Belgium has some of the strictest food packaging and recycling rules in Europe.

But it is also one of the most predictable markets if you understand how the system works and how costs are calculated.

For packaging managers, exporters, and private-label manufacturers, the challenge is rarely the rule itself. The challenge is knowing who is responsible, what must be declared, and how packaging design choices quietly increase costs.

This guide explains Belgium’s packaging system in plain English, outlines what suppliers typically pay, and shows how Belgian retailers are shaping packaging decisions in 2025.

Belgium’s packaging rules: strict, but structured

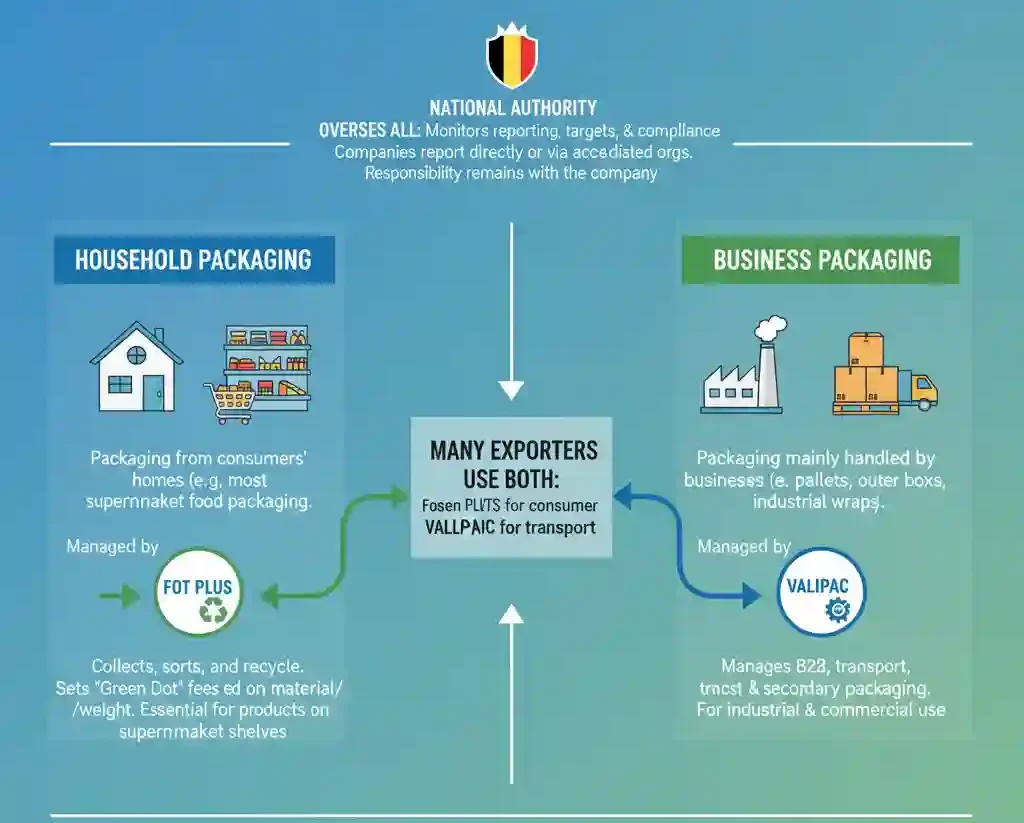

Belgium operates a national packaging compliance system based on Extended Producer Responsibility (EPR).

In simple terms, this means that the company placing packaged products on the Belgian market must contribute to the cost of collecting, sorting, and recycling that packaging.

Belgium’s system is not fragmented by region for businesses. The rules apply nationally and are enforced through a single framework agreed by the country’s regions. That consistency is one reason Belgium is seen as demanding, but also manageable.

For suppliers, the most important point is this:

you do not need to navigate the system alone, but you do need accurate packaging data and a compliant route.

How The system works in practice (no legal language)

Household vs business packaging

Belgium separates packaging into two main streams:

-

Household packaging: packaging that ends up in consumers’ homes

-

Commercial or industrial packaging: packaging mainly handled by businesses (transport, B2B, secondary packaging)

Most food sold through supermarkets falls into the household category.

Fost Plus: the household packaging route

For food products sold in Belgian retail, compliance is usually handled through Fost Plus.

This organisation manages household packaging recovery and publishes the Green Dot fees that suppliers pay based on packaging material and weight.

If your product is on a supermarket shelf, Fost Plus is almost always part of the conversation.

Valipac: business and transport packaging

Packaging that is used mainly in B2B environments, such as pallets, outer boxes, or industrial wraps, is usually managed through Valipac.

Many exporters deal with both systems at the same time:

Fost Plus for consumer-facing packaging, Valipac for transport and secondary packaging.

Who oversees it all

At the top level, Belgium has a national authority that monitors reporting, targets, and compliance. Companies either report directly or through accredited organisations, but the responsibility always stays with the company placing packaging on the market.

The takeaway is simple:

choose the right compliance route and keep your data clean.

What Suppliers pay in Belgium – and why design matters

Packaging cost in Belgium is not just about buying materials.

It includes a mandatory EPR contribution, calculated mainly on weight and material type.

This is where many exporters get caught out.

Green Dot fees: why material choice matters

Belgium applies different fees per kilogram depending on the packaging material.

Glass, paper-cardboard, metals, plastics, and composites all sit in different cost bands.

In general terms:

-

Glass and paper-based materials sit at the lower end

-

Metals sit in the middle

-

Plastics, especially complex or flexible plastics, are often higher

Even within plastics, costs vary significantly depending on format, colour, and recyclability.

Two packs that look similar on shelf can generate very different compliance costs simply because of structure, not size.

The hidden cost of “small” packaging elements

Belgium requires packaging to be declared by component and material.

That means:

-

bottle

-

cap

-

label

-

sleeve

-

tray

-

film

-

spout

All must be declared separately.

A packaging design that uses multiple materials or complex layers increases:

-

reporting complexity

-

compliance fees

-

redesign pressure from retailers

This is why Belgian buyers often ask early questions about packaging breakdowns.

Why “problematic” packaging costs more

Belgium’s system is designed to support efficient sorting and recycling at scale.

Packaging that:

-

blocks sorting

-

mixes materials that cannot be separated

-

uses colours or coatings that reduce recyclability

is actively discouraged through higher contributions and stricter scrutiny.

In practice, this pushes suppliers toward simpler, cleaner structures, not marketing-heavy designs.

Packaging costs are now a retail issue, not just a compliance one

Belgian retailers look at packaging through three lenses at the same time:

-

cost

-

operational simplicity

-

sustainability credibility

This is especially visible in the Belgium FMCG market, where margins are tight, private label is strong, and retailers manage large SKU counts across multiple banners.

Packaging that is expensive to recover, difficult to declare, or misaligned with national systems becomes a commercial problem, not just a regulatory one.

Retail packaging trends shaping decisions in 2025

1) Strong push toward mono-material packaging

Belgian retailers increasingly prefer mono-material structures wherever possible.

The reason is practical, not ideological:

-

easier to sort

-

easier to recycle

-

easier to declare

-

lower risk of future redesign

This applies across rigid and flexible formats, including pouches, trays, and flow-wraps.

2) Reuse and refill pilots are becoming coordinated

Belgium has moved beyond isolated experiments.

In fresh categories, multiple major retailers are participating in shared reuse pilots, testing standardised formats instead of one-off solutions.

Once retailers align on a reusable format, suppliers are expected to adapt quickly. These pilots often start in fresh food and expand outward.

3) Pressure on plastics and over-packaging

Belgian consumers are highly aware of packaging waste, and retailers reflect that sensitivity.

Suppliers are increasingly challenged on:

-

oversized trays

-

unnecessary plastic layers

-

double wrapping for visual effect

This pressure is strongest in fresh and impulse categories, but it is spreading across grocery.

EU rules are accelerating change, not slowing it

Belgium’s national system operates within wider EU packaging reforms.

The direction is clear: packaging must be recyclable, clearly labelled, and increasingly circular.

For food packaging, this creates tension:

-

safety and shelf life still matter

-

recycled content availability is uneven

-

redesign cycles are long

Belgian retailers are already planning packaging updates with future EU deadlines in mind, which is why suppliers are being asked to adapt earlier than in some other markets.

What exporters must be ready to report

Belgium does not expect perfection, but it does expect accurate data.

At minimum, you should be able to provide:

-

a list of SKUs sold in Belgium

-

a packaging bill of materials per SKU

-

weight per packaging component

-

material type per component

-

confirmation of household vs business packaging

If this information is scattered across suppliers, agencies, or internal teams, compliance becomes slow and costly.

Belgian retailers often ask for this data during onboarding, not after listing.

Practical checklist for new exporters

Language on pack

Belgium is multilingual.

Retailers usually specify language requirements based on where the product is sold. Confirm this early and don’t assume one language version works everywhere.

Recycling and disposal information

Packaging should clearly support Belgium’s national sorting habits.

Simple, accurate disposal guidance reduces consumer confusion and retailer pushback.

Logos and sustainability claims

Do not reuse logos or claims from other markets without checking.

Belgian retailers are cautious about unverified environmental messaging.

Declarations and annual reporting

Make sure you know:

-

who is responsible for declarations

-

which organisation handles your compliance

-

what data you must submit annually

Late or incorrect declarations create friction with buyers.

Food-contact and safety controls

Retail buyers expect proof that packaging is controlled, traceable, and safe.

This is less about certificates on shelf and more about confidence during audits and tenders.

Private label: where packaging scrutiny is highest

Private label is where Belgian retailers are least flexible.

Packaging for private label must:

-

meet cost targets

-

support retailer ESG positioning

-

avoid future regulatory risk

Retailers use packaging to signal responsibility without raising shelf prices.

Suppliers who cannot adapt packaging quickly risk losing volume, even if product quality is strong.

This is closely linked to how Supermarkets in Belgium operate: each group applies the same national rules but interprets sustainability and design standards differently.

Fresh food packaging: the toughest balance

Fresh food packaging faces the most pressure in Belgium.

It must:

-

protect product quality

-

reduce food waste

-

meet plastic reduction goals

-

work with reuse pilots

This is why fresh categories are often the testing ground for new packaging formats and rules.

If you supply into Belgium fresh produce, expect packaging questions to appear earlier and more often than in ambient grocery.

Final advice: how to avoid cost and compliance problems

Suppliers who succeed in Belgium usually do three things well:

-

Design packaging with compliance in mind

Clean structures mean clean declarations and fewer surprises. -

Keep packaging simple unless complexity is essential

Belgium rewards packaging that works with the system, not against it. -

Talk to retailers early

Packaging expectations change fast when retailers align. Early discussion saves money later.

Handled properly, food packaging Belgium supermarkets becomes predictable and manageable.

Handled late, it becomes a hidden cost that shows up after the listing is signed.

Editor’s note: This article is written as a practical market guide based on publicly available regulatory frameworks, compliance system guidance, and observed retail practices in Belgium. It is intended for commercial planning, not legal advice.