Behind every supermarket aisle, café shelf, and convenience store chiller is a vast network of distributors moving food and drink across the country.

These companies make sure products reach retailers, caterers, and hospitality businesses daily — from chilled ready meals to bulk ingredients and beverages.

The top FMCG distributors UK are the backbone of this system.

In 2025, they include long-established wholesalers such as Booker, Bidfood, and Brakes, as well as fast-growing regional and digital distributors adapting to a changing market.

As the economy stabilises after inflationary shocks, foodservice and retail are both looking for reliable partners who can handle scale, speed, and sustainability.

That’s where distribution powerhouses come in — connecting thousands of suppliers with the UK’s food outlets, hospitality chains, and supermarkets.

Editor’s Note:

This article draws on verified financial and operational data from Booker Group (Tesco PLC Annual Report 2025), Bidfood UK (Bidcorp Europe disclosures), Brakes UK (Sysco Corporation filings), Castell Howell Foods, JJ Foodservice, and regional suppliers. Additional insights were reviewed from The Grocer, FWD (Federation of Wholesale Distributors), and government trade statistics covering the 2024–2025 financial period.

Top FMCG Distributors UK: Booker, Bidfood, And Brakes

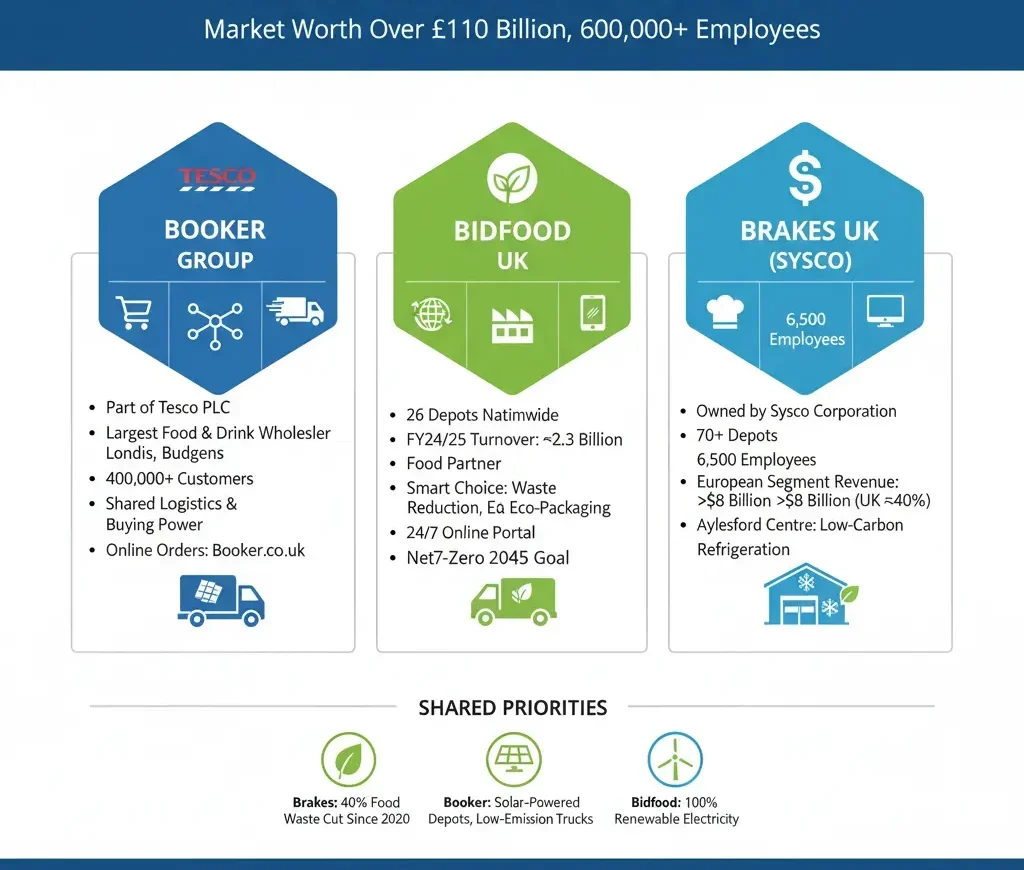

The UK wholesale and distribution market is worth more than £110 billion and employs over 600,000 people.

Most of the country’s food and drink products move through a small group of major distributors — led by Booker, Bidfood, and Brakes.

Together, they form the backbone of supply to supermarkets, convenience retailers, caterers, and hospitality chains.

Booker Group

Booker, part of Tesco PLC, is the largest food and drink wholesaler in the UK.

Its network includes Booker Wholesale, Makro, and symbol brands such as Premier, Londis, and Budgens.

The company serves more than 400,000 customers, from small shops to national chains.

Booker Direct supplies motorway service stations, cinemas, and restaurant groups, while Chef Central focuses on independent caterers.

The group benefits from Tesco’s shared logistics, data systems, and buying power — giving it strong pricing and delivery efficiency.

Online orders through Booker.co.uk have grown steadily since the pandemic recovery, reinforcing its lead among the top FMCG distributors UK.

Bidfood UK

Bidfood is one of the most advanced distributors in the market, combining large-scale coverage with regional focus.

It operates 26 depots across the UK and supplies more than 45,000 customers across hospitality, healthcare, and education.

Annual turnover for FY 2024/25 stands at about £2.3 billion.

The company promotes itself as a food partner rather than a wholesaler.

Its Smart Choice programme supports waste reduction, eco-packaging, and low-emission delivery.

Customers can order 24/7 through its online portal, check allergen data, and track stock in real time.

In 2025, Bidfood is rolling out more electric vehicles as part of its long-term net-zero 2045 goal.

Brakes UK (Sysco)

Brakes, owned by Sysco Corporation, specialises in foodservice and catering supply.

It runs more than 70 depots and employs about 6,500 people nationwide.

Sysco’s reports show its European segment revenue at over US $8 billion, with the UK responsible for roughly 40 percent.

Brakes serves restaurants, hotels, and public-sector kitchens with a range of more than 10,000 products.

Its Sysco Your Way digital platform lets large customers build custom product lists and manage multiple sites.

The Aylesford distribution centre in Kent is among the UK’s most advanced frozen logistics facilities, using low-carbon refrigeration and automation.

Shared Priorities

All three companies are investing heavily in sustainability and technology.

-

Brakes has cut food waste by 40 percent since 2020.

-

Booker is adding solar-powered depots and low-emission trucks.

-

Bidfood now operates entirely on renewable electricity.

Together, these distributors define what leadership looks like in the sector — combining logistics scale, digital tools, and uk low-carbon strategies.

They set the benchmark for every other contender among the top FMCG distributors UK.

Regional Distributors And Specialist Suppliers

While the big three command national coverage, regional distributors are crucial for specialist categories, local sourcing, and flexible service.

Castell Howell Foods, based in Carmarthenshire, is Wales’s largest independent food wholesaler.

It employs over 700 staff and supplies around 15,000 products to hospitality, retail, and catering clients.

The company operates a 500,000 sq ft distribution centre in Cross Hands, complete with chilled, frozen, and ambient zones.

Its turnover in 2024 reached roughly £200 million, supported by its focus on Welsh produce and sustainability-led delivery.

JJ Foodservice, founded in 1988, is one of the top independent distributors in England.

The company serves more than 80,000 customers nationwide and operates depots in Enfield, Manchester, Leeds, and Bristol.

JJ Foodservice has become known for its strong online platform and efficient logistics.

Almost 70% of its orders come through its digital channels, and its focus on automation has made it a model for medium-sized distributors seeking to compete with national networks.

Thomas Ridley Foodservice, part of Bidcorp UK since its 2023 acquisition, continues to serve East Anglia and the South East.

It specialises in ambient and chilled goods for schools, hospitals, and caterers.

By integrating into Bidfood’s network, it gains supply stability while keeping its regional identity.

Dunns Food and Drinks, based in Scotland, and Woods Foodservice, which supplies London’s restaurant scene, add further regional diversity to the top FMCG distributors UK.

Dunns, founded in 1875, combines alcohol and food distribution and is expanding its online business-to-business portal.

Woods serves high-end chefs and hotels, with an emphasis on premium imported products and next-day delivery in central London.

These smaller players thrive on relationships, not just volume.

Their ability to respond quickly to customer needs, source local goods, and maintain service quality keeps them vital to the UK’s food ecosystem.

Regional distributors also provide resilience — ensuring supply continuity when national networks face strikes, weather disruptions, or capacity constraints.

Together, they represent a critical layer in the UK’s multi-tier distribution structure.

Growth Of Online B2B Marketplaces

The top FMCG distributors UK increasingly rely on retail technology in supermarkets to manage vast inventories, track emissions, and forecast demand.

In 2024, Booker reported double-digit growth in digital orders, while Bidfood’s online sales now represent over 80% of total transactions.

Brakes’ Sysco platform enables real-time inventory access for major restaurant chains and public institutions.

Meanwhile, new entrants are changing the game.

Platforms like Faire, Creoate, and Suppla connect producers directly with small retailers, bypassing traditional intermediaries for select categories.

Though still small compared to the giants, these startups show how digital marketplaces could redefine what it means to be among the top FMCG distributors UK.

The UK government’s Made Smarter and Digital Wholesale initiatives also encourage mid-tier distributors to adopt automation, IoT tracking, and AI forecasting tools.

Warehouses are integrating scanning robots, voice-picking systems, and cloud-based fleet scheduling to improve delivery efficiency.

In practice, this means a more transparent and data-driven market.

Retailers now compare wholesale pricing, delivery times, and sustainability scores directly online.

The winners among the top FMCG distributors UK will be those who combine strong logistics networks with seamless digital access.

Revenue, Customers, And Logistics Hubs

Distribution scale can be measured in both turnover and reach.

Here’s how the key players stack up in 2025 based on publicly available data and industry analysis:

| Distributor | FY2024/25 Revenue | Key Customers | Main Logistics Hubs |

|---|---|---|---|

| Booker Group (Tesco) | ~£7.7 billion | Independent retailers, pubs, caterers | Over 200 depots nationwide |

| Bidfood UK | ~£2.3 billion | Schools, hospitals, restaurants | 26 depots (Slough, Manchester, Wakefield, etc.) |

| Brakes UK (Sysco) | ~£3.2 billion (est.) | Hotels, restaurants, public sector | 70+ distribution centres (Aylesford, Inverness, etc.) |

| Castell Howell Foods | ~£200 million | Hospitality, retail, schools | Cross Hands, Carmarthenshire |

| JJ Foodservice | ~£300 million | Takeaways, cafés, retailers | Enfield, Manchester, Leeds |

| Dunns Food and Drinks | ~£130 million | Bars, restaurants, grocers | Blantyre, Scotland |

| Woods Foodservice | ~£70 million | London hotels, fine dining | Uxbridge, London |

These figures show a sector balancing consolidation and specialisation.

The top FMCG distributors UK increasingly rely on technology to manage vast inventories, track emissions, and forecast demand — turning logistics into a science.

The Consolidation Trend In UK Distribution

Mergers and acquisitions are reshaping the wholesale landscape.

Bidcorp’s acquisition of Thomas Ridley and Caterfood Buying Group expanded its reach across southern England.

Sysco’s integration of Brakes with its European logistics hub is streamlining cold-chain operations.

Booker’s link with Tesco continues to blend retail data with wholesale supply.

Smaller regional distributors are joining buying groups such as Confex, Sugro, and Caterforce to stay competitive.

These cooperatives give them collective purchasing power, shared marketing, and digital tools to rival national players.

Federation of Wholesale Distributors (FWD) data show that the UK’s top 10 wholesalers now account for over 70% of sector turnover, compared with 55% a decade ago.

This consolidation brings efficiency but also raises competition concerns for small suppliers seeking shelf space.

Still, the trend is clear: scale, efficiency, and sustainability are shaping who stays at the top.

For manufacturers, working with the top FMCG distributors UK guarantees access to more stores, faster delivery, and centralised payment systems.

For retailers and caterers, it means consistency — one delivery, one invoice, and increasingly one digital dashboard.

Outlook: Technology, ESG, And Regional Balance

The next chapter of UK distribution will revolve around three themes: technology, sustainability, and regional balance.

Distributors are under pressure to reduce emissions, improve packaging, and cut food waste.

Booker and Bidfood have pledged full electrification of local delivery fleets by 2030.

Brakes is trialling hydrogen-fuelled trucks and investing in low-temperature storage efficiency.

Digitisation will accelerate.

Expect more predictive ordering, route optimisation, and real-time dashboards that let customers see exactly where their products are in the network.

AI forecasting will also help manage stock rotation and prevent food waste.

Yet regional networks will remain essential.

Even as consolidation continues, the UK’s geography and customer diversity ensure a place for local distributors who can adapt to niche demands, cultural preferences, and independent retail formats.

By late 2025, the UK wholesale and distribution sector is more data-driven, energy-aware, and interconnected than ever before.

But at its heart, success still depends on reliability — the ability to deliver the right product, at the right time, every day.

That consistency keeps the top FMCG distributors UK at the centre of the nation’s food economy.