French Retail Tech industry is entering a new phase where technology decisions are shaping store performance more than location or format ever did.

Automation, AI, and digital integration are no longer experiments — they are essential.

The combination of inflation, changing labor structures, and sustainability goals has accelerated the move toward retail tech.

For the first time, digital investments are viewed as cost control measures, not future bets.

Supermarket groups including Carrefour, Monoprix, and Auchan are now treating retail technology as part of their supply and pricing architecture, not just front-of-house innovation.

Note: Before we start, we remind you that all information in this article is based on verified data from INSEE Digital Economy Report 2024, Fédération du Commerce et de la Distribution (FCD) technology briefings, Capgemini Retail Innovation Index 2025, and trade analyses published by LSA Commerce & Consommation and Retail Tech Europe.

From Data To Daily Decisions

The Capgemini Retail Innovation Index 2025 highlights that France’s largest retail groups now use AI-based systems for demand forecasting, price optimization, and inventory balance.

What used to take days now happens in hours.

n Carrefour’s operations, for example, shelf replenishment cycles are guided by machine-learning models trained on store-level data.

The result is fewer out-of-stock moments and reduced food waste.

It’s a quiet, practical revolution — driven by efficiency, not publicity.

This approach is being adopted across the grocery, DIY, and pharmacy sectors, demonstrating how French retail tech is spreading horizontally across multiple retail formats.

The Smart Store Becomes The Norm

French supermarkets have been testing digital formats for more than a decade, but 2025 marks a turning point.

Smart stores are no longer pilot projects — they are scalable business units.

Carrefour’s “Flash 10/10” cashierless concept in Paris now uses real-time shelf sensors and camera analytics to enable automatic checkout.

Monoprix has introduced hybrid self-checkout stations powered by facial recognition to seamlessly link loyalty programs.

Casino has moved deeper into 24-hour autonomous convenience stores, combining cashless access, automatic inventory updates, and remote supervision.

Each chain approaches the technology differently, but the direction is the same: human staff are being redeployed to service and merchandising roles while core transactions go digital.

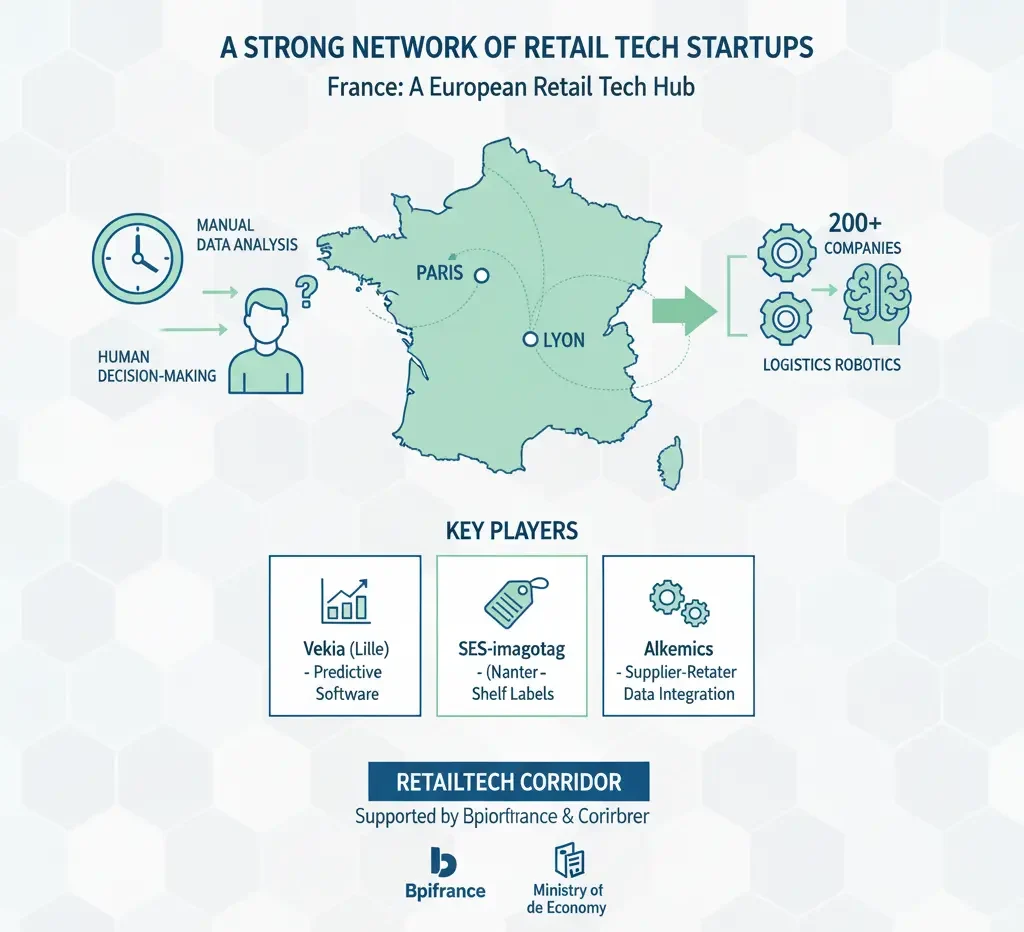

A Strong Network Of Retail Tech Startups

France’s startup ecosystem has quietly become a European retail tech hub.

Paris and Lyon together host more than 200 companies specializing in payment systems, data analytics, and logistics robotics.

Examples include:

-

Vekia (Lille) is a provider of predictive inventory software used by major chains.

-

SES-imagotag (Nanterre), Europe’s leader in electronic shelf labels.

-

Alkemics (Paris), focusing on supplier-retailer data integration.

These firms work closely with both domestic and global retailers.

They form part of a “retailtech corridor” supported by Bpifrance and the Ministry of Economy’s digital transformation program.

The ecosystem’s strength lies in practicality — French startups tend to specialize in applied solutions that integrate smoothly with existing store networks rather than disrupting them.

Logistics: The New Front Line Of Innovation

Technology in French retail extends far beyond the checkout. Warehouse automation is growing at double-digit rates, driven by the need for efficiency in online order fulfillment.

Auchan has automated several regional distribution centers using robotics and AI-assisted picking.

Intermarché is testing digital twin models to simulate warehouse flows before new layout changes.

These advances are paired with energy-efficiency measures, as France tightens regulations on logistics emissions.

Intelligent energy management systems and predictive vehicle routing are now standard investment categories in new warehouse projects.

AI Moves To The Back Office

Behind the scenes, artificial intelligence is now embedded in everything from labor scheduling to assortment planning.

Retailers are combining AI and human expertise to balance operational realities with customer experience.

Monoprix and Leclerc have been early adopters of hybrid AI dashboards that forecast both demand and delivery constraints.

These systems don’t replace managers — they provide scenarios.

This approach fits the French market culture, where human oversight remains central even in advanced digital systems.

The outcome is a faster response time when market conditions change — whether it’s a product shortage, regional demand spike, or energy disruption.

Customer Experience Goes Digital

French shoppers are open to digital solutions when convenience and privacy are balanced.

That’s why mobile loyalty and scan-and-go services are expanding, while intrusive advertising technologies remain limited.

Carrefour’s mobile app ecosystem is now one of the largest in Europe, connecting digital coupons, delivery scheduling, and payment within one interface.

Monoprix focuses on personalized product recommendations, while Lidl France integrates AI-generated weekly flyers based on household data.

These initiatives may look small individually, but together they create a smoother, data-driven retail environment where digital and physical touchpoints finally align.

Omnichannel Maturity

Unlike earlier phases of digital transition, France’s retailers are now approaching true omnichannel maturity.

According to FCD’s 2024 technology survey, more than 70% of major grocery chains run unified product databases for both in-store and online channels.

Click-and-collect orders, which rose sharply during the pandemic, have stabilized as a permanent feature of urban and suburban life.

In smaller towns, hybrid convenience stores now handle parcel pickup, grocery orders, and returns in a single workflow.

This combination of flexibility and reliability keeps French grocery e-commerce steady even as pure online formats lose market share.

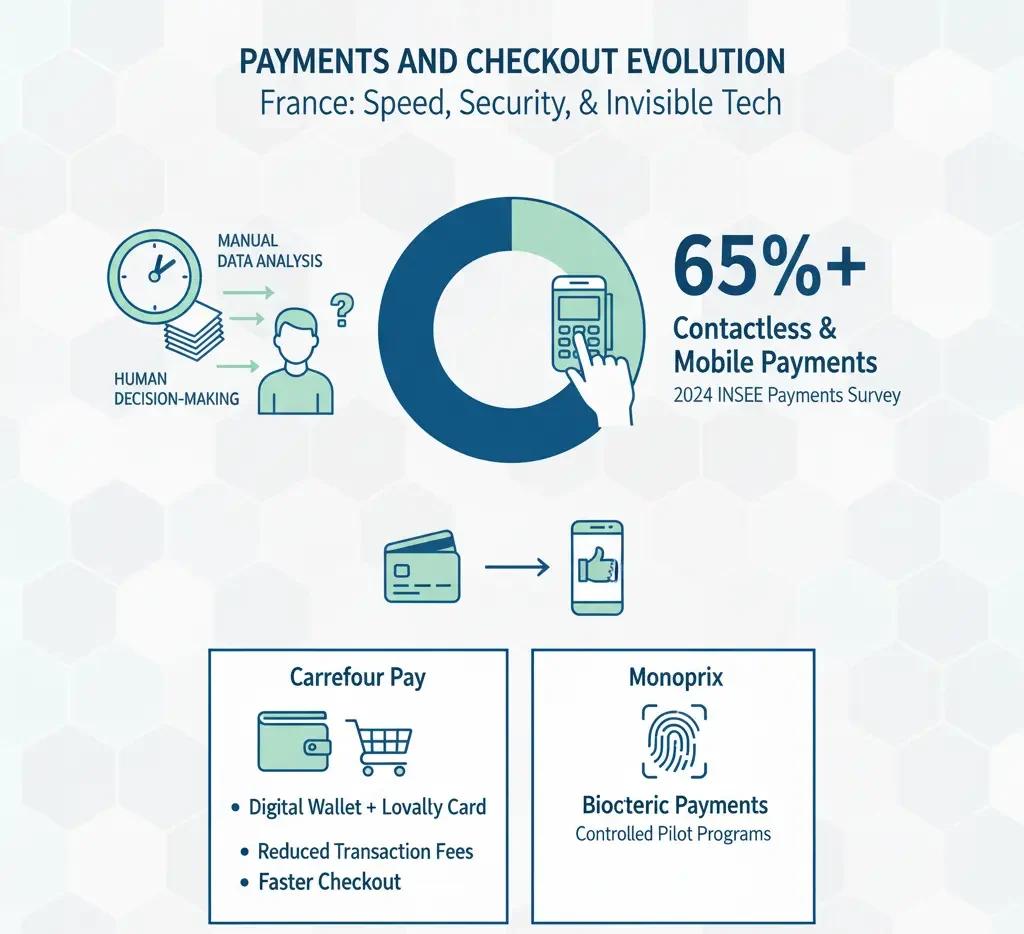

Payments And Checkout Evolution

Payment innovation has advanced rapidly in France. Contactless and mobile payments now account for more than 65% of all in-store transactions, according to INSEE’s 2024 Payments Survey.

Retailers are expanding into digital wallets and proprietary payment systems.

Carrefour Pay, for example, allows a direct link between the shopper’s account and the loyalty card, cutting transaction fees and speeding up checkout times.

Monoprix is testing biometric payments under controlled pilot programs.

The emphasis is on speed and security, not novelty.

French consumers expect technology to feel invisible — efficient but not intrusive.

Sustainability Through Digital Control

Retail tech in France is tightly connected to sustainability goals.

Energy-efficient refrigeration, automated lighting systems, and AI-based waste reduction tools are all expanding.

Auchan’s smart refrigeration project reduced energy use by 15% across pilot sites.

Casino’s digital waste-tracking platform now reports real-time data to environmental agencies, fulfilling new French transparency requirements.

Technology here isn’t just about profit — it’s about compliance and public trust.

Retailers understand that digital control systems can provide both economic and ecological stability.

Public Support And Regulation

The French government has placed retail digitalization within its national industrial strategy.

Through Bpifrance and France Numérique 2030, grants and loans are offered to support AI, robotics, and logistics digitalization projects.

Regulatory bodies, meanwhile, set clear boundaries for consumer data use and AI decision transparency.

This dual system — support and control — defines France’s retail tech progress: ambitious, but always accountable.

Exporting French Retail Tech

French solutions are gaining recognition beyond national borders.

SES-imagotag now serves retailers in more than 60 countries.

Vekia and Alkemics are entering partnerships in Germany and the UK.

Carrefour’s internal retail tech tools are being rolled out across its international branches, from Spain to Brazil.

This export capability is turning France into a European benchmark for applied retail technology — practical, ethical, and scalable.

The Next Phase: Integration And People

The next challenge for French retail tech is integration.

Many chains now operate multiple digital systems developed at different stages.

Unifying data flows, retraining staff, and ensuring consistent cybersecurity are top priorities for 2025–2026.

Technology may automate tasks, but human skills still drive the customer relationship.

Retailers are focusing on retraining store teams to use data tools, manage automated systems, and interpret analytics.

The human-digital balance remains a central value in the French model.

What Comes Next

By 2025, French retail technology is no longer an accessory — it’s infrastructure.

Every major retail decision, from shelf design to logistics planning, runs through a digital interface.

The French retail tech landscape will continue to evolve quietly but consistently.

Its strength lies in practicality, integration, and measurable improvement — a model that many European neighbors are now studying closely.

–