Private Label Growth has become one of the most powerful shifts in the UK grocery market in 2025.

From household staples to gourmet ready meals, own-brand lines are now driving supermarket profits and reshaping how shoppers see value, quality, and trust.

Across the country, the lines between national brands and private labels are blurring. Supermarkets are investing heavily in design, taste, and sourcing — proving that store brands can compete head-to-head with A-brands.

Why Private Label Growth In UK Supermarkets Keeps Accelerating

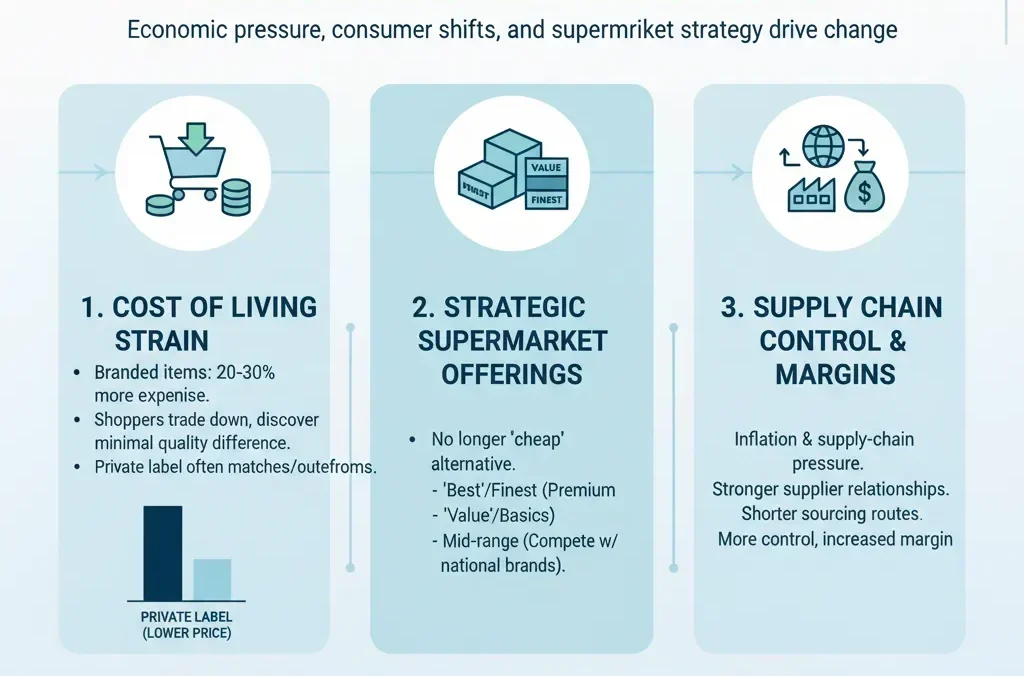

The rise of Private Label Growth in the UK didn’t happen overnight. It’s been building for years through economic pressure, consumer confidence shifts, and supermarket strategy.

According to Kantar and IGD data, private-label products now account for around 53% of sales at Aldi, 67% at Lidl, and 52% at Tesco. Even mid-market players like Sainsbury’s and Morrisons are seeing strong performance from their premium and value tiers.

The reasons are clear.

First, shoppers continue to feel the cost-of-living strain. Branded items are often 20–30% more expensive than comparable private-label goods. When households trade down, they often discover that quality differences are minimal — or in some categories, private label even outperforms.

Second, supermarkets are no longer treating own-brand as a cheap alternative. They’re creating sub-ranges that target specific segments: “Best” or “Finest” tiers for premium, “Value” for basics, and mid-range lines that compete directly with national brands.

Finally, inflation and supply-chain pressure have encouraged retailers to build stronger supplier relationships and shorten sourcing routes. That gives supermarkets more control — and more margin.

The result: Private Label Growth UK supermarkets are experiencing in 2025 is not just a temporary phase. It’s a structural shift in how the grocery market works.

Supermarkets’ Focus On Quality And Innovation

Private Label Growth in the UK is not driven by low price alone. Quality and innovation are at its core.

Tesco, for example, has re-engineered its Tesco Finest and Plant Chef lines with upgraded recipes and cleaner packaging. Sainsbury’s has refreshed its Taste the Difference range, focusing on local sourcing and seasonal ingredients.

At Asda, the relaunch of its Extra Special collection included new bakery and deli products with better packaging and provenance messaging. Marks & Spencer, long a benchmark for private label quality, continues to influence others by linking premium quality with strong ethical standards.

Innovation is another reason why private label growth can sustain momentum in uk. Aldi and Lidl have shown how new product development (NPD) can mirror branded launches — from protein yoghurts to plant-based ready meals — often hitting shelves faster and cheaper.

Supermarkets are using customer data, loyalty apps, and AI-driven analytics to test what shoppers want and roll out quickly. When a new trend appears — such as air-fryer meals or Mediterranean meal kits — private label can move faster than multinational brands bogged down by global approvals.

Packaging has also evolved. Retailers like Waitrose and Co-op are testing recyclable films, paper trays, and refill systems. These efforts reinforce the idea that own-brand can be both premium and sustainable.

In short, quality and innovation have turned private label from a cost-saving option into a creative growth engine.

Discounters’ Role In Shaping Private Label Growth

If there’s one group leading Private Label Growth, it’s the discounters.

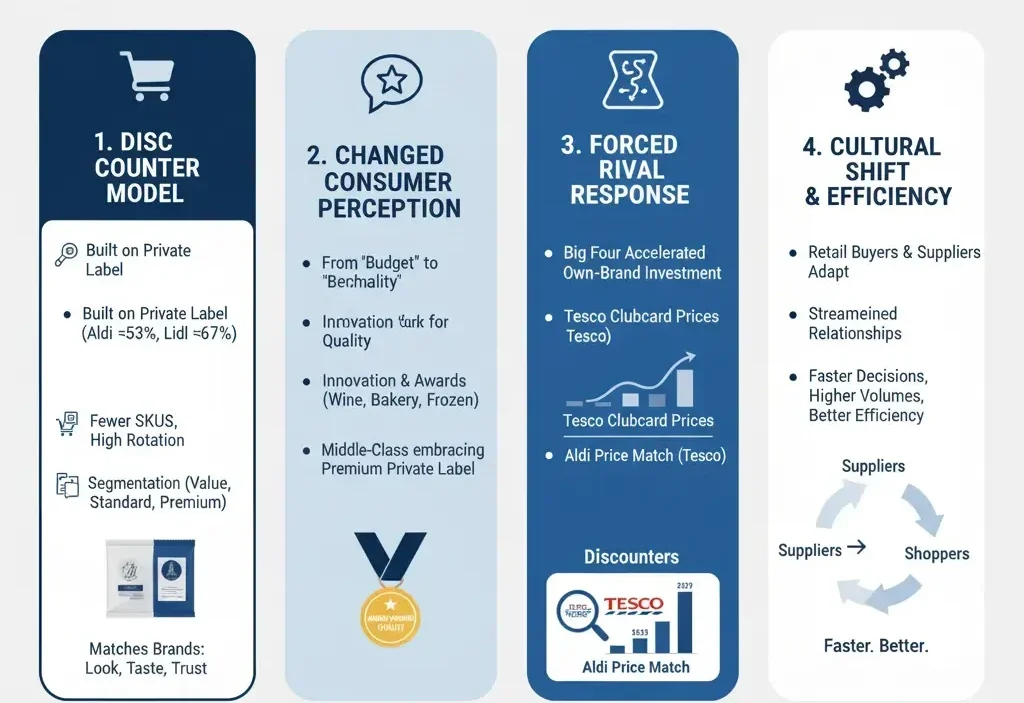

Aldi and Lidl have built their business models around private label from day one. In 2025, their ranges account for most of their shelf space — 53% for Aldi and 67% for Lidl — showing how central own-brand is to their identity.

Their model is simple: fewer SKUs, but high rotation and clear segmentation. Products compete directly with brands in look, taste, and trust — often with packaging that evokes the branded equivalent.

This approach has changed how consumers think about private label. Once viewed as “budget,” Aldi’s and Lidl’s ranges are now benchmarks for quality and innovation. Awards for wine, bakery, and frozen meals have reinforced that perception.

Their influence goes beyond their own stores. The success of the discounters forced the Big Four — Tesco, Sainsbury’s, Asda, and Morrisons — to accelerate investment in own-brand. Tesco’s Clubcard Prices and Aldi Price Match campaigns strengthened the message that private label equals value.

At the same time, the middle-class shopper profile has changed. Many now buy both branded products and premium private labels in the same basket. Aldi’s “Specially Selected” or Lidl’s “Deluxe” ranges make that possible.

Discounters also created a cultural shift in how retail buyers and suppliers work together. Their streamlined supplier relationships mean faster decisions, better efficiency, and higher volumes — all key to sustainable Private Label Growth.

Impact On A Brands And Supplier Relationships

The expansion of private label growth UK markets are seeing has deeply affected A-brand manufacturers.

Big food companies now face shelf competition not only from each other but from the same retailers they supply. This dual role — supplier and competitor — creates tension. Supermarkets have used their insight into sales data and shopper behaviour to launch rival products that undercut brands while targeting their customer base.

Some brands are responding by focusing on innovation, marketing, or niche categories where private label penetration is still low (like confectionery or pet care). Others are choosing to partner rather than compete — becoming contract manufacturers for supermarket labels.

For suppliers, this shift has both risks and rewards.

Margins are tighter, and competition is fierce. Yet, long-term partnerships with major supermarkets can bring stability, scale, and predictable volume.

Private label manufacturing is now a serious growth opportunity in itself. UK-based firms such as Bakkavor, Greencore, and 2 Sisters Food Group are key production partners for ready meals, salads, and chilled foods sold under supermarket brands.

Their growth mirrors that of the retailers. Bakkavor supplies M&S and Tesco with high-quality chilled dishes, while Greencore works with Asda, Sainsbury’s, and Co-op on convenience foods. Both report that supermarket own-brand demand has increased steadily since 2022, particularly in categories like fresh prepared meals and sandwiches.

Meanwhile, A-brand suppliers must find new ways to justify their higher prices — often through heritage, emotional branding, or health credentials. But as inflation stabilises and consumers stay cautious, that becomes harder.

Ultimately, the rise of private label has rebalanced the power between manufacturers and retailers — giving supermarkets more influence than ever before.

Premiumisation And Consumer Trust

Private Label Growth isn’t only about affordability; it’s also about aspiration.

Premium own-brand lines are now shaping how shoppers see value. Tesco’s Finest, Sainsbury’s Taste the Difference, and Aldi’s Specially Selected have become status symbols for everyday shopping — products that deliver indulgence without the luxury price tag.

These ranges also strengthen trust. Consumers who enjoy a positive experience with a retailer’s premium line often extend that trust to other products under the same brand. It creates what analysts call a “halo effect” — loyalty built on reliability and familiarity.

For supermarkets, this emotional connection is invaluable. It turns casual shoppers into long-term customers and supports category expansion. M&S Food, for instance, has leveraged this effect to drive cross-sales from bakery to frozen foods.

Private label also plays a key role in sustainability and transparency. Retailers have more control over sourcing, packaging, and environmental claims. Shoppers can trace where meat, fish, or produce comes from — details that branded products often hide behind global supply chains.

All of this contributes to Private Label Growth as both a commercial and cultural phenomenon. It’s changing what it means to “trust” a retailer.

Data, Technology, And The Future Of Private Label Growth

Behind the scenes, technology is fuelling the next wave of Private Label Growth.

Retailers are investing in digital twins, predictive analytics, and AI-driven category planning to forecast demand and manage supplier risk. These tools now sit at the heart of wider store systems too, as highlighted in our overview of retail technology in supermarkets, where digital upgrades are reshaping how grocers plan ranges and control cost.

Automation in warehouses and factories has also cut costs, allowing private-label suppliers to remain competitive. Robotics in salad packing or bakery production lines means higher consistency and lower waste.

E-commerce adds another layer. Online grocery platforms let supermarkets showcase their private-label lines more prominently than in physical stores. Some are now creating digital-only sub-brands or bundling own-brand products into subscription models.

The next step could be co-creation — inviting shoppers to vote on flavours, packaging, or even product names. This direct feedback loop strengthens loyalty and speeds up innovation.

Why Private Label Growth UK Supermarkets Will Continue

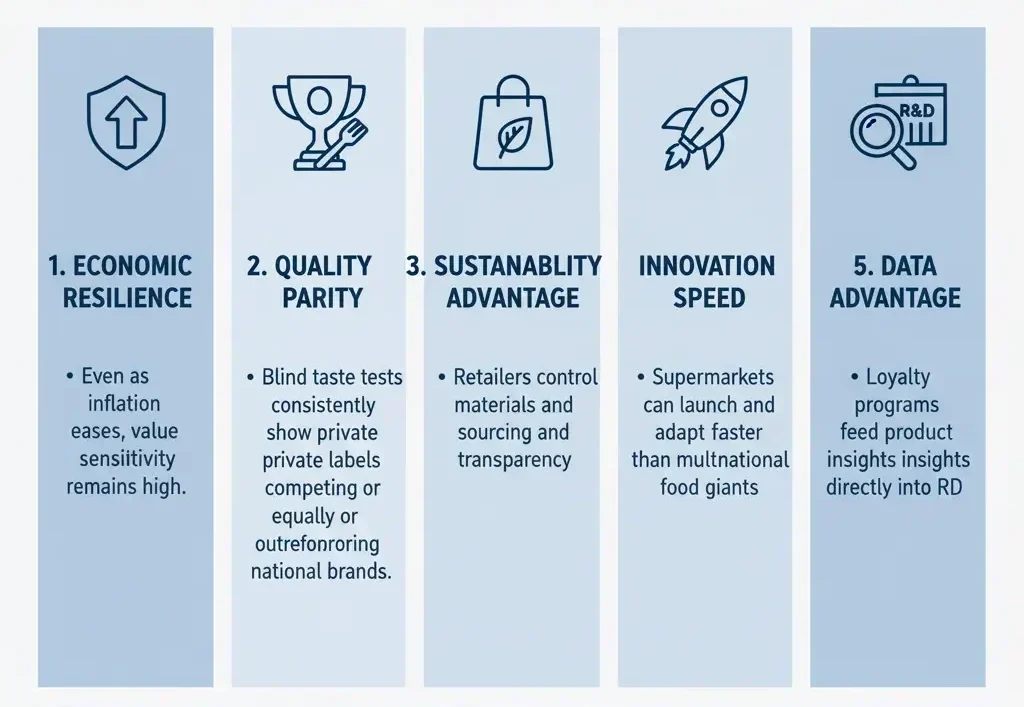

Several structural factors ensure that UK supermarkets are experiencing will not slow down soon.

-

Economic resilience: Even as inflation eases, value sensitivity remains high.

-

Quality parity: Blind taste tests consistently show private labels competing equally or outperforming national brands.

-

Sustainability advantage: Retailers control materials and sourcing transparency.

-

Innovation speed: Supermarkets can launch and adapt faster than multinational food giants.

-

Data advantage: Loyalty programmes feed product insights directly into R&D.

All these elements make private label not just a defensive play but a long-term strategy.

How Premium Own Brands Redefine Consumer Trust

Private Label Growth has redefined the UK supermarket landscape. What started as an alternative for cost-conscious shoppers has become a cornerstone of brand identity and shopper loyalty.

Supermarkets now manage complex portfolios of own-brand products that deliver both profit and prestige. The boundaries between retailer, manufacturer, and brand are fading.

In 2025 and beyond, the challenge will be maintaining consistency and transparency as ranges expand. Shoppers expect value and quality — but they also demand ethics, clarity, and authenticity.

Private label will continue to evolve: cleaner ingredients, smarter packaging, digital traceability, and global sourcing networks that respond to local needs.

For UK supermarkets, the story of Private Label Growth is far from over. It’s the foundation of the next decade of retail competition.

Note: All market share figures (Aldi 53%, Lidl 67%, Tesco 52%) and trend observations are based on verified data from Kantar, IGD Retail Analysis, and company annual reports (2024–2025).

Additional context on retailer strategies, supplier partnerships, and category trends was drawn from Tesco, Sainsbury’s, Asda, Morrisons, Aldi, Lidl, and M&S public updates, combined with grocerytradenews means our editorial analysis.