Private label in Asia is growing because retailers want control and stability, not because shoppers are trading down.

Across Asia, private label ranges are expanding. But the reason is often misunderstood.

This is not a repeat of what happened in Europe. It is not mainly about consumers abandoning brands. And it is not driven by price alone.

In many Asian markets, brands are still powerful. Brand loyalty remains strong. In some categories, brands continue to dominate shelf space and marketing spend.

So why is private label still growing?

Because retailers are responding to risk.

Supply risk. Cost volatility. Import dependence. Margin pressure that cannot be solved with promotions alone.

This article explains what is really happening — and why private label in Asia follows a very different set of rules.

Why private label is growing in Asia

-

Retailers want more control over supply

-

Import risk and cost swings increased

-

Strong regional OEM manufacturing supports store brands

-

Brands still lead many categories, so growth is selective

In Europe, private label grew because shoppers trusted retailers to deliver quality at a lower price. Over time, store brands became normal, even preferred.

Asia is different.

In most Asian markets:

-

Brands still carry strong trust

-

Price is not the only decision factor

-

Status and familiarity matter

-

Gifting culture influences buying behaviour

This means private label does not replace brands in the same way.

Instead, private label grows quietly. It fills gaps. It stabilises ranges. It gives retailers leverage.

A simple comparison helps explain this difference:

| Region | Main Driver Of Private Label |

|---|---|

| Europe | Value and shopper trust |

| United States | Margin and differentiation |

| Asia | Control and supply resilience |

Private label in Asia is less about winning hearts.

It is more about reducing exposure.

Why Retailers Are Pushing Private Label Now

The timing matters.

Private label existed in Asia before. But it was often limited, cautious, and focused on basics.

What changed is not consumer behaviour first.

What changed is the operating environment.

Retailers now face:

-

Higher freight costs

-

Currency volatility

-

Less predictable imports

-

Greater pressure on working capital

In this context, private label becomes a tool.

Across many Asia supermarket groups, store brands are used to:

-

Secure reliable volume

-

Reduce dependence on single suppliers

-

Protect margin without aggressive price cuts

This does not require large ranges.

It requires dependable ones.

Private label allows retailers to plan better — even if sales growth is modest.

How Supply Chain Risk Changed Retail Strategy

Supply chain risk is not theoretical. It is operational.

Retailers across Asia rely heavily on imports. Many categories depend on long shipping routes, multiple intermediaries, and foreign currencies.

When any of these fail, shelves suffer.

Private label helps in three practical ways:

-

Shorter supply chains

Retailers can source regionally instead of globally. -

Fewer decision layers

Negotiations are simpler when the retailer controls the product. -

More predictable availability

Production can be aligned with demand forecasts.

This does not eliminate risk.

But it reduces surprises.

For retailers, fewer surprises matter more than slightly higher margins.

Why OEM Manufacturing Matters More In Asia

One reason private label can grow at all in Asia is manufacturing structure.

Asia already produces a large share of the world’s FMCG products.

OEM and contract manufacturing are deeply established.

This means:

-

Factories already meet global quality standards

-

Production lines are flexible

-

Multi-client manufacturing is normal

Private label does not require building new capability.

It uses what already exists.

| OEM Factor | Why It Matters |

|---|---|

| Scale | Faster volume ramp-up |

| Experience | Consistent quality |

| Flexibility | Lower risk for retailers |

This is why private label in Asia often looks “quiet”.

There is no need for loud innovation.

Execution matters more.

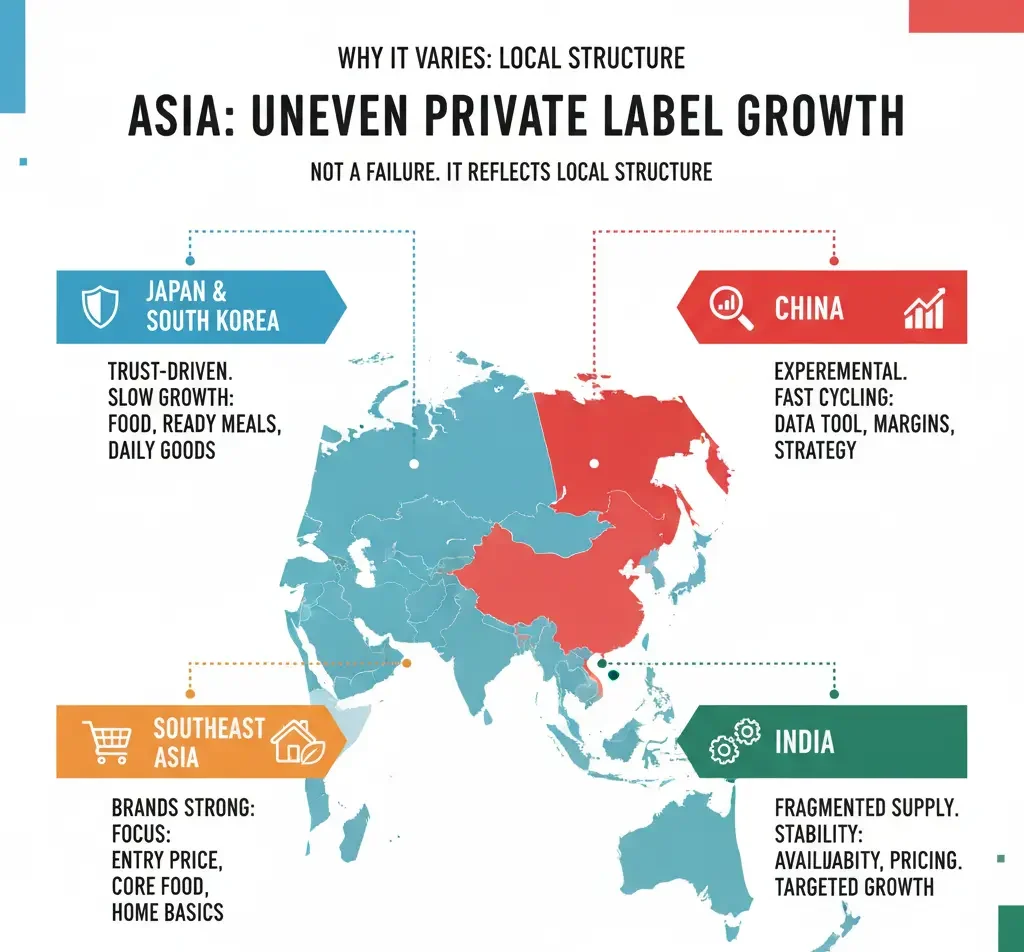

Why Private Label Growth Looks Uneven Across Asia

Private label growth is not uniform across the region.

That is not a failure.

It reflects local structure.

Japan And South Korea

These are trust-driven markets.

Shoppers expect high quality.

Retailers move carefully.

Private label grows slowly, often in:

-

Food staples

-

Ready meals

-

Daily-use categories

Ranges stay narrow. Quality control is strict.

China

Private label in China is more experimental.

Large retail platforms test products quickly.

Poor performers are removed fast.

Private label is used as:

-

A data tool

-

A margin buffer

-

A way to control category economics

It is not always visible — but it is strategic.

Southeast Asia

Brands remain very strong.

Private label focuses on:

-

Entry price points

-

Core food items

-

Household basics

Retailers avoid range expansion that could upset key suppliers.

India

India is different again.

Supply chains are fragmented.

Retailers use private label to stabilise availability and pricing, not to displace brands.

Growth is careful and targeted.

Why Private Label Ranges Stay Narrow In Asia

This is one of the most misunderstood points.

Many assume limited private label ranges mean limited ambition.

In reality, narrow ranges are intentional.

Asian retailers keep private label ranges small because:

-

Fewer SKUs reduce execution risk

-

Quality control is easier

-

Brand relationships stay balanced

-

Inventory exposure is lower

A small range that sells reliably is better than a wide range that underperforms.

In Asia, discipline beats scale.

Why Cheaper Pricing Is Not The Main Goal

Private label is often cheaper.

But cheaper is not the main objective.

In many Asian markets:

-

Price gaps between brands and private label are modest

-

Retailers avoid extreme undercutting

-

Private label sets a value reference, not a race to the bottom

| Role | Brands | Private Label |

|---|---|---|

| Innovation | Lead | Follow |

| Trust | Strong | Growing |

| Price reference | High | Stabilising |

Private label helps retailers anchor value without destroying category economics.

That balance matters.

How Packaging Strategy Reflects Lower Risk Appetite

Packaging tells a story.

Private label packaging in Asia is often conservative.

This is not a design weakness.

It is a risk decision.

Many retailers work closely with an Asia packaging company to:

-

Keep costs predictable

-

Ensure compliance across markets

-

Avoid overstated claims

Common features include:

-

Simple layouts

-

Clear labelling

-

Familiar formats

Packaging is designed to reassure, not excite.

That fits the strategy.

What This Means So Far

By this point, one thing should be clear:

Private label in Asia is not about replacing brands.

It is about building resilience.

Retailers are not chasing trends.

They are managing exposure.

Why Brands Still Control Most Shelf Space In Asia

Private label is growing.

But brands still dominate most Asian supermarket shelves.

This is not a contradiction.

In many Asian markets, brands represent:

-

Trust built over decades

-

Familiar taste and quality

-

Social status, especially in food and gifting

-

Heavy advertising support

Retailers understand this.

Private label is not used to challenge brands head-on.

It is used to support category stability.

Removing brands would increase risk.

Keeping brands while adding limited private label reduces it.

This balance explains why shelf space shifts slowly, not dramatically.

Why Private Label Growth Is Additive, Not Replacive

A key mistake in private label analysis is assuming replacement.

In Asia, growth is mostly additive.

Private label usually:

-

Fills entry price gaps

-

Covers basic daily needs

-

Supports private value tiers

Brands remain essential for:

-

Innovation

-

Premium segments

-

Emotional connection

This is why retailers protect brand relationships carefully.

Private label growth works best when it does not provoke conflict.

What Successful Private Label Actually Looks Like In Asia

This section matters for readers trying to apply lessons.

Successful private label in Asia is:

-

Narrow in range

-

Stable in supply

-

Quiet in marketing

-

Consistent in quality

Success is not measured by:

-

Fast SKU expansion

-

Loud launches

-

Frequent redesigns

It is measured by:

-

Reliable sell-through

-

Predictable margin

-

Low operational friction

Retailers value calm performance more than excitement.

Why Premium Private Label Moves Slowly In Asia

Premium private label exists.

But it grows slowly.

This is not because consumers reject quality.

It is because expectations are high.

In many Asian markets:

-

Premium equals brand reputation

-

Shoppers are cautious with unknown labels

-

Trust takes time to build

Retailers therefore move carefully.

Premium private label often appears first in:

-

Ready meals

-

Health-led categories

-

Limited seasonal offers

Even then, volumes remain controlled.

Why Data And Discipline Matter More Than Innovation

Innovation gets attention.

Discipline delivers results.

Asian retailers use private label to:

-

Test pricing tolerance

-

Understand demand elasticity

-

Manage category economics

Data shapes decisions.

Products that do not perform are removed quickly.

Successful lines are kept unchanged for long periods.

This reduces waste and execution risk.

How Retailers Manage Brand Relationships Carefully

Brand relationships remain critical.

Retailers avoid:

-

Aggressive copycat products

-

Direct brand displacement

-

Excessive price undercutting

Instead, private label is positioned:

-

Alongside brands

-

At clear value points

-

Without confusing shoppers

This approach keeps suppliers engaged and shelves balanced.

Why Private Label Will Not Follow A European Path

This is a key conclusion.

Asia will not repeat Europe’s private label journey.

The reasons are structural:

-

Different consumer expectations

-

Different retail concentration

-

Different brand power

-

Different supply chain dynamics

Private label will grow.

But it will stay selective.

Scale will come through consistency, not speed.

What Happens Next For Private Label In Asia

Looking forward, change will be gradual.

What is most likely:

-

Slow expansion into adjacent categories

-

Greater regional sourcing

-

Better packaging execution, not louder branding

-

More focus on reliability and margin protection

What is unlikely:

-

Rapid category takeover

-

Aggressive brand displacement

-

Large-scale premium rollouts

Retailers will choose safety over spectacle.

Final Conclusion: Rethinking The Narrative

Private label in Asia is growing.

That much is clear.

But the reason matters.

It is not mainly about price.

It is not driven by consumer rejection of brands.

It is driven by retailers responding to risk.

They want:

-

Control

-

Stability

-

Predictable performance

Private label is one of the few tools that delivers all three.

And that is why its role in Asia will keep expanding — quietly, carefully, and on its own terms.