Supermarkets in Asia are changing how they use their mobile apps. In the past, these apps were mainly used for loyalty cards, discount tracking or online ordering. Now, many supermarket groups are turning their apps into media platforms. These apps are becoming places where shoppers receive suggestions, see seasonal produce highlights, and notice small, helpful reminders about what to buy and when to shop.

This shift is happening quietly. It is not being pushed by marketing slogans or big advertising. It is happening because people already use their phones before they shop. The app fits naturally into this habit.

The physical store still matters the most. The store is where shoppers check freshness, touch vegetables, compare fruit, and make final choices. But the decision of what to look for, which store to visit, and whether today is the day to shop is increasingly shaped by what shoppers see on their phones before they leave home.

The app has become the starting point.

The store remains the confirmation point.

This is the core change taking place in the Asia retail tech market today.

Note: This article is based on ongoing market discussions commonly seen in AsiaFruit and FruitNet, as well as publicly communicated digital strategies from supermarket groups across Asia. We are not making anything up.

The goal is to present a clear and realistic explanation of change in the Asia retail tech market.

The App Now Begins The Shopping Trip

In many Asian cities, grocery shopping is part of a regular weekly routine. Many households buy fresh produce several times a week. This is not just about cooking. It is part of everyday life, culture, and family care.

Because of this, shoppers often take a quick look at what is fresh, what is on promotion, and what is convenient to prepare — before they shop. The mobile phone is usually the first place they look.

This is where supermarket apps have found new importance.

When shoppers open a supermarket app, they are not always trying to place an order. Sometimes they are simply checking:

-

Is something new in season?

-

Is there a reasonable price on fruit this week?

-

What is recommended for quick cooking tonight?

-

Is there something special for children’s lunchboxes?

These small checks shape the basket.

The shopper may decide that today is a good day to buy grapes, or that the leafy greens look better this week, or that it is time to try a new type of melon or apple.

This is influence — but influence that fits into daily habits, not influence that tries to change them.

From Tool To Media Platform

When supermarkets saw how often shoppers were using their apps before visiting the store, they realised the app could do more than provide information. It could guide attention.

The app can highlight:

-

Seasonal produce

-

Fresh arrivals

-

Local harvest items

-

Meal ideas for busy evenings

-

Low-effort vegetables for home cooking

-

Fruit that is especially sweet this week

The app is not forcing decisions.

It is helping decisions.

This is the difference between being a tool and being a media platform.

A tool provides information.

A media platform guides focus.

Asia’s supermarkets are now using the app to guide focus, especially toward fresh produce and weekly meal planning.

Why Supermarket Apps Are Becoming Media Platforms

(Only bullet list in the article — kept small and clean.)

-

To stay connected with shoppers between store visits

-

To personalise offers in a simple and helpful way

-

To reduce waste by matching supply with likely demand

-

To give brands a way to appear in front of shoppers at the right time

These reasons are practical.

They come from real stores and supply needs.

Fresh Produce Is At the Center Of The Change

Fresh produce is often the most important category in Asian grocery shopping. It affects:

-

Which supermarket does a family choose

-

How often do they shop

-

How loyal they feel to a specific store

-

How much do they buy each time

Fresh produce is linked to care.

Buying fresh vegetables and fruit signals care for the home and health.

Because of this, supermarkets place produce at the top of the app experience.

The app often shows:

-

Which vegetables are at their peak this week

-

Which fruits are sweet and ready now

-

Which items are good value today

-

Simple meal or preparation suggestions

This type of guidance is gentle, familiar, and useful.

It does not try to change how people eat.

It supports how they already eat.

Why Brands And Suppliers Are Participating

For many years, brands mainly competed for visibility in-store: shelf position, price tags, signage, and sampling stations. Now, they are beginning to see that the moment before the store visit may be just as important.

If a shopper is already thinking about apples, grapes, or salad greens before entering the store, the brand linked to that thought has an advantage.

This does not mean supermarkets are selling aggressive ads inside their apps. The tone is usually simple and soft — more like:

-

“Season started this week.”

-

“Crisp and sweet”

-

“Easy to prepare for dinner”

-

“Kids like this flavor.”

This is not advertising language.

It is kitchen language.

And kitchen language is trusted.

Regional Differences Across Asia

The shift is happening at different speeds in each region.

Southeast Asia:

Many shoppers mix traditional markets and supermarkets. The app helps plan which items to buy where.

East Asia:

Supermarket apps are strongly linked with loyalty points and mobile payment systems. Integration is deep and smooth.

South Asia:

Large supermarket groups use apps to bring consistency across many store locations.

GCC-connected Asia retail operations:

Apps are used to coordinate promotions across large, multi-country store networks.

In every region, the direction is the same, even if the journey is different.

The app is becoming part of the everyday grocery rhythm.

How It Affects Supplier Relationships

This change also affects how suppliers work with retailers.

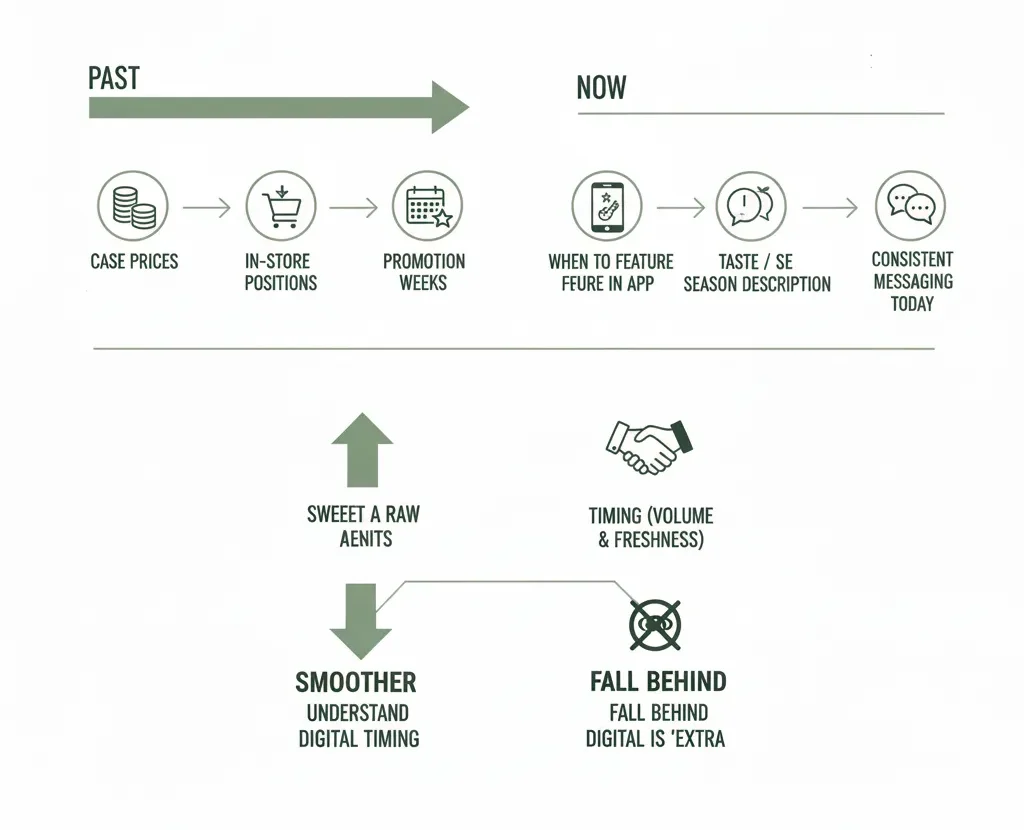

In the past, suppliers mainly discussed:

-

Case prices

-

Promotion weeks

-

In-store display positions

Now they also discuss:

-

When to feature produce in the app

-

How to describe the taste or season

-

How to time visibility with expected volume and freshness

-

How to keep messaging consistent and straightforward

Suppliers who understand the relationship between supply timing and digital timing work more smoothly with retailers.

Those who treat digital visibility as something separate, or “extra,” may fall behind.

The App Does Not Replace The Store

It is essential to be clear:

The store still matters the most.

Shoppers still want to see produce in person.

They still want to judge freshness with their own eyes.

The app does not try to take this away.

Instead:

-

The app shapes what shoppers look for.

-

The store provides proof of quality and value.

The shopper moves back and forth between the two.

This is why this shift is substantial.

It fits how people already behave.

Looking Ahead

The Asia retail tech market will likely continue in this direction. The change is slow, steady, and practical. It is not loud. It is not dramatic. It is not based on trends. It grows from daily life.

The app has become the quiet voice before the shopping trip.

The store remains the familiar place where decisions are confirmed.

The future of supermarket shopping in Asia will not be digital-only.

It will be digital, guiding physical. The household routine does not disappear.

Technology simply settles into it.