Belgium’s FMCG landscape has entered a new phase in 2025. Value growth is slowing after two intense years of inflation, volume pressure is rising again, and shoppers are making more cautious decisions across all categories. Against this backdrop, the Belgium FMCG market 2025 is being shaped by three forces: muted growth, a powerful private-label engine, and a shopper who is more selective, more promotional, and more channel-agile than ever.

Retailers are adapting quickly. Discounters continue to take ground. Full-line players are protecting share through loyalty ecosystems, personalised offers and deeper joint business planning with suppliers. Brands, meanwhile, are fighting to maintain relevance through innovation, format agility and premium lines that still justify price gaps.

This article maps the key trends driving Belgium’s FMCG performance in 2025 and the dynamics behind brands vs private label, category behaviour, channel change and shopper sentiment.

A Market Moving From Growth To Caution

The early quarters of 2025 delivered steady value growth supported mostly by food inflation. But as the year progressed, the curve flattened. Q3 saw growth slow to +1.4% — far below the +5.1% registered earlier.

Volumes remain the pressure point. Trips are down. Units per basket are down. Promotional intensity fluctuates from quarter to quarter, creating unpredictable peaks in branded performance. Consumers are recalibrating their weekly spend and shifting into safer value tiers, not only for essential goods but also for treats and household categories.

Two factors underpin the slowdown:

1. Inflation fatigue.

Food inflation remains positive, but households feel no relief. This keeps value elevated even as true consumption softens.

2. A more selective shopper

Promotions, comparative shopping, and deliberate channel switching are now routine behaviours across Belgium.

Although the environment remains challenging, the slowdown is not uniform across categories — and not necessarily negative for all manufacturers.

Where Growth Is Coming From

Even in a cooling market, some categories are resisting pressure better than others. 2025 shows a divide between essential lines that continue to enjoy stable demand and more discretionary segments that are exposed to caution.

Growing or resilient categories:

Fresh and dairy staples

Belgian households continue to prioritise freshness, traceability and familiarity. Price sensitivity is high, but volumes hold relatively steady due to necessity.

Frozen foods

Convenience wins again. Frozen vegetables, meals and seafood show positive demand as households cook more at home and stretch budgets.

Snacking and confectionery

Though volumes fluctuate, chocolate remains deeply embedded in Belgian consumption. The category is evolving — claims around cocoa quality, reduced sugar, plant-based fats and sustainability are shaping innovation. The insights highlighted in recent chocolate behaviour studies show how affordability, packaging perceptions and ethical sourcing now influence purchase decisions more than before.

Health and wellness categories

Sports nutrition, functional beverages, and “better-for-you” snacks maintain strong interest among younger households and urban consumers.

Categories under pressure:

Beverages

Soft drinks face volume declines due to promotional cycles, sugar-reduction trends and shoppers trading down in size or brand.

Household and personal care

Shoppers cut back by choosing multipacks, XXL formats and private-label equivalents.

Premium lines

Premiumisation has not disappeared, but it is no longer the default growth engine. When consumers trade up, it must deliver clear extra value.

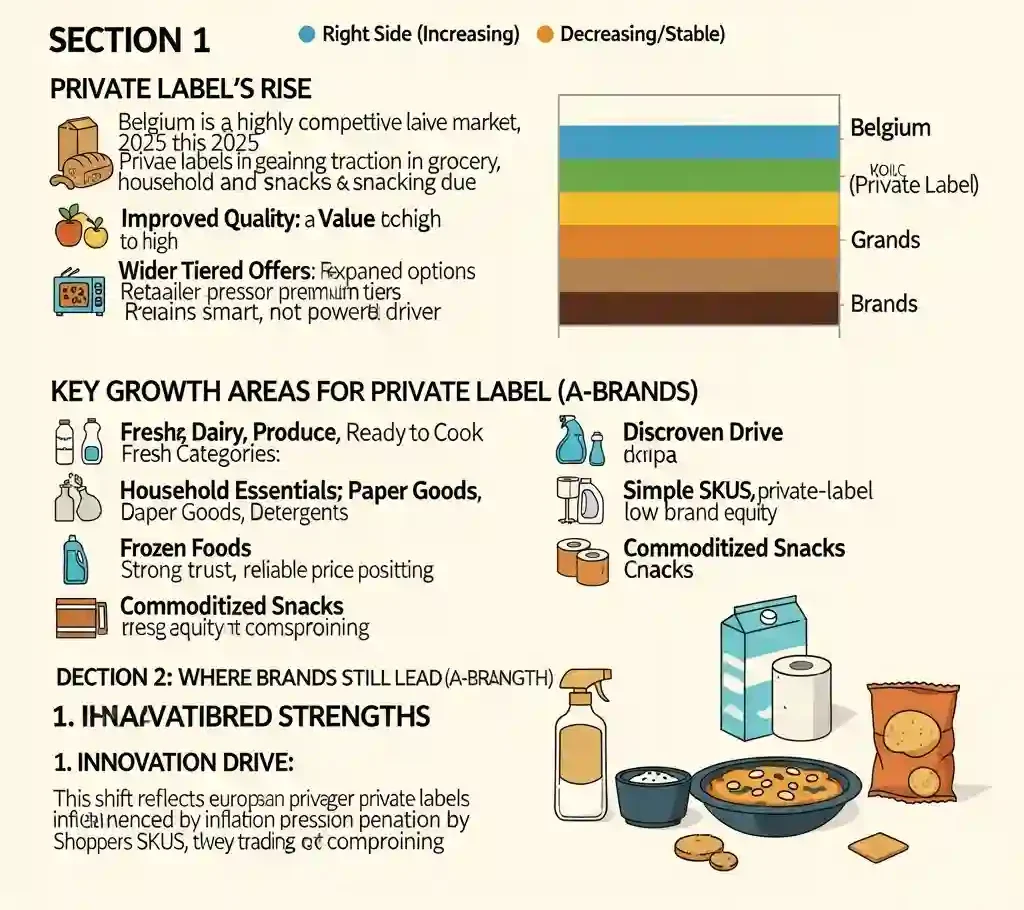

Brands vs Private Label: A Shifting Balance

Belgium is one of Europe’s most competitive private-label markets, and 2025 strengthens this position. Private label is gaining ground across grocery, household and snacking categories as quality improves and retailers widen their tiered offers. Shopper trust is high, and the value gap remains a powerful driver.

These shifts also reflect broader patterns seen in private label trends Europe, where inflation pressure and rising expectations around quality continue to influence how consumers make everyday choices.

Where private label is strongest

-

Fresh categories: bakery, dairy, produce, ready-to-cook.

-

Household essentials: cleaning, paper goods, detergents.

-

Frozen foods: strong trust, reliable price positioning.

-

Commoditised snacks: simple SKUs where brand equity is low.

Discounters have pushed private-label penetration even higher by expanding premium tiers. Shoppers trading down are not necessarily compromising; they feel they are trading smart.

Where A-brands still lead

Despite private label strength, A-brands remain essential in categories where:

1. Innovation drives rotation.

Flavour innovation, functional claims, lifestyle positioning.

2. Marketing builds emotional equity.

Chocolate, beverages, beauty, baby categories.

3. Trust matters.

Infant food, specialised dietary lines, well-being products.

4. Categories are fragmented.

Where brands curate consumer choice (e.g., spreads, sauces, drinks).

The gap is no longer guaranteed. Brands must give retailers a compelling story, not just a price.

Channel Dynamics: The Rise Of Hard Discount

2025 marks a structural shift in Belgian retail. Hard discount, led by a value-driven offer and a broad assortment, has exceeded the 20% market-share threshold for the first time.

Why discounters keep growing

-

A stable price message

-

Clear quality reassurance

-

Bigger fresh assortment

-

Faster shopping missions

-

Low-friction promotional strategy

Discounters are gaining share from practically every other channel except e-commerce.

Full-line retailers under pressure

Hypermarkets: declining footfall, high operating costs.

Proximity stores: still essential, but losing share to discounters on value missions.

Cross-border shopping: structurally down, but sensitive to price gaps.

Belgium’s full-line retailers are responding with data-led personalisation, investment in store experience, and a renewed focus on their loyalty ecosystems.

Shopper Behaviour In 2025

The Belgian shopper is now defined by four traits: cautious, value-driven, convenience-seeking, and increasingly shaped by digital touchpoints.

These behaviours align with how retailers are investing in retail technology in supermarkets, using loyalty apps, personalised offers and low-friction checkout tools to guide missions and improve conversion.

Key behaviors:

1. Promo sensitivity

Promotions continue to drive incremental volume more than brand loyalty. Deep, tactical discounts can shift significant share in short periods.

2. Multi-retailer shopping

Consumers mix discounters, full-line stores and convenience formats depending on mission.

3. Loyalty ecosystem engagement

Belgian shoppers respond strongly to personalized coupons, digital savings and exclusive app benefits.

4. Ethical and ingredient-conscious purchases

Especially visible in chocolate, dairy alternatives, snacks and beauty — where sustainability, ingredient transparency and packaging impact brand choice.

5. Rising interest in plant-based and reduced-sugar options

Though not always replacing traditional products, they shape innovation agendas.

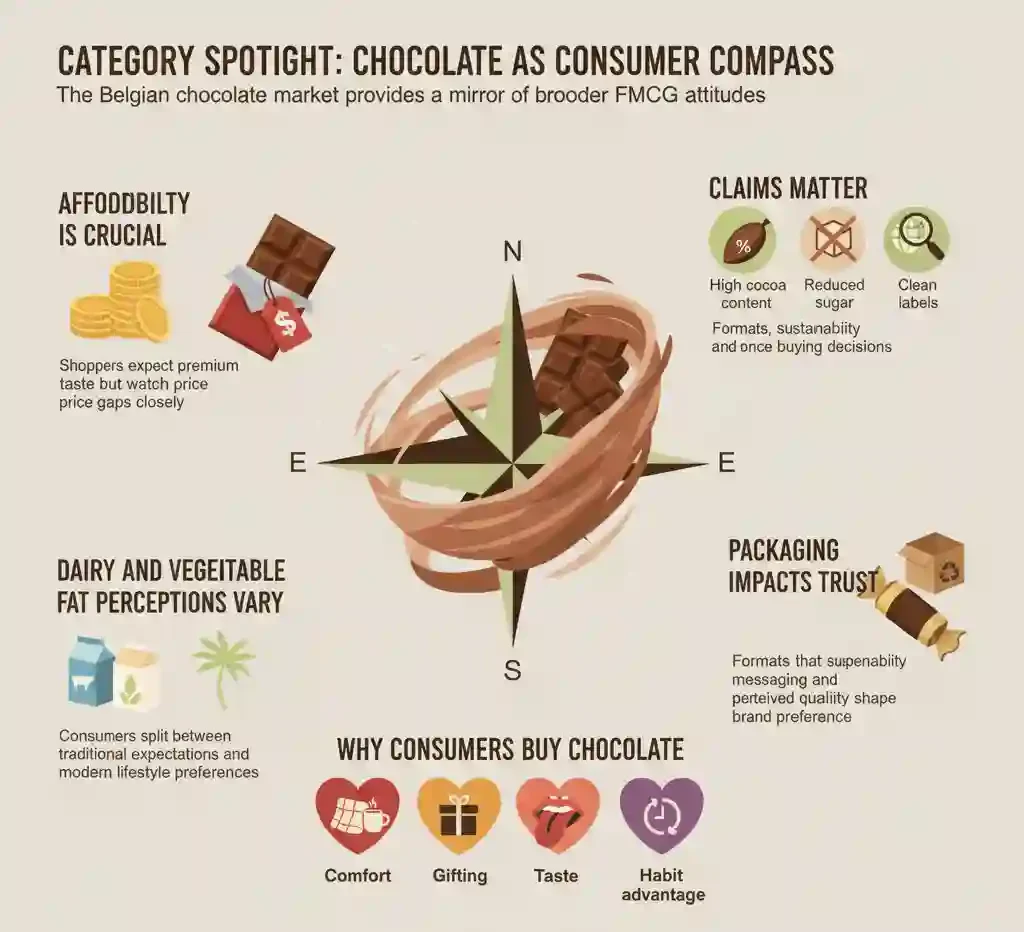

Category Spotlight: Chocolate as a Consumer Compass

The Belgian chocolate market provides a mirror of broader FMCG attitudes:

-

Affordability is crucial

Shoppers expect premium taste but watch price gaps closely. -

Claims matter

High cocoa content, reduced sugar, ethical sourcing, and clean labels all influence buying decisions. -

Dairy and vegetable fat perceptions vary

Consumers split between traditional expectations and modern lifestyle preferences. -

Packaging impacts trust

Formats, sustainability messaging and perceived quality shape brand preference. -

Why consumers buy chocolate

Comfort, gifting, taste, habit — categories that depend on emotional value must retain meaning, not just price advantage.

This behaviour offers strong cues for brands in other categories looking to defend share in a value-driven market.

3 Things FMCG Brands Must Do in Belgium in 2025

1. Fix Pricing and Pack Strategy

Shrinkflation fatigue is real. Transparent formats, good-better-best tiers and clear value storytelling are essential. Innovation must justify premium lines.

2. Win Retail Media With Data and Stories

Belgian retailers expect suppliers to deliver informed growth plans. Retail media campaigns must link directly to loyalty data, shopper missions and measurable conversion.

3. Strengthen Joint Business Planning

A-brands need deeper alignment on margin, assortment clarity and promo discipline. Retailers want partners, not Planogram fillers.

Looking Ahead: 2026 Pressure Points And Opportunities

The coming 12 months will be defined by:

1. Continued volume fragility: Unless real income rises, volume growth will remain elusive.

2. Intensified discounter competition: Private-label tiering, fresh expansion and store network optimisation will keep pressure on full-line retailers.

3. Innovation that earns its place: Functional, ethical and flavour-driven launches will win — but must show value.

4. Packaging and sustainability as differentiators: Belgian shoppers are increasingly aware of claims, formats and environmental impact. Categories like chocolate already show how these factors shape decisions.

Brands that combine affordability, transparency, compelling claims and retailer partnership will be best placed to protect and grow share.

As we move deeper into the Belgium FMCG market 2025, this balance between value, innovation and relevance will define who wins and who falls behind.