A-Brands in Spain 2025 are operating in one of Europe’s hardest supermarket environments.

Private label takes a big share, discounters keep expanding, and shoppers compare prices more than ever.

But A-brands still fight back. They use pricing tactics, product innovation, store visibility, and category strength to stay relevant.

This article explains where they stand today, and what they must do next to stay competitive.

A-Brand Challenges In Spain

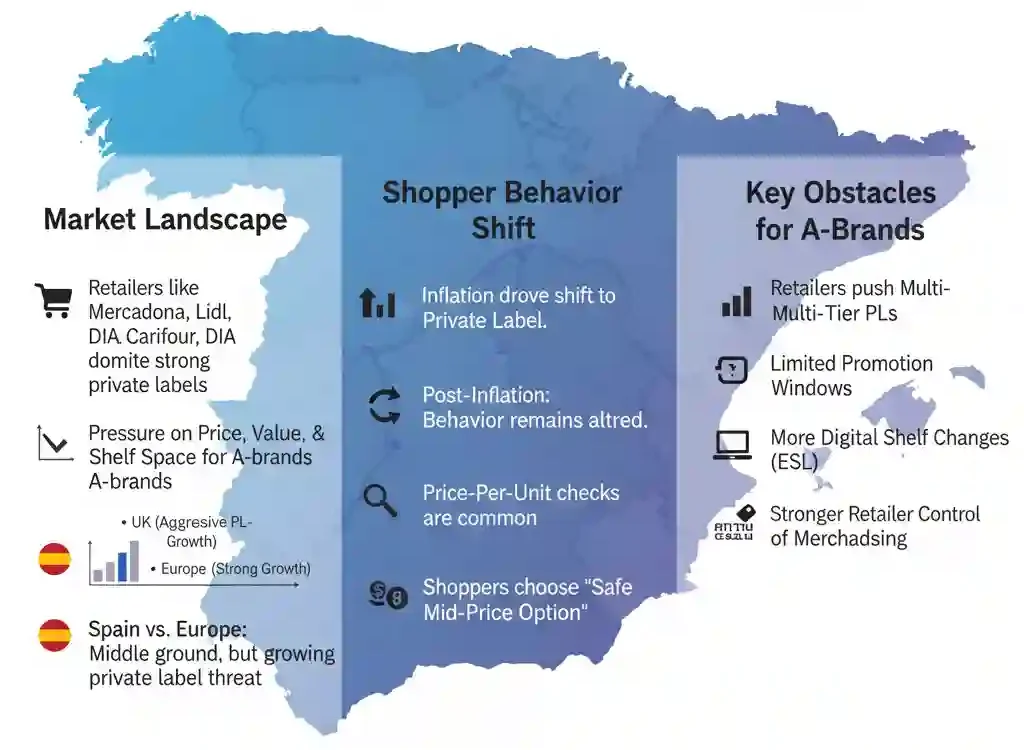

Spain is a private-label heavy market. Retailers like Mercadona, Lidl, Carrefour and DIA use strong private-label families across all categories. For A-brands, this creates pressure on price, value perception and shelf space.

At the same time, when you compare this with the strong private label growth in UK and Europe, you can see how Spain sits in the middle — not as aggressive as the UK, but still moving in a direction that makes life harder for branded suppliers.

Many shoppers shifted to private label during inflation. Even as inflation cools, behaviour does not fully return. People now check price-per-unit more often and pick the “safe mid-price option,” not always the brand they used to buy.

This is the main backdrop shaping A-Brands in Spain 2025: high competition, limited space, and a value-focused shopper mindset.

A-brands also struggle with:

-

retailers pushing multi-tier PL

-

limited promotional windows

-

more digital shelf changes due to ESL

-

stronger retailer control of merchandising

But the picture is not all negative. Certain categories still favour brands strongly.

Price Promotions vs EDLP

A-brands in Spain depend heavily on promotions.

Spanish shoppers respond strongly to:

-

2×1 deals

-

family-size discounts

-

loyalty card savings

-

multi-buy formats

But retailers reduce deep promotions to protect margins. Some banners move closer to EDLP (Everyday Low Price) structures, especially on core private-label items.

This puts A-brands under pressure.

If they promote too much, they lose profitability.

If they promote too little, they lose shelf rotation.

In 2025, the trend is a mix. Promotions still exist, but many retailers push for fair-price ranges instead of dramatic discounts.

This means A-brands must justify their value with pack quality, taste, function, and innovation — not only discount depth.

Which Categories Still Favour A-Brands?

Even in a private-label market, some categories remain brand-led.

In A-Brands in Spain 2025, three stand out: baby, beverages, and beauty.

Baby Products

Baby formula and baby care keep strong brand loyalty.

Parents prefer branded quality, safety certifications, and trusted ingredients.

Retailers have private label, but the trust gap still helps A-brands.

Beverages

Soft drinks, energy drinks and some juices stay branded.

Flavour loyalty and brand identity matter more than price here.

Even when PL options grow, brands remain the default choice for teenagers, young adults and families.

Beauty & Personal Care

Shampoo, deodorant, skincare and hygiene items keep a stable brand base.

People trust long-term performance and prefer recognised formulas.

Private label grows in value lines, but premium segments stay brand-led.

These three areas are where A-brands can still expand, because brand meaning matters more than price.

How Brands Are Responding: Innovation, Pack Formats & Reformulation

A-brands answer the Spanish market shift with three strategies.

1. Innovation

A-brands launch new flavours, functional claims, or improved experiences.

In beverages, this includes low-sugar ranges and functional hydration.

In beauty, it includes dermatology-inspired solutions and faster-working formulas.

Innovation gives shoppers a reason to choose a brand over private label.

2. Pack Formats

Smaller packs help with affordability.

Large family packs help with value.

A-brands test both.

Many Spanish retailers prefer A-brands to offer:

-

1L or 1.25L bottles instead of 2L

-

200 ml cosmetics instead of 300 ml

-

multi-pack snacks

-

on-the-go drinks

Pack strategy is now a core part of competitiveness.

3. Reformulation

A-brands reformulate to:

-

cut sugar

-

reduce salt

-

use cleaner labels

-

meet sustainability targets

Retailers highlight these improvements on shelf tags, so reformulation also becomes a visibility driver.

Innovation, formats and formulas all work together to secure space in A-Brands in Spain 2025.

Brand Visibility Inside Spanish Stores

In-store visibility is one of the biggest battles.

Private-label products often take the central shelves, while brands must negotiate for eye-level positions.

A-brands increase visibility by:

-

buying secondary placements

-

using branded shelf strips

-

investing in end caps

-

supporting in-store sampling

-

joining seasonal campaigns

Retail media also grows fast. Digital screens at Carrefour, ALDI, Eroski and others allow brands to promote short messages.

Some brands work directly with retailers on category resets to defend their shelf blocks.

Visibility now requires both physical and digital presence.

Discounters And The Threat To A-Brands

Lidl and ALDI are the toughest competitors for A-brands in Spain.

They grow private label, add premium tiers, and move into categories that used to be brand-heavy.

For example:

-

premium chocolate

-

sports drinks

-

skincare

-

breakfast cereals

Each new private-label launch takes shelf space and volume away from brands.

Discounters also attract younger shoppers with simple ranges and strong price trust.

For A-Brands in Spain 2025, discounters are the biggest long-term pressure, not traditional supermarkets.

What A-Brands Must Do in 2026

A-brands face another tough year ahead, so they must focus on a clear value story, stronger retailer partnerships, and constant innovation to stay competitive in 2026. Shoppers need solid reasons to pay more, which means brands must prove better performance, longer-lasting use, or superior ingredients. Working closely with retailers is now essential, because joint planning, data sharing and coordinated promotions help protect shelf space in a market where visibility depends more on retail relationships than national advertising.

Innovation also has to stay continuous, as Spain is a fast-moving market where slow-moving brands lose space quickly to private label. Retail media will play a bigger role too, with short screen messages inside stores helping remind shoppers why the brand matters. Pack strategy must get smarter, offering affordable sizes and multi-pack options that fit into weekly budgets.

And A-brands should protect their strongest categories — baby, beverages and beauty — with consistent marketing and product upgrades, because these are the segments where brand loyalty is still highest. By following these steps, A-Brands in Spain 2025 can hold their position and keep meaningful share even with rising private-label pressure.

FAQ

1. Why is Spain considered a difficult market for A-brands compared to other EU countries?

Spain has one of the highest private-label shares in Europe, stronger discounters, and retailers with very powerful private-label families. This makes it harder for brands to win shelf space and maintain premium pricing.

2. Do Spanish shoppers still trust A-brands after the inflation period?

Yes, but trust depends on category. Shoppers trust A-brands most in baby, beverages and beauty. In other categories, private label earns more trust due to good quality and better prices.

3. Are A-brands losing national TV visibility in Spain?

Yes. Many companies reduce big TV campaigns because consumers switch to streaming and retailers control more store-level media. Visibility now depends more on retail media, end caps and in-aisle screens.

4. Why do Spanish retailers limit promotional depth for A-brands?

Retailers try to protect their margins and avoid pricing gaps between A-brands and private label. Deep promotions can disrupt category pricing, so banners now prefer balanced, steady deals instead of heavy discounts.

5. Can A-brands still negotiate premium shelf positions in 2025?

Yes, but it requires stronger joint business plans. Retailers expect data support, innovation calendars and category growth justification before giving eye-level positions to brand manufacturers.

6. How important are e-commerce and home delivery for A-brands in Spain?

Online grocery is smaller in Spain than in France or the UK, but it is growing. A-brands use strong images, clearer pack information and better search placement to improve visibility on retailer apps.

7. Are sustainability claims helping A-brands compete against private label?

They help, but only when claims are clear and visible on-pack. Shoppers look for reduced plastic, cleaner ingredients and responsible sourcing. These details help brands justify a higher price.

8. Do Spanish shoppers respond well to new flavours or limited editions?

Yes. Spain is a very flavour-driven market, especially in beverages, snacks and beauty. Limited editions help brands create excitement and improve rotation, even without deep promotions.

9. Are A-brands expanding into value price tiers to compete with private label?

Some brands test value lines or “entry” ranges, but they do it carefully to avoid harming their premium perception. Multi-size packs are often a safer option than launching low-tier SKUs.

10. Which retailers are the toughest for A-brands to negotiate with in 2025?

Discounters like Lidl and ALDI are the hardest because they rely heavily on private label and give limited space to brands. Their range is small, so they select only a few A-brands per category.