Packaging Companies in Europe operate across very different material systems, each with its own cost pressures, regulatory exposure, and supply risks. This ranking breaks the market down by paper, plastic, metal, and glass to show which suppliers truly matter to retailers, private label programmes, and fresh produce supply chains today.

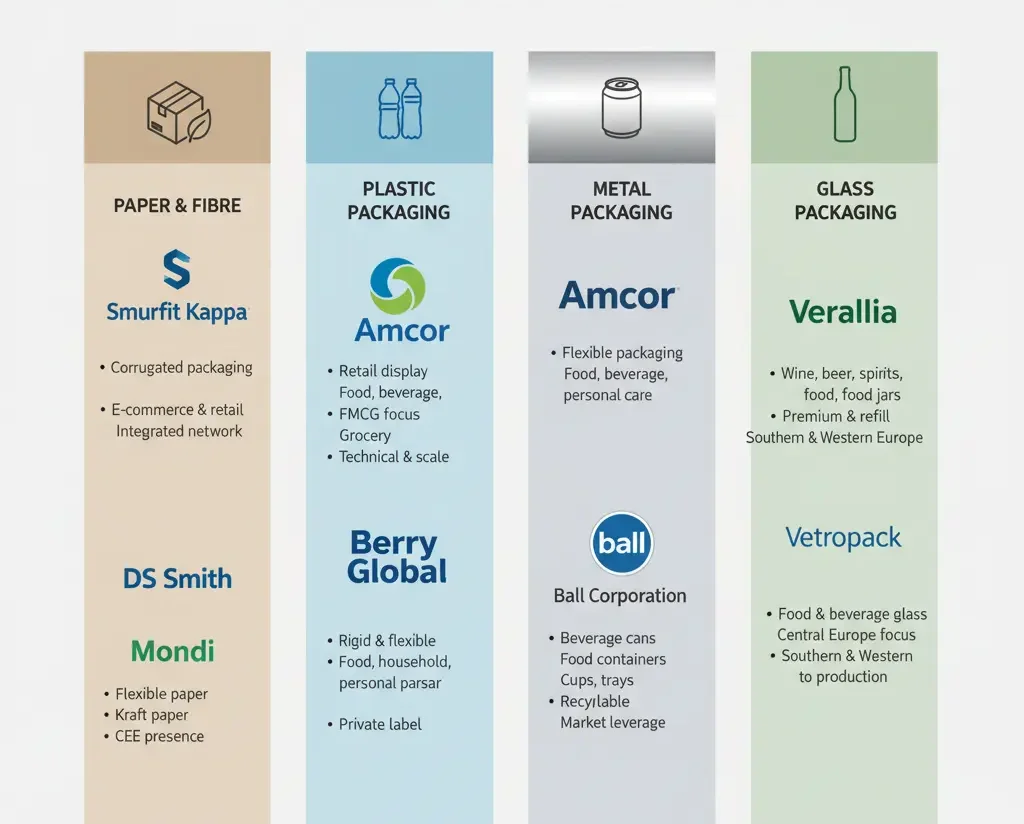

Paper & Fibre Packaging

Smurfit Kappa

Europe’s largest corrugated packaging supplier, with deep exposure to supermarket-ready packaging, e-commerce boxes, and shelf-ready formats across Western and Central Europe. The company’s scale and integrated paper network make it a critical partner for high-volume grocery and fresh food supply chains.

DS Smith

Strong in retail display packaging and fast-moving consumer goods. The company is known for close operational partnerships with major European grocery retailers and private label suppliers, particularly where shelf execution and rapid redesign cycles matter.

Mondi

A major force in paper, flexible paper-based packaging, and kraft paper, with a strong footprint across Central and Eastern Europe. Mondi plays an important role in balancing cost efficiency with regulatory compliance in fibre-based packaging.

Plastic Packaging

Amcor

One of the most influential flexible packaging suppliers in Europe, serving food, beverage, and personal care brands with high-volume, high-complexity packaging. Amcor’s strength lies in its ability to manage technical requirements while scaling compliant designs across multiple markets.

Berry Global

A key supplier of rigid and flexible plastic packaging for food, household, and personal care categories, with strong exposure to retailer own brands. Berry’s breadth makes it especially relevant for private label programmes that require consistency across formats.

Huhtamaki

Best known for foodservice and consumer packaging, including cups, trays, and flexible solutions widely used in European grocery and convenience retail. The company sits at the intersection of on-the-go consumption and supermarket supply.

Metal Packaging

Ardagh Group

A major European supplier of beverage cans and food containers, serving soft drinks, beer, and canned food categories across multiple markets. Ardagh’s strength lies in long-term customer contracts and capital-intensive production capacity that is difficult to replicate quickly.

Ball Corporation

Holds a strong position in aluminium beverage cans, benefiting from continued demand for recyclable packaging in European drinks retail. Switching suppliers in this segment is complex, which gives established players significant structural leverage.

Glass Packaging

Verallia

Europe’s leading glass packaging producer, supplying wine, beer, spirits, and food jars, with a strong presence in Southern and Western Europe. Verallia is deeply embedded in premium and refill-ready packaging systems.

Vetropack

A key regional player focused on food and beverage glass packaging, particularly strong in Central Europe. Its proximity to food production hubs makes it strategically important despite a smaller footprint than pan-European rivals.

Why This Ranking Matters

This segmented view reflects how packaging decisions are actually made in Europe.

Packaging is not bought as a single category. It is sourced by material, because each material behaves differently across cost, regulation, logistics, and shelf performance. Paper, plastic, metal, and glass operate under separate supply chains, face different regulatory pressures, and carry very different risk profiles. Treating them as one market hides the real power dynamics.

For buyers, this distinction matters more now than at any point in the past decade.

Cost Pressure Is Material-Specific

Paper and fibre packaging remain highly exposed to energy pricing and recovered paper availability. Even small swings in pulp costs can move margins quickly for suppliers and buyers.

Plastic packaging faces ongoing volatility linked to polymer pricing, recycled content availability, and compliance investment, particularly as regulatory requirements tighten.

Metal packaging is sensitive to aluminium and steel pricing as well as long-term capacity planning. Beverage can demand spikes cannot be solved quickly because new capacity requires years of investment.

Glass packaging carries some of the highest energy exposure in the sector. Furnace operation, rebuild cycles, and gas pricing directly affect supply stability.

Because of this, procurement teams do not compare suppliers across materials. They compare within materials.

Regulation Is Not Uniform Across Materials

EU policy impacts each segment differently.

Paper benefits from strong recycling infrastructure but faces growing scrutiny on forestry, fibre sourcing, and waste export rules. Plastic packaging is under the heaviest regulatory pressure, with recycled content mandates, design-for-recycling requirements, and extended producer responsibility costs reshaping supplier economics.

Metal enjoys strong recyclability credentials but faces capacity constraints and high capital intensity. Glass aligns well with reuse and refill models, but energy intensity remains a structural challenge.

This is why supplier strength must be evaluated by segment, not by headline revenue.

Europe Private label

For Europe private label, packaging choice directly affects commercial performance.

Private label margins are tighter than branded goods. Packaging is one of the few areas where retailers can still influence cost without changing product quality. Material decisions affect unit cost and price stability, compliance with retailer sustainability targets, shelf readiness, transport efficiency, and the speed at which packaging can be redesigned when regulations change.

Retailers do not want the biggest packaging company. They want the right material leader, with scale, reliability, and flexibility. That is why paper and plastic specialists often matter more to private label programmes than diversified packaging groups.

Europe Fresh Produce

In Europe fresh produce, packaging plays a different but equally critical role.

Produce packaging must protect shelf life, allow visibility for quality assessment, meet recyclability or reuse targets, and remain cost-effective under high volume. Fresh produce suppliers rely heavily on paper, fibre, and flexible plastic, with limited tolerance for supply disruption.

Material choice directly affects food waste rates, transport efficiency, retail presentation, and compliance with country-specific packaging rules. As EU rules tighten and retailers push harder on sustainability, fresh produce packaging decisions are becoming more strategic, not less.

Structural Concentration Is Increasing.

Across all four materials, the number of suppliers capable of serving large European volumes is shrinking. Investment requirements are rising, compliance costs are rising, and capacity expansion is slower.

This favours segment leaders rather than generalists. Understanding who controls each material category is essential for retailers, brands, and suppliers planning for the next three to five years.

What Buyers And Suppliers Should Do With This Ranking

This ranking is not just descriptive. It is practical.

For fresh produce suppliers, the most immediate action is risk management. Relying on a single packaging supplier within one material category increases exposure to energy shocks, capacity constraints, and regulatory delays. A more resilient approach is to diversify across two material leaders, ideally with production footprints in different regions of Europe.

Suppliers should also align packaging partners with regulatory readiness, not just price. The EU’s Packaging and Packaging Waste Regulation (PPWR) will tighten requirements on recyclability, reuse, and reporting. Working with suppliers that already invest in compliant designs reduces the risk of rushed redesigns or product disruption.

For retailers and private label teams, the action is more strategic. Material leaders are not interchangeable. Choosing the right supplier within each segment directly affects margin stability, redesign speed, and long-term compliance.

Why This Changes Procurement Thinking

What this ranking ultimately shows is that procurement strategy in Europe is becoming more material-specific, regulation-led, and risk-aware.

Segment leadership determines who can absorb shocks, adapt quickly, and support customers through regulatory change without disruption. Buyers that understand this can plan sourcing more deliberately, avoid last-minute redesigns, and protect margins in categories where packaging decisions increasingly shape commercial outcomes.

Breaking Europe’s packaging market down by material is no longer optional. It is the difference between reacting to change and staying ahead of it.

Editor’s Note: This analysis is based on publicly available information and industry data. Companies are included based on material leadership, scale, and relevance to retail, private label, and fresh produce supply chains.