopping trip smoother, especially for larger baskets. Many Spanish families now expect these features, which pushes the whole market forward.

DIA: Local Reach, Smaller Stores and Recovery Strategy

DIA has been rebuilding after years of restructuring. In 2025, the chain shows clearer focus. It simplifies assortments, improves fresh food and cleans up store layouts.

DIA’s private label also gets stronger packaging and clearer pricing. The retailer works with more regional suppliers to improve fruit, vegetables and bakery. Local sourcing helps DIA build trust in neighbourhoods where it was losing relevance before.

What makes DIA competitive is its location network. Many stores sit inside residential streets, close to schools, apartments and transport routes. For quick top-ups and evening missions, DIA is still a daily-life brand.

Lidl And Aldi: Discounters That Keep Growing

Lidl and Aldi continue to shape the Spanish market in 2025. Lidl keeps its strength in bakery, fresh produce, weekly promotions and rotating non-food offers. Aldi keeps its focus on strong private-label value and very clear pricing.

Both chains gain traffic from young families and middle-income shoppers. They benefit from rising pressure on household budgets and the rising trust in private label.

Their partnership with Spanish suppliers is also important. Both chains support local fruit, vegetables, dairy, olive oil, cheese and cured meats. This makes the value offer feel more premium than it did a decade ago.

Shopper Behaviour In Spain 2025

Spanish shopper behaviour is shifting in deep, structural ways this year. These changes mirror wider patterns in Supermarket Trends 2025, but Spain adds its own flavours.

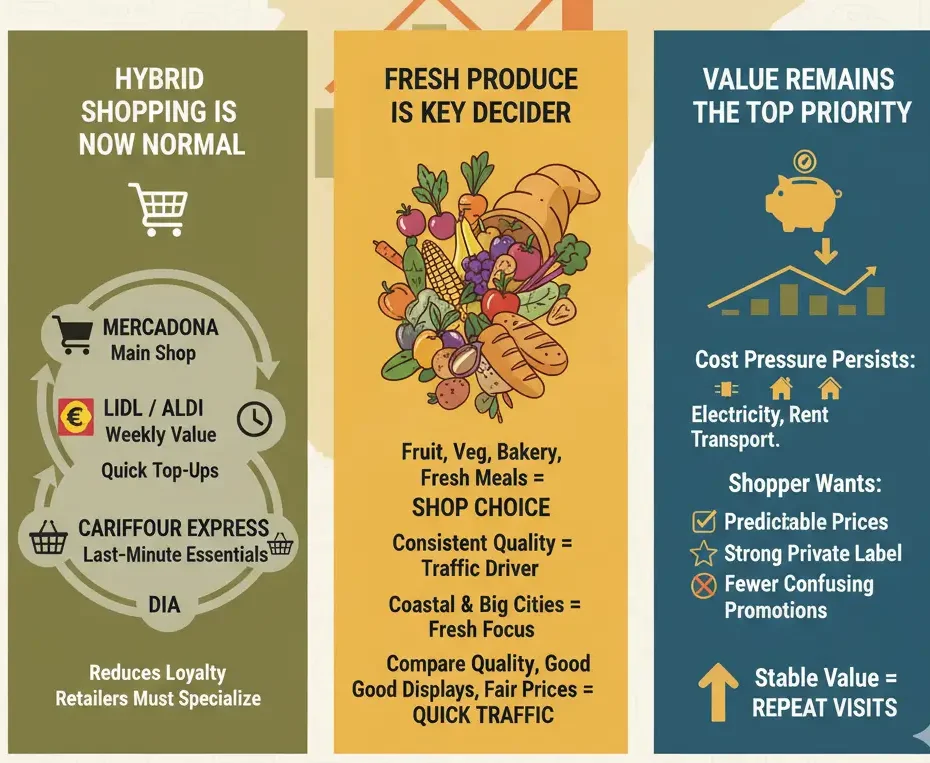

Hybrid Shopping Is Now Normal

More shoppers buy from two or three stores each week. A typical pattern is:

• Mercadona for main shop

• Lidl or Aldi for weekly value

• Carrefour Express for quick top-ups

• DIA for last-minute essentials

This hybrid behaviour reduces loyalty. It forces every retailer to be strong in its core categories.

Fresh Produce Is a Key Decider

Fruit, vegetables, bakery and fresh meals strongly influence where families shop. Quality must be consistent. Fresh departments are a main traffic driver, especially in coastal regions and big cities.

Spanish shoppers compare produce quality more than before. Good displays and fair prices can move traffic very quickly.

Value Remains the Top Priority

Even with easing inflation, Spanish households still feel cost pressure. Electricity, rent and transport all influence food budgets.

Shoppers want predictable prices, strong private label and fewer confusing promotions. Chains that offer stable value gain repeat visits.

Regional Differences: Spain Is Not One Single Market

Spain’s regions behave differently, and retailers adjust their strategies based on local needs.

Andalusia

Households often do one larger weekly shop. Mercadona and Carrefour hypermarkets perform strongly. Shoppers look for large bakery areas, fish counters and affordable ready meals.

Catalonia

Shoppers buy more frequently and prefer shorter trips. Carrefour Express, DIA and well-placed Mercadona stores get strong traffic. Premium private label performs better here than in many other regions.

Madrid Region

Many households combine online shopping with top-up trips during the week. Tech features, quick checkout and click-and-collect matter more.

Valencian Community

Mercadona has deep roots here, and loyalty is very strong. Local products and seasonal produce play a major role.

The Growing Role Of Technology In 2025

Technology is moving from “nice to have” to “normal expectation.” Spain is aligning with broader patterns seen in Retail Technology 2025, where in-store digital tools now guide store operations.

Digital shelf labels reduce pricing errors. Smart forecasting improves fresh-produce waste. Apps help personalise baskets. Self-checkout lines continue to grow in popularity.

Retailers that invest early get smoother operations and happier customers.

Private Label Becoming Central to Spain’s Grocery Identity

The strength of private label in Spain mirrors what is happening across Europe, as shown through Private Label Europe.

Spanish families trust retailer brands in categories like:

• dairy

• olive oil

• ready meals

• frozen food

• bakery

• household cleaning

In 2025, private label becomes even more important for controlling basket spend. When prices move, shoppers switch to private label instead of reducing quantity. This helps retailers protect volume.

Fresh Food Still The Heart Of The Spanish Market

The trends highlighted in Fresh Produce Trends Europe are visible across Spain too. Strong produce quality drives traffic. Good bakery drives loyalty. Fish, meat, deli and ready meals keep customers returning.

Spain’s climate and farming sector make fresh food a natural competitive area. Retailers that manage waste, maintain low prices and offer high-quality local items gain an advantage.

What’s Next for 2026?

Several shifts are already visible:

• Ready meals will grow even faster, especially premium options.

• More urban mini-stores will enter Madrid, Barcelona and Valencia.

• Discounters will put more pressure on national brands.

• Technology will move deeper into store operations.

• Private label will expand into more mid-tier and premium areas.

• Fresh produce pricing will decide traffic during summer seasons.

2026 will likely bring a market where value and convenience remain top priorities, but quality and sustainability continue to push innovation.