The French FMCG market underwent significant and challenging changes between 2022 and 2024. Prices moved quickly. Suppliers adjusted formulations. Retailers made quick decisions to protect shelf availability. Households changed their shopping habits to manage costs. That period was stressful for every level of the supply chain.

Now, in 2026, the environment is calmer. Inflation has slowed, and while not every category is yet stable, the overall market is more balanced. This does not mean everything has returned to how it was before. Instead, the market is entering a slower, steadier stage, where decisions take longer and performance and consistency matter more than rapid change.

Retailers are reviewing assortments more carefully. Suppliers are planning production with more structure. Consumers are choosing what they know and trust. The pace is calmer, but the expectations are higher.

Note: Before we begin, we want to be clear about our approach. We have not made up any information for this article. Everything is based on real industry reporting and market commentary from French retail associations, INSEE’s consumer and pricing outlook data, supermarket group communications, and ongoing trade coverage from LSA Commerce & Consommation.

Our goal here is to explain the French FMCG market in a practical, straightforward way, making the context easier to understand whether you are a retailer, supplier, distributor, or export-side partner.

French Households Are Shopping More Carefully

Consumers in France remain price-aware, but they are not simply buying the cheapest option. They are reading labels more often. They are comparing packaging sizes. They are choosing products that feel consistent and familiar. Instead of filling the basket with many items, they are choosing fewer, more reliable products.

This is especially evident in everyday categories such as dairy, bakery, beverages, pantry staples, and household cleaning. French shoppers are avoiding unnecessary complexity. They do not want overly bold marketing claims or packaging that looks unfamiliar. They want products they can understand at a glance.

This behavior supports brands and private-label lines that keep recipes stable and avoid sharp price fluctuations. Many retailers are responding by simplifying shelf layouts and reducing overlapping SKUs.

Retailers Are Reducing SKU Complexity

One of the most substantial structural changes in French FMCG is the ongoing reduction of product range clutter. Retail groups have been reviewing how many SKUs they carry in each category. The aim is not to remove consumer choice, but to remove confusion and inefficiency.

For example, instead of stocking five versions of the same pasta shape with nearly identical specifications, retailers may keep two strong options: one national brand and one private label. In breakfast cereals, soft drinks, biscuits, and spreads, similar consolidations are expected.

Reducing SKU complexity helps in several ways:

-

It makes shelf navigation simpler for shoppers.

-

It reduces storage and picking pressure in warehouses.

-

It improves forecasting and reduces waste.

-

It strengthens volume allocation between fewer suppliers.

This is not a short-term strategy. It is becoming a long-term part of how French FMCG is managed.

Private Label Continues To Play A Central Role

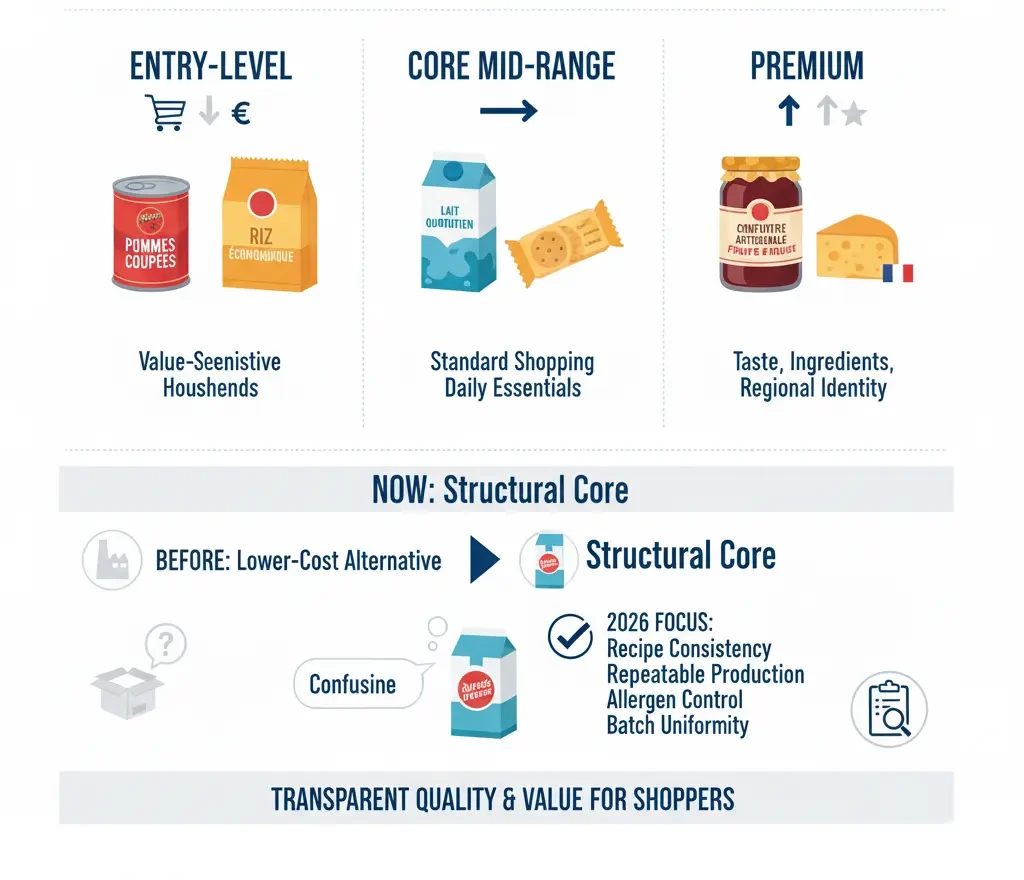

Private-label sales in France have not decreased after inflation eased. Instead, it has settled into a structured, stable position. Retailers have now clearly defined three primary private label levels:

-

Entry-level value products for price-sensitive households.

-

Core mid-range store brands for daily standard shopping.

-

Premium store brands focus on taste, ingredients, or regional identity.

This tiering allows shoppers to easily recognize quality levels. It also allows retailers to manage price positioning more transparently.

What is changing in 2026 is the emphasis on recipe consistency and repeatable production. Retail buyers want suppliers who can guarantee consistent product quality throughout the year, not just during the first production runs. Suppliers are being asked to document ingredient sourcing, allergen control, and batch uniformity more clearly.

Private label is no longer viewed as the lower-cost alternative. It is now one of the main structural parts of the French FMCG system.

Fresh And Chilled Categories Show Steady Strength

Fresh and chilled categories are performing steadily because they meet two needs simultaneously: familiarity and practicality. French households continue to value fresh produce, bakery goods, dairy products, cured meats, salads, and chilled prepared meals. These categories are closely tied to weekly meal routines and are central to domestic food culture.

Retailers support these categories with local sourcing programs, clear origin labeling, and visibility for regional suppliers. In chilled ready meals, portion sizes and ingredient clarity matter more than innovation. Shoppers are choosing products that are simple to prepare and easy to understand.

This segment does not need a dramatic change to perform well. It benefits from slow, careful refinement.

Frozen Food Holds Its Position Through Practical Value

Frozen food remains a quiet, stable strength in the French FMCG market. Consumers appreciate frozen categories because they help reduce food waste, allow meal planning, and offer predictable pricing. Frozen vegetables, fish, potatoes, bakery items, and prepared dishes continue to be frequently purchased.

For retailers, frozen categories help balance stock levels and protect margins. For suppliers, the key factor is packaging practicality. Retailers prefer frozen products that stack evenly in freezers and are easy to handle in both store and e-commerce picking environments. Packaging that performs poorly in cold-chain handling will be phased out.

The message in frozen food is simple: practical beats experimental.

Shelf-Stable Grocery Is Recovering More Slowly

Dry grocery, confectionery, sauces, and beverages are still adjusting. These categories experienced intense pricing pressure in recent years, and consumers remain alert to price changes. Households are avoiding impulsive purchases in this segment and sticking to familiar brands and stable private-label equivalents.

Promotional activity continues, but retailers are more cautious about discount depth and timing. The focus is shifting toward fair pricing, not aggressive discounting.

This segment will likely recover gradually rather than quickly.

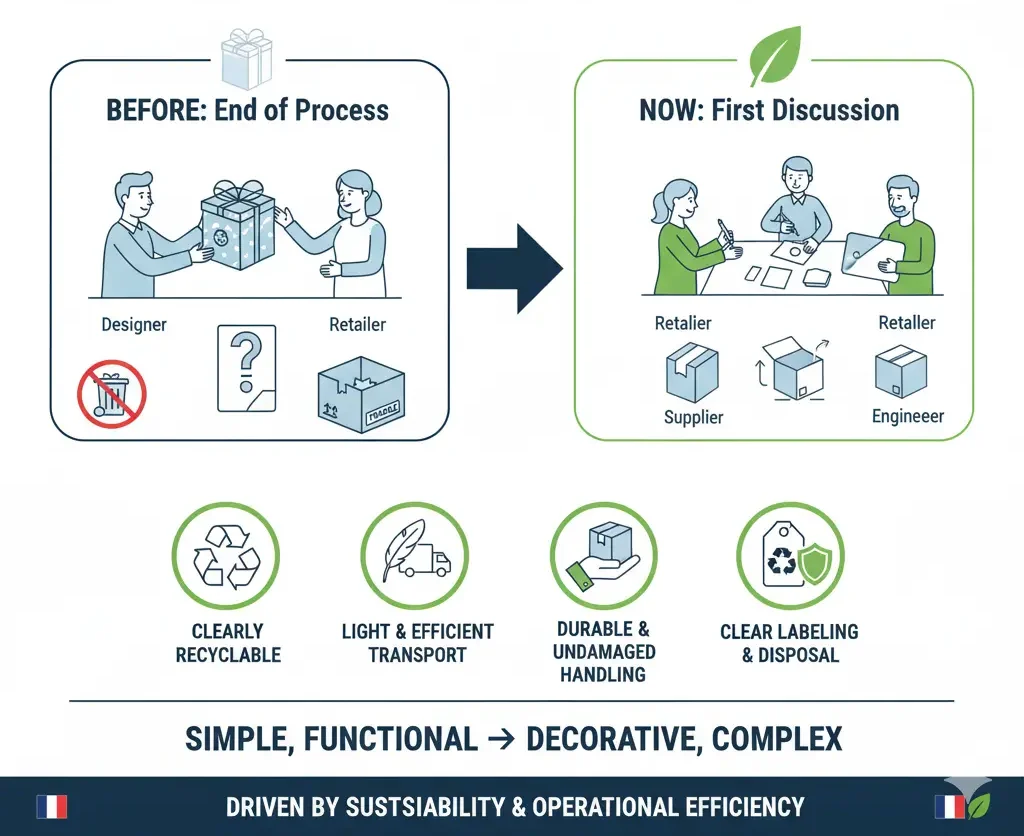

Packaging Is Now Part of Every Commercial Discussion

Packaging in 2026 is not handled at the end of product development. It is part of the first discussion between a buyer and a supplier. Retailers expect packaging to be:

-

Clearly recyclable in the French system.

-

Light enough to support transport efficiency.

-

Durable enough to avoid damage in handling.

-

Clear in labeling, especially disposal instructions.

This shift is driven by sustainability expectations and by the need for stable handling across store formats. A product that is good but packaged inefficiently will struggle to maintain shelf presence.

Simple, functional packaging now performs better than decorative packaging that complicates recycling or logistics.

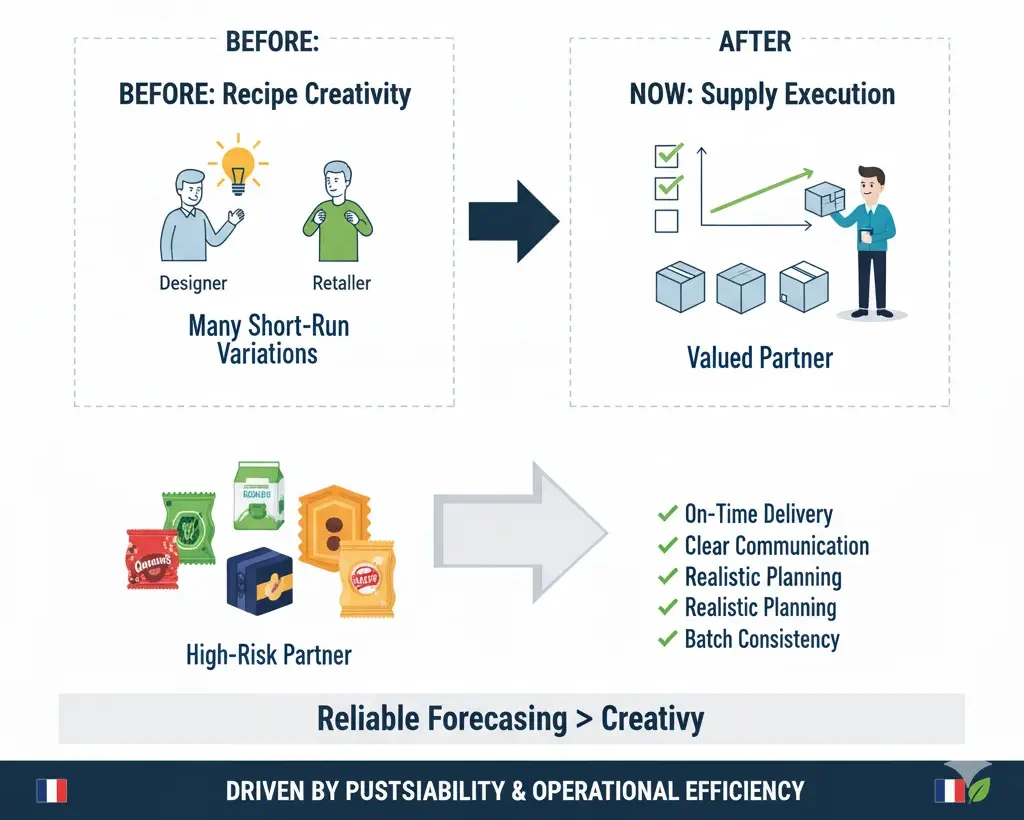

Logistics And Forecasting Are Now Competitive Advantages

The most significant competitive difference in French FMCG in 2026 is not recipe innovation. It is supply execution. Retailers are evaluating suppliers on:

-

Ability to deliver on time every week.

-

Clear communication when production changes are needed.

-

Realistic planning parameters.

-

Batch consistency and stable specifications.

Suppliers who communicate clearly, plan carefully, and deliver predictably are valued. Suppliers who attempt to “surprise” the market or offer many short-run product variations are viewed as higher-risk partners.

Reliable forecasting and realistic scheduling matter more than creativity.

The Outlook For 2026 And Beyond

The French FMCG market in 2026 is defined by steady discipline. Not fast expansion. Not aggressive contraction.

A stable middle path. Retailers want long-term supplier relationships based on trust and performance.

Consumers want clarity and predictability in what they buy. Suppliers need to focus on quality consistency, packaging practicality, and managing costs.

The market tone is quieter than before, but it remains strong. It rewards companies that act with care and long-term thinking.