Food and drink trade shows are changing.

They are no longer just big halls, free samples and long days of meetings.

In 2025–2026, they are one of the most important sourcing tools in the retail calendar.

Retailers use these shows to build next year’s product pipelines.

Suppliers use them to show new ideas, packaging formats and better margins.

And everyone uses them to see what is real, not just what looks nice on a PDF.

When buyers talk about planning their year, many now say the same thing: trade shows help them shape category ideas earlier, faster, and with much better visibility.

This is why interest is rising again across the global circuit of food and drink events 2025–2026.

Retailers want fresh ideas, private-label innovation and trusted partners.

Suppliers want visibility in front of real buyers, not random email lists.

And in many categories, this face-to-face moment still makes the biggest difference.

Why Trade Shows Still Matter In A Digital World

Retail is becoming more digital every year.

Buyers run supplier meetings on Teams, category reviews on dashboards, and market research with AI tools.

But when it comes to choosing actual products, nothing beats seeing, touching and tasting them.

A buyer standing in front of a shelf mock-up gets a very different impression than a PDF file.

They see space impact, packaging mistakes, colour tone, and how the product fights for attention.

And tasting samples tells a truth nothing else can.

You instantly know if the flavour is right, if the texture will work, and if the product is strong enough to justify a slot.

Trade shows also help buyers compare suppliers quickly.

In one morning, they might taste ten granola options, see five packaging ideas, and discuss two private-label projects.

Doing that by email would take weeks.

There is also something simple but powerful: trust.

Meeting a supplier, shaking hands, and seeing their product range in person still matters.

Retail is built on long-term partnerships, and trust grows faster when people meet in real life.

For suppliers, shows help them tell their story properly.

They can explain their capacity, show packaging compliance, present logistics setups, highlight sustainability work and actually display the products.

In a digital world, this physical experience has become even more valuable.

How Supermarket Buyers Plan Their Show Agenda

Buyers do not walk trade shows randomly anymore.

Their agendas look more like business missions.

Most come with a plan based on the category roadmap.

If snacks are under review, they spend time on snacks.

If bakery is due for update next year, they go deep into bakery halls.

Before the show even starts, many buyers book meetings with core suppliers.

They want to see updates, packaging improvements, pricing changes and new SKUs.

They often bring a small document listing gaps: a missing flavour, a size they need, or a margin target that must improve.

For private label, the planning is even sharper.

Buyers come with detailed briefs: target price, packaging specs, certifications, minimum volumes.

They speak with contract manufacturers to see if production is possible at the right cost.

For branded discovery, the mood is different.

Buyers walk through innovation zones to spot early ideas before they appear in mainstream channels.

Many say the best finds usually come from smaller booths, not the big headline stands.

Some buyers also use the show to compare countries.

A product trending in Spain may be unseen in Germany.

A format rising in the US may be perfect for the UK.

This cross-market view helps them build forward-looking plans.

For many retailers, trade shows are now treated like an extension of the category review cycle.

They gather insights, talk to suppliers, and sometimes make early decisions on what should launch next year.

What Suppliers Must Bring To The Table

Suppliers attending trade shows must come prepared.

Retailers today need more than a nice story — they need proof a supplier can deliver.

The first thing buyers look for is price architecture.

They want to understand the good-better-best structure and how the supplier positions the product.

Clear pricing builds trust and helps buyers see how it fits in a category plan.

Next is logistics.

Retailers need to know lead times, pallet formats, case sizes, storage temperatures and delivery reliability.

A strong product without strong logistics will not be listed.

Packaging compliance has become critical, especially with laws in Europe.

Buyers check if packaging is recyclable, if it meets local rules, and if the supplier understands Germany’s requirements under VerpackG and the LUCID register.

If a supplier cannot show compliance, the conversation usually ends quickly.

Sustainability claims must be backed with real data.

Retailers want certificates, third-party audits, and simple explanations buyers can use internally.

And of course, suppliers must bring ready samples.

Retailers taste everything.

Samples must be final quality — buyers do not want early prototypes unless clearly explained.

Suppliers who arrive organised, with clean decks, real data and retail-ready packaging, get more attention.

Shows are busy.

Buyers give time to partners who look prepared.

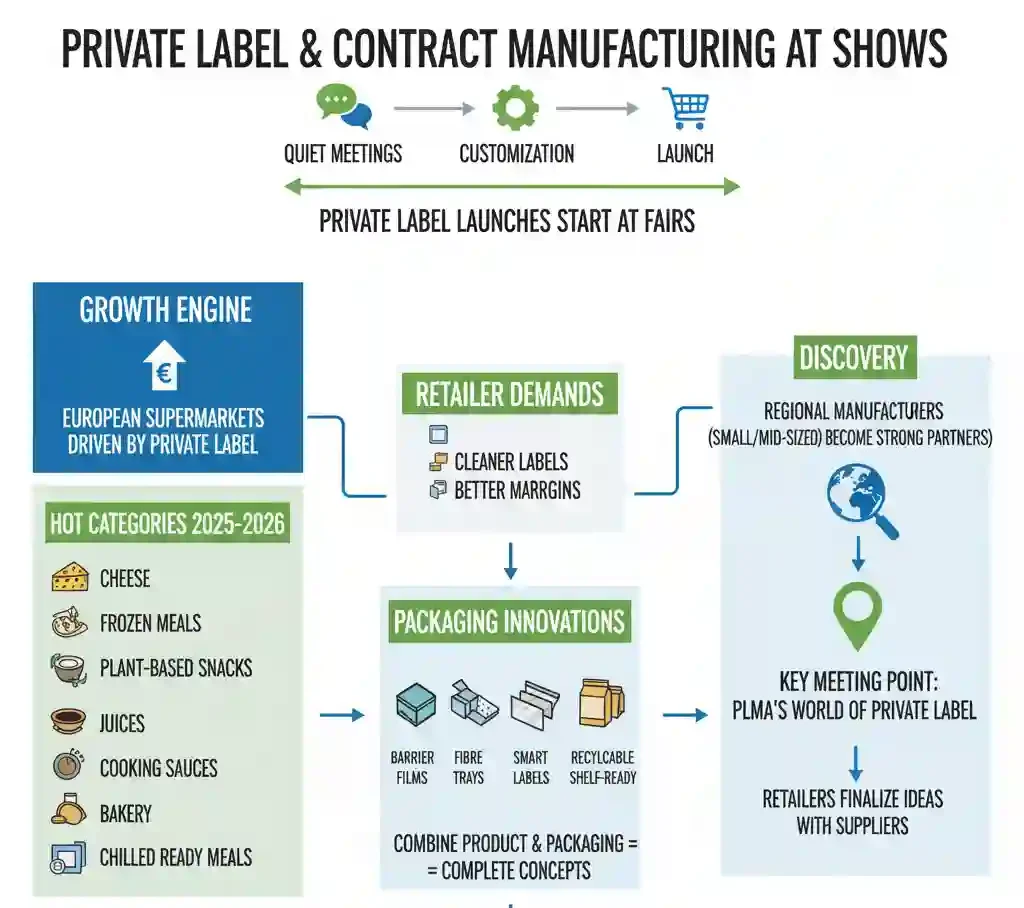

Private label And Contract Manufacturing At Shows

Private label has become one of the biggest engines of growth for European supermarkets.

This is why trade shows are critical for contract manufacturers.

Many private label launches start with quiet meetings at major fairs.

A buyer sees a product, asks if it can be customised, and a conversation begins.

From there, packaging, pricing and recipes are shaped over the next months.

Hot areas in 2025–2026 include cheese, frozen meals, plant-based snacks, juices, cooking sauces, coffee, bakery, and innovation in chilled ready meals.

Retailers want cleaner labels, simpler packaging, and formats with better margins.

Packaging suppliers also play a large role here.

They bring new barrier films, fibre trays, smart labels, recyclable pouches and shelf-ready packaging solutions.

Retailers can combine product ideas with packaging ideas and create complete private label concepts.

A similar story happens in personal care, household and near-food categories.

Here, shows help retailers discover regional manufacturers who never appear in mainstream search results.

These small or mid-sized suppliers often become strong private-label partners.

One of the biggest meeting points globally is PLMA’s World of Private Label.

Many retailers consider it the best place to finalise private-label ideas for the next year.

Category teams walk the halls with clear briefs and leave with new supplier options.

This private-label sourcing role is one reason why trade shows remain so important in modern retail.

Digital Follow-up And The long Tail Of The show

Ten years ago, trade shows ended when people left the hall.

Today, the digital life of a show continues for months.

Buyers scan badges and receive follow-up notes through digital portals.

Suppliers send sample packs later, share certifications online, and upload product specs to retailer platforms.

Most major shows now include online exhibitor directories that stay active year-round.

Buyers use them to check who they met, download documents, and book new meetings.

This long digital tail has changed how suppliers work.

A good follow-up strategy can turn a short booth visit into a full listing discussion.

A weak follow-up usually kills the opportunity.

Some suppliers ship samples after the show to make a stronger impression.

Others use virtual tasting sessions for retailer teams who did not attend.

And many buyers now prefer a digital second meeting to review data in detail.

Retailers also cross-check products with market research tools after the show.

They compare format trends, pricing benchmarks, competitor launches and packaging.

This second, digital stage is often where the real decision is made.

For UK teams specifically, there is strong interest in shows that connect with domestic priorities.

This is where UK food and drink trade events help category managers track local suppliers, follow novel claims, and compare what smaller producers are launching for the coming year.

This blend of physical meetings and digital follow-up has become the new normal in retail sourcing.

Conclusion

Trade shows in 2025–2026 are not just events.

They are strategic sourcing engines.

Retailers use them to build product pipelines earlier, test new packaging ideas, understand price positions, and compare suppliers side by side.

Suppliers use them to show they can deliver on quality, cost, compliance and reliability.

The retailers who treat these shows as serious category tools — not just long days out — usually leave with stronger innovation plans and better private-label pipelines.

And the suppliers who arrive with clear data, strong samples and good follow-up win the most interest.

As the food and drink industry becomes more competitive, trade shows sit right at the centre of how products move from concept to shelf.