For the first time in Ireland, own brand is no longer the challenger; it is the benchmark.

Recent competition and consumer data shows private label has reached — and in some categories surpassed — branded products in value share. This is not just another growth headline. It is an inflection point.

When own brand becomes the default choice for everyday grocery spend across Irish supermarkets, the rules change. Growth slows. Shelf space tightens. And the conversation shifts from “how do we grow share?” to “how do we protect value?”

Ireland is now in that phase.

This is not a decline story. It is a maturity story. And it raises a harder question for retailers, suppliers, and brands alike: where does own-brand growth come from next?

The “why now” Moment Ireland Cannot Ignore

Irish grocery has spent more than a decade in structural private-label expansion.

Discounters reset shopper expectations on price and quality. Mainstream multiples responded by rebuilding their own-label ranges. Premium tiers followed. Over time, shoppers learned that own brand was no longer a compromise.

That long shift has now reached its logical limit.

Recent analysis from Ireland’s Competition and Consumer Protection Commission (CCPC), referencing Kantar data, confirms what buyers already see in store performance: own brand has crossed a psychological threshold. In several everyday categories, it now matches or exceeds branded value share.

Once that happens, growth mechanics change.

You cannot keep adding SKUs endlessly.

You cannot keep pushing value tiers without margin damage.

And you cannot premiumise everything.

Mature own-brand markets behave differently. Ireland is now joining that group.

Maturity As Compression: Why Slowing Growth Isn’t Stagnation

The biggest mistake in coverage of Irish private label is assuming maturity equals slowdown.

In reality, maturity equals compression.

Retailers are still investing in own brand. But they are doing it in fewer places, with more discipline, and to higher standards.

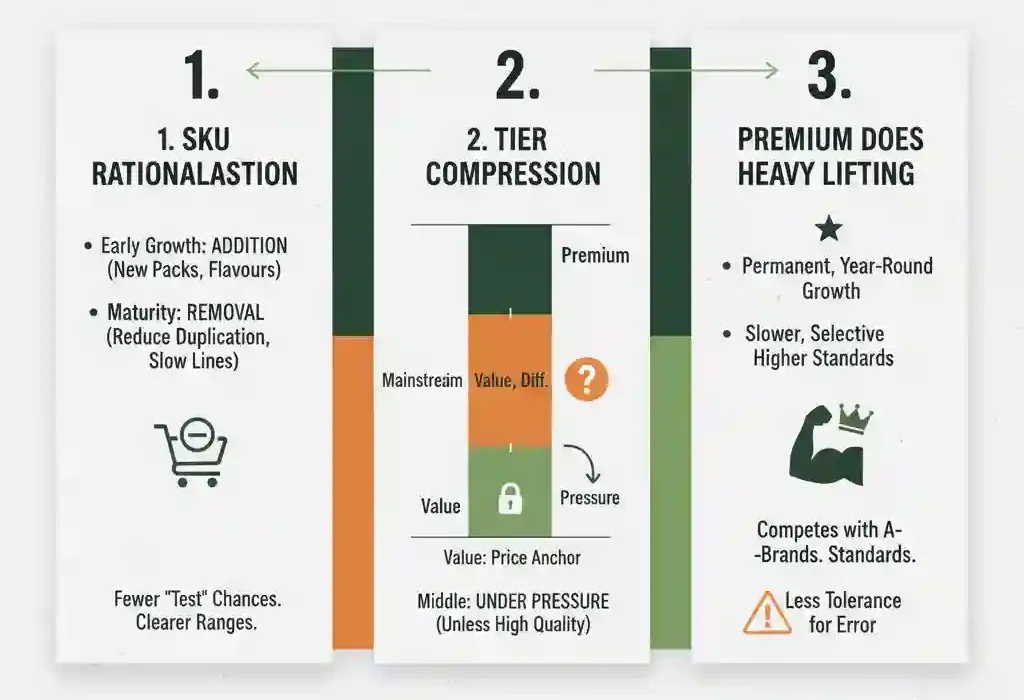

Three structural shifts now define the Irish market.

1. SKU rationalisation becomes permanent

In early growth phases, own brand expands by addition.

- New pack sizes.

- New flavours.

- New sub-ranges.

In maturity, growth comes from removal.

Irish retailers are quietly reducing duplication inside their own-label ranges. Similar SKUs across value and standard tiers are being merged or dropped. Slow-moving lines are losing space faster than before.

This is not cost-cutting theatre. It is operational necessity.

- Shelf space is finite.

- Store execution is under pressure.

- Supply chains are tighter than five years ago.

For suppliers, this means fewer chances to “test” marginal ideas. For buyers, it means clearer range architecture — but harder listing decisions.

2. Tier compression: why the middle is under pressure

Irish own-brand ranges are typically structured around three tiers:

- Value

- Mainstream

- Premium

That structure remains, but it is no longer evenly weighted.

Value continues to anchor price credibility, especially in high-traffic staples. It protects trust, not margin.

Premium is where most incremental value now comes from. It supports differentiation, margin protection, and shopper engagement.

The pressure point is the middle.

A typical example can be seen in categories like pasta sauces or ready meals. The value tier competes confidently on price. Premium ranges lean into provenance, flavour, or recipe credibility. The mid-tier option — neither cheapest nor special — struggles to justify its shelf space unless it clearly outperforms on quality or functionality.

This is tier compression in practice.

The effect is subtle, but it is already reshaping Irish ranges.

3. Premium own brand does the heavy lifting — with limits

If there is still a growth engine inside Irish own brand, this is it.

Premium own-label ranges are no longer seasonal or experimental. They are permanent, year-round contributors to value growth.

But this does not mean endless premium launches.

The next phase of premiumisation is slower and more selective. Fewer SKUs. More scrutiny. Higher expectations on sourcing, Irish packaging standards, and consistency.

Premium own brand now competes directly with strong A-brands — not just on price, but on credibility. That raises compliance thresholds and reduces tolerance for error.

For suppliers, the bar is higher than it was five years ago.

The New Supplier Mandate: Higher Barriers, lower Tolerance

For own-label suppliers, Ireland is becoming more demanding, not more generous.

- Listings last longer — but are harder to win.

- Volume is more stable — but growth is harder to unlock.

- Audits, specifications, and service levels are tightening.

Retailers are consolidating supplier bases quietly. Fewer partners. Deeper relationships. Less appetite for operational complexity.

This favours suppliers who can scale, invest, and execute consistently. It is more challenging for smaller players relying on single SKUs or marginal differentiation.

What Maturity Means For A-brands — Without The Drama

Irish private-label maturity does not mean brands are finished.

It means their role is clearer.

Brands now win when they do at least one of three things:

-

Deliver innovation own brand cannot replicate quickly

-

Carry emotional or heritage value that justifies price

-

Anchor categories where trust, performance, or reassurance matters

What no longer works is relying on historic presence alone.

In a mature own-brand market, shelf space must earn its place every year. Ireland is now firmly in that reality.

The next phase: fewer launches, higher standards

The Future Of Own Brand In Ireland Is Not louder. It Is Quieter.

- Fewer launches.

- Cleaner ranges.

- More premium weight.

- Higher compliance thresholds.

Growth will come from doing less, better — not from doing more.

For buyers, this is about control and clarity.

For suppliers, it is about resilience and execution.

For brands, it is about relevance, not resistance.

Ireland has reached own-brand maturity. What happens next will define the next decade of grocery competition.

FAQ

Which grocery categories lead own-brand share in Ireland?

Own brand is strongest in everyday staples, chilled prepared foods, ambient grocery, and household categories. These are areas where quality parity is well established and brand differentiation is weaker, allowing retailers to control both value and margin.

Is private label still growing in Ireland, or has it peaked?

Private label growth has not stopped, but it has changed form. Volume growth is slowing, while value growth continues through premiumisation, range optimisation, and tighter tier management rather than SKU expansion.

What does own-brand maturity mean for range innovation?

Innovation does not disappear, but it becomes more selective. Retailers launch fewer products, with higher execution standards and clearer commercial roles. Incremental or “me-too” SKUs are less likely to survive range reviews.

How does own-brand maturity affect supplier competition?

Competition intensifies. Retailers work with fewer suppliers, expect higher compliance and reliability, and tolerate less operational risk. Long-term relationships matter more, but entry barriers are higher than in growth-phase markets.

Editor’s note: Based on publicly available competition analysis, Kantar data, CCPC commentary, Bord Bia reporting, and Irish and European grocery trade coverage. Internal use only.