Canadian food brands are gaining a more substantial presence in U.S. supermarkets. The shift is not fast or loud, but it is steady. It is happening through regional rollouts, broker partnerships, packaging readiness, and reliable supply performance. For U.S. retailers, Canadian suppliers are offering products that align with today’s priorities: cleaner ingredient lists, clear product stories, and dependable logistics.

This is not a trend story driven by hype. It is a commercial movement shaped by retail conditions, manufacturing discipline, regulatory alignment, and consumer preferences changing at a practical pace. Canadian manufacturers are finding ways to fit into the U.S. market without forcing identity or price battles. They are growing because they reduce friction for buyers who need consistent, well-aligned products to fill precise gaps in category sets.

The U.S. grocery market is large, crowded, and competitive. Shelf space is expensive. Private label programs are strong. National brands defend their positions carefully. But Canadian suppliers are making progress in a way that does not trigger resistance. They offer incremental innovation, not disruption. They offer reliability, not volatility. That is precisely what many retail teams want.

Note: The understanding in this article is based on publicly available industry resources, such as PLMA supplier guidance and CFIA/FDA labeling rules. Nothing here is based on private or unverifiable information.

Why U.S. Retailers Are Interested

U.S. buyers are paying attention for a few straightforward reasons:

-

Canadian products often have simpler recipes: Many brands use fewer additives because that’s what Canadian shoppers expect at home. This makes the product easier to approve and place on U.S. shelves.

-

Supply routes can be shorter: From Ontario or Quebec into the Northeast and the Great Lakes, shipping is often faster than moving product across the U.S. itself. This helps with freshness and reduces freight swings.

-

Canadian manufacturers are used to challenging logistics: moving food over long winter routes, maintaining the cold chain, and managing border paperwork are normal for them. U.S. retailers see that as reliability, not risk.

In short, U.S. buyers want suppliers who are steady, clean-label-ready, and don’t cause problems.

Some Canadian brands already fit that naturally — so the conversation starts easier.

Packaging Readiness Is A Quiet Advantage

Canadian food products are typically labeled in both English and French. This creates packaging designs that use space efficiently, prioritize front-panel messaging, and offer layout flexibility. When entering the U.S. market, most of the core label structure already meets practical communication clarity standards.

This matters because packaging updates are one of the most common causes of launch delays. A product that arrives already fitting standard retail communication formats moves through setup faster. It also reduces cost. Canadian brands rarely need a complete label redesign to be shelf-ready. They adjust regulatory statements, update nutrition format if required, revise distribution addresses, and proceed.

In a category review cycle where time is limited, speed to shelf is a competitive advantage.

Where The Growth Is Happening

The expansion is not uniform across the entire grocery landscape. It is concentrated in categories where Canadian suppliers have competitive strength and where U.S. retailers are actively seeking to refresh their assortments.

Snack foods are one of the clearest areas of movement. Brands offering oat-based snacks, baked alternatives, natural-ingredient granola bars, and light, savory items are finding placement in both natural food sets and mainstream store clusters. These products do well because they offer familiarity with a slight quality shift rather than something experimental or niche.

Frozen ready meals and comfort foods are another strong area. Many Canadian frozen meals emphasize balanced ingredient lists and straightforward flavor profiles. They feel practical and warm rather than indulgent or lifestyle-driven. These products are landing in both “better-for-you” freezer sets and value-seeking family dinner sets.

Ready-to-drink beverages are also gaining momentum. Canadian cold brew coffee brands and artisanal tea companies are entering convenience coolers and supermarket grab-and-go cases. The performance is strongest in regions where weather patterns and shopper routines align with warm beverage cultur,e shifting toward chilled formats.

Specialty dairy and bakery products round out the picture. Regional storytelling still matters in these categories. A Canadian dairy brand does not always feel foreign in northern U.S. markets. In some states, it feels almost local. That perception creates an opening where freshness expectations and origin identity can coexist without heavy marketing.

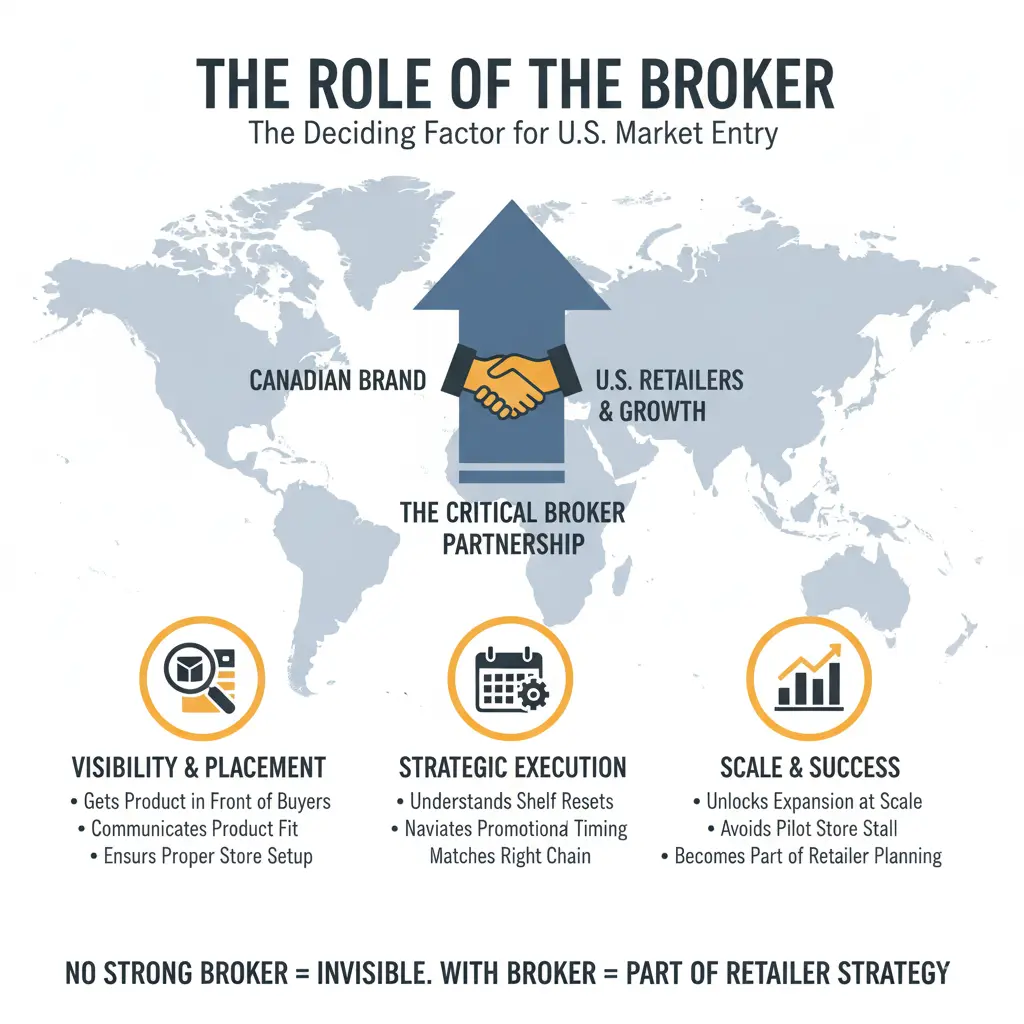

The Role Of The Broker

For Canadian brands entering the U.S., the most critical decision is not about packaging, pricing, or brand messaging. The deciding factor is the broker relationship. A broker is the one who gets the product in front of category buyers, who communicates where the product fits, and who ensures the product is properly set and supported at the store level.

Without a strong broker partnership, a brand remains invisible. With one, the brand becomes part of retailer planning conversations. Good brokers understand shelf resets, promotional timing, and regional execution patterns. They know how to match a Canadian brand with the right chain, not just any chain.

This step often determines whether expansion happens at scale or stalls in a few pilot stores.

Challenges That Shape The Rollout

Even with advantages, expansion is not simple. Slotting fees, promotional spend, and trade support requirements can be heavy in large U.S. chains. For mid-sized brands, margin pressure must be carefully managed. Warehousing inside the U.S. becomes necessary as distribution expands beyond border-adjacent territories.

Retail promotions also run differently in the U.S. From seasonal resets to loyalty card programming, brands must learn the rhythm rather than copy the Canadian market playbook. The brands that adjust strategy rather than assume similarity tend to grow with fewer setbacks.

The Path Forward

Canadian food brand expansion into the U.S. will continue, but it will continue at the same pace it has moved so far: steady, practical, and region-first. The strongest momentum remains in the Northeast and Great Lakes regions, followed by the Pacific Northwest. Expansion into southern and western U.S. markets is possible, but it usually comes later, after distribution and supply performance stabilize.

The brands that will succeed are the ones that treat the U.S. not as a single market but as a set of regions with different pace, taste, pricing tolerance, and shelf competition. They will succeed through execution rather than marketing. Through reliability rather than bold claims. Through presence rather than promotion.

For U.S. retailers, Canadian brands offer manageable innovation. For Canadian suppliers, the U.S. offers scale — but only if approached with discipline.

This is not a trend cycle. It is a long-term supply chain and category evolution. And it is far from finished.