The fresh produce in Canada is changing faster than most people realize. Shifts in sourcing, pricing, logistics, and consumer preferences are reshaping how fruits and vegetables move from farm to shelf.

Demand is strong. Canadians are buying more fresh produce than ever — not only because of health awareness but also because of convenience formats that make fresh produce easier to consume.

Retailers and suppliers are adapting, trying to meet this steady demand while facing climate limits, import dependence, and growing calls for local supply.

Note: Before we begin, please note that every part of this article is based on verified information. We have carefully reviewed data from Agriculture and Agri-Food Canada (2024 Statistical Overviews), Grand View Research (2024 Market Outlook), and recent analyses published by FreshPlaza and Fruit & Vegetable Magazine Canada.

This article combines insights from those trusted sources to give you a clear, research-based view of Canada’s fresh produce sector — presented simply, for easier understanding.

Import Reliance And Trade Gaps

Canada’s geography means that the supply of fresh produce depends heavily on imports. Cold winters, limited farmland, and short growing seasons restrict domestic output.

According to Agriculture and Agri-Food Canada, the country imported over CAD 8 billion worth of fruits and more than CAD 4 billion in vegetables in 2024. By contrast, exports of fresh fruit were just over CAD 1 billion, showing a clear trade gap.

The majority of imports come from the United States, which supplies nearly 60 percent of the vegetables sold in Canada. Mexico follows with around 24 percent, filling winter supply gaps for tomatoes, peppers, and berries.

This import-heavy balance gives Canadian buyers a wide range of options, but it also creates exposure to currency swings, border delays, and logistical challenges.

Domestic Production And Its Limits

Canadian growers continue to expand production where conditions allow. Ontario leads the country with more than half of all field vegetable output, followed by Quebec and British Columbia.

Blueberries remain the largest fruit crop, representing more than half of Canada’s fruit-growing area. Apples come second, followed by grapes, cranberries, and strawberries. For vegetables, tomatoes, carrots, and onions dominate production.

Despite these gains, local output can only cover a small portion of total consumption. Growers face rising costs for labor, energy, and inputs — and shorter growing windows mean that large-scale investment often requires greenhouses or indoor systems.

Greenhouse Growth And Controlled Environments

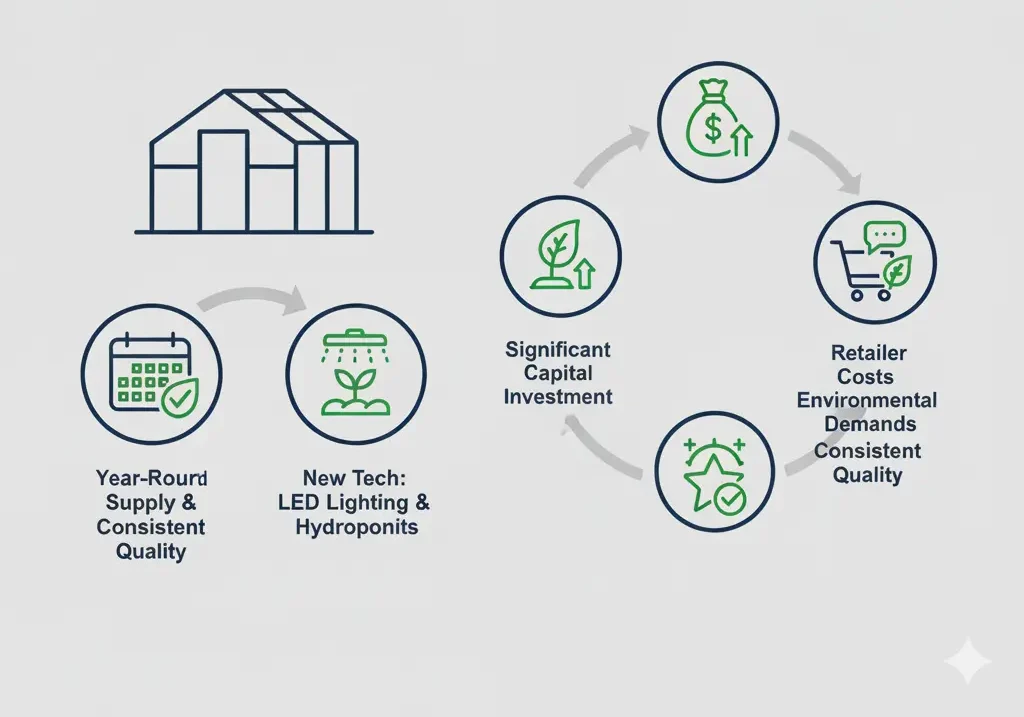

Greenhouse farming is becoming one of the defining trends in Canadian produce. It helps extend the growing season and reduce reliance on imports for tomatoes, cucumbers, and peppers.

Ontario and British Columbia lead this shift. New investments in greenhouse technology, LED lighting, and hydroponic systems are enabling year-round supply.

These facilities can produce consistent quality but require significant capital. As energy costs rise, operators must balance efficiency with sustainability goals — especially as retailers ask suppliers to demonstrate environmental responsibility.

Retail Evolution: How Stores Are Changing

Supermarkets in Canada are rethinking their approach to fresh produce.

Chains such as Loblaw, Sobeys, Metro, and Save-On-Foods are expanding local sourcing programs and increasing in-store visibility for regional growers.

Retailers see fresh produce as a key traffic driver. It shapes how shoppers perceive freshness and value across the store. That’s why the section layout, signage, and lighting often receive heavy investment compared with other categories.

To reduce shrinkage and waste, many retailers are tightening supplier standards and improving cold-chain coordination. They also invest in better data systems to forecast demand more accurately.

Consumer Shifts: Health, Convenience, And Origin

Canadian shoppers are more selective about what they buy. They want freshness, clear labeling, and traceable origins.

Convenience plays a major role. Pre-cut fruit, salad kits, and ready-to-cook vegetable packs are among the fastest-growing categories. Busy urban consumers prefer options that save time while maintaining a sense of “real food.”

Health awareness continues to grow across demographics. Younger consumers are increasing their intake of produce as part of flexitarian and plant-based diets. Older consumers, meanwhile, are choosing low-sodium and antioxidant-rich options.

This shift is reshaping assortments, packaging formats, and in-store merchandising.

The Rise Of “Local”

The word “local” has taken on a new meaning in Canadian supermarkets. It is no longer just about geography — it signals trust, freshness, and community. Retailers now use “locally grown” signage to highlight regional suppliers.

Consumers often pay a small premium when they believe their purchases support nearby farms.

For smaller producers, this creates an opening. Independent growers can gain listings by demonstrating reliability and traceability. Retailers see value in promoting Canadian produce when it aligns with their sustainability and social-impact messaging.

Packaging And Sustainability

Packaging innovation is another area of change in the fresh produce sector. Retailers and suppliers are under pressure to reduce plastic use while maintaining product protection and shelf life.

Compostable trays, fiber-based punnets, and recyclable films are increasingly common in produce departments.

Canadian converters are working with brand owners to test materials that balance barrier protection with environmental goals.

In the case of berries and tomatoes, new ventilation designs help manage moisture and extend freshness without compromising recyclability. The push for sustainable packaging is not just environmental — it’s now a commercial requirement.

Logistics: Cold Chain And Distance

Distance is a constant factor in Canada’s produce supply chain. From southern Ontario to northern Alberta, temperature and timing define success.

Retailers depend on stable cold-chain networks that maintain product integrity from import terminals or farms to distribution centers and stores. Any weak link — a delayed truck, an over-warm dock — can lead to losses.

Transportation costs have also risen sharply. Fuel price fluctuations and limited trucking capacity make freight planning a major issue for both growers and distributors. For perishable goods, those costs can quickly erase margins.

Cost Pressures And Margin Squeeze

Margins in fresh produce are notoriously thin. Suppliers and retailers must deal with short shelf lives, constant price competition, and strict quality expectations.

Domestic producers face particularly tough economics. Energy costs for heating greenhouses, labor shortages during harvest, and higher packaging prices all erode profit. In some cases, growers pivot toward premium or niche products to stay viable.

Retailers balance cost control with differentiation. They must deliver value to consumers while maintaining consistency and visual appeal on shelves.

Opportunities For Growth

Even with challenges, opportunities across the Canadian produce market remain strong.

Grand View Research expects steady growth of more than 5 percent annually through 2033.

Several areas show promise:

-

Greenhouse expansion: Year-round tomato, cucumber, and pepper production continues to rise.

-

Organic and specialty crops: Consumer demand for clean labels and variety supports small-scale innovation.

-

Value-added formats: Pre-cut and ready-to-eat items drive higher turnover.

-

Traceability and tech adoption: Growers investing in digital systems for tracking and quality assurance gain retailer confidence.

Each of these areas aligns with broader retail trends — transparency, convenience, and local credibility.

Technology And Data In The Produce Chain

Digitalization is starting to play a larger role. Producers are using data platforms to manage irrigation, monitor crop health, and plan harvest schedules.

Retailers use analytics to forecast demand, reduce waste, and fine-tune promotions.

Distributors integrate temperature sensors and GPS tracking to maintain cold-chain integrity.

These systems improve efficiency but require capital and technical training.

As margins tighten, adoption may depend on collective action — cooperatives, provincial programs, or retailer-supported initiatives.

Weather, Climate, And Sustainability Pressures

Climate variability is becoming a real concern for Canadian agriculture. Droughts, floods, and temperature extremes affect both field yields and quality.

In British Columbia, heatwaves have hurt berry production in recent years. Prairie regions face more unpredictable rainfall, impacting root-crop stability.

Sustainability goals are also tightening. Retailers set environmental targets that filter down to growers, requiring proof of responsible water use and soil management. For long-term stability, both growers and retailers must invest in resilience through better infrastructure and shared risk management.

Retail Partnerships And Private Label

Private-label development in fresh produce is expanding. Large grocery chains are using their in-house brands to build trust and loyalty in the category.

These programs often include exclusive sourcing partnerships with Canadian growers. They allow retailers to offer consistent quality while maintaining pricing control.

For suppliers, private-label relationships can bring volume stability, but also tighter margin constraints and performance expectations. Producers with strong operational discipline benefit most.

The Role Of Trade Events and Export Links

Trade events such as the Canadian Produce Marketing Association (CPMA) Convention & Trade Show have become key meeting points for buyers and suppliers. They provide exposure for growers and highlight innovation in packaging, logistics, and sustainability.

Exports are also gaining attention. Canada’s blueberry and apple producers are building stronger links with Asian and European markets. While volumes remain modest, these exports help diversify risk and showcase quality standards abroad.

Government Support And Policy

Government policy plays a quiet but essential role in shaping the fresh produce industry. Programs under Agriculture and Agri-Food Canada support research, technology upgrades, and food-safety certification.

The “Buy Canadian” initiative continues to encourage domestic purchasing, helping retailers showcase national origin. At the same time, trade agreements with the U.S. and Mexico remain vital to ensure steady import flows year-round.

Policy direction increasingly focuses on sustainability, workforce stability, and supply-chain security — all central to the sector’s long-term growth.

Outlook: The Next Phase

Canada is entering a new phase in the fresh produce industry. With recent growth, we definitely expect Demand to continue to grow, driven by health, convenience, and sustainability priorities. At the same time, logistics costs, weather patterns, and reliance on imports will test supply stability.

For retailers, the next step is stronger integration with domestic suppliers and more sophisticated forecasting tools.

For growers, success will depend on efficiency, differentiation, and technology adoption.

By 2033, analysts expect the Canadian fresh produce market to exceed USD 36 billion in annual revenue.

That growth will not come from volume alone — it will come from smarter systems, stronger partnerships, and a better understanding of what “fresh” means to the Canadian consumer.

Closing Reflection

The landscape of fresh produce in Canada is both complex and full of opportunity. Imports remain necessary, but domestic innovation is closing some of the gap. Retailers are refining sourcing, packaging, and in-store execution to keep up with changing consumer habits.

Ultimately, the winners will be those who adapt fastest — the growers who invest in sustainable methods, and the retailers who align freshness with value and trust. For Canada’s fresh-produce market, evolution is not optional. It’s already underway.