Retail technology is one of the most misunderstood parts of the supermarket business.

From the outside, it looks simple.

A new system appears. It promises efficiency, automation, or cost savings.

The retailer compares features, chooses the “best” solution, and rolls it out.

That is not how it works in reality.

Inside supermarkets, technology buying is slow, cautious, political, and shaped by risk far more than innovation. Many good technologies never make it past the first internal conversation. Others win contracts even though they are not the most advanced on the market.

To understand how supermarkets actually choose retail tech suppliers, you need to understand how decisions are made inside grocery organisations — and why procurement logic often outweighs product quality.

The First Mistake Vendors Make: Assuming Innovation Wins

Most retail technology pitches are built around one idea:

“Our technology is better.”

- Better features

- Smarter AI

- Faster processing

- More dashboards

Supermarkets rarely start from that question.

They start with different ones:

-

Will this disrupt stores during rollout?

-

Will it integrate with what we already use?

-

Who will be blamed if it fails?

-

Can we exit the contract easily if something goes wrong?

A supplier can have excellent technology and still lose the deal because it introduces uncertainty. In food retail, uncertainty is expensive.

That is why the best tech often loses.

How Supermarket Tech Buying Really Starts

Retail technology projects usually do not begin with innovation teams.

They begin with a problem.

- A system is outdated

- A regulation changes

- Costs are rising

- Manual work is becoming unmanageable

Only then does technology enter the conversation.

By the time a supplier is invited to pitch, several things are already fixed:

-

Budget range

-

Preferred system architecture

-

Internal risk limits

-

Existing vendor relationships

This is why many pitches fail without vendors understanding why.

They are solving a problem that has already been defined — and sometimes already narrowed to a short list.

Procurement And Operations Do Not Want The Same Thing

One of the biggest realities in retail technology procurement is the tension between procurement teams and operations teams.

They are both decision-makers.

They do not think the same way.

Operations want:

-

Systems that work every day

-

Minimal training

-

Fast rollout

-

Strong local support

Procurement wants:

-

Predictable costs

-

Contract flexibility

-

Vendor stability

-

Low long-term risk

A technology supplier must satisfy both, or it will fail.

Many strong products win over operations teams during pilots, but lose later when procurement reviews the commercial and legal risks.

This is where buying decisions often change quietly.

Why Rollout Speed Matters More Than Features

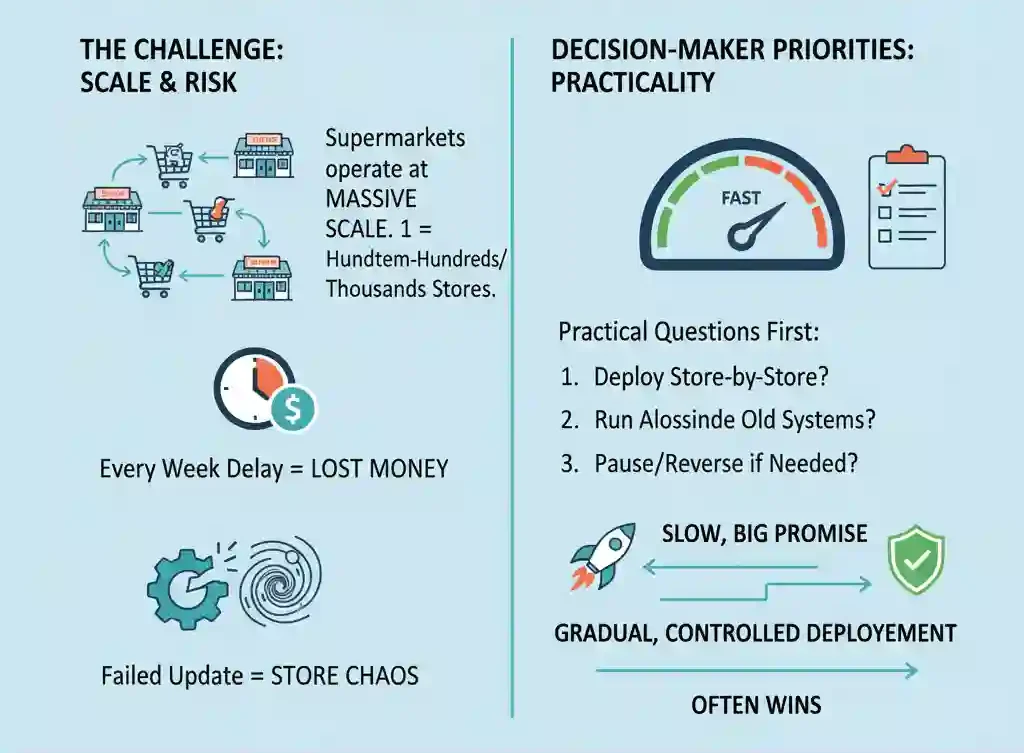

Supermarkets operate at scale.

A single system can touch hundreds, sometimes thousands, of stores.

Every week of delay costs money.

Every failed update creates store-level chaos.

That is why rollout speed often matters more than innovation when supermarkets evaluate new retail technology.

Decision-makers usually ask practical questions first.

- Can this be deployed store by store?

- Can it run alongside legacy systems?

- Can we pause or reverse rollout if needed?

A supplier that promises gradual, controlled deployment often beats one that promises transformation.

This logic shows up clearly in areas like store automation, supermarket refrigeration systems, energy management platforms, and checkout technology — where even small disruptions can affect daily operations across the entire network.

Integration risk is the silent deal-breaker

Supermarkets run on layers of old and new systems.

- POS

- ERP

- Warehouse systems

- Energy systems

- Price files

- Supplier data

If a new retail technology does not integrate cleanly, it creates hidden costs.

Decision-makers are less impressed by features and more focused on questions like:

-

Who handles integration?

-

Who pays if something breaks?

-

Who owns data when systems overlap?

This is why established suppliers often win.

Not because they are better — but because they are already inside the ecosystem.

Who Is Really Involved In the Buying Decision

Another common misunderstanding is assuming there is one buyer.

In reality, supermarket tech decisions involve several layers:

-

Operations leadership

-

IT teams

-

Procurement

-

Finance

-

Sometimes store managers

-

Sometimes external consultants

Each group has veto power.

A supplier that only sells to one group risks being blocked later by another.

This is why successful retail tech suppliers speak different languages to different stakeholders — even within the same meeting.

Why Most Tech Pitches Fail Quietly

Most failed pitches do not fail dramatically.

They fade.

- No follow-up.

- No clear rejection.

- No feedback.

This usually means one of three things:

-

The risk profile felt too high

-

The rollout looked too complex

-

The supplier felt too dependent on one key person

Supermarkets prefer suppliers that look boring but safe.

That is uncomfortable for innovative companies — but it is reality.

Why Supermarkets Prefer Suppliers They Already Know

Trust is a form of risk reduction.

If a supplier has already delivered:

-

Another system

-

A pilot project

-

Regional support

-

Reliable maintenance

They start ahead.

This is why many supermarket groups expand contracts with existing partners rather than introduce new ones.

Innovation often enters through extensions, not replacements.

What Decision-Makers Actually Care About

When supermarket executives review retail technology proposals, their priorities are consistent:

-

Stability over novelty

-

Predictable costs over theoretical savings

-

Integration over standalone performance

-

Vendor longevity over startup speed

Technology that fits quietly into daily operations wins more often than technology that tries to change behaviour.

Why Understanding This Matters

Retail technology is not sold the way software vendors expect.

It is bought like infrastructure.

Slowly.

Carefully.

With fear of failure in mind.

Suppliers that understand this reality build better pitches, better contracts, and better long-term partnerships.

Those that do not keep wondering why “great tech” keeps losing deals.

Final thought

If you want to understand the supermarket tech buying process, stop looking at product features.

Look at risk.

Look at rollout.

Look at who carries responsibility when something breaks.

That is where decisions are actually made.