Portugal’s FMCG market is a mix of global multinationals and strong domestic producers. International groups bring scale, category leadership, and brand power. Local companies bring manufacturing depth, export capacity, and tight links to the national retail system.

What shoppers see on shelves is only part of the story. Real FMCG control comes from production capacity, logistics reach, retailer contracts, and private label manufacturing. Some of the largest volume players operate quietly in the background, supplying supermarkets under retailer-owned brands or exporting large shares of output abroad.

This ranking shows which companies actually control FMCG volume and revenue flow in Portugal in 2026.

It focuses on operational presence, local manufacturing footprint, retail dependence, and realistic Portugal-linked revenue — not global turnover headlines.

Top 10 FMCG Companies in Portugal by Revenue (2026)

| Rank | Company | Revenue Portugal | Category | Employees |

|---|---|---|---|---|

| 1 | Nestlé Portugal | €2.0–2.3bn | Food & Beverage | ~3,000 |

| 2 | Unilever Portugal | €1.5–1.8bn | Food & Personal Care | ~1,600 |

| 3 | Lactogal | €1.2–1.4bn | Dairy & Food | ~3,500 |

| 4 | Sumol+Compal | €1.2–1.4bn | Beverages | ~1,200 |

| 5 | Jerónimo Martins Agro-Alimentar | €1.0–1.2bn | Food Manufacturing | ~2,000 |

| 6 | Sonae MC Private Label Manufacturing | €0.9–1.1bn | Food Manufacturing | ~2,000 |

| 7 | Super Bock Group | €0.9–1.1bn | Beverages | ~1,300 |

| 8 | Danone Portugal | €0.7–0.9bn | Dairy & Nutrition | ~700 |

| 9 | Sovena Group | €0.6–0.8bn | Food Oils & FMCG | ~1,200 |

| 10 | Central de Cervejas (Heineken Portugal) | €0.6–0.8bn | Beer & Beverage | ~1,000 |

Revenue ranges reflect Portugal-linked operations including domestic sales and locally produced export volumes where manufacturing is based in Portugal.

Company Profiles

Nestlé Portugal

Nestlé remains the largest FMCG operator in Portugal by revenue and volume impact.

The group operates major production facilities in Portugal covering coffee, dairy, cereals, pet food, and confectionery. A large share of output is exported to other European and international markets, while domestic sales remain strong across supermarkets and convenience channels.

Nestlé’s strength comes from category leadership and scale. Coffee, infant nutrition, and pet food continue to generate stable margins. The company maintains long-term supply relationships with Continente, Pingo Doce, Auchan, Lidl, and Intermarché.

While private label competition has grown, Nestlé’s manufacturing footprint and brand portfolio keep it at the top of the Portuguese FMCG structure.

Unilever Portugal

Unilever remains one of Portugal’s most influential FMCG suppliers across food, ice cream, home care, and personal care.

Unlike Nestlé, Unilever’s local manufacturing footprint is smaller. Its Portugal revenue is driven mainly by domestic retail sales rather than export production. Brands such as Knorr, Magnum, Dove, and Skip remain high-rotation products in Portuguese supermarkets.

Retail relationships are central to Unilever’s performance. Promotional agreements, private label co-manufacturing, and category partnerships help protect shelf presence in a competitive environment.

Despite pressure from retailer brands and discounters, Unilever’s portfolio scale keeps it firmly among the country’s largest FMCG operators.

Lactogal

Lactogal is Portugal’s largest domestic dairy group and one of the strongest food manufacturers in the country.

The company operates an extensive milk collection network and multiple processing plants across Portugal. Its brands dominate milk, cheese, butter, yogurt, and cream categories.

Retail dependence is high. Supermarket private label contracts represent a significant share of Lactogal’s volume. At the same time, branded products remain important for margin stability.

Exports continue to grow, especially to African and European markets. This mix of domestic retail supply and export manufacturing gives Lactogal structural strength inside the Portuguese FMCG system.

Sumol+Compal

Sumol+Compal is Portugal’s largest beverage-focused FMCG group.

Its portfolio covers juices, soft drinks, bottled water, and functional beverages. The company operates large production facilities serving both domestic demand and international markets.

Exports play an important role, especially for juice and branded beverage products distributed across Europe, Africa, and the Middle East. At the same time, Portuguese supermarkets remain a core revenue channel.

Sumol+Compal also supplies private label beverages, which strengthens long-term retailer relationships and stabilises volume during price-sensitive periods.

Jerónimo Martins Agro-Alimentar

Jerónimo Martins is widely known as a retailer through Pingo Doce. Less visible is its large FMCG manufacturing operation.

Through Agro-Alimentar and related food production units, the group controls meat processing, ready meals, bakery production, fresh food preparation, and packaged food manufacturing. Most output is produced directly for Pingo Doce private label ranges.

This vertical integration gives Jerónimo Martins direct control over a significant share of national food production. It also reduces dependency on external suppliers and improves margin management.

In volume terms, Jerónimo Martins’ manufacturing activity rivals Sonae MC and some multinational FMCG suppliers operating in Portugal.

Sonae MC Private Label Manufacturing

Sonae MC is not only Portugal’s largest food retailer. It is also one of the country’s most important FMCG producers through its private label manufacturing network.

Production covers ready meals, bakery, chilled foods, packaged grocery products, household items, and personal care. Almost all output flows directly into Continente stores.

This structure allows Sonae to control pricing, product development, and shelf positioning. It also increases pressure on branded suppliers competing for space.

Sonae’s FMCG manufacturing arm plays a central role in shaping Portugal’s private label growth.

Super Bock Group

Super Bock Group remains Portugal’s second-largest beverage producer after Sumol+Compal.

Beer remains the core business, supported by bottled water and soft drink operations. The company operates large brewing and bottling facilities serving domestic supermarkets and export markets.

Exports contribute meaningfully to revenue, especially in Lusophone markets. However, Portuguese retail distribution remains critical for maintaining volume and brand visibility.

Competition from international beer brands and supermarket private labels continues to increase, but Super Bock’s strong domestic loyalty base supports stable performance.

Danone Portugal

Danone focuses on dairy products, plant-based alternatives, and specialised nutrition.

Local manufacturing supports both domestic sales and Iberian distribution. However, most Portugal-linked revenue comes from retail sales rather than export production.

Danone faces strong private label competition in yogurt and chilled categories. Premium positioning and health-focused branding help protect margins but limit volume growth.

Retail relationships remain central to Danone’s business model in Portugal.

Sovena Group

Sovena is one of Portugal’s most important food export manufacturers.

The company specialises in olive oil and edible oils, supplying both branded products and supermarket private labels. A large share of production is exported to Europe, the Americas, and Asia.

Domestic retail sales remain important, but export manufacturing gives Sovena revenue stability and international scale.

Its integrated sourcing and processing operations allow strong cost control in a volatile agricultural environment.

Central de Cervejas (Heineken Portugal)

Heineken’s Portuguese subsidiary remains a major beverage supplier.

Production is centred around large brewing facilities supplying Portuguese supermarkets and hospitality channels. Compared with domestic competitors, export exposure is lower.

Retail promotions and multi-pack formats drive much of the company’s volume. Competition from local brewers and discount beer ranges continues to increase.

Even so, Heineken’s brand portfolio secures a stable position within Portugal’s beverage market.

Retail Power Shapes FMCG Performance

One of the most important features of Portugal’s FMCG market is retailer control.

Supermarket groups such as Continente and Pingo Doce dominate shelf access, promotional planning, and product visibility. For FMCG suppliers, maintaining strong retail relationships is often more important than brand awareness alone.

Private label expansion has accelerated this shift. Many FMCG manufacturers now supply both branded and retailer-owned products to protect factory utilisation and volume stability.

As a result, production scale and retailer integration have become more important than traditional brand power in several food categories.

Inflation and Revenue Growth Context

Between 2023 and 2025, Portugal experienced sustained food price inflation. By 2026, nominal FMCG revenue across most categories has increased.

However, much of this growth reflects price movement rather than real volume expansion. In several staple categories, unit sales remain flat or only slightly positive.

This is why revenue rankings must be interpreted carefully. Higher turnover does not always mean higher consumption. It often reflects higher input costs, logistics inflation, and retail pricing adjustments.

For market structure analysis, production capacity, retail contracts, and export reach provide a more accurate picture of long-term strength.

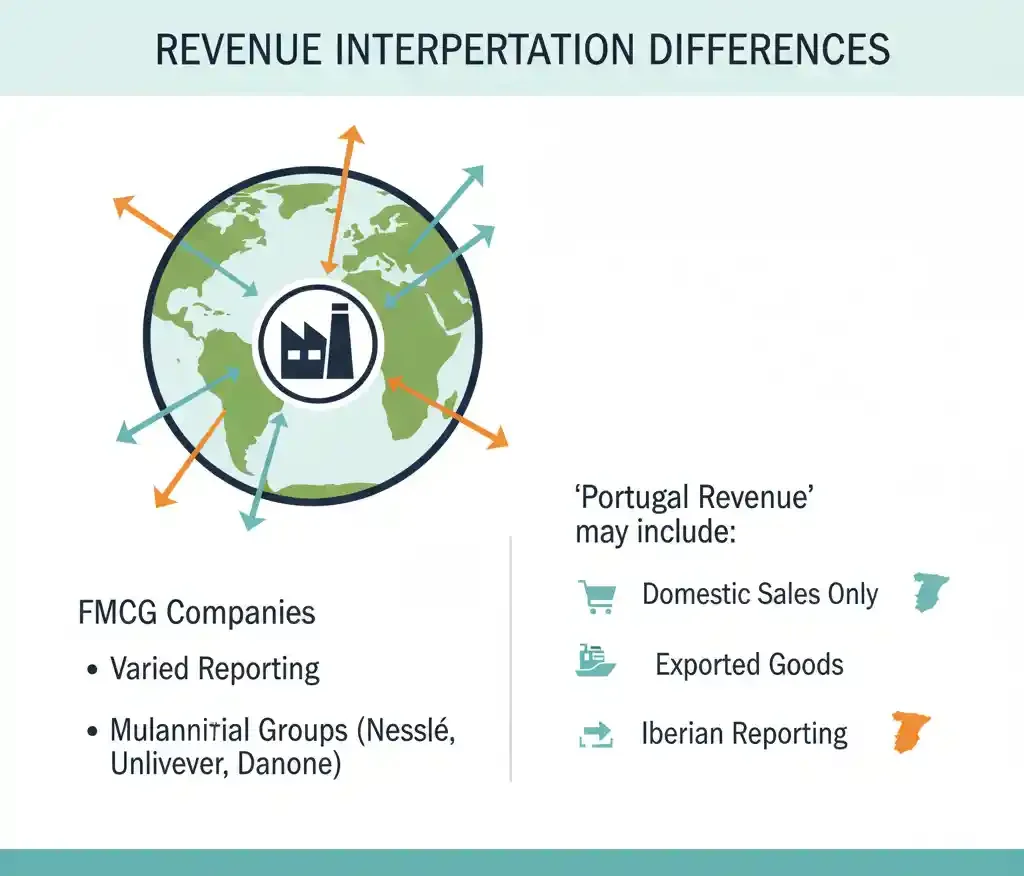

Revenue Interpretation Differences

Revenue reporting methods vary widely across FMCG companies.

For multinational groups such as Nestlé, Unilever, and Danone, “Portugal revenue” may include:

-

Domestic supermarket sales only

-

Locally manufactured goods exported abroad

-

Regional Iberian reporting structures

This ranking prioritises operational footprint and manufacturing presence rather than accounting structure alone. Companies with major production facilities in Portugal are weighted more heavily than sales-only operations.

FMCG Companies by Category and Export Exposure

| Company | Food | Beverage | Personal Care | Export Share |

|---|---|---|---|---|

| Nestlé Portugal | Yes | Yes | No | Medium |

| Unilever Portugal | Yes | No | Yes | Low |

| Lactogal | Yes | No | No | Medium |

| Sumol+Compal | No | Yes | No | High |

| Jerónimo Martins Manufacturing | Yes | No | No | Low |

| Sonae MC Manufacturing | Yes | No | Yes | Low |

| Super Bock Group | No | Yes | No | Medium |

| Danone Portugal | Yes | No | No | Low |

| Sovena Group | Yes | No | No | High |

| Heineken Portugal | No | Yes | No | Low |

What Happens Next

Portugal’s FMCG sector will continue shifting toward scale-driven production and tighter retailer integration, particularly as major Portugal supermarket groups consolidate buying power and expand private label penetration.

Private label manufacturing will grow further. Export-oriented producers will focus on international expansion to offset domestic volume pressure, while Portugal packaging will play a more strategic role in sustainability compliance, cost efficiency, and regulatory alignment across the supply chain.

Multinational brands will defend market share through category leadership and innovation rather than competing on price alone.

In 2026, the companies that control factories, logistics networks, Portugal packaging capacity, and supermarket access will remain the real volume leaders in Portugal’s FMCG market.