Because the old way no longer works.

That is the short answer.

The longer answer is more nuanced, more human, and more uncomfortable for both sides than most trade coverage admits.

This article explains why FMCG brands are rethinking how they work with retailers — not by assigning blame, but by examining the real dynamics shaping modern brand–retailer relationships today. It looks at what has broken, what is changing, and what “success” now looks like in practice.

The goal here is not to defend brands or retailers. It is to describe reality as it is experienced inside negotiation rooms, category reviews, and joint business planning sessions — where commercial pressure, fatigue, and realism increasingly define outcomes.

A Quiet Reset Is Underway

For decades, FMCG brand–retailer relationships followed a familiar rhythm.

Annual negotiations.

Volume promises.

Promotional calendars.

Margin pressure disguised as partnership language.

For a long time, this rhythm worked well enough. Categories grew. Volumes expanded. Inflation was predictable. Promotions delivered incremental uplift often enough to justify the effort.

That rhythm is now breaking down.

Not because one side suddenly became unreasonable, but because the operating conditions underneath the relationship have changed.

Retailers are managing thinner margins, higher labour costs, rising shrink, and volatile consumer demand. Brands are facing rising input costs, slower innovation payback, stricter sustainability requirements, and less room to fund endless trade spend.

Both sides are tired.

And increasingly, both sides understand that repeating the same annual battles produces worse outcomes for everyone involved.

This is why FMCG brands are rethinking how they work with retailers — not out of idealism, but out of necessity.

How the Industry Has Been Talking About This (And Why It Falls Short)\

Before looking at what is actually changing inside brand–retailer relationships, it helps to understand how this topic is usually covered — and what those narratives consistently miss.

Across trade media and consultancy content, three dominant framings appear again and again.

1. Brand Trade Media: Defensive Framing

Brand-focused trade publications often frame the situation defensively.

Common themes include:

-

Retailers are overreaching

-

Margin demands are unsustainable

-

Data requests are unfair

-

Promotions are being devalued

This coverage reflects real frustrations felt by many brand teams. Negotiations have become tougher. Requests feel broader and more intrusive. Trade spend feels harder to justify internally.

However, this framing often stops short of acknowledging the structural pressures retailers are under.

What’s missing

An honest admission that some brand practices — such as excessive SKU proliferation, weak in-store execution, and innovation that adds complexity without clear shopper value — have also contributed to the tension.

2. Retail Trade Media: Retailer-Centric Narratives

Retail-focused outlets tend to emphasise the opposite angle.

Typical themes include:

-

Supplier accountability

-

Execution failures

-

Cost-to-serve discipline

-

The need for “partnership on retailer terms”

This content accurately reflects the pressures retailers face on margin, labour, and operational efficiency. Buyers are expected to defend category profitability while managing increasing complexity.

But this framing often simplifies brand economics and innovation risk.

What’s missing

A realistic view of brand margin constraints, portfolio cross-subsidisation, and the cost of funding constant tactical activity across multiple customers.

3. Consultancy Content: Polished but Sanitised

Consultancy white papers usually strike a neutral tone — at least on the surface.

They tend to focus on:

-

Collaboration

-

Joint value creation

-

Ecosystem thinking

-

Win-win outcomes

All sensible ideas. All directionally correct.

But these papers are often stripped of friction.

What’s missing

The fatigue.

The mistrust.

The hard trade-offs that happen when spreadsheets collide with real shelves, real stores, and real execution constraints.

The Missing Middle Ground

Across all three narratives, one thing is consistently absent:

A clear, practical middle ground that recognises both sides are constrained — and that the old playbook is exhausted.

This gap matters because it is precisely where real change is now happening.

Brands and retailers are not becoming friends.

They are becoming more realistic.

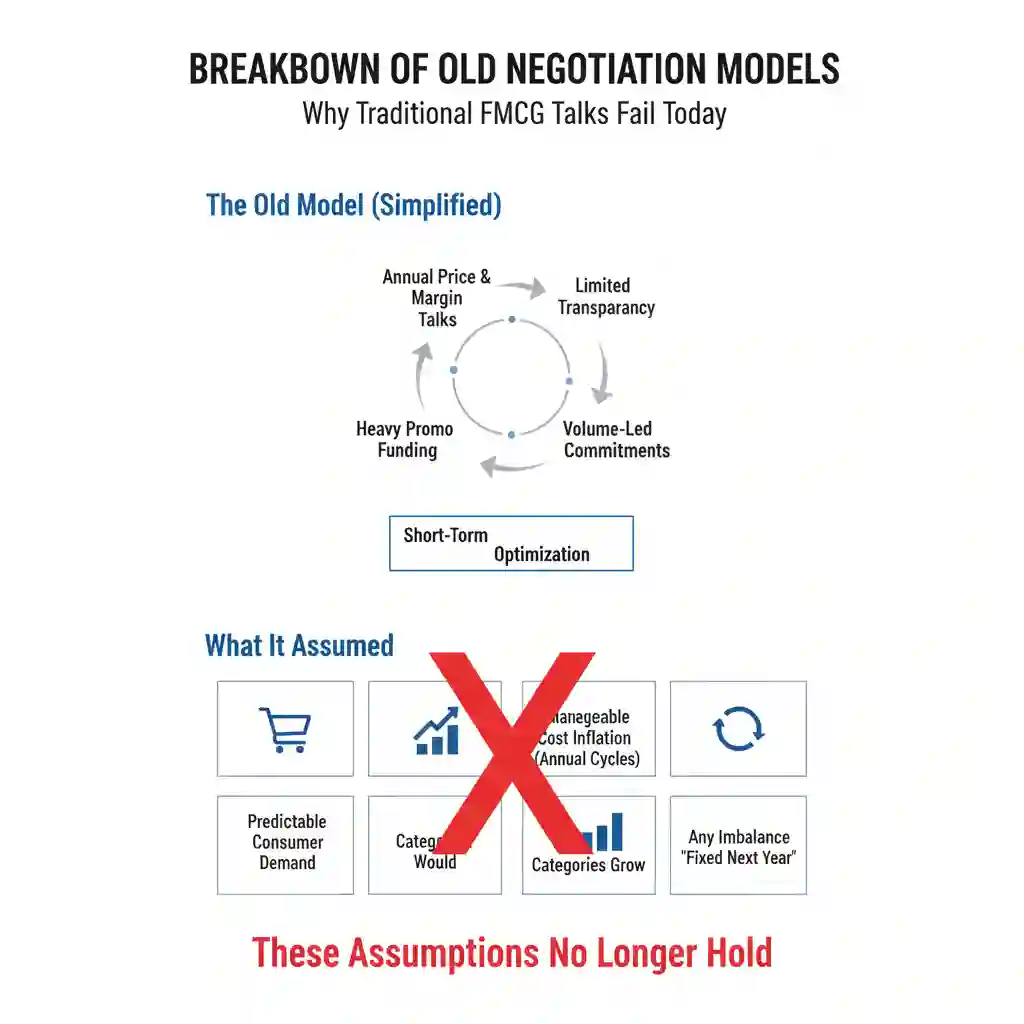

The Breakdown of Old Negotiation Models

The traditional FMCG negotiation model was built for a different era.

The Old Model (Simplified)

-

Annual price and margin negotiations

-

Heavy reliance on promotional funding

-

Volume-led commitments

-

Limited transparency on cost structures and data use

-

Short-term optimisation

This model assumed several conditions were stable.

What It Assumed

-

Consumer demand would remain broadly predictable

-

Cost inflation would be manageable within annual cycles

-

Categories would continue to grow

-

Any imbalance could be “fixed next year”

Those assumptions no longer hold.

Why the Model Is Failing

1. Cost volatility broke predictability

Input costs, logistics, energy, and labour have become structurally more volatile since 2020. Annual pricing cycles are no longer flexible enough to absorb this volatility cleanly.

Both brands and retailers are forced into reactive renegotiations that strain trust and planning.

2. Promotions stopped delivering incremental growth

In many mature categories, promotions now:

-

Pull volume forward rather than grow it

-

Train shoppers to wait for discounts

-

Compress margins without expanding the category

What once drove growth increasingly just reshuffles demand.

3. Volume promises lost credibility

Retailers have become sceptical of volume-led commitments that depend on perfect execution across hundreds or thousands of stores.

Missed forecasts now feel systemic rather than exceptional.

4. Negotiations became zero-sum

Each cycle has felt more extractive and less constructive.

Winning the negotiation often means damaging the relationship — and increasing friction for the year ahead.

Why Old FMCG Negotiation Models Are Breaking Down

-

Annual cycles cannot handle cost volatility

-

Promotions no longer guarantee incremental volume

-

Volume commitments are harder to deliver reliably

-

Trust erodes with repeated zero-sum outcomes

A More Realistic Conversation About Profit Margins

One of the most sensitive — and least honestly discussed — topics in FMCG relationships is profit margin.

Retailer Reality

Retail margins in grocery remain thin.

After accounting for:

-

Labour

-

Energy

-

Shrink

-

Logistics

-

Store operations

There is limited room to absorb supplier cost increases indefinitely.

Retailers are not exaggerating this pressure. In many cases, they are managing structural cost inflation with little pricing flexibility.

Brand Reality

Brand margins are also under strain.

Brands must fund:

-

Product development

-

Marketing and media

-

Trade spend

-

Data systems

-

Compliance and regulation

-

Sustainability requirements

Many brand portfolios rely on a small number of SKUs to subsidise a much broader range.

The uncomfortable truth

There is less “fat” on both sides than public narratives suggest.

Why This Changes Behaviour

When both sides accept margin reality, behaviour shifts.

-

Less theatrical negotiation

-

More focus on total value, not line-item wins

-

Greater scrutiny of unproductive spend

-

Harder conversations about range rationalisation

This realism is one of the quiet drivers behind newer partnership models.

Fewer Promotions, Better Execution: A Structural Shift

One of the clearest behavioural changes across FMCG relationships is the move toward fewer promotions with better execution.

This is not about doing less activity for its own sake.

It is about recognising diminishing returns.

What Changed

Retailers and brands have observed that:

-

Poorly executed promotions damage trust

-

Over-promotion confuses shoppers

-

Deep discounts without availability backfire

As a result, many relationships are shifting focus.

From Quantity to Quality

Instead of asking:

“How many promotions can we run?”

The more useful question has become:

“Which promotions actually change shopper behaviour?”

Why FMCG Promotions Are Being Reduced

-

Execution matters more than frequency

-

Shoppers are less responsive to constant discounting

-

Poor promotions destroy trust and margin

-

Fewer, well-supported events perform better

What Better Execution Looks Like in Practice

-

Clear roles for brand and retailer teams

-

Aligned forecasting assumptions

-

Simpler promotional mechanics

-

In-store compliance as a shared KPI

-

Honest post-event reviews

This approach requires more collaboration — but produces less noise.

Data Sharing: Where Trust Is Tested Most

Data sharing is often described as the foundation of modern partnerships.

In practice, it is one of the most contested areas in brand–retailer relationships.

Retailer Perspective

Retailers want:

-

Better forecasting accuracy

-

Supplier-funded insight

-

Transparency on brand plans

-

Data that supports category performance

From this perspective, data access is a prerequisite for partnership.

Brand Perspective

Brands worry about:

-

Asymmetric transparency

-

Data being used primarily to extract margin

-

Limited reciprocity

-

Blurred ownership of insights

Many brands feel they are asked to share more than they receive.

The Reality Most Coverage Ignores

Data sharing is not just technical.

It is emotional and political.

Trust is built slowly — and lost quickly.

The brands rethinking retailer relationships are not rejecting data sharing. They are redefining the conditions under which it makes sense.

What Healthier Data Sharing Looks Like

| Principle | What It Means in Practice |

|---|---|

| Purpose-led | Data requests tied to clear decisions |

| Reciprocity | Value flows both ways |

| Limits | Not all data needs sharing |

| Governance | Clear rules on usage |

| Outcomes | Measured by action, not volume |

This approach reduces friction and increases adoption.

How Behaviour Is Changing Inside Organisations

These shifts are not abstract. They show up clearly in day-to-day behaviour.

Inside FMCG Brands

-

Sales teams prioritise fewer, deeper relationships

-

Category teams focus more on execution capability

-

Finance teams are involved earlier in planning

-

Long-term profitability is weighted higher than short-term wins

Inside Retailers

-

Buyer roles evolve toward category ownership

-

Fewer tactical renegotiations mid-year

-

More emphasis on supplier reliability

-

Greater intolerance for noise without delivery

These changes reflect fatigue — but also maturity.

Why Long-Term Partnerships Are Gaining Logic

“Long-term partnership” used to be a slogan.

Now it is becoming a practical response to constraint.

The Economic Logic

Longer-term frameworks allow:

-

Better planning

-

Reduced negotiation cost

-

Smoother cost recovery

-

Clearer investment signals

They do not eliminate tension — but they reduce churn.

What These Partnerships Are (And Are Not)

They are:

-

Structured

-

Conditional

-

Performance-driven

They are not:

-

Soft

-

Exclusive by default

-

Free from accountability

The best partnerships still include tough conversations — just fewer surprises.

Why FMCG Brands Are Moving Toward Long-Term Retail Partnerships

-

Lower negotiation friction

-

More predictable economics

-

Clearer execution standards

-

Shared accountability for outcomes

What Success Looks Like Now

Success has been quietly redefined.

Old Success Metrics

-

Negotiation “wins”

-

Promotional depth

-

Shelf share gains

-

Short-term volume spikes

New Success Signals

-

Consistent in-store execution

-

Stable margins over time

-

Fewer escalations

-

Joint problem-solving

-

Lower organisational fatigue

These outcomes are harder to headline — but easier to sustain.

A Practical Comparison

| Dimension | Old Model | Emerging Model |

|---|---|---|

| Timeframe | Annual | Multi-year |

| Focus | Price & volume | Value & execution |

| Promotions | High frequency | Selective |

| Data | Transactional | Purpose-led |

| Trust | Fragile | Conditional but improving |

Why This Matters Beyond FMCG

These shifts matter because FMCG often sets the tone for broader retail–supplier dynamics.

As categories become more complex and margins tighter, the lessons learned here will travel across sectors.

The brands that adapt first are not those conceding power — but those choosing realism over ritual.

Conclusion: Rethinking, Not Retreating

FMCG brands are not rethinking how they work with retailers because partnership language sounds good in presentations.

They are doing it because the old models are exhausted.

Both sides face real constraints.

Annual battles drain value and energy.

Execution now matters more than rhetoric.

Another pressure sits quietly behind this shift. As private label continues to defend and expand its shelf position, branded suppliers are being forced to justify space through performance, reliability, and long-term value — not legacy strength or promotional spend alone. Shelf space is no longer protected by history. It is defended through delivery. That reality is changing how brands approach retailers, and why short-term, adversarial negotiations are giving way to more structured, outcome-driven relationships.

The future relationship is not softer.

It is clearer.

Less noise.

More honesty.

Fewer promises — better kept.

For brands and retailers willing to meet in the middle, that clarity is becoming a competitive advantage.

And that — more than any negotiation tactic — is why this rethink is happening now.