Trade events are no longer evaluated as marketing moments.

They are evaluated as commercial tools.

For retail buyers and wholesalers, attendance is now judged against the same standards applied to range reviews, supplier listings, and margin decisions. Time, cost, and decision value are weighed carefully. Presence alone no longer justifies participation.

This is why many trade events feel under pressure. Not because buyers have lost interest in the industry, but because buyer expectations have shifted structurally.

Events must now add context, not access.

Executive implication: Attendance Is Now A Commercial Decision

For buyers, attending a trade event is no longer a default activity. It is a deliberate choice with measurable opportunity cost.

In practical terms, this means:

-

Time spent at an event competes directly with range work, supplier reviews, and internal reporting.

-

Travel and accommodation must be justified internally.

-

Outcomes are expected, not impressions.

Buyers now evaluate events using the same internal logic they apply to suppliers:

Does this deliver value that improves decision quality?

If the answer is unclear, the event is deprioritised.

Buyer Reality: Roles Are Compressed, Not Expanded

Retail buying teams today operate under tighter structures than in the past.

Across grocery and FMCG:

-

Fewer buyers manage broader category scopes.

-

SKU counts are under pressure from rationalisation programmes.

-

Compliance, sustainability reporting, and supplier risk assessment consume more time.

-

Internal justification has increased at every listing stage.

This creates a simple constraint: buyers have less discretionary time.

A three-day trade event is no longer neutral. It removes capacity from core buying work. As a result, buyers approach events with a sharper filter.

They ask:

-

Will this materially support my next range decision?

-

Will it improve my supplier shortlist?

-

Will it help preserve margin or reduce operational risk?

If those links are weak, attendance does not survive internal scrutiny.

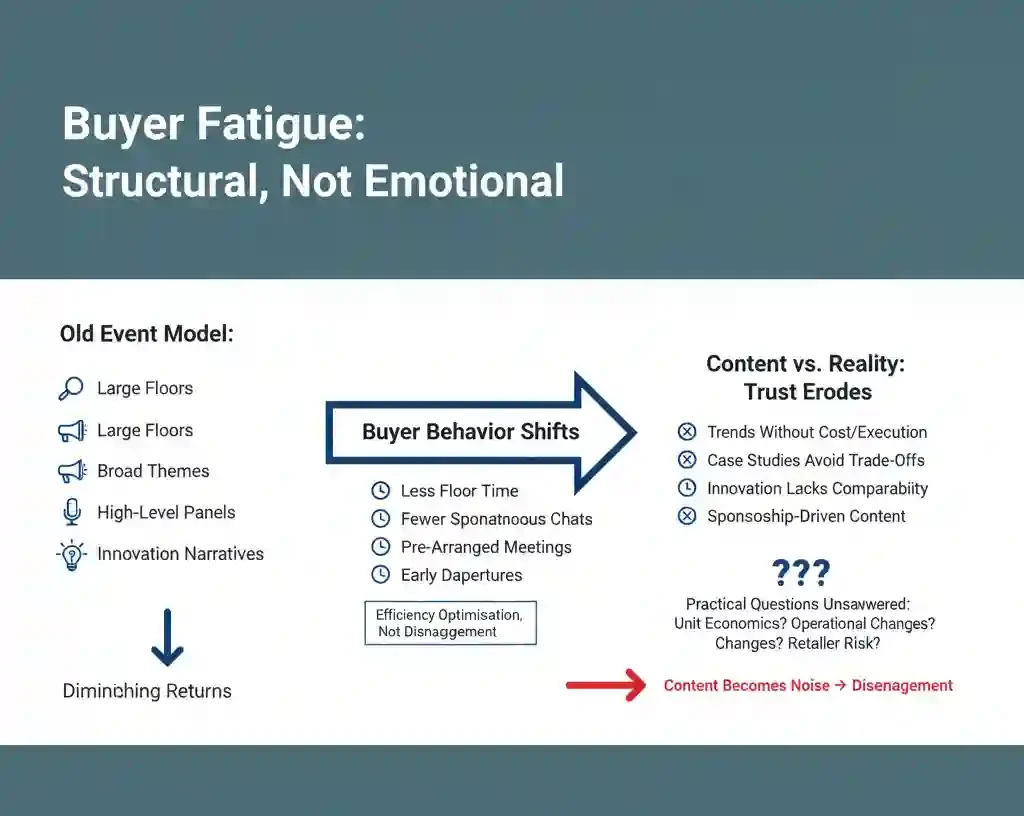

Executive Implication: Buyer Fatigue Is Structural, Not Emotional

Buyer fatigue is often misunderstood as boredom or cynicism. In reality, it is a rational response to repeated low-yield formats.

Many events still rely on structures built for a different era:

-

Large floors optimised for visibility.

-

Broad themes designed to attract volume.

-

High-level panels with limited commercial detail.

-

Innovation narratives that are hard to benchmark.

From a buyer perspective, this leads to diminishing returns.

Attendance may continue, but behaviour shifts.

-

Less time on the floor.

-

Fewer spontaneous conversations.

-

Priority given to pre-arranged meetings.

-

Early departures once key objectives are met.

This is not disengagement from the sector. It is efficiency optimisation.

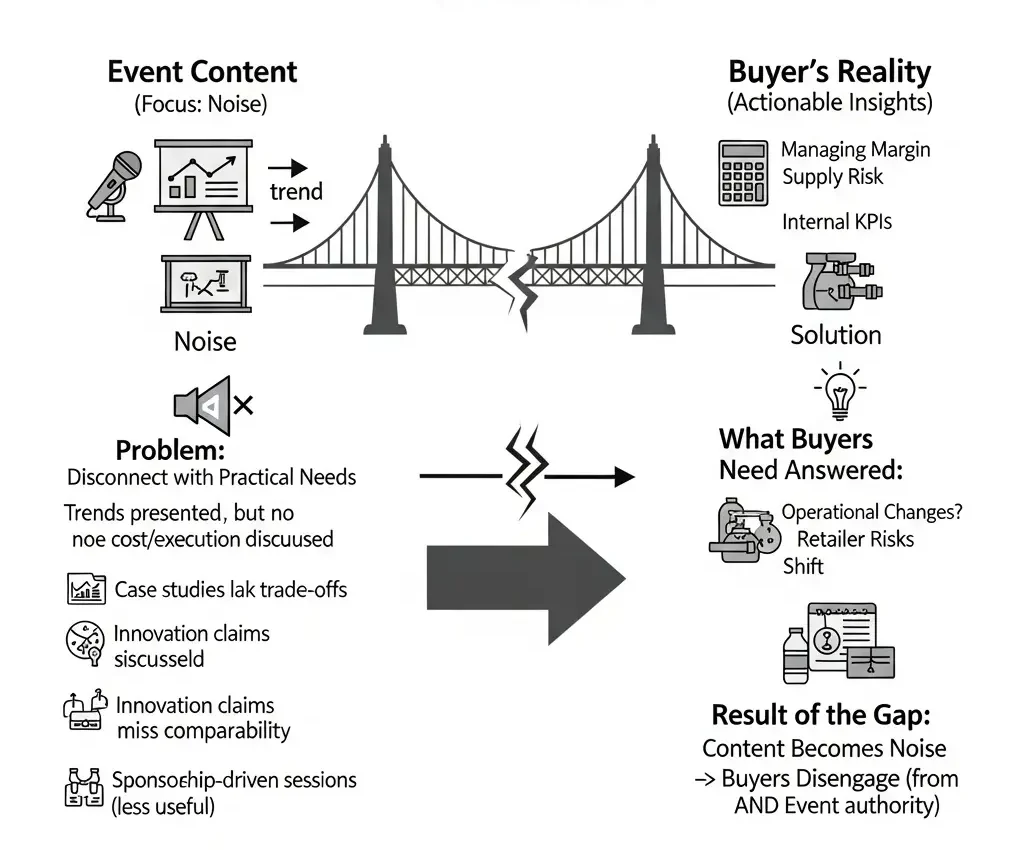

Content vs. Commercial Reality: Where Trust Erodes

One of the clearest friction points for buyers is the gap between event content and real buying decisions.

Buyers frequently report similar issues:

-

Panels describe trends without addressing cost or execution.

-

Case studies avoid trade-offs.

-

Innovation claims lack comparability.

-

Sessions feel influenced by sponsorship rather than usefulness.

For a buyer managing margin, supply risk, and internal KPIs, this creates a problem.

If content does not help answer practical questions such as:

-

How does this affect unit economics?

-

What changes operationally?

-

What risks shift to the retailer?

Then content becomes noise.

Once that happens, buyers disengage not only from sessions, but from the event’s authority.

Executive Implication: Access Has lost Its Scarcity Value

Historically, trade events justified themselves through access.

Access to:

-

Suppliers

-

New products

-

Market signals

-

Industry contacts

That scarcity no longer exists.

Today, buyers have year-round access to:

-

Supplier decks and data rooms

-

Digital product showcases

-

Virtual meetings

-

Peer insight through professional networks

As a result, access alone no longer creates value.

What buyers now need is context.

Context means:

-

How options compare commercially.

-

Where risks sit in the listing lifecycle.

-

Which innovations matter now versus later.

-

How decisions align with range architecture.

Events that fail to provide this context struggle to justify their role.

What Formats Still Work: A Buyer-Side View

Despite tougher evaluation, some event formats continue to perform well with buyers.

They share clear structural traits.

Focused scope beats scale

Events with a defined category, function, or decision-stage focus outperform broad, all-industry shows. Buyers value relevance over volume.

Curated meetings outperform footfall

Pre-qualified meetings aligned to active buying cycles deliver more value than open-floor discovery.

Practical insight beats narrative

Sessions that explain commercial mechanics, operational impact, or compliance implications outperform trend-led presentations.

Buyer roles are acknowledged

Events that recognise different buyer functions (range, sourcing, packaging, sustainability, operations) feel more credible than one-size-fits-all programming.

These formats respect buyer time and decision pressure. That respect is noticed.

Executive Implication: Events Are Now Judged like Suppliers

An important shift is happening quietly.

Buyers increasingly evaluate trade events the same way they evaluate suppliers:

-

Is the proposition clear?

-

Is the value measurable?

-

Does it fit our current priorities?

-

Does it reduce complexity or add to it?

This changes the competitive landscape for events.

Legacy status matters less.

Scale matters less.

Attendance numbers alone matter less.

What matters is decision relevance.

Why Fewer Events Are likely To survive

The current event landscape is dense. Buyer capacity is not.

As buyers become more selective:

-

Marginal events lose decision-makers first.

-

Exhibitors reassess stand ROI.

-

Sponsorship value weakens without senior buyers present.

This creates a compression effect.

Events that cannot clearly articulate their buyer-side value proposition struggle to sustain both sides of the market. Over time, this leads to consolidation.

The market does not need more events.

It needs fewer, sharper ones.

Strategic Adaptation: What Events Must Change

To remain relevant, trade events must adjust structurally.

Key shifts include:

-

Designing programmes around buyer decisions, not exhibitor exposure.

-

Replacing generic content with comparative, decision-ready insight.

-

Aligning formats to real buying cycles and listing windows.

-

Treating buyers as decision-makers, not audiences.

This requires difficult trade-offs.

But without them, relevance erodes.

What Matters Going Forward

Trade events are not disappearing.

But their role is narrowing.

For buyers and wholesalers, the evaluation criteria are now clear:

-

Does this improve decision quality?

-

Does it reduce risk or uncertainty?

-

Does it save time elsewhere in the buying process?

Events that meet these standards can still earn trust and attendance.

Those that do not will not be rejected publicly.

They will simply be bypassed.

That quiet absence is why trade events are being judged more harshly today.

FAQ

What are the problems faced by retailers today?

Retailers face margin pressure, time scarcity, and operational complexity. Buying teams manage broader scopes with fewer resources, while internal justification and compliance demands have increased. This makes discretionary activities harder to defend.

What are the disadvantages of trade fairs for retail buyers?

The main disadvantages are time cost, unclear ROI, and limited decision-ready insight. Many trade fairs deliver visibility but not practical value for active buying decisions.

Do business buyers face more complex buying decisions than consumer buyers?

Yes. Business buyers balance price, supply reliability, compliance, risk, and internal alignment. Decisions must be justified internally and carry long-term consequences.

What is the benefit of trade shows in finding buyers?

Trade shows can still help suppliers meet buyers when formats are focused, meetings are curated, and conversations align with real buying cycles rather than general promotion.

Editor’s Note: Methodology & Sources

This analysis is synthesized from a cross-section of primary and secondary grocery and FMCG trade intelligence to provide a neutral, buyer-side view of trade event effectiveness.

Insights are informed by:

-

Ongoing buyer feedback from retail buying teams and wholesalers across grocery and FMCG.

-

Industry benchmarks from category management frameworks (IGD and Category Management Association) relating to decision cycles, SKU efficiency, and range architecture.

-

Observed exhibitor ROI behaviour across European and UK trade events, including changes in stand investment, meeting strategy, and attendance patterns.

-

Broader structural trends in retail buying, including margin preservation strategies, SKU rationalisation, and listing lifecycle management.

The goal is to provide decision-makers with actionable intelligence, not event promotion or headline commentary.