Irish fresh produce shelves often look calm.

Tomatoes are there. Bananas are stacked. Salad bags are full. Seasonal fruit rotates on cue.

From the outside, the system appears stable.

But that appearance is misleading.

Behind Irish supermarket shelves sits one of the most structurally volatile fresh produce supply systems in Europe. An island market. Highly import-dependent. Weather-exposed. Cost-sensitive. And increasingly managed through short-term risk controls rather than long-term supply certainty.

This article explains why Irish fresh produce supply remains volatile, even when availability looks normal.

It separates supply stability from price stability, examines the real causes of disruption, and looks closely at the retailer tactics that mask risk rather than remove it.

The focus is practical, not theoretical.

This is about how Irish supermarkets actually keep produce flowing — and what that means for growers, suppliers, logistics partners, and buyers inside the system.

Why does Irish fresh produce supply look stable but remain volatile?

Irish fresh produce supply appears stable because retailers actively manage risk through sourcing flexibility, specification changes, and range substitution. However, the system remains volatile due to heavy import dependence, weather exposure, transport constraints, and short buying cycles. Availability is protected first; price stability is not.

The Irish fresh produce reality at a glance

Before examining causes, it helps to frame the structure of the market.

Ireland is:

-

An island grocery market

-

With high fresh produce import dependence

-

Operating under tight retail margin pressure

-

Supplied through short lead-time logistics

-

Exposed to weather risk across multiple origin countries

Fresh produce supply stability in Ireland is not achieved by certainty.

It is achieved by constant adjustment.

Availability vs Price Stability: A Critical Distinction

One of the biggest gaps in existing coverage is the failure to separate two different concepts:

| Concept | What it means | Who carries the risk |

|---|---|---|

| Supply stability | Products remain on shelf | Suppliers, growers, logistics |

| Price stability | Prices remain predictable | Rarely protected |

Irish supermarkets prioritise availability first.

Price stability is often sacrificed to maintain that availability.

This distinction explains why shoppers see:

-

Minimal gaps on shelf

-

Frequent quiet price increases

-

Promotion volumes that fluctuate

-

Short-run price drops followed by resets

The shelf looks calm.

The commercial mechanics behind it are not.

Availability Of Fresh Produce In Ireland

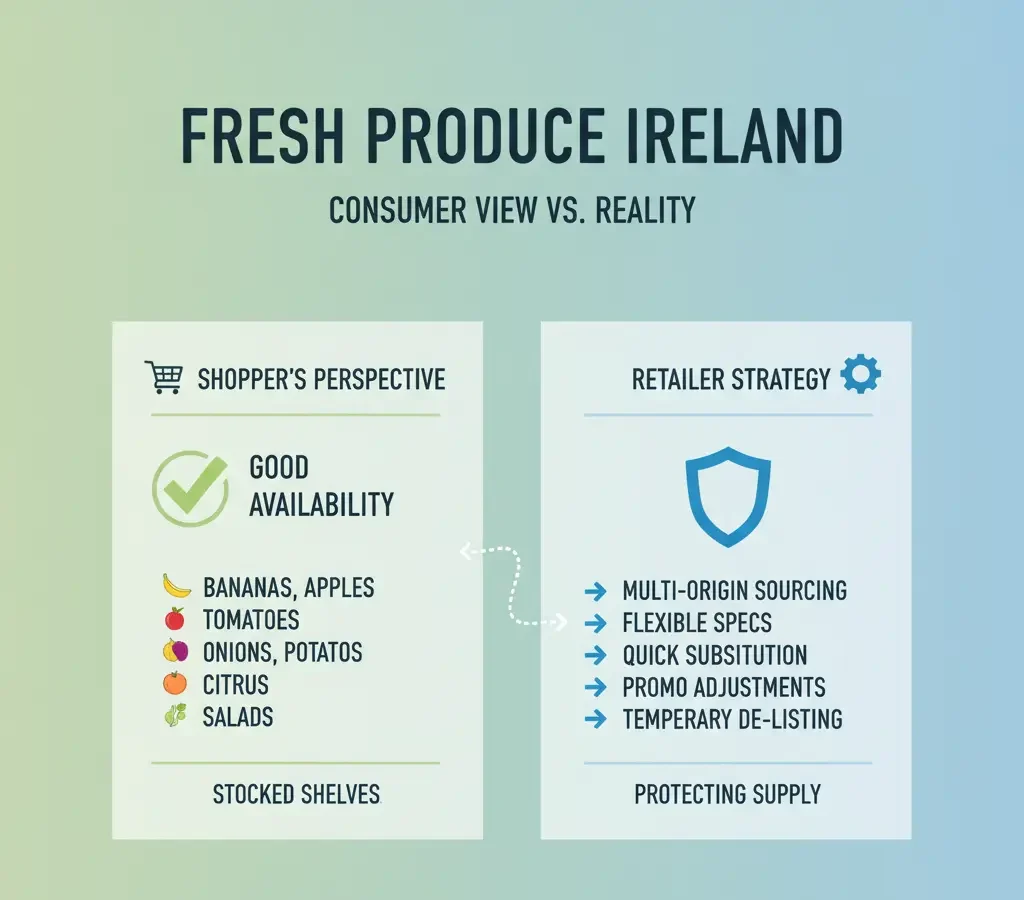

From a consumer perspective, Irish supermarkets perform well on availability.

Core categories remain consistently stocked:

-

Bananas

-

Apples

-

Tomatoes

-

Onions

-

Potatoes

-

Citrus

-

Leafy salads

But this does not indicate supply certainty.

It indicates retailer intervention.

How Irish retailers protect availability

Retail buyers use a layered approach:

-

Multiple origin sourcing

-

Flexible specifications

-

Rapid range substitution

-

Promotion timing adjustments

-

Temporary de-listing of stressed SKUs

These actions are rarely visible to shoppers.

They are highly visible to suppliers.

Import Dependence: The Foundation Of Volatility

Ireland grows some fresh produce domestically — but not enough to anchor the system.

Broad category split (simplified)

| Category | Domestic share | Import dependence |

|---|---|---|

| Potatoes | High | Low |

| Mushrooms | High (export-led) | Low |

| Apples | Medium | Medium |

| Leafy salads | Low | High |

| Tomatoes | Very low | Very high |

| Citrus | None | Total |

| Soft fruit | Seasonal | High off-season |

For most produce categories, Ireland is structurally dependent on imports.

This creates volatility because:

-

Weather risk is externalised

-

Transport risk is constant

-

Cost pressure arrives late but hits fast

-

Retailers have limited leverage on origin economics

Weather Disruption: The Headline Explanation — And Its limits

Irish trade press often frames disruption simply as “weather impact”.

This is true — but incomplete.

Commonly cited weather issues

-

Spanish heatwaves affecting salads and citrus

-

Flooding in Southern Europe

-

Frost events impacting early season crops

-

North African drought affecting export volumes

Sources such as ShelfLife and Checkout frequently report these events, especially during:

-

Salad shortages

-

Tomato supply squeezes

-

Soft fruit season transitions

But weather alone does not explain persistent volatility.

The Overlooked Factor: Retailer Risk Management

What most articles miss is how retailer behaviour amplifies or absorbs volatility.

Irish supermarkets do not respond to disruption by waiting it out.

They respond by reshaping demand.

Typical retailer responses to supply stress

-

Narrowing specifications (size, colour, origin)

-

Reducing promotional volumes

-

Switching to secondary origins

-

Re-labelling varietal descriptions

-

Adjusting pack formats

-

Quietly increasing price per unit weight

These actions stabilise shelves — but shift pressure upstream.

Why does volatility persist even when shelves look normal?

Volatility persists because Irish retailers manage disruption through short-term adjustments rather than long-term supply certainty. Specification flexibility, origin switching, and range substitution protect availability but transfer cost and risk to suppliers and growers.

Price swings: why they are sharp and frequent

Irish fresh produce pricing is sensitive because:

-

Volumes are relatively small

-

Transport costs are high per unit

-

Margins are thin

-

Buying cycles are short

When costs move, prices move quickly.

Key drivers of price swings

-

Fuel and freight costs

-

Weather-related yield losses

-

Currency movement

-

Labour availability at origin

-

Packaging cost changes

Retailers rarely absorb these fully.

They smooth them temporarily — then reset.

Logistics And Transport: The Island Factor

Logistics plays an outsized role in Irish produce volatility.

Ireland relies heavily on:

-

UK landbridge routes

-

Direct EU ferry capacity

-

Tight delivery windows

Key logistics pressure points

-

Ferry capacity constraints during peak seasons

-

Weather disruption at sea

-

Driver shortages

-

Border documentation complexity

-

Time-sensitive shelf life windows

Insights from logistics operators consistently highlight the same issue:

there is little slack in the system.

When one link breaks, the impact is immediate.

Why Shelves Stay Full Despite Structural Risk

This is the central paradox.

Shelves look stable because retailers design ranges to be flexible, not because supply is secure.

Common range management tactics

-

Fewer SKUs per category

-

Broader product descriptions

-

Seasonal switching without announcement

-

Reduced dependence on single origins

-

Tactical delisting of fringe lines

This is not resilience in the traditional sense.

It is managed fragility.

Domestic Production: Strengths And limits

Ireland’s domestic production base helps — but only in specific categories.

Where domestic supply matters

-

Potatoes

-

Mushrooms

-

Some root vegetables

-

Limited apple production

Where it does not

-

Tomatoes

-

Peppers

-

Cucumbers

-

Citrus

-

Most salads year-round

Domestic supply smooths some volatility, but cannot anchor the system.

Procurement Tactics That Rarely Get Discussed

Most commentary focuses on growers and weather.

Less attention is paid to buyer-led tactics.

Key retail procurement strategies

1. Dual sourcing

Maintaining approved suppliers across multiple origins.

2. Specification flexibility

Adjusting size, grade, and visual standards during stress.

3. Range substitution

Switching between similar products to maintain category presence.

4. Promotion control

Delaying, shrinking, or cancelling promotions to protect volume.

5. Simplified SKU strategies

Reducing complexity to increase sourcing optionality.

These tactics stabilise retail operations — but create planning uncertainty upstream.

How do Irish supermarkets manage fresh produce risk?

Irish supermarkets manage fresh produce risk through dual sourcing, flexible specifications, range substitution, controlled promotions, and simplified SKU structures. These tactics protect shelf availability but do not eliminate underlying supply volatility.

Supplier-Side Pressures: Often Invisible, Always Present

Suppliers sit between retailer demands and origin realities.

Key challenges include:

-

Packaging specifications that limit flexibility

-

Short lead times that compress planning windows

-

Compliance requirements that vary by retailer

-

Forecast volatility driven by late buying decisions

-

Waste risk when specifications change mid-season

Suppliers absorb much of the system’s shock.

Forecasting: The Weakest link

Fresh produce forecasting in Ireland remains challenging because:

-

Weather risk is unpredictable

-

Promotions are often adjusted late

-

Retailer flexibility undermines volume certainty

-

Consumer demand is price-sensitive

Forecasts exist — but they are frequently overridden.

Seasonal Promotions: Useful But Analytically Thin

Retailer communications often highlight:

-

Seasonal value events

-

Local sourcing messages

-

Promotional abundance

These messages matter for marketing.

They are less useful for understanding risk.

Promotions are often a signal of confidence, not proof of stability.

Bord Bia context: macro stability, micro volatility

Bord Bia reporting shows:

-

Strong export performance in certain categories

-

Continued domestic capability

-

Market access resilience

At a macro level, the sector performs well.

At an operational level, volatility remains high — especially for imports.

Why Volatility Is Structural, Not Temporary

This volatility persists because:

-

Ireland is an island market

-

Import dependence is unavoidable

-

Weather volatility is increasing

-

Logistics costs remain high

-

Retail buying remains short-cycle

No single intervention fixes this.

What Stability Really Means In Irish Fresh Produce

Stability does not mean certainty.

It means:

-

Problems are managed quietly

-

Costs move upstream

-

Prices adjust without fanfare

-

Ranges flex continuously

The shelf is the outcome — not the system.

Is Irish Fresh Produce Supply Stable?

Irish fresh produce supply is operationally stable at shelf level but structurally volatile underneath. Retailers maintain availability through flexible sourcing and range management, while cost and supply risk persist across the supply chain.

What This Means For Stakeholders

For retailers

-

Flexibility remains essential

-

Long-term certainty remains limited

-

Risk management will continue to dominate buying strategy

For suppliers

-

Specification agility is critical

-

Margin volatility is unavoidable

-

Planning assumptions must remain conservative

For logistics providers

-

Reliability is a differentiator

-

Capacity planning remains tight

-

Disruption response matters more than optimisation

For growers

-

Weather risk is only part of the story

-

Retail demand signals remain fluid

-

Price pressure is structural

Conclusion: stability is managed, not guaranteed

Irish fresh produce supply looks stable because it is actively managed.

Availability is protected.

Price certainty is not.

Risk is shifted, not removed.

Weather matters.

Imports matter.

Logistics matter.

But the most important factor is how Irish supermarkets manage uncertainty.

Understanding that distinction — between what looks stable and what actually is — is essential for anyone operating inside the Irish fresh produce supply chain.