Irish grocery shopping feels different now.

Not just more expensive, but different in how it works.

There is more self-service.

Fewer staff on the shop floor.

Prices change more often.

Ranges feel tighter.

These changes are not accidental.

They reflect a deliberate reset in how Irish supermarkets operate behind the scenes.

This article explains that shift.

What changed inside stores.

Why the old model stopped working.

And what the new operating reality means for shoppers and suppliers.

The question Irish shoppers are really asking

Shoppers usually ask it in different ways:

- Why is grocery shopping so expensive now?

- Why are there fewer staff on the floor?

- Why does everything feel automated?

- Why do prices change so often?

Those questions share one answer.

Irish supermarkets changed how stores are run.

Prices, staffing, and self-service are outcomes.

The operating model is the cause.

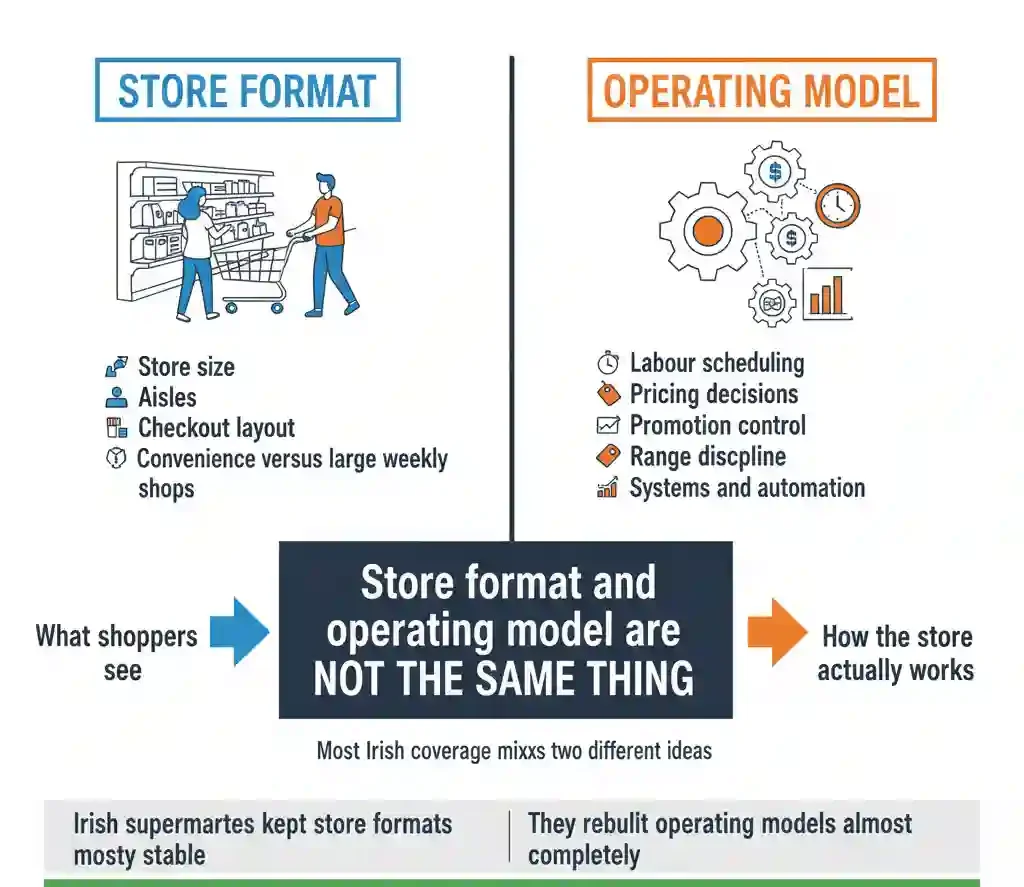

Store format and operating model are not the same thing

Most Irish coverage mixes two different ideas.

Store format

What shoppers see.

- Store size

- Aisles

- Checkout layout

- Convenience versus large weekly shops

Operating model

How the store actually works.

- Labour scheduling

- Pricing decisions

- Promotion control

- Range discipline

- Systems and automation

Irish supermarkets kept store formats mostly stable.

They rebuilt operating models almost completely.

That is why stores look familiar.

But feel different.

Why the reset happened: labour became structurally expensive

Labour costs in Ireland did not rise once.

They climbed year after year.

This matters because grocery retail runs on thin margins.

Small cost increases force big structural changes.

The labour pressures that mattered most

- Minimum wage increases, cumulative over time

- Tighter labour availability, especially for evenings and weekends

- Stricter compliance around breaks, rostering, and contracts

- Lower tolerance for overtime and informal cover

This was not temporary inflation.

It was a permanent cost reset.

Supermarkets had three options:

- Raise prices

- Reduce labour hours

- Change how labour is used

Irish retailers chose all three.

Why this change is structural, not cyclical

Many shoppers expect things to “go back”.

They will not.

Why?

- Wage floors do not roll back

- Compliance rules do not loosen

- Labour supply does not suddenly improve

Once a retailer redesigns its staffing model, it does not reverse it.

The cost base is locked in.

Self-service was not about convenience

Self-service checkouts are often explained as speed or choice.

That explanation is incomplete.

Self-service expanded because of labour maths.

Traditional checkout model

- 1 staff member

- 1 checkout

- Fixed labour cost per transaction

Self-service model

- 1 staff member oversees:

- 4 checkouts

- 6 checkouts

- Sometimes more

The labour cost per transaction drops sharply.

That is the reason self-service spread so quickly.

Everything else came second.

Yes, queues can be awkward.

Yes, theft risk increased.

Yes, shoppers complain.

Those were accepted trade-offs.

RTÉ consumer explainers focus on frustration and usability, but the structural driver was cost control, not customer experience RTÉ.

What self-service changed inside the store

Self-service did more than remove checkout roles.

It reshaped labour deployment.

Before

- Large share of labour tied to tills

- Predictable staffing blocks

- Narrow role definitions

After

- Fewer checkout staff

- More roles focused on:

- Monitoring

- Intervention

- Loss prevention

- Problem resolution

Staff became more flexible.

Stores became leaner.

This also made labour easier to control centrally.

Labour control quietly moved to head office

Ten years ago, store managers controlled:

- Staffing levels

- Shift patterns

- Local adjustments

That autonomy is largely gone.

What is now set centrally

- Labour hours per store

- Staffing ratios

- Role allocation rules

- Peak-time coverage models

Why centralise?

- Consistency

- Cost control

- Risk reduction

- Easier compliance

Stores became execution points.

Decision-making moved upstream.

Why Irish stores feel “short-staffed”

Many shoppers say stores feel understaffed.

From a system perspective, they are right-sized.

The goal is not service richness.

The goal is labour efficiency per transaction.

If volumes hold, the model works.

If volumes dip, pressure increases.

That is why the floor feels thinner.

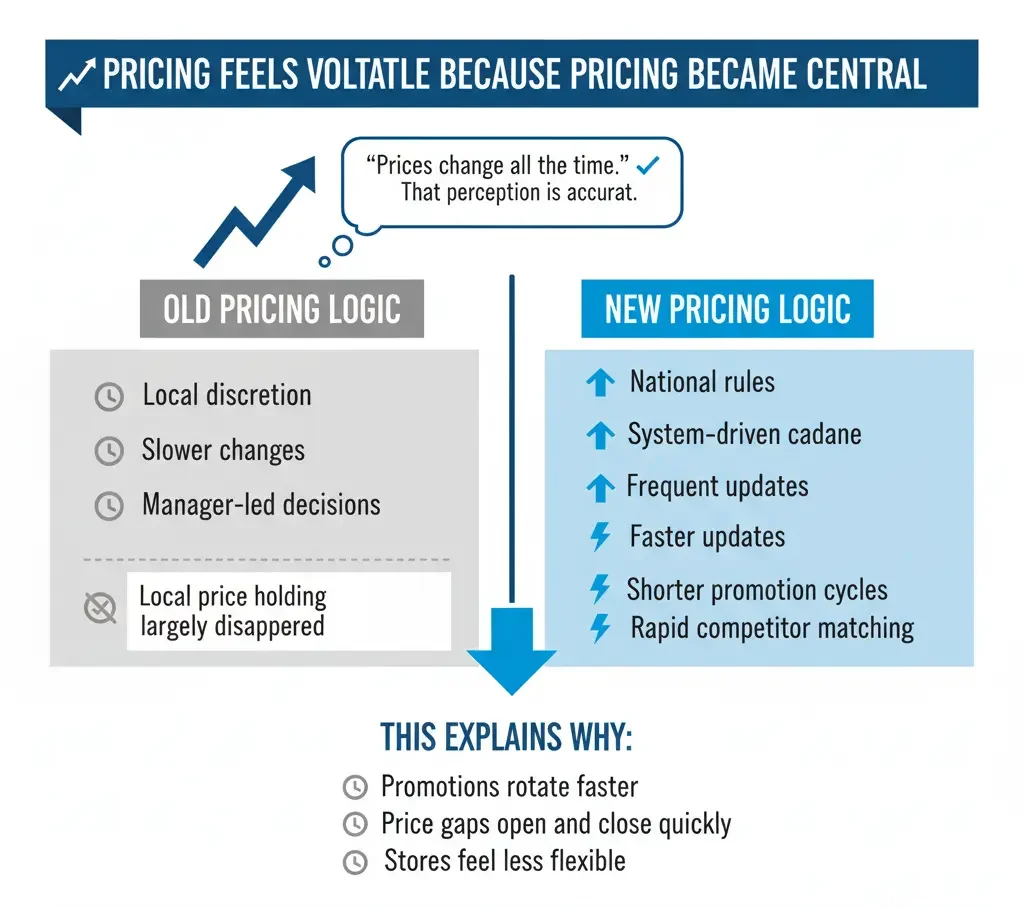

Pricing feels volatile because pricing became central

Another common complaint is price volatility.

“Prices change all the time.”

That perception is accurate.

Centralised pricing systems allow:

- Faster updates

- Shorter promotional cycles

- Rapid competitor matching

Old pricing logic

- Local discretion

- Slower changes

- Manager-led decisions

New pricing logic

- National rules

- System-driven cadence

- Frequent updates

Local price holding largely disappeared.

This explains why:

- Promotions rotate faster

- Price gaps open and close quickly

- Stores feel less flexible

The Competition and Consumer Protection Commission has repeatedly pointed to tight margins and scale pressure as drivers of system-led pricing.

Why promotions feel less generous

Promotions did not disappear.

They became more controlled.

What changed

- Shorter promotional windows

- Tighter discount bands

- Less local discretion

Promotions are now designed to:

- Drive volume quickly

- Protect margin

- Limit operational disruption

Deep, messy offers are harder to run under central systems.

Range discipline tightened across Ireland

Another quiet change is tighter range control.

This is not about empty shelves.

It is about discipline.

Each SKU adds:

- Forecasting complexity

- Waste risk

- Compliance checks

- Operational noise

Central teams now enforce:

- Clear category roles

- Fewer local variations

- Stronger performance thresholds

Bord Bia grocery market mapping shows how Irish retailers structured ranges more tightly around private label and fewer branded tiers Bord Bia.

Why private label fits the new model

Private label is not just cheaper.

It is operationally cleaner.

Why private label gained power

- Predictable volumes

- Central cost control

- Fewer negotiations

- Easier system planning

This suits:

- Centralised buying

- Automated forecasting

- Margin protection

That is why private label expanded even as shoppers traded down.

It fits the system.

Competition did not disappear — it moved

Irish grocery remains competitive.

But competition no longer happens store by store.

Then

- Local rivalries

- Manager discretion

- Visible price battles

Now

- Head office versus head office

- Buying scale

- Cost models

- Systems efficiency

National price comparisons show the outcome.

They rarely explain the mechanism.

Competition moved upstream.

Why shopping feels less personal

Many shoppers say stores feel colder.

That is not accidental.

Personal discretion creates:

- Inconsistency

- Risk

- Cost leakage

Centralisation removed it.

Standardisation won because it scales.

Suppliers feel the operating model shift first

Operating model changes hit suppliers before shoppers.

Always.

Why?

- Stores execute

- Systems decide

When decisions move to head office, suppliers must adapt to systems, not people.

This is one of the least discussed changes in Irish grocery.

What changed for suppliers

Before

- Local relationships mattered

- Late changes were possible

- Promotions could be flexed

- Exceptions happened

Now

- Central planning rules

- Locked calendars

- Compliance-driven execution

- Low tolerance for deviation

Suppliers did not lose relevance.

They lost flexibility.

Central buying changed negotiations

Centralisation compressed negotiation windows.

What buyers now prioritise

- Operational reliability

- Cost transparency

- Forecast accuracy

- Compliance readiness

Sales growth alone is not enough.

If a supplier:

- Misses delivery windows

- Breaks specifications

- Fails audits

The system records it.

And the system decides.

Lead times are longer and firmer

Irish promotions now run on locked calendars.

Typical supplier changes

- Promotions planned months ahead

- Artwork deadlines fixed early

- Volumes committed sooner

- Less tolerance for late changes

Why this matters:

- Central systems need stability

- Forecasts depend on early inputs

- Late changes create cost and risk

Suppliers must plan earlier.

Cash-flow pressure increases.

Promotion mechanics are tighter

Promotions still exist.

They are just more controlled.

What changed in practice

- Fewer overlapping offers

- Narrower discount bands

- Clearer mechanics

- Shorter run times

This protects:

- Margin

- Labour planning

- System predictability

Deep, messy deals break models.

They are now avoided.

Compliance load increased quietly

Centralisation increases documentation.

Not because retailers want paperwork.

Because systems require proof.

Common supplier requirements

- Traceability data

- Audit readiness

- Packaging compliance

- Delivery accuracy metrics

Failure is visible.

Repeated failure is terminal.

Fewer suppliers now win more volume

Range discipline has consequences.

Irish supermarkets now prefer:

- Fewer suppliers

- Deeper relationships

- Higher volume per partner

This reduces:

- Operational complexity

- Risk exposure

- System noise

For suppliers, the outcome is polarising:

- Winners scale up

- Marginal players exit

This is not consolidation hype.

It is operational logic.

Private label suppliers face pressure and protection

Private label aligns best with the new model.

But it is not easy.

Upside

- Volume stability

- Longer planning horizons

- Strong system fit

Downside

- Cost pressure

- Thin margins

- Heavy compliance

Private label suppliers must be efficient, predictable, and quietly excellent.

Shrink became a system problem

Shrink used to be handled locally.

Now it is:

- Measured centrally

- Flagged digitally

- Linked to labour rules

Self-service increased shrink risk.

Systems now monitor it in near real time.

This creates feedback loops:

- Higher shrink

- More monitoring

- Less open floor presence

The store feels tighter.

Automation is already embedded

Automation is not future talk.

It is already live.

Common systems in Irish grocery

- Automated ordering

- Algorithmic forecasting

- Central price engines

- Digital shrink dashboards

These systems:

- Reduce discretion

- Increase consistency

- Lower cost

They also remove “human fixes”.

Labour scheduling is now data-led

Scheduling used to be experience-based.

Now it is algorithmic.

Inputs include:

- Footfall by hour

- Transaction density

- Basket size trends

- Promotion timing

The result:

- Leaner staffing

- Less slack

- Higher pressure during peaks

This is efficient.

It is not personal.

What changes next in Ireland

Three shifts are already underway.

1. Deeper central control

Store autonomy will not return.

2. Shrink and labour fully integrated

Loss prevention and staffing will link more tightly.

3. Supplier lists will shrink further

Not because of M&A.

Because of operations.

FAQ

Why are Irish supermarkets changing how they run stores?

Because labour costs rose structurally and forced a permanent operating model reset.

Is self-service about convenience?

No. It is about reducing labour cost per transaction.

Why do prices change so often?

Because pricing is now centralised and system-driven.

Will stores re-staff?

Unlikely. Efficiency gains are now baked in.

Summary table: operating model shift

| Area | Before | Now |

|---|---|---|

| Labour | Checkout-heavy | Oversight-heavy |

| Pricing | Local control | Central cadence |

| Promotions | Flexible | Tightly planned |

| Range | Broad | Disciplined |

| Decisions | In-store | Head office |

Final takeaway

Irish supermarkets did not suddenly become more expensive or automated.

They re-engineered how stores run.

Labour pressure triggered the reset.

Centralisation enabled it.

Automation locked it in.

For shoppers, the experience feels leaner and less personal.

For suppliers, the bar is higher and the stakes are bigger.

This is not a cycle.

It is the new operating reality of Irish grocery retail.

Editor’s Note: This article is based on research using publicly available data, regulatory reporting, and Irish grocery market analysis.