Packaging sustainability in Ireland is no longer optional — it is a commercial requirement shaped by law, cost pressure, and operational reality.

For suppliers, retailers, and brand owners, compliance now directly affects SKU viability, margin, packaging design, and route-to-market decisions.

This article explains what businesses actually need to know — not just what the rules say, but how they land commercially inside Irish grocery, FMCG, and packaging supply chains.

What This Article Answers — Clearly

If you are searching for information on packaging sustainability in Ireland, you are likely asking one (or more) of the following:

-

What is Ireland’s Deposit Return Scheme (DRS) and who must comply?

-

What are EPR and Repak obligations, and how much do they cost?

-

How do EU packaging rules affect Irish suppliers today — not just in theory?

-

How does compliance influence packaging choice, SKU count, and margins?

-

What do supermarkets expect from suppliers now?

This article answers those questions in plain commercial terms, with clear explanations, tables, and practical implications.

Why Packaging Sustainability Became a Commercial Necessity in Ireland

For years, sustainability in packaging sat in the “future planning” bucket.

In Ireland, that phase is over.

Three forces now converge:

-

Regulation is live, enforceable, and costly

-

Retailers require proof of compliance to list or retain products

-

Packaging costs now move faster than consumer pricing

The result: sustainability decisions now sit alongside pricing, sourcing, and range planning — not CSR decks.

Ireland’s Packaging Framework — The Three Pillars

Ireland’s packaging sustainability system rests on three overlapping layers:

| Layer | What it Covers | Why it Matters Commercially |

|---|---|---|

| Deposit Return Scheme (DRS) | Beverage containers | Immediate cash flow, labeling, logistics impact |

| EPR / Repak | All household packaging | Annual fees, reporting, SKU-level cost |

| EU Packaging Rules (PPWR) | Design, recyclability, reduction | Forces redesign and rationalisation |

Each layer has different triggers, costs, and compliance timelines — but they stack.

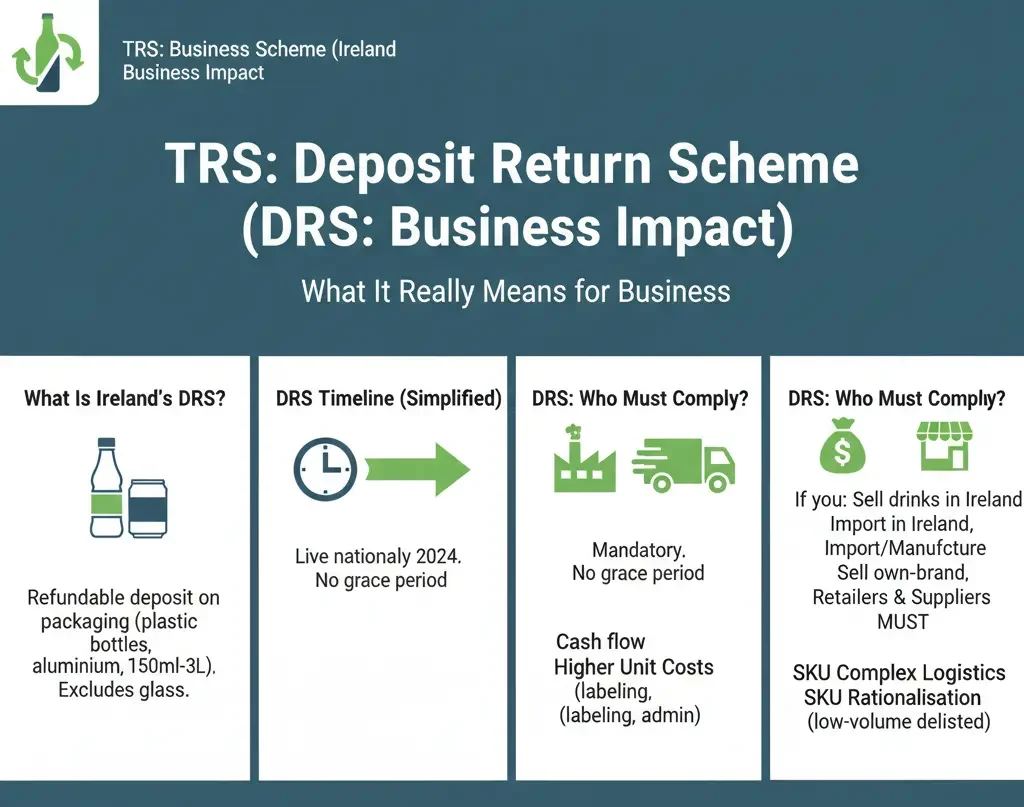

The Deposit Return Scheme (DRS): What It Really Means for Business

What Is Ireland’s DRS?

Ireland’s Deposit Return Scheme places a refundable deposit on certain beverage containers to encourage return and recycling.

Covered packaging includes:

-

Plastic bottles (PET)

-

Aluminium cans

-

Specific size ranges (typically 150ml to 3L)

Glass is currently excluded.

DRS Timeline (Simplified)

-

Live nationally since 2024

-

Mandatory participation for affected SKUs

-

Ongoing reporting and reconciliation

There is no grace period once a product is on shelf.

DRS: Who Must Comply?

You must comply if you:

-

Place in-scope beverages on the Irish market

-

Import or manufacture drinks for retail sale

-

Sell own-brand beverages through Irish retailers

Retailers are not optional participants — neither are suppliers.

DRS Commercial Impact (The Part Most Articles Skip)

DRS affects more than labeling.

Commercial consequences include:

-

Cash flow pressure from deposit handling

-

Higher unit costs due to labeling, registration, admin

-

Logistics complexity for returns and reconciliation

-

SKU rationalisation — low-volume SKUs often fail viability tests

Many suppliers quietly delisted marginal pack sizes rather than absorb compliance costs.

DRS: Design and Packaging Decisions

DRS accelerates “good enough” packaging logic.

Suppliers increasingly choose:

-

Standard bottle formats

-

Fewer pack sizes

-

High-volume SKUs only

Custom or niche packaging now carries structural cost risk, not just design cost.

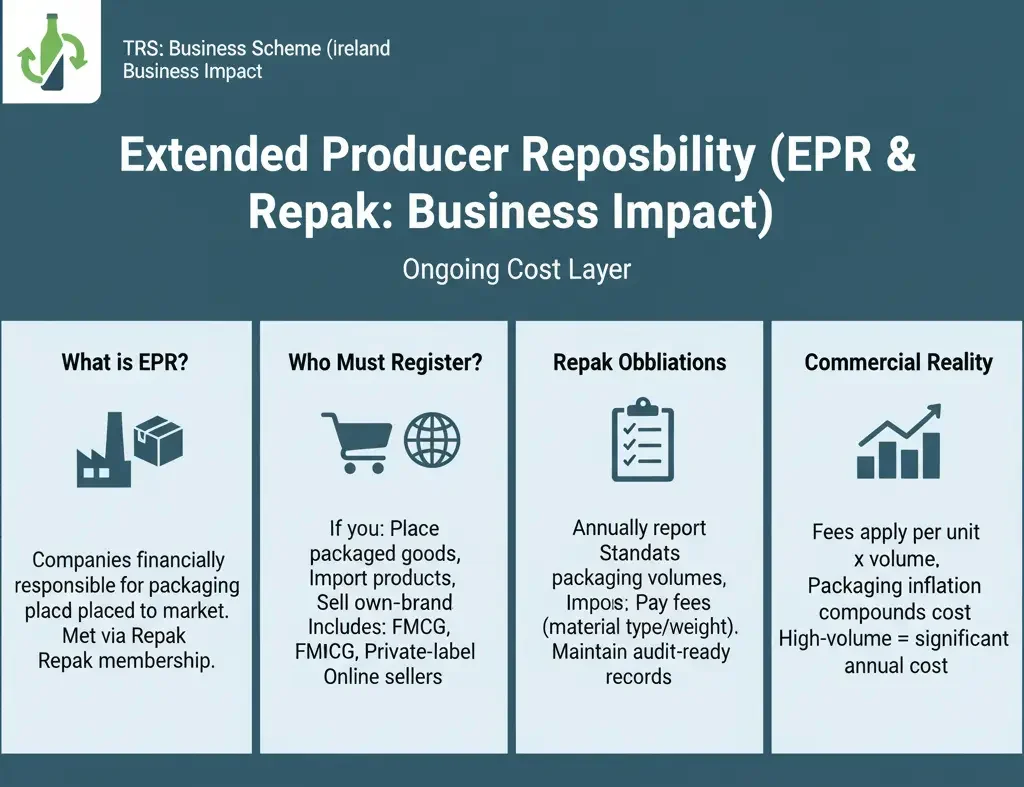

Extended Producer Responsibility (EPR) and Repak: The Ongoing Cost Layer

What Is EPR in Ireland?

Extended Producer Responsibility makes companies financially responsible for the packaging they place on the market.

In Ireland, this obligation is typically met through Repak membership.

Who Must Register with Repak?

You must register if you:

-

Place packaged goods on the Irish market

-

Import products in packaging

-

Sell own-brand products under your name

This includes:

-

FMCG suppliers

-

Private-label brand owners

-

Online sellers shipping into Ireland

Repak Obligations — In Simple Terms

Repak requires businesses to:

-

Report packaging volumes annually

-

Pay fees based on material type and weight

-

Maintain audit-ready records

Fees vary by:

-

Plastic type

-

Paper/cardboard

-

Aluminium

-

Composite materials

The Commercial Reality of Repak Fees

Repak is often described as “modest” in compliance guides.

Commercially, that framing is misleading.

Why?

-

Fees apply per unit × volume

-

Packaging inflation compounds fee impact

-

Low-margin SKUs feel cost first

For high-volume suppliers, Repak costs quietly become six-figure annual line items.

Reporting Is Not Optional — or Light

Reporting requires:

-

Material breakdown accuracy

-

Supplier data alignment

-

Internal systems discipline

For SMEs, reporting admin often costs more than the fee itself.

EU Packaging Rules: PPWR and What Ireland Cannot Avoid

What Is the EU PPWR?

The EU Packaging and Packaging Waste Regulation (PPWR) is replacing earlier directives with directly applicable rules.

Ireland must enforce it — without national dilution.

Core PPWR Themes That Matter Commercially

The regulation pushes three outcomes:

-

Less packaging

-

More recyclable packaging

-

More reusable systems where viable

These are not suggestions.

Key PPWR Requirements Businesses Must Prepare For

-

Design for recyclability

-

Material reduction targets

-

Clear labeling standards

-

Restrictions on certain formats

Many current packaging formats will not pass future thresholds.

The Hidden Cost: Redesign Cycles

PPWR does not arrive once.

It triggers:

-

Re-tooling

-

Artwork changes

-

Supplier renegotiation

-

MOQ resets

That cycle costs money before a single unit is sold.

Why “Good Enough + Compliant + Scalable” Wins

The Sustainability Myth Businesses Learn the Hard Way

Early sustainability narratives pushed:

-

Premium materials

-

Novel substrates

-

Experimental formats

The Irish market rejected most of them.

What Actually Works in Ireland

Irish retail now rewards solutions that are:

-

Legally compliant

-

Operationally simple

-

Scalable across SKUs

-

Cost-controlled

Not the most innovative.

Not the most visible.

The most survivable.

Why “Perfect” Is Commercially Dangerous

Perfect packaging often means:

-

Higher MOQs

-

Supplier lock-in

-

Fragile margins

Retail buyers increasingly ask:

“Can this scale across the range without breaking cost?”

If the answer is no, sustainability credentials will not save the SKU.

The Gap in Most Packaging Sustainability Articles

What Compliance Documents Miss

Official guidance explains:

-

What to register

-

Where to report

-

Which law applies

They rarely explain:

-

What to delist

-

Which SKUs to consolidate

-

How fees stack against margin

What Consumer Explainers Miss

Consumer-focused content explains:

-

Why recycling matters

-

How deposits work

They do not explain:

-

Supplier obligations

-

Packaging cost pass-through

-

Why pack sizes disappear

This gap leaves businesses underprepared.

Irish Supermarkets: The Real Enforcement Layer

Why Supermarkets Matter More Than Regulators

In practice, Irish supermarkets enforce sustainability faster than the state.

They do this through:

-

Listing requirements

-

Own-brand standards

-

Supplier audits

If you fail compliance, your product does not reach shelf.

What Irish Supermarkets Now Expect

From suppliers:

-

Proof of Repak registration

-

DRS-ready labeling

-

Future-proof packaging formats

From own-brand partners:

-

Design aligned to retailer sustainability strategy

-

Reduced material use

-

Clear recyclability

Range Reviews Now Include Packaging

Packaging sustainability is now assessed alongside:

-

Price

-

Availability

-

Margin

-

Supply reliability

Non-compliant packaging becomes a range risk, not a legal footnote.

Own Brand in Ireland: Where Sustainability Scales Fastest

Why Own Brand Moves First in Ireland

Irish retailers control:

-

Design

-

Specification

-

Volume

That allows them to standardise sustainable packaging faster than branded suppliers.

How Own Brand Approaches Packaging Sustainability

Common strategies include:

-

Single-material packaging

-

Reduced ink and finishes

-

Standard pack sizes

-

Shared components across ranges

This simplifies compliance and lowers Repak exposure.

The Commercial Logic Behind Own Brand Choices

Retailers optimise for:

-

Fewer SKUs

-

Lower admin

-

Predictable cost

Sustainability here is a cost-control tool, not a brand story.

What Branded Suppliers Can Learn

Own brand proves that:

-

Sustainability scales when design discipline exists

-

Simpler packaging survives regulation better

-

Volume efficiency offsets compliance cost

Packaging Sustainability and SKU Decisions

Why SKUs Are Disappearing

In Ireland, sustainability pressure accelerates SKU reduction because:

-

Each SKU carries reporting cost

-

Each format multiplies admin

-

Each pack size adds risk

Low-volume SKUs increasingly fail economic tests.

How Businesses Respond

Typical responses include:

-

Dropping niche pack sizes

-

Aligning formats across channels

-

Reducing material variation

This is not trend-driven.

It is math-driven.

Who Must Do What (Quick Reference)

Businesses that must act now in Ireland:

-

Beverage producers → DRS mandatory

-

FMCG suppliers → Repak registration

-

Importers → EPR reporting

-

Own-brand owners → Full compliance responsibility

There is no exemption for size or intent.

Cost Summary Table: Where the Money Goes

| Cost Area | Direct | Indirect |

|---|---|---|

| Repak fees | ✔ | |

| DRS admin | ✔ | |

| Packaging redesign | ✔ | |

| SKU rationalisation | ✔ | |

| Internal reporting | ✔ |

Most costs are structural, not visible on invoices.

Why Understanding Compliance Early Matters

Late compliance leads to:

-

Emergency redesigns

-

Delistings

-

Margin erosion

-

Buyer friction

Early understanding allows:

-

Planned transitions

-

Cost smoothing

-

SKU prioritisation

Conclusion: Sustainability as an Operating Reality

Packaging sustainability in Ireland is no longer a future ambition or a branding exercise.

It is:

-

A cost structure

-

A listing requirement

-

A design constraint

-

A commercial filter

The businesses that succeed are not those with the most ambitious sustainability language — but those that understand how DRS, EPR, and EU rules reshape everyday decisions.

In Ireland, the winning formula is clear:

Compliant. Good enough. Scalable.

That is not a compromise.

It is commercial survival.