The French packaging industry is not standing still. After three years of material shortages and price shocks, it has settled into a new phase: rebuilding capacity while cutting environmental impact. The direction is clear — more circular, more traceable, and more export-ready.

According to FDE estimates, France’s packaging sector generated over €28 billion in 2024. The recovery is steady rather than rapid, driven by food, cosmetics, and beverage markets. These sectors rely heavily on packaging not only for logistics but also for product identity and sustainability compliance.

The shift now is less about growth at any cost and more about sustainable design and regulatory alignment.

Note: Before we start, we remind you that all information in this article is based on verified data from CITEO (2024 Annual Report), ADEME Packaging and Waste Prevention Review 2025, Fédération de l’Emballage (FDE) industry data, and trade analyses published by Emballages Magazine and Packaging Europe.

A Clear Material Shift

One of the most defining changes in 2025 is the visible material transition.

Plastic still dominates in volume, but its share is shrinking.

Paper-based and hybrid materials are gaining ground, supported by both EU policy and consumer sentiment.

CITEO’s latest report shows that paper and cardboard now represent nearly half of all French packaging placed on the market by weight.

Glass and metal maintain stable shares, while flexible plastic volumes decline as recycling targets tighten.

The French approach differs from many EU countries — it doesn’t ban plastic outright.

Instead, it focuses on recyclability, collection efficiency, and innovation in material blends.

That’s why bioplastics and fiber-based composites are drawing so much attention in trade fairs and R&D programs.

Leading French Packaging Companies

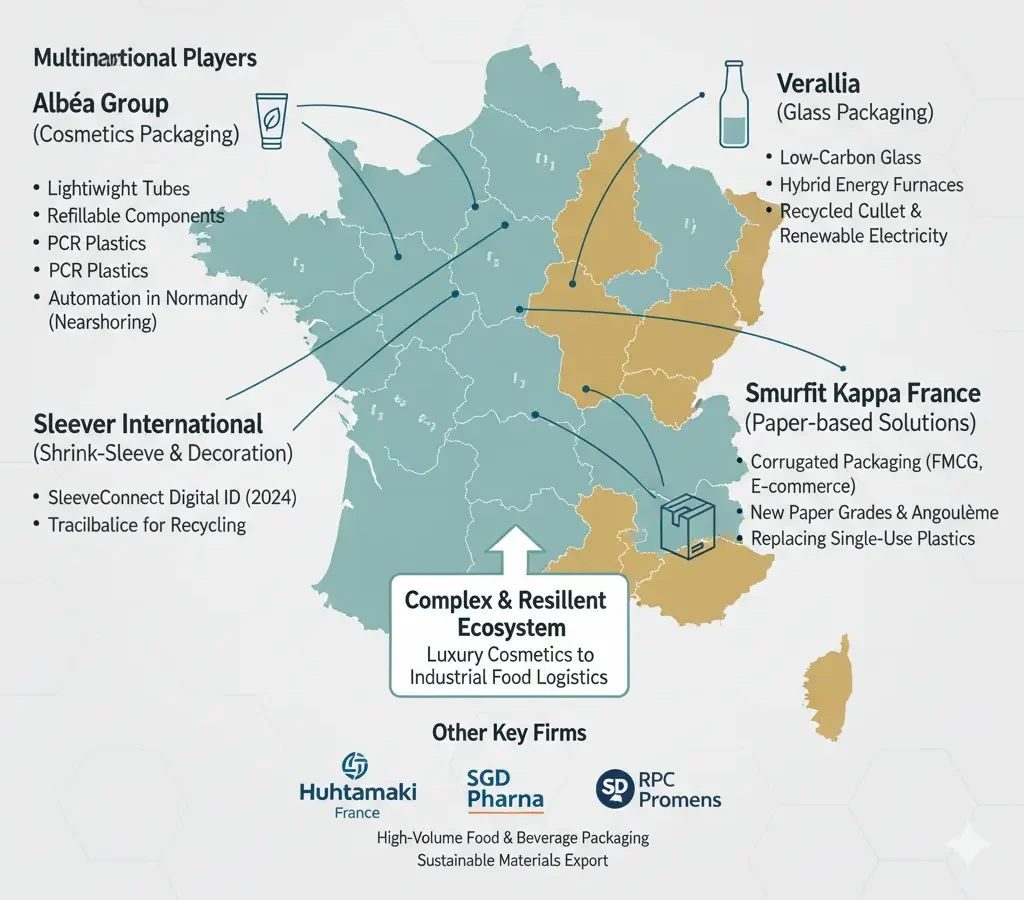

The French packaging landscape includes both multinational players and highly specialized regional firms.

Together, they form a complex but resilient ecosystem that stretches from luxury cosmetics to industrial food logistics.

Albéa Group remains one of France’s global leaders in cosmetics packaging.

Its 2025 strategy revolves around lightweight tubes, refillable components, and PCR (post-consumer recycled) plastics.

The company’s investment in automation at its Normandy site signals confidence in nearshoring production.

Verallia, a glass-packaging specialist, continues to expand its low-carbon glass initiatives.

Its furnaces in Cognac and Oiry now operate with hybrid energy systems combining recycled cullet and renewable electricity.

Sleever International focuses on shrink-sleeve and decoration technologies.

Its “SleeveConnect” digital ID system, launched in 2024, supports traceability for recycling sorters.

Smurfit Kappa France dominates paper-based solutions, supplying corrugated packaging to both FMCG and e-commerce markets.

The company’s design labs in Reims and Angoulême now test new paper grades aimed at replacing single-use plastics.

Other firms — including Huhtamaki France, SGD Pharma, and RPC Promens — remain active in high-volume food and beverage packaging, maintaining France’s export presence in sustainable materials.

Innovation As A Daily Discipline

In France, innovation is not a marketing slogan — it’s a compliance requirement.

New packaging designs must now consider the entire life cycle, from sourcing to recyclability.

ADEME’s 2025 review shows that the average packaging innovation cycle has shortened from 24 months to under 12.

Companies now integrate recyclability, weight reduction, and refill compatibility at the concept stage.

Digital technology plays a growing role.

QR codes and data matrices link to recycling instructions, batch data, and environmental impact scores.

For industrial clients, digital twins simulate packaging lines before physical production starts — reducing waste and improving line efficiency.

The sector’s mindset is becoming more data-driven, with traceability seen as both a regulatory tool and a value proposition.

Regulation As A Catalyst

France’s Loi AGEC (Anti-Waste for a Circular Economy Law) continues to shape the entire packaging value chain.

Its progressive targets — 100% recyclable packaging by 2025 and 20% reuse by 2030 — force constant redesign.

CITEO manages the country’s extended producer responsibility (EPR) scheme, collecting eco-contributions and financing recycling systems.

This structure ensures that brand owners remain financially linked to packaging recovery performance.

Rather than resisting, French manufacturers have integrated compliance into their innovation budgets.

R&D labs now include environmental engineers alongside material scientists and designers.

Circular Economy In Practice

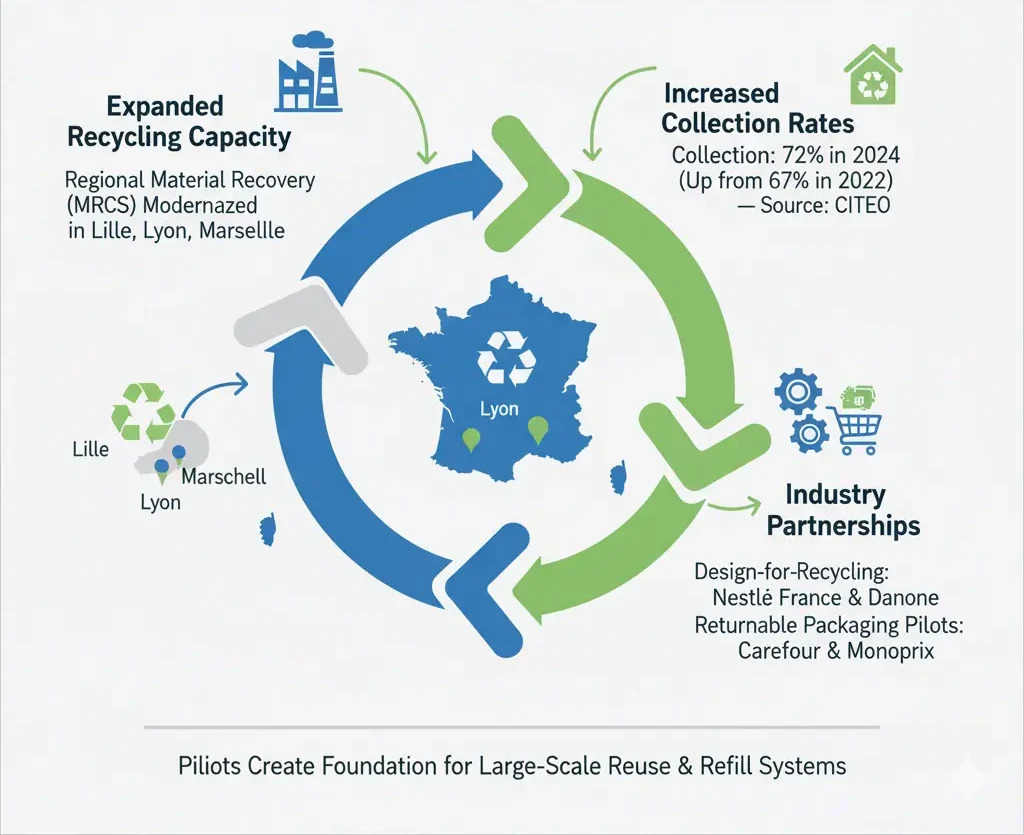

Circularity is no longer a concept — it’s a measurable framework.

Recycling capacity has expanded with regional material recovery centers (MRCs) modernized in Lille, Lyon, and Marseille.

Collection rates for household packaging reached 72% in 2024, according to CITEO data — up from 67% in 2022.

Industry partnerships have become key to progress.

Nestlé France and Danone work directly with packaging converters to improve design-for-recycling.

Retailers like Carrefour and Monoprix have introduced returnable packaging pilots for select product lines.

While not all trials succeed, they create a foundation for large-scale reuse and refill systems that will shape the next decade.

Collaboration With Retail And FMCG

French packaging companies are deeply integrated with the country’s retail ecosystem.

Carrefour’s “Loop” initiative, developed with TerraCycle, remains a benchmark for circular retail collaboration.

It has inspired supermarket groups to explore similar packaging return loops for dry goods and household products.

For food brands, Albéa and Huhtamaki supply lighter packaging formats that reduce freight emissions and align with eco-design standards.

Verallia’s partnership with Pernod Ricard on lightweight bottles shows how traditional materials can adapt to modern efficiency demands.

Packaging has become a strategic bridge between sustainability and consumer trust.

For retailers, it’s also a new communication channel — every pack is a message about values.

Costs And Constraints

Even with innovation momentum, the sector faces intense cost pressures. Energy, raw materials, and compliance all cost more than before 2020. Profit margins for converters remain narrow, especially in the mid-market segment.

The FDE notes that smaller converters are struggling with investment capacity. Digitalization, required by law for traceability, adds both cost and complexity. However, automation and AI-supported production monitoring are starting to balance those expenses with long-term efficiency gains.

The challenge for 2025 is managing this transition without losing competitiveness against imports from low-cost regions.

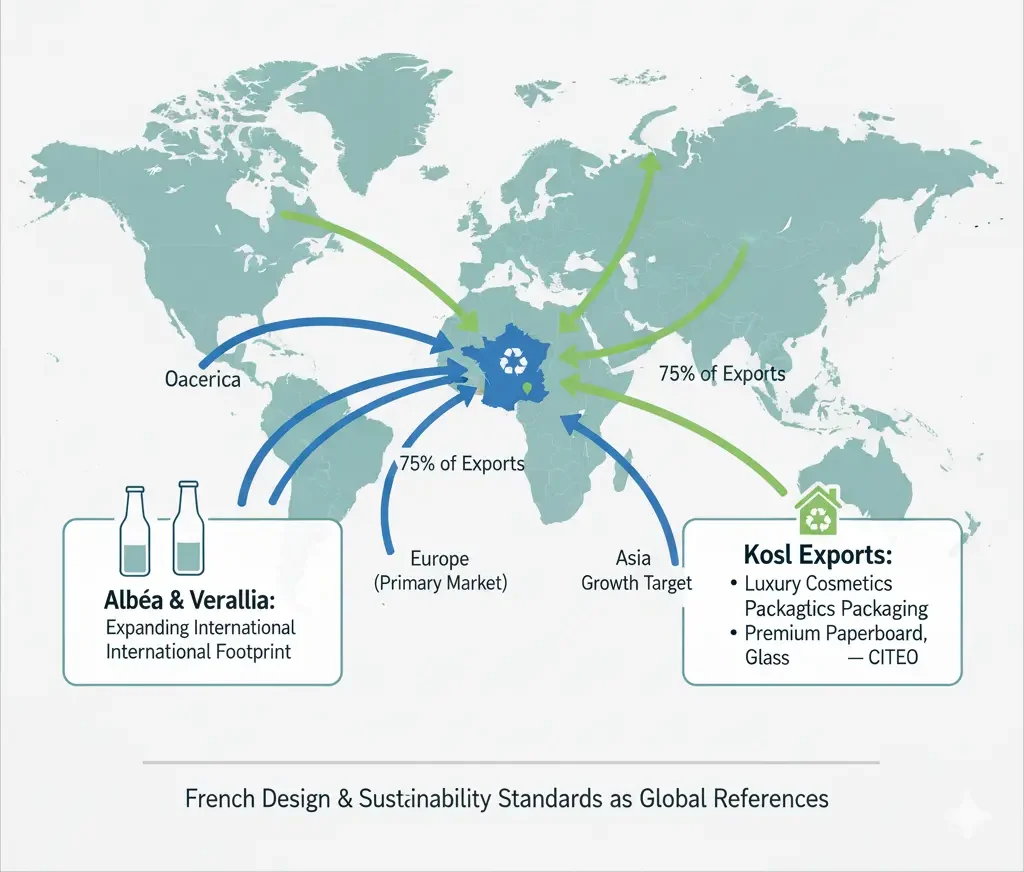

Export And International Reach

France remains a net exporter of high-value packaging. Glass, luxury cosmetics packaging, and premium paperboard solutions lead the way. The European market absorbs around 75% of exports, but Asia and North America remain growth targets.

Albéa and Verallia continue to expand their international footprints, positioning French design and sustainability standards as global references.

The French brand of “precision, performance, and responsibility” gives its packaging companies credibility in global tenders.

Training And Workforce Renewal

The packaging industry’s transformation depends on its people. New technical roles in sustainability, digital modeling, and material testing are replacing older production profiles.

The French government and industry associations have launched upskilling initiatives in partnership with engineering schools. CITEO reports a growing number of certifications for eco-design specialists and packaging data analysts.

France’s strength here lies in education — it builds the next generation of packaging professionals alongside regulatory change.

The Road Ahead

By 2025, the French packaging industry will stand at a balanced midpoint — modernized but still adapting.

Its core advantage is integration: manufacturers, retailers, and regulators work within the same sustainability framework.

Innovation continues, not for show, but for survival.

Companies that invest in automation, circular design, and data integration will remain competitive.

Those who wait risk falling behind in a market increasingly defined by transparency and efficiency.

For global buyers, France represents a mature, responsible, and inventive packaging base — one that combines industrial scale with regulatory credibility. In short, it’s a sector that has learned to evolve without losing its identity.