Spain enters 2025 as Europe’s most important source of fresh fruit and vegetables. The country ships more than 13 million tonnes of produce across the continent each year, and its role in European food security remains central. But the landscape is changing. Climate pressure, new retailer strategies and shifting consumer expectations are reshaping how Spain produces, moves and sells fresh produce.

Spain’s Role as Europe’s Fresh Produce Engine

Spain continues to dominate Europe’s fruit and vegetable supply. Citrus from Valencia, berries from Huelva, vegetables from Almería and brassicas from Murcia remain the backbone of European supermarket assortments. Export networks are strong and well-organised, supported by packhouses with fast turnaround times and logistics hubs linked to major highways and ports.

However, Europe’s demand is evolving. German, Dutch and UK retailers are asking for shorter delivery windows, more transparency on water use and stronger quality consistency. These expectations flow back to the Spanish domestic market, where supermarkets must meet the same standards.

Climate Effects on Supply

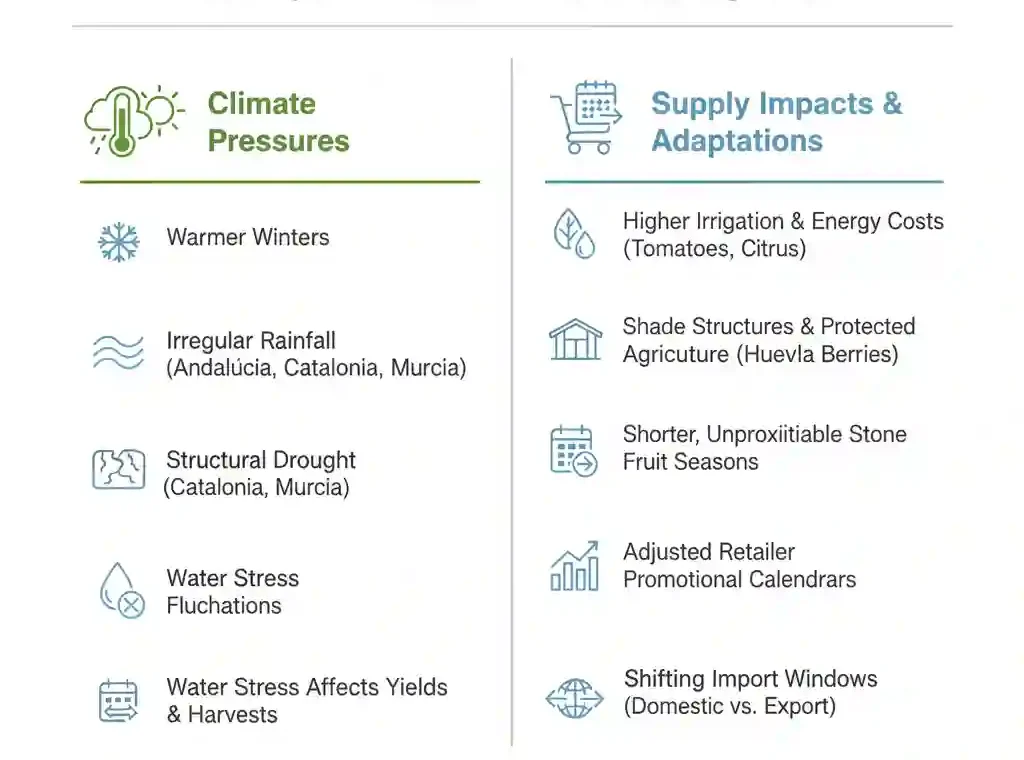

Climate pressure is the most significant concern for growers entering 2025. Warmer winters, irregular rainfall and structural drought conditions continue across the Mediterranean regions. AEMET reports that Andalucía, Catalonia and Murcia remain under long-term water stress, which affects how growers manage yields and plan harvests.

Tomato and citrus growers face higher irrigation and energy costs. Berry producers in Huelva are expanding shade structures and protected agriculture to stabilise volumes. Stone fruit seasons are becoming shorter and more unpredictable, making it harder for retailers to plan promotions and secure consistent volumes.

The impact shows up in pricing and availability. Retailers now adjust their calendars more often, shifting promotional weeks depending on harvest timing. Import windows also change as Spain balances domestic and export needs.

Retailer Strategies: Mercadona, Carrefour and Lidl

Spanish supermarkets are reshaping their fresh-produce operations to adapt to these pressures.

Mercadona continues to strengthen its relationships with local growers through the Proveedores Totaler model. These long-term agreements give suppliers greater visibility and allow Mercadona to demand improvements in farming techniques, cold-chain handling and sustainability reporting. The retailer also upgraded cold rooms in several regions, improving the care of sensitive items like leafy greens, strawberries and ready-to-eat fruit.

Carrefour Spain focuses on transparency and sustainability through its Act For Food strategy. The retailer has expanded sourcing contracts with producers in Murcia, Valencia and Andalucía. Many stores now use digital shelf labels, smart scales and freshness monitoring tools. These investments help reduce waste and improve presentation, especially in berries, lettuce and stone fruit.

Lidl continues to emphasise local sourcing and value. It has increased its volumes of Spanish tomatoes, peppers, citrus and potatoes and remains one of the largest buyers of Huelva berries for its wider European network. This scale gives growers long-term demand and helps Lidl maintain consistent prices.

Rise of Local and Regional Sourcing

Local sourcing is now a clear trend. Spanish shoppers increasingly seek freshness, transparency and proximity. Retailers highlight regional origins in signage and product labels, helping consumers understand exactly where items come from.

Domestic sourcing has strengthened in several categories. Castilla-La Mancha maintains its strong position in onions and garlic, while Murcia continues to dominate lettuce and other leafy vegetables. Valencia remains the anchor for citrus, Extremadura shows resilience in stone fruit, and the Canary Islands maintain their reputation for bananas and speciality tomatoes.

MAPA data confirms a rise in retailer–producer contracts for short-lead products such as strawberries, peppers, aubergines and grapes. These agreements reduce risk for both sides and give supermarkets a steadier supply base.

A Return to Seasonality

Seasonality has become more important again. Retailers are reducing or delaying imports during peak Spanish harvest weeks, especially when transport costs rise. This approach supports local growers and gives shoppers more flavourful produce.

Winter sees a strong focus on citrus and local strawberries. Spring brings a wider range of Spanish tomatoes when volumes are at their best. Summer remains the core season for melon, watermelon and early stone fruit, followed by regional apricots and plums. Supermarkets are increasingly building promotional calendars around these natural rhythms, helping them control costs and reduce shrink.

Consumers Want Fresher, Shorter-Life Produce

Spanish consumers have become more selective about freshness. Younger households in particular prefer fruit and vegetables that have been handled minimally and have a shorter shelf life. This preference reflects a desire for better flavour and a growing interest in home cooking.

As a result, supermarkets now replenish produce sections more frequently. Case sizes are smaller, displays turn faster and staff rotate stock more proactively. While convenience formats still grow, the strongest momentum remains in raw, high-quality produce with visible freshness cues.

Retail Tech Moves into the Produce Section

Technology is now at the centre of fresh-produce management.

AI forecasting helps retailers anticipate supply variations linked to weather patterns. This allows chains to prepare for fluctuation in categories like strawberries, cucumbers, peppers and summer melons.

Shelf-sensing technology is appearing in more stores. Sensors track temperature, humidity and stock levels, while computer-vision tools identify ageing fruit or low stock. These tools reduce waste and improve consistency between stores.

Cold-chain investment also continues. Retailers are upgrading refrigerated vehicles, improving back-room cooling systems and raising standards for handling delicate items such as berries and leafy greens. In packhouses, automated grading and optical sorting are becoming common, especially for tomatoes, citrus and peppers.

Packaging and Sustainability in Focus

Packaging remains a major point of change in 2025. Spanish supermarkets are cutting plastic across several produce categories. Citrus, cucumbers, tomatoes and many salad items now appear in formats with less packaging or in fully recyclable materials.

Paper banding is being tested for bunch vegetables and some tomato lines. Recyclable trays and compostable options are becoming more common, although cost remains a challenge.

At the same time, retailers are placing more emphasis on sustainability reporting from growers. Water-use data, integrated pest-management adoption and biodiversity commitments are increasingly reviewed during supplier assessments. These requirements influence how growers invest in technology and how supermarkets choose long-term partners.

Spain’s Export Position in 2025

Despite climate challenges, Spain remains Europe’s leading exporter of fresh produce. Citrus volumes are steady overall, though water stress in some regions has tightened margins. Berries continue to grow in export importance, supported by strong demand in Germany, the Netherlands, France and the UK.

Tomato exports from Almería have improved after years of competition pressure from Morocco and Dutch greenhouse operations. Stone fruit performance varies, with some regions reporting stable harvests and others facing climate-related losses. Even with these fluctuations, European retailers continue to rely heavily on Spanish produce for year-round supply.

What to Expect in 2026

Entering 2026, Spain’s fresh-produce sector faces another year shaped by climate and cost. Growers will continue investing in protected agriculture, advanced irrigation solutions and precision farming. Retailers will expand their use of AI and real-time monitoring tools. Local sourcing will grow further as supermarkets seek closer relationships with producers who can guarantee consistency.

Price pressure will remain strong. Waste reduction, improved logistics and more efficient cold-chain systems will be essential for controlling costs without compromising freshness.

Spain remains Europe’s fresh-produce engine — but the market now operates with new rules, tighter expectations and faster changes.