Irish trade events are not failing.

But they are no longer being treated casually.

For a long time, trade shows in Ireland were seen as automatic diary entries. Buyers went because it was expected. Suppliers exhibited because everyone else did. Success was measured in noise, footfall, and visibility.

That era has ended.

Today, buyers attend fewer events. When they do attend, they arrive with intent. They are not browsing. They are assessing. And they are far less patient than they used to be.

This change matters for anyone exhibiting to Ireland supermarkets, supplying Ireland private label ranges, or targeting export buyers through Irish trade platforms.

Buyers Are Choosing Fewer Events By Design

The first and most important change is attendance behaviour.

Buyers across retail, foodservice, and wholesale are under pressure. Ranges are tighter. Supplier lists are smaller. Internal reporting is heavier. Travel time has to justify itself.

As a result, most buyers now limit themselves to:

-

One or two domestic trade events a year

-

A small number of export-focused formats

-

Events where meetings can be planned in advance

This is not about disinterest. It is about discipline.

If an event does not clearly support their buying priorities, it does not make the cut. Even long-established shows are not guaranteed attendance anymore.

For Ireland supermarkets, this is especially true in categories where consolidation has already happened. Buyers do not need to see twenty versions of the same product. They need suppliers who understand how the category works today.

The End Of “Walk The Hall” Buying

There was a time when buyers walked trade halls hoping to be surprised.

That behaviour has almost disappeared.

Most buyers now decide who they want to see before they arrive. They scan exhibitor lists quickly. They identify a short list. Meetings are booked in advance, or at least mentally prioritised.

Walking the hall still happens, but it is secondary. It is not how decisions are made.

This has changed how events are experienced on the ground. Halls may still look busy, but senior decision-makers move differently. They go directly to specific stands. They stay for short conversations. They leave early.

For suppliers relying on chance discovery, this is a problem. For prepared suppliers, it is an opportunity.

Why Promotional-Heavy Events Struggle With Buyers

Much Irish trade event coverage still focuses on promotion. Big claims. Record attendance. Packed halls.

Buyers read those signals differently.

A large exhibitor list often means too much noise.

A busy stand does not mean a productive conversation.

A general “networking” promise does not justify a full day out of the office.

From a buyer’s point of view, poorly filtered events create friction. Too many similar pitches. Too little relevance. Too much time spent explaining basics that should already be known.

This is why some events feel less valuable than before, even if they are well organised and well attended.

The issue is not execution. It is relevance.

What Still Works — And Why Buyers Show Up

Despite tighter filters, some Irish trade events continue to attract serious buyers.

The difference is not scale. It is clarity.

Events that still work tend to be very clear about:

-

Who the event is for

-

What kind of buyers will attend

-

What commercial conversations are expected

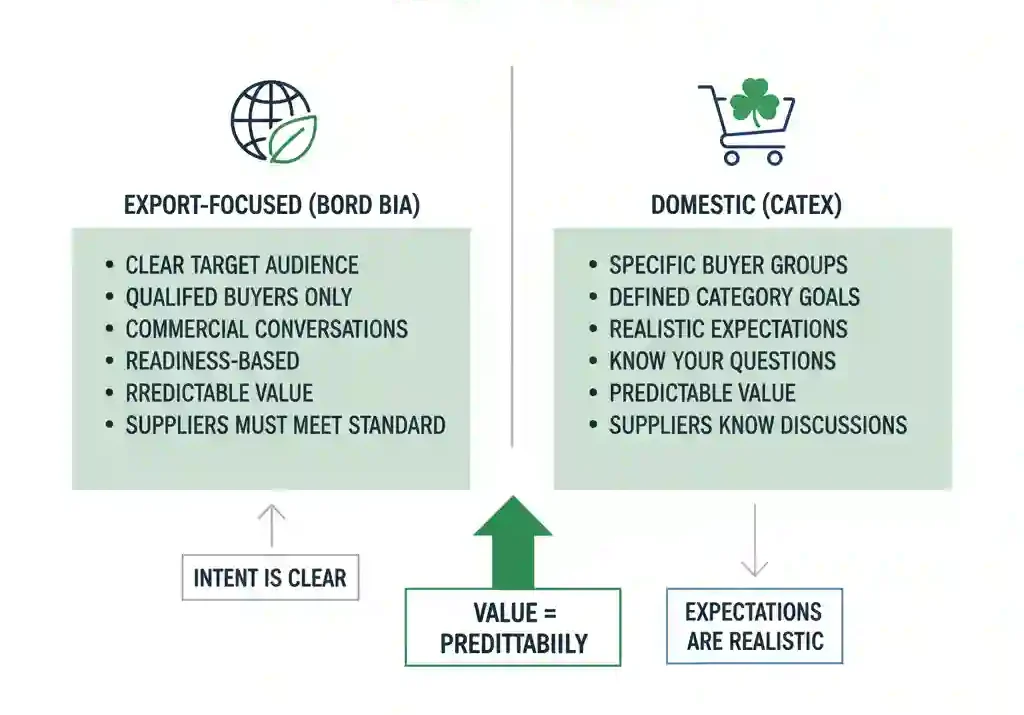

Export-focused formats supported by Bord Bia remain relevant because buyers understand the intent. These events are built around readiness, not discovery. Suppliers are expected to meet a certain standard before they show up.

Large domestic events such as CATEX still matter for specific buyer groups because expectations are realistic. Buyers attend with defined category goals. Suppliers know the type of discussion that will happen.

In both cases, the value comes from predictability. Buyers know what kind of time they will have. Suppliers know what kind of questions they will face.

Insight Now Matters More Than Novelty

Another major shift is what buyers value during conversations.

In the past, “new” carried weight. New product. New flavour. New concept.

Today, newness alone is not enough.

Buyers want insight. They want to understand:

-

How the category is moving

-

Where demand is strengthening or weakening

-

What supply risks exist

-

How other markets are behaving

This is especially true for Ireland private label buyers. They already control the shelf. They are not looking for excitement. They are looking for stability, margin control, and long-term fit.

Trade events that support this kind of discussion feel useful. Events that focus only on product display feel shallow.

What Buyers Expect At The Stand

When a buyer stops at a stand today, expectations are clear.

They do not want a brand story.

They do not want a long introduction.

They do not want generic claims.

They want to understand quickly:

-

What problem this supplier solves

-

Where the product fits commercially

-

Whether supply is realistic

-

Whether the conversation is worth continuing

For Ireland supermarkets, this often comes down to simple questions. Can you supply consistently? Do you understand price architecture? Have you worked with retailers like us before?

If those answers are unclear, the meeting ends quickly.

Why Meetings Are Shorter But More Decisive

Many suppliers notice that meetings at Irish trade events feel shorter than before.

This is true. But it is not a negative change.

Shorter meetings mean buyers are filtering faster. Decisions are being shaped earlier. Suppliers who fit move forward quickly. Suppliers who do not are screened out without drama.

This makes events more efficient, even if they feel less social.

For suppliers prepared for this environment, trade events can still deliver strong returns. For unprepared suppliers, they can feel disappointing.

The Supplier Shift: From Pitching To Proving

Suppliers who perform well at Irish trade events today tend to approach meetings differently.

They do not pitch. They explain.

They arrive ready to talk about:

-

Pricing logic, not just price points

-

Volumes that make sense for the buyer

-

Operational realities, not ideal scenarios

-

Export readiness where relevant

This matters for both branded suppliers and Ireland private label manufacturers. Buyers are no longer interested in ambition alone. They want to see that a supplier understands how retail actually works.

This is why suppliers who respect buyer time tend to stand out.

Domestic And Export Buyers Want Different Signals

One mistake suppliers still make is treating all buyers the same.

Domestic buyers and export buyers look for different things.

Domestic buyers focus on:

-

Range fit

-

Margin stability

-

Operational simplicity

-

Supply reliability

Export buyers focus on:

-

Scalability

-

Compliance

-

Market adaptability

-

Long-term capacity

Irish trade events that make this distinction clear are easier for buyers to navigate. Suppliers who adjust their conversation accordingly are more likely to secure follow-ups.

Smaller Diaries, Clearer Outcomes

The overall result is not a decline in trade events, but a change in tone. Events feel quieter. Conversations feel more serious. Outcomes are clearer. A supplier may leave with fewer leads, but better ones. A buyer may attend fewer events, but make faster decisions.

This is not accidental. It reflects how buying now works.

What This Means For Irish Trade Events Going Forward

Irish trade events are entering a more disciplined phase.

- Buyers are no longer passive attendees.

- Suppliers are no longer competing for attention.

- Events are no longer judged by volume alone.

The events that matter most going forward will be those that respect time, support real commercial discussion, and help buyers do their jobs better.

For suppliers targeting Ireland supermarkets or Ireland private label programmes, the message is simple: trade events still work, but only if you work them properly.

Editor’s note:

This article is based on analysis of Irish trade event formats, buyer attendance behaviour, Bord Bia export frameworks, and observed procurement patterns across grocery and foodservice in Ireland.