Private label margins continue to outperform branded products in 2025 — even after two years of inflation pressure, supply chain disruption, and cost volatility.

That result surprises some observers.

It does not surprise retailers.

While much of the public conversation around PL focuses on growth, penetration, or consumer trade-down, margin performance tells a more structural story. One rooted in control. Ownership. And how supermarkets design their buying systems.

This article explains why private label margins remain structurally higher than brands, what retailers control that brands do not, and where real margin pressure does appear — without exaggeration.

Private label Margins Are Structural, Not Cyclical

The first mistake many competitor articles make is treating PL margin strength as a temporary effect of inflation.

It is not.

PL margins are higher because the economic structure is different, not because retailers got lucky during price shocks.

At a basic level, PL removes layers that brands depend on:

-

Brand marketing budgets

-

National media spend

-

Sales agents and trade marketing

-

Branded innovation risk

Those costs do not disappear.

They simply never exist inside the PL model.

In 2025, that difference matters more than ever.

Brands are still carrying long-term cost commitments made in a low-inflation world. Retailers are not.

Cost Control vs Brand Dependency

Brands are structurally dependent on retailers.

Private label is not.

A branded supplier must:

-

Convince a buyer to list

-

Fund promotions to stay listed

-

Absorb retailer margin demands

-

Protect brand price architecture across multiple markets

A retailer running PL does the opposite.

They define:

-

The product specification

-

The acceptable cost range

-

The margin target

-

The shelf role

If costs rise, retailers can adjust specification, pack size, sourcing, or supplier mix without damaging a brand promise.

Brands cannot.

This is why private label margins hold even when input costs rise faster than expected.

Retailers Control The Specification, Not Just The Price

One of the least discussed margin levers in private label is specification control.

Retailers are not simply pricing products.

They are engineering them.

That includes:

-

Ingredient selection

-

Quality tolerances

-

Pack formats

-

Shelf life requirements

-

Logistics design

In 2025, many retailers quietly protected margins by:

-

Reformulating to manage commodity exposure

-

Switching pack materials or grammage

-

Adjusting production geography

-

Simplifying SKU complexity

None of this is visible to consumers.

All of it protects margin.

Brands, by contrast, are locked into product promises that are costly to change.

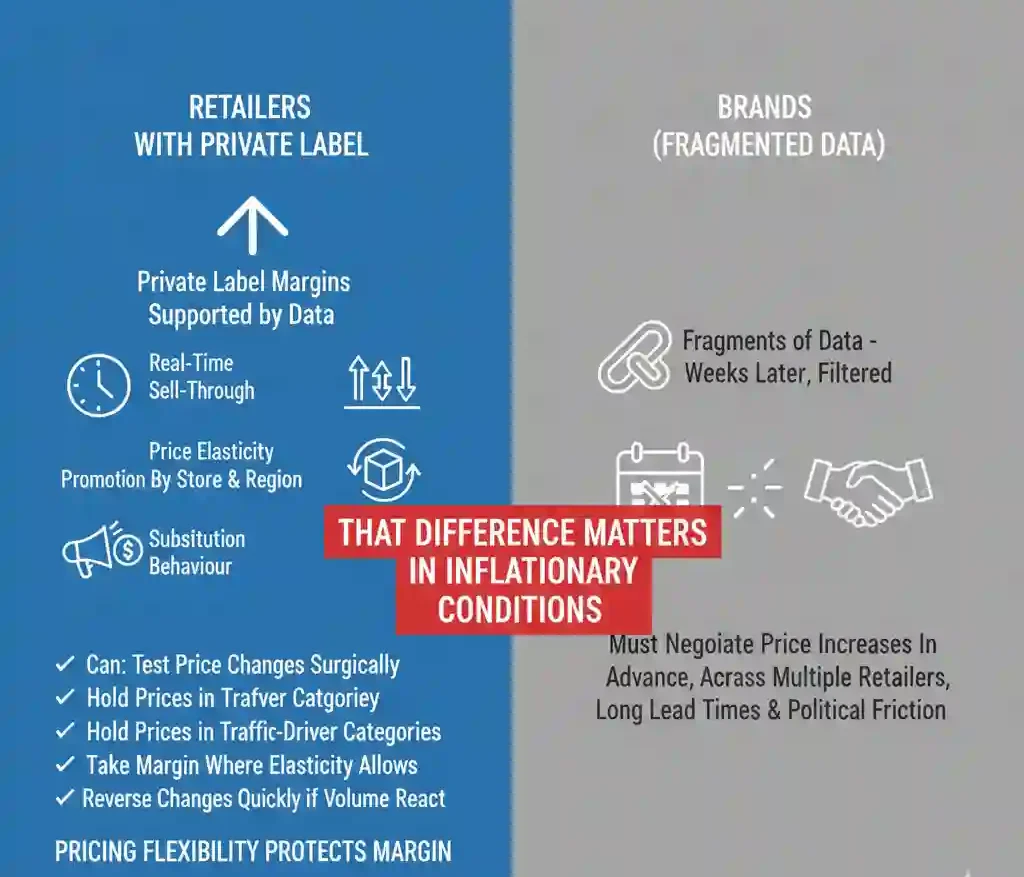

Data Ownership And Pricing Flexibility

Private label margins are also supported by data ownership.

Retailers see:

-

Real-time sell-through

-

Price elasticity by store and region

-

Promotion effectiveness

-

Substitution behaviour

Brands see fragments of this data — often weeks later, filtered through retailer systems.

That difference matters in inflationary conditions.

Retailers running private label can:

-

Test price changes surgically

-

Hold prices in traffic-driver categories

-

Take margin where elasticity allows

-

Reverse changes quickly if volume reacts

Brands must negotiate price increases in advance, often across multiple retailers, with long lead times and political friction.

Pricing flexibility protects margin.

Why Inflation Didn’t Break Private label Margins

Inflation did squeeze private label in specific moments.

It did not break the model.

Here is why.

Retailers were able to spread cost pressure across:

-

Price

-

Pack size

-

Specification

-

Promotion mechanics

Brands largely relied on price alone.

In categories where retailers chose to defend value perception — staples, entry-tier ranges, known price points — margins narrowed temporarily.

In mid-tier and premium private label, margins often expanded.

This is rarely discussed publicly, but it is well understood inside buying teams.

Where Margin Pressure Does Appear (honest balance)

Private label margins are not immune.

Pressure is real in:

-

Protein-heavy categories

-

Energy-intensive manufacturing

-

Highly regulated packaging formats

-

Imported products exposed to currency volatility

In these cases, retailers face a choice:

-

Absorb margin pressure

-

Pass costs to consumers

-

Re-engineer the product

The key difference is optionality.

Private label gives retailers choices.

Brands often have none.

Why Buyer logic Favours Private label In 2025

From a buyer’s perspective, private label is not just a margin tool.

It is a risk management system that is applied differently by market.

In the private label UK market, buyers use own-brand ranges to stabilise pricing in core grocery categories while protecting margin through tiered value, core, and premium lines.

In the private label US market, margin strength is supported by scale, data-led pricing flexibility, and rapid assortment adjustments across large-format stores.

In the private label Switzerland market, buyers rely more heavily on specification control, supplier consolidation, and premium private label positioning to offset higher operating costs — and similar dynamics apply across other European markets, etc.

Buyers value private label because it:

-

Reduces dependency on any single supplier

-

Protects shelf control

-

Improves negotiation leverage with brands

-

Supports long-term category planning

Margins are a result of that control — not the sole objective.

This is why private label continues to expand even as inflation eases.

Private label vs Brand Margins: The Real Takeaway

The margin gap between private label and brands in 2025 exists because:

-

Retailers control costs upstream

-

Retailers own data downstream

-

Retailers can adapt faster than brands

-

Retailers design products around margin, not marketing

This is not a temporary advantage.

It is structural.

As long as retailers continue to invest in private label sourcing, packaging, and data systems — themes explored across existing private label trends and sourcing content — private label margins will remain resilient.

Brands will continue to play a vital role.

But on margins, the economics are clear.

What Happens Next

Margin pressure will not disappear in 2025 or 2026.

Input costs may stabilise, but labour, energy, compliance, and packaging complexity will remain structurally higher than they were before inflation. That reality affects every part of the grocery supply chain — including private label.

What changes is how retailers respond.

The next phase of private label margin management will be less about price increases and more about system design.

Retailers will continue to:

-

Reduce over-specification in own-brand ranges

-

Rationalise pack formats to simplify production and logistics

-

Consolidate suppliers where scale improves cost certainty

-

Use tiered PL architectures to protect entry price points while preserving margin elsewhere

This is already visible across value, core, and premium PL ranges, where margin roles are clearly separated by tier rather than applied uniformly.

Data will play a bigger role.

Retailers are increasingly using transaction-level data to decide where margin can be taken and where it must be protected. That means fewer blanket price moves and more targeted adjustments by category, store cluster, and shopper mission.

For brands, this widens the gap.

As PL becomes more operationally integrated — linking sourcing, packaging, pricing, and shelf logic — branded suppliers face a tougher environment. Negotiations become more data-driven, margin expectations become firmer, and the role of brands shifts further toward differentiation rather than volume defence.

The long-term implication is simple.

PL is no longer just a response to inflation or a value alternative. It is a permanent margin stabiliser built into supermarket operating models.

That is why private label remains one of the most powerful tools in the supermarket margin toolkit — not just in 2025, but structurally, going forward.