Private Label Growth in Spain 2025 is moving faster than most retailers expected. Spain now has one of the highest private-label shares in Europe, and store brands have become the first choice for many households. Shoppers trust the quality, like the pricing, and see supermarket labels as a normal part of their weekly shop, not a cheaper fallback.

Spain Leads Europe In Private Label Share

Spain has been a private-label leader for more than a decade, but the gap widened in 2024 and early 2025. Private-label penetration rose again as shoppers stayed price-sensitive, searched for dependable quality, and found fewer reasons to return to national brands.

Retailers across Spain have used a simple formula: good quality, clear pricing, wide choice. That formula now shapes big weekly baskets, not only basic staples.

Compared with Northern Europe, Spain has a stronger emotional link to store brands. Many households trust supermarket labels as much as — or even more than — national brands. The combination of consistent quality and value has made private label part of everyday life, not a backup option.

This is also why Spain is often used as a reference market in wider European discussions about Private Label Europe.

Mercadona’s Private Label Dominance

Mercadona remains one of Europe’s strongest private-label retailers. The scale of Hacendado (food), Deliplus (beauty), Bosque Verde (household) and Compy (pet care) gives the chain real control over quality and pricing.

Hacendado continues to set the tone for Spanish private label. Offer depth is wide, quality is stable and prices remain competitive even when input costs fluctuate. A strong supplier network across Spain also helps keep shelves full and fresh categories reliable.

Deliplus strengthened its presence in personal care during 2024–2025. Many shoppers now choose Deliplus over national brands because the packaging, performance and shelf visibility feel premium but the prices stay accessible. It fits the Spanish pattern: shoppers look for value without feeling they are “trading down”.

Bosque Verde has become a household staple with cleaning products that compete directly with big A-brands. Mercadona keeps the range simple but effective. The result is trust built over many years.

Mercadona’s leadership matters because it shapes the entire market. When Mercadona adjusts a price, changes pack design or introduces a new ready meal, competitors often react within weeks.

Carrefour Spain’s Three-Tier Architecture

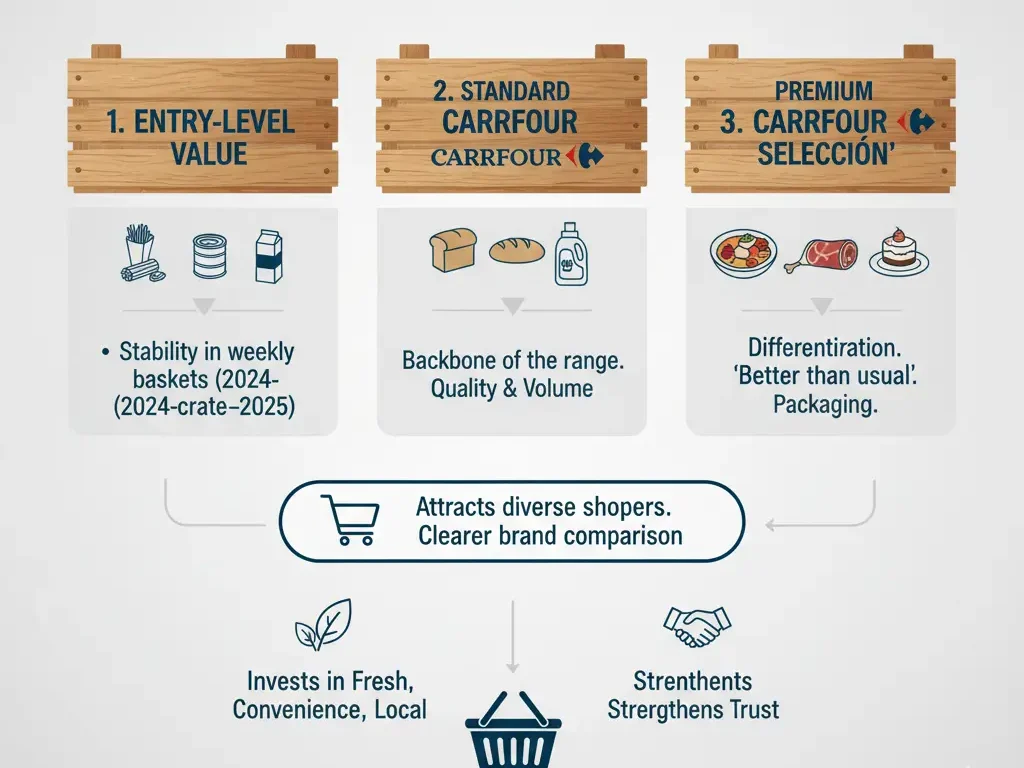

Carrefour Spain has grown its private-label share through a solid three-level structure:

1. Entry-level value

2. Standard Carrefour brand

3. Premium “Carrefour Selección” lines

This architecture helps the retailer attract different shopper groups without confusing the shelf. It also allows clearer comparisons with national brands.

The value tier became more important in 2024–2025 as shoppers looked for stability in weekly baskets. Basic pasta, tinned foods, dairy and cleaning products performed well.

The standard Carrefour brand holds the backbone of the range. These products cover large volumes and push strong quality signals.

Carrefour Selección is where the chain brings differentiation. Ready meals, cured meats, desserts and bakery items in this tier appeal to shoppers who want something “better than the usual” but still expect competitive pricing. The design and packaging are key to the appeal.

Carrefour Spain also invests heavily in fresh, convenience and local suppliers. These efforts feed into the private-label story and strengthen shopper trust.

DIA’s Value-Driven Relaunch

DIA has gone through several years of repositioning, but 2024–2025 marked a clearer shift back to value and simplicity.

The chain focused on improving:

- pricing clarity

- product quality

- category consistency

- supplier partnerships

DIA now leans heavily on private label to deliver value. The relaunch refreshed packaging, stabilised product recipes, and simplified the range in many categories. The goal is to rebuild shopper trust and create a clear point of difference from competitors.

Private label is central to DIA’s comeback strategy. Many stores now highlight value items more visibly, especially in chilled and bakery areas. DIA’s share in private label rose during inflationary periods, and shoppers returned when quality improved.

Fresh, Bakery and Ready Meals: Spain’s Fastest-Growing PL Categories

Private label is advancing across most departments, but several categories stand out as the fastest movers.

Fresh Produce

Spanish shoppers care deeply about the origin and freshness of their produce. Retailers use private label to guarantee consistency and highlight regional sourcing. This helps reconnect customers to local supply and keeps trust strong.

This trend connects naturally with Fresh Produce Trends across Europe.

In-Store Bakery

Spain has one of the strongest in-store bakery cultures in Europe. Private-label bakery items — breads, pastries, buns — continue to grow because shoppers feel they are getting fresh quality at better prices. The simplicity of buying bakery under the supermarket brand also supports impulse purchases.

Ready Meals and Prepared Dishes

Ready meals are a fast-expanding category. Mercadona, Carrefour and regional chains have all invested to meet rising demand for convenience. Spanish households want quick meals that still taste homemade. Private-label lines now include fresh pastas, tapas-style dishes, rice bowls, premium salads and chilled international meals.

This category also benefits from strong packaging innovation, which helps store brands stand out on the shelf.

Household Essentials

Cleaning, laundry and paper products remain stable private-label performers. Spanish shoppers value the balance between quality and final price. This category saw big shifts during inflation and continues to deliver high private-label penetration.

Why Spanish Shoppers Choose Private Label

Private-label growth in Spain is not driven by one factor. It is a combination of trust, price, quality and culture.

1. Strong Long-Term Trust

Spain’s relationship with private label is established. Many families grew up with supermarket brands and see them as reliable and honest choices. Trust comes from predictable quality, clear labels, and everyday consistency.

2. Price Sensitivity After Years of Inflation

Inflation changed how Spanish households think about shopping. Even as inflation eased, people continued searching for stable value. Private label offered that stability. A-brands struggled to win back shoppers because the price gap stayed wide.

3. Local and Regional Identity

Spanish retailers highlight local sourcing, regional recipes and Spanish suppliers. This helps private label feel “authentic”, not generic. Many customers like supporting Spanish suppliers while saving money.

4. Quality Now Matches A-Brands

Over the last decade, Spanish retailers invested quietly in product development. Today the gap between private label and national brands is much smaller. In many categories, shoppers feel store brands are as good or better.

5. Clear Shelf Layout

Spanish stores keep private label simple and visible. Good signage, clean tiers and fewer overlapping lines make it easy to navigate the aisles. When shelves are simple, people choose what they know.

Full-Market View: Beyond the Big Three

Spain’s private-label story goes further than Mercadona, Carrefour and DIA. Regional and online retailers are also pushing the market forward.

Eroski

Eroski, strong in the Basque Country, Navarra and surrounding regions, continues to push private label with a strong local identity. Many shoppers trust the brand because of regional roots and fresh sourcing.

Consum

Consum performs well with families and focuses on clear value. Bakery and fresh ready meals show growth, supported by consistent quality and everyday prices.

Alcampo

Alcampo maintains a large private-label footprint with strong offers in produce, meat, bakery and household products. The chain uses store brands to keep its hypermarket formats attractive.

Lidl Spain

Lidl is an important part of the picture. The retailer continues to gain market share with strong private-label offers, weekly promotions and premium lines in bakery, dairy and ready meals.

Forecast For 2026

Private-label growth is expected to continue into 2026, but the shape of the market will evolve.

More Premiumisation

Premium private-label lines will expand further. Retailers will add chef-inspired dishes, higher-quality ingredients and more restaurant-style prepared foods.

Fresh and Convenience Will Lead

Fresh and ready-to-eat products will see the highest growth. Spanish shoppers want quality and convenience without paying a national-brand price.

Cleaner Packaging and Reformulation

Retailers are expected to invest in cleaner ingredient lists, improved nutritional profiles and more sustainable packaging. This is becoming a key driver for younger households.

Stronger Competition With A-Brands

National brands will push harder with promotions, but the overall momentum remains with private label. The trust and value built during inflation will not disappear quickly.

E-commerce Integration

Online channels will keep expanding. Private-label ready meals, bakery and chilled categories are performing well in click-and-collect baskets.

Why It Matters for Retailers And Suppliers

Private-label growth in Spain is not a short-term shift. It is a structural change. Retailers now build their strategies around private label, not around national-brand negotiations. Suppliers who work with retailers on innovation, reformulation and packaging will stay competitive in this landscape.

For international suppliers looking to enter Spain, understanding how private label works is essential. Spain is not a market where brands automatically win on recognition or heritage. They must compete on value and quality.

This also means Spanish private label will continue influencing wider European strategies, and its trends often feed into broader conversations seen in A-Brands articles and industry analysis. And as Private Label Growth in Spain 2025 continues shaping shopper habits, the pressure on A-brands and retailers will only rise in the next year.