For much of the past few years, fresh produce supply has felt persistently unstable. Prices moved quickly, seasonal gaps appeared without warning, and retailers were often forced to adjust plans mid-season as weather, logistics, or labour issues disrupted supply.

More recently, that sense of constant disruption has eased. Shelves are generally fuller, ranges look more consistent, and seasonal transitions are happening with fewer visible shocks. For shoppers, the experience feels calmer. For retailers, the system appears to be working again.

Yet the underlying unease has not disappeared.

Buyers, suppliers, and consumers are now asking a more nuanced question: if fresh produce supply has stabilised, why does risk still feel so close to the surface?

This article addresses that question directly. It explains what stabilisation actually means in the context of fresh produce, what has genuinely improved across supply chains, where structural risks still sit, and how retailers are quietly managing a system that is more resilient than it was — but still far from secure.

Most readers landing on this topic are not looking for drama.

They already lived through:

-

Pandemic disruption

-

Weather-driven shortages

-

Logistics breakdowns

-

Sudden price inflation

What they want now is clarity.

Specifically:

-

Has the system really recovered?

-

Is volatility behind us?

-

Or are we just between shocks?

Understanding the current state of fresh produce supply requires separating two ideas that are often blurred together: availability and resilience.

Shelves can look full while the system behind them remains under pressure. Short-term performance does not automatically indicate long-term security, particularly in a category as exposed to weather, logistics, and cross-border trade as fresh produce.

Much of the existing coverage focuses on visible outcomes — shortages, price changes, or weather events — without examining how the system behaves when conditions deteriorate. That distinction matters. Stability today is less about the absence of disruption and more about how effectively disruption is absorbed when it occurs.

The current landscape: what dominates search today

Trade press: reactive by design

Trade publications still dominate search rankings for fresh produce supply topics.

Their focus is typically:

-

Weather events

-

Crop failures

-

Delayed harvests

-

Extreme conditions

These reports are useful, but reactive.

They explain why something broke, not how the system now absorbs similar stress without breaking.

NGO and agricultural commentary: risk-heavy framing

NGO and agri-sector blogs often frame produce supply through:

-

Climate vulnerability

-

Environmental pressure

-

Long-term sustainability warnings

Much of this analysis is valid.

But it often:

-

Underplays commercial adaptation

-

Ignores retail operational changes

-

Treats fragility as static rather than managed

Price trackers: outcomes without context

Price indices and dashboards show:

-

Inflation trends

-

Category movements

-

Volume changes

They answer what changed, but not why pricing still behaves unpredictably even when supply improves.

What competitors consistently miss

Across almost all existing coverage, the same blind spots appear.

Short-term stability is mistaken for long-term security

A good season is treated as recovery.

A smooth quarter is treated as proof of resilience.

In reality, these are performance windows, not guarantees.

The retail buyer perspective is missing

Most articles speak about retailers, not from their operating reality.

They rarely explain:

-

How sourcing strategies have changed

-

How contracts are now structured

-

How risk is redistributed, not removed

Adaptation is mentioned, not explained

Readers are told that the system has “adapted”.

Very few articles explain how.

That explanation is the missing piece — and the most valuable one.

Clear opening answer: what is actually happening now

Fresh produce supply has stabilised operationally, not structurally.

That single sentence explains the entire situation.

-

Products are available more consistently.

-

Disruptions recover faster.

-

Retail systems are less brittle.

But:

-

Exposure remains.

-

Volatility has shifted upstream.

-

Risk is managed daily, not eliminated.

What “stabilisation” really means in fresh produce

Stabilisation does not mean predictability.

It means the system can function under pressure.

In practical terms, stabilisation shows up as:

-

Fewer empty shelves during disruptions

-

Shorter recovery periods after shocks

-

More substitution across origins and varieties

-

Better communication across supply chains

The system still bends.

It just breaks less often.

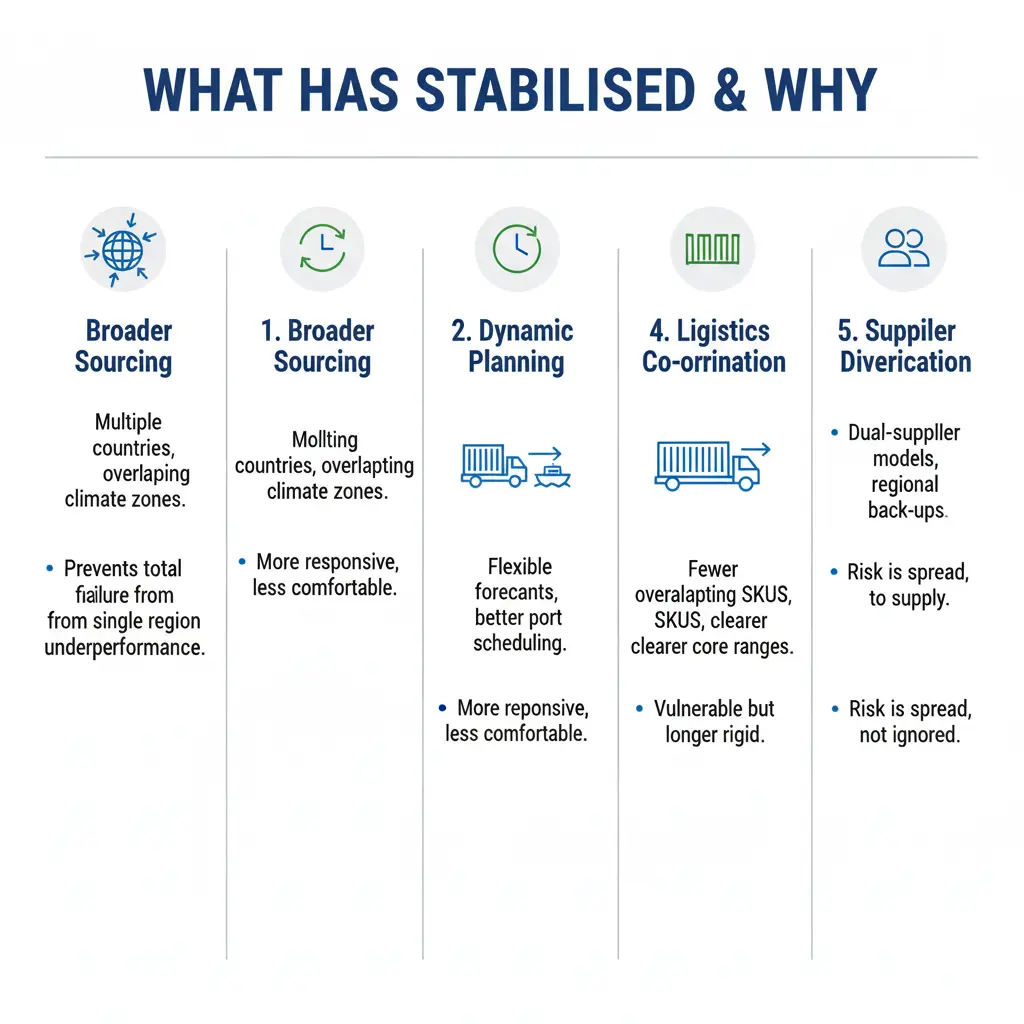

What has stabilised — and why

Several structural adjustments have improved day-to-day reliability.

Broader sourcing footprints

Retailers increasingly avoid reliance on a single origin per season.

Instead, the same product may now be sourced from:

-

Multiple countries

-

Overlapping climate zones

-

Parallel growing regions

This does not remove risk — but it prevents total failure when one region underperforms.

More dynamic planning cycles

Annual forecasts are no longer trusted on their own.

Buyers now work with:

-

Rolling forecasts

-

Shorter review intervals

-

Faster reallocation decisions

This makes planning more responsive, even if less comfortable.

Improved logistics coordination

After years of disruption, logistics networks have adjusted.

Key improvements include:

-

More flexible routing options

-

Better port scheduling

-

Stronger contingency planning

Shipping is still vulnerable — but no longer rigid.

Tighter range discipline

Retailers have quietly reduced complexity.

This includes:

-

Fewer overlapping SKUs

-

Clearer core ranges

-

Less duplication across varieties

Simpler ranges are easier to supply under stress.

Supplier diversification

Retailers increasingly avoid single-supplier dependence.

Common strategies now include:

-

Dual-supplier models

-

Regional back-up growers

-

Blended sourcing contracts

Risk is spread, not ignored.

What has not stabilised — and likely won’t

Despite operational improvements, several risks remain unresolved.

Climate volatility

Weather risk is not declining.

It is becoming:

-

More uneven

-

More localised

-

Harder to predict

Forecasting accuracy matters less when variability increases.

Logistics fragility

Transport systems remain exposed to:

-

Fuel price swings

-

Labour shortages

-

Infrastructure bottlenecks

-

Geopolitical chokepoints

Flexibility helps — but fragility remains.

Geopolitical exposure

Fresh produce crosses borders constantly.

That exposes supply to:

-

Policy changes

-

Trade restrictions

-

Sanctions

-

Regional instability

These risks are outside retail control.

Input cost pressure

Even with good harvests, growers face:

-

Energy volatility

-

Fertiliser costs

-

Labour expenses

-

Water constraints

These costs feed directly into pricing.

Labour availability

Seasonal labour shortages persist in many producing regions.

This affects:

-

Harvest timing

-

Packhouse throughput

-

Quality consistency

Stability requires people — and that remains uncertain.

Why price volatility persists despite better supply

This is where many readers feel confused.

Availability no longer guarantees price stability.

Several structural reasons explain why.

1. Risk is now priced in

Buyers assume disruption is possible — even during calm periods.

That changes pricing behaviour.

2. Shorter contracts mean faster price movement

Less long-term fixing means:

-

More frequent renegotiation

-

Faster response to cost changes

-

Greater visible volatility

3. Higher cost baselines remain

Input inflation does not reset quickly.

Even stable supply carries higher embedded costs.

4. Promotions are used more cautiously

Retailers are less willing to:

-

Over-commit volume

-

Lock in aggressive pricing

-

Absorb margin shocks

5. Leaner ranges reduce internal competition

Fewer SKUs mean fewer internal price anchors.

Prices move more freely as a result.

How retailers are adapting — quietly

Most adaptation happens below the headline level.

No campaigns.

No announcements.

Just operational shifts.

Overlapping origin calendars

Supply is planned as layers, not handovers.

This allows:

-

Earlier switching

-

Partial substitution

-

Volume smoothing

Flexible specifications

In some categories, cosmetic standards are adjusted quietly.

This improves:

-

Yield usability

-

Waste reduction

-

Supply continuity

Shoppers rarely notice — which is intentional.

Smaller, smarter commitments

Retailers avoid locking in too early unless necessary.

Optionality is treated as a strategic asset.

Deeper supplier relationships

Fewer suppliers, closer collaboration.

Better data sharing.

Earlier warnings.

Faster adjustment.

Resilience over perfection

The goal is no longer flawless execution.

It is:

-

Acceptable continuity

-

Predictable substitution

-

Rapid recovery

Stability vs risk: a clear comparison

| Area | Improved | Still Exposed |

|---|---|---|

| Shelf availability | ✔ | |

| Origin diversity | ✔ | |

| Forecast agility | ✔ | |

| Climate volatility | ✔ | |

| Logistics shocks | ✔ | |

| Input cost pressure | ✔ | |

| Labour availability | ✔ | |

| Price predictability | ✔ |

What stabilisation does not mean

It does not mean:

-

The system is safe

-

Volatility is over

-

Risk can be ignored

It means:

-

The system is more adaptive

-

Retailers are better prepared

-

Shocks are managed, not eliminated

Closing reality check

Fresh produce supply has not returned to a calm, predictable past.

That past no longer exists.

Instead, the system now operates in a managed-risk environment:

-

More flexible

-

Less brittle

-

Still exposed

The real shift is not the disappearance of risk.

It is the industry’s growing ability to live with it — and keep shelves full while doing so.

That distinction matters more than any headline about stabilisation.