2025 is almost over now, and Japanese food-trade calendar has been one of the busiest in years.

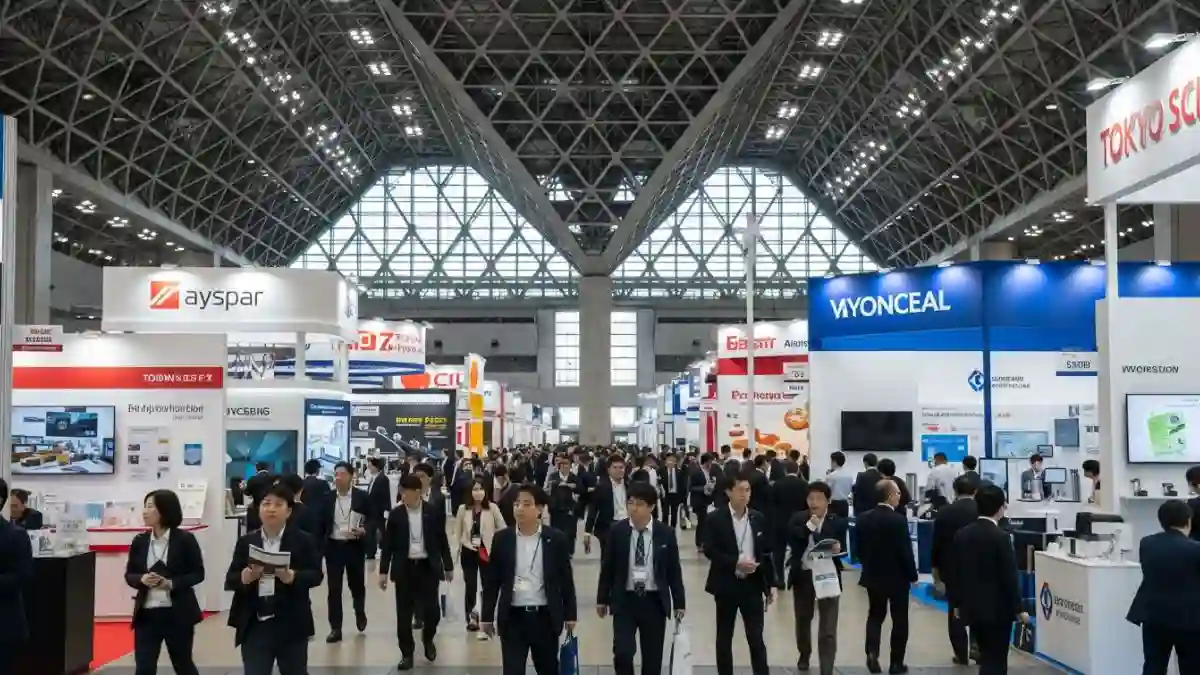

The mix of new events, expanded halls, and strong international turnout created a different rhythm than before. Buyers from supermarkets, distributors, and importers flew in from across Asia, Europe, and North America. Many said the same thing — the market felt more open, more export-ready, and more organised around global demand.

With the year coming to an end, it is a good moment to look back and understand how Japanese food trade events 2025 actually shaped sourcing decisions for 2026.

The timing, the themes, and the type of suppliers showing up all point toward a shift in how global supermarkets will build their shelves next year.

A Year When the Trade Calendar Tightened Up

Japan has hosted major food fairs for decades, but 2025 stood out because everything felt closer together in timing and stronger in purpose.

Spring started with the usual wave of food-and-drink exhibitions, followed by a long summer break. Then, from early autumn until early December, it felt like almost every two weeks there was another large-scale fair.

Buyers who visited Japan between November and the first week of December could cover multiple events in one trip — and this was one of the biggest advantages of the Japanese food trade events 2025.

People walked from hall to hall meeting wellness-food suppliers, seafood exporters, regional snack makers, organic lines, premium tea companies, and exhibitors from Japan’s big agricultural prefectures.

Japan’s events have always been neatly organised, but this year the calendar almost worked like one long, connected journey.

Why Japan Pushed So Hard In 2025

When walking the floors this year, it was obvious Japan wanted to reposition itself globally.

There were more English-language booths, more export desks, and many more packaging-ready products.

A few reasons explain the push:

Japan’s domestic food market is steady but not fast-growing

Producers want to grow through exports, especially in categories where Japan already has a competitive edge like snacks, sauces, tea, seafood, and healthy convenience foods.

More global supermarkets are looking for “specialty premium”

Japanese suppliers fit that niche well. Their products tend to be clean, safe, well-designed, and naturally positioned at a mid-high price point.

Retailers said Japanese items help create a premium tier that shoppers still trust even when budgets are tight.

Regulatory clarity improved

Export labels and documentation seemed smoother this year. Many suppliers had updated packaging to meet requirements for the US, EU, Middle East, and Southeast Asia.

Japan responded to global food trends faster than before

Fermented products, functional snacks, low-sugar drinks, plant-based lines — all these appeared with better design and clearer claims.

This broader shift is one reason Japanese food trade events 2025 ended up having such a strong influence on next year’s sourcing.

A Strong Year for Wellness and Functional Foods

Wellness was one of the biggest themes across the year.

Even in general food shows, sections for health-focused or functional items were packed.

You saw:

-

fermented drinks and powders

-

low-carb and sugar-free snacks

-

teas with functional claims

-

collagen and beauty-from-within beverages

-

plant-based proteins and convenient ready-to-eat sets

What surprised many buyers was how prepared the suppliers were.

Products came with clear export packaging, stability data, and suggested retail positioning.

For supermarkets planning 2026 assortments, this segment will likely be one of the first to grow.

Regional Foods Gained More Interest

Japan’s regional foods always appeal to tourists, but in 2025, trade events presented them in a more export-friendly way.

Hokkaido dairy, Okinawa citrus drinks, Kyushu ramen kits, Shikoku yuzu items, and specialty rice varieties were displayed with updated packaging and longer shelf life.

Buyers from Europe and the Middle East said these items help create seasonal or limited-edition programmes.

And because many of the producers are small, retailers can negotiate exclusive deals without heavy competition.

This movement was one of the reasons Japanese food trade events 2025 helped shape unique value-added sourcing strategies.

Seafood and Processed Foods Stayed Strong

Japan’s seafood category continues to attract attention, especially with strict quality controls.

This year, frozen seafood presentations and shelf-stable seafood snacks were very visible.

There was also strong demand for premium processed foods like curries, noodles, sauces, and ready-to-cook kits.

Exporters this year used more compact packaging, cleaner ingredient lists, and QR codes showing traceability.

This matched what many supermarkets want for 2026: high-quality convenience foods that still feel “crafted” or authentic.

Packaging Improvements Caught Everyone’s Eye

One thing nearly every buyer mentioned: Japanese packaging is getting more export-friendly.

Labels were clearer, with simpler English.

Nutritional panels were easier to read.

The visual style moved a bit away from traditional busy layouts and more toward global minimalism.

Eco-friendly packaging was also more common.

Mono-material pouches, lighter trays, and recyclable bottles appeared across many booths.

These changes made it easier for international retailers to imagine placing the products directly on shelf without redesign.

A Better Buyer Experience in 2025

Another noticeable improvement this year was how well trade shows handled international buyers.

Registration processes were smoother.

More staff could speak English.

Navigation maps were clearer, and many events added “category routes” showing where health, snacks, seafood, regional foods, or frozen items were located.

For supermarket teams arriving with tight schedules, these small improvements saved a lot of time and made the Japanese food trade events 2025 much easier to navigate.

How Supermarket Buyers Are Planning 2026 After This Year

Because 2025 trade events came with such a strong showing, many buyers already started planning their 2026 sourcing before the year even ended.

Here are the main shifts they are making:

1. One big trip instead of multiple small ones

Since the late-year cluster worked so well, many buyers plan to visit Japan only once but stay longer, covering all major fairs in one go.

2. More focus on smaller suppliers

Big companies kept their usual presence, but the excitement came from SMEs with unique, high-margin items.

Retailers are now building mixed assortments: large-brand essentials + regional specialty finds.

3. Higher interest in long-term contracts

Because wellness foods and premium Japanese snacks are trending in many countries, buyers want to secure supply earlier and avoid shortages.

4. Expanding Japanese shelves in 2026

Several Western supermarket groups said they plan to grow their “Japanese corner” or “Asian premium” shelves next year.

Products from this year’s events helped shape that plan.

5. More attention to packaging sustainability

Many retailers said Japanese packaging improvements now align better with their sustainability goals.

This made sourcing easier and reduced the need for repackaging.

6. Frozen foods rising as a borderless category

Frozen fruit, frozen bakery, frozen seafood, and ready meals gained a lot of interest.

The quality was high and the shelf life longer, making logistics simpler for importers.

All these changes show how strongly Japanese food trade events 2025 influenced sourcing direction.

Why This Year Mattered More Than Usual

It wasn’t just the number of events — it was the timing and the mindset.

Buyers said the year felt like Japan was “re-introducing itself” to global retail, with more confidence and a clearer message:

Japan is ready to export, ready to innovate, and ready to support international supermarket programmes.

For many categories, especially snacks, beverages, seafood, wellness foods, specialty condiments, and frozen products, Japanese suppliers brought ideas that fit the 2026 trend cycle perfectly.

By the end of the year, it became obvious that the trade-show activity was not just noise.

It set the tone for how retailers will source in 2026.

And this is exactly why the Japanese food trade events 2025 ended up shaping global strategies in such a significant way.

Conclusion

With 2025 almost finished, the impact of Japan’s trade-show season is clear.

Japan strengthened its position as a sourcing hub for premium, health-focused, and specialty foods.

Buyers gained easier access to suppliers, better packaging, and clearer export options.

The calendar structure helped teams cover more fairs in one trip and prepare early for next year.

As 2026 approaches, supermarkets and distributors who attended these events are already adjusting their shelves and building stronger Japanese assortments.

If the momentum continues, Japan may become one of the most influential sourcing markets in the Asia-Pacific region over the next few years.