The US fresh produce market 2025 is shaped by rising import dependence, unpredictable weather, and shifting shopper expectations. Retailers face tight margins while demand for fresh fruits and vegetables stays strong across all channels.

At the same time, berries, avocados, salads, greenhouse vegetables and snacking fruits continue to grow faster than most supermarket categories. This makes sourcing, forecasting and quality control more important than ever for buyers.

Where the US Fresh Produce Market Stands In 2025

The market enters 2025 with steady consumption, strong focus on health, and higher expectations for consistency and quality. Even though inflation has cooled, shoppers remain very price-sensitive. They still buy fresh produce every week, but they watch value more closely.

Supermarkets also rely on produce to reinforce trust. When pricing looks fair and the displays look fresh, shoppers feel more confident in the rest of the store. That is why major banners among the largest supermarkets in the United States continue investing heavily in produce sourcing, refrigeration, merchandising and supplier partnerships.

Market Size Snapshot

Industry estimates show that fresh fruits and vegetables remain one of the largest areas in the food sector. Total value continues to grow slightly each year, but real volume depends on seasonal weather. When California or Florida experience stable conditions, supply improves. When climate pressure hits, imports become essential.

Even with these ups and downs, produce remains a weekly priority for households. Shoppers may cut back on premium categories at times, but overall demand stays stable. Retailers position produce at the front of the store to drive traffic and reinforce the perception of freshness.

Core Categories in 2025

Across the country, key everyday items continue to be:

-

Apples, bananas and citrus

-

Berries, the fastest-growing segment

-

Grapes, supported by domestic and South American supply

-

Avocados from Mexico and Peru

-

Leafy greens, especially salad kits

-

Greenhouse vegetables like tomatoes, peppers and cucumbers

-

Potatoes and onions

These categories carry the pricing power, volume and reliability needed to shape store performance. Retailers balance domestic farms with greenhouse partners and international growers to maintain year-round consistency.

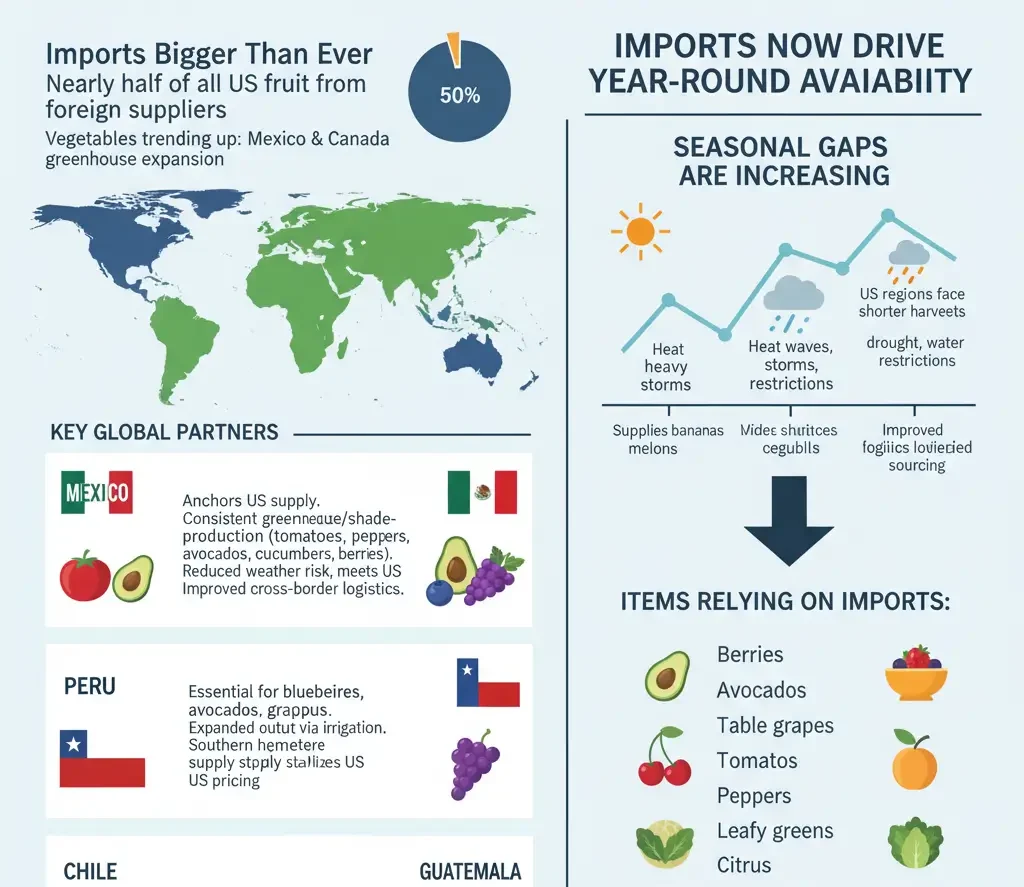

Imports Now Drive Year-Round Availability

Imports play a bigger role now than at any point in the past decade. Nearly half of all fruit consumed in the US comes from foreign suppliers. Vegetables are also trending that direction as greenhouse production expands in Mexico and Canada.

Mexico

Mexico anchors the US supply system. Its greenhouse and shade-house production of tomatoes, peppers, avocados, cucumbers and berries has become more consistent due to investment in controlled-environment agriculture. These systems reduce weather risk and help meet quality specifications required by US retailers.

Cross-border trucking and inspection systems have also improved, helping retailers maintain tight cold-chain timelines.

Peru

Peru is essential for blueberries, avocados, grapes and asparagus. The country continues to expand output through better irrigation systems and long-season production. Its southern hemisphere supply stabilises US retail pricing during months when domestic supply cannot meet demand.

Chile

Chile remains a key partner for table grapes, berries, cherries and early stone fruit. Retailers rely on the country’s predictable export seasons to bridge transitions between California and other regions.

Guatemala

Guatemala supplies bananas, melons, vegetables and several tropical lines. Logistics improvements make the region more attractive for retailers looking to build diversified sourcing strategies across Central America.

Seasonal Gaps Are Increasing

More US regions now face shortened harvest windows because of heat waves, heavy storms, drought and water restrictions. As a result, imports fill wider and more irregular gaps than they used to.

Items that rely heavily on imports during these periods include:

-

Berries

-

Avocados

-

Table grapes

-

Tomatoes

-

Peppers

-

Leafy greens

-

Citrus

Retailers track global weather models more closely, using the type of operational insights highlighted in reports such as Fresh Produce Supply Chain 2025, which help buyers understand how different regions handle seasonal pressure.

Import Share of Key Categories

Across fruit categories, import reliance is high:

-

Berries: strong dependence on Mexico and South America

-

Avocados: Mexico leads, with Peru as the stabiliser

-

Table grapes: Chile and Peru carry the off-season

-

Bananas: nearly 100% import-driven

This dependence means buyers need stronger relationships with exporters, early contracting, and more flexible logistics.

What’s Driving Prices In 2025

Price volatility remains a major challenge. Three main factors shape pricing this year: transportation costs, labour, and weather disruptions.

Transport and Fuel Costs

Even with some normalisation, transport remains a significant cost driver. Fresh produce requires temperature-controlled trucking, careful handling and tight timelines. Small shifts in diesel prices or cross-border fees quickly impact retail pricing.

Long-haul routes also face higher insurance and compliance costs, which increase operational pressure on suppliers.

Labour Costs

Labour shortages continue in farming, packing houses and distribution centres. Many high-labour crops — such as berries, vegetables and fresh-cut salads — face rising costs. Retailers either absorb part of the increase or adjust their price architecture to maintain value perception.

Weather Volatility

Weather is the biggest short-term disruptor in 2025. California, Florida and Texas face irregular patterns ranging from extreme heat to heavy rain. These events impact yields and increase the need for imports from Mexico, Peru and Chile.

Price spikes often occur in:

-

Berries during storms in Baja or California

-

Avocados when Mexican harvests tighten

-

Leafy greens during water-stressed periods in California

-

Citrus after storm activity in Florida

Retailers use multi-region sourcing and scenario planning to reduce these shocks.

Consumer Trends

Even with cost pressure, shopper interest in fresh produce is strong. Several clear behaviours continue shaping the market.

Health and Wellness

Health drives most buying decisions. Shoppers want fresh ingredients for immunity, daily nutrition and general wellbeing. Simple, clean labels are more important than before, and stores highlight these benefits in merchandising.

Gen Z Influence

Gen Z brings new habits into the produce department:

-

Strong interest in berries and snacking fruits

-

High usage of salad kits and meal-prep vegetables

-

Preference for products seen in online recipes

-

Higher expectations for sustainability and packaging transparency

Retailers develop formats that match these behaviours, especially convenience packs and smaller portion sizes.

Sustainability Expectations

Shoppers continue valuing:

-

Recyclable packaging

-

Reduced plastic

-

Local sourcing when possible

-

Lower-waste formats

Retailers update packaging across salads, berries and tomatoes faster than other grocery areas.

Growth Categories

The strongest categories in 2025 include:

-

Berries

-

Avocados

-

Salad kits

-

Greenhouse-grown vegetables

-

Citrus

These segments drive both basket size and shopper loyalty. They also receive the most investment from buyers.

What Supermarket Buyers Should Prioritise

Buyers working in this environment need stronger forecasting, better contracting strategies and more flexible supplier networks.

Forecasting

Forecasting now requires short-term and long-term modelling. Buyers monitor:

-

Weather forecasts across multiple regions

-

Border crossing data

-

Shipping patterns

-

Domestic harvest projections

-

Supplier weekly updates

Scenario-based planning helps buyers prepare for unexpected volume shifts, especially those working for major retailers within the largest supermarkets in the United States.

Contracting

Long-term contracts stabilise pricing for high-volume categories like berries, avocados, grapes and bananas. Many buyers combine:

-

Long-term base agreements

-

Short-term seasonal deals

-

Spot buying for volatility

-

Region mixing for price protection

This structure helps reduce overall risk.

Diversifying Sourcing

Relying on one region is no longer viable. Buyers diversify across domestic farms, greenhouse producers and international partners to manage availability.

Quality Management

Quality is more important than ever. Retailers use:

-

Strict specification sheets

-

Regular supplier audits

-

Temperature tracking

-

Consistency checks on size and flavour

Berries, avocados and greenhouse vegetables require especially strong quality controls.

Category Development

Retailers develop growth categories by improving price ladders, upgrading cold-chain handling, refreshing packaging and adjusting merchandising. This helps maintain trust and drives repeat purchases.

Opportunities For Exporters

Exporters looking to grow in the US market see openings across several regions.

Regions with the Best Opportunity

-

South America: Peru, Chile, Colombia

-

Central America: Guatemala, Honduras, Costa Rica

-

Mediterranean regions: Spain, Morocco, Turkey

-

Greenhouse producers in Canada and Northern Europe

Buyers often compare trends with markets like Spain Fresh Produce or Canada Fresh Produce to understand global competition and seasonal overlap.

Exporters that can offer consistent quality, good cold-chain handling, reliable volumes and flexible pricing become preferred partners for US retailers.

Table: Key US Produce Categories in 2025 — Growth, Risk, Availability

| Category | Growth Trend | Risk Factors | Availability Outlook |

|---|---|---|---|

| Berries | Strong year-round demand | Weather and labour costs | Reliable with imports |

| Avocados | Stable long-term growth | Market volatility | Strong supply from Mexico/Peru |

| Grapes | Seasonal but stable | Climate issues | Good with Chile/Peru support |

| Leafy Greens | Rising via salad kits | Water stress, food safety | Better with greenhouse expansion |

| Citrus | Stable demand | Storm risk in Florida | Consistent but price sensitive |

| Tomatoes | High volume | Heat and logistics | Strong via Mexico greenhouse |

| Bananas | Steady essential item | Logistics and disease | Reliable, import driven |

| Onions/Potatoes | Core staples | Weather in NW | Stable domestic supply |

Checklist: Produce-Buying Priorities For 2025

-

Use region diversification to reduce weather risk.

-

Monitor fuel and labour costs weekly.

-

Strengthen cold chain to reduce shrink.

-

Balance long-term and short-term contracts.

-

Track import conditions and border data.

-

Focus on growth categories like berries and salads.

-

Tighten quality specifications for suppliers.

-

Watch sustainability preferences shaping shopper choices.

Conclusion

The US fresh produce market 2025 is defined by volatility, import dependence and rising shopper expectations. Weather remains unpredictable, and costs continue shaping retail pricing. At the same time, demand for fruits and vegetables stays strong, especially in health-driven and convenience categories.

Retailers that build flexible sourcing plans, diversify suppliers, improve forecasting and invest in quality control will be best positioned to meet shopper needs. Comparing global sourcing models — including trends seen in Fresh Produce Supply Chain 2025, Spain Fresh Produce and Canada Fresh Produce — helps buyers stay ahead in a market that changes quickly.

Editor’s Note: This report is based on publicly available retail data, supermarket industry releases, cross-border trade updates, and seasonal produce outlooks from major US growing regions. Additional context reflects insights from supply-chain reports, importer trends across Mexico, Peru, Chile and Central America, and current supermarket merchandising practices in the United States. No proprietary or unpublished data was used.