Private label has grown quickly over the past decade. In many grocery categories, it now holds a stable and significant share of sales. Price gaps have narrowed, quality perceptions have improved, and private label ranges have expanded across entry, core, and premium tiers.

That period of rapid expansion is now slowing. Not because private label has failed, but because it has reached a natural point of maturity. Shelf space is finite. Ranges are full. Shoppers are familiar with store brands and already make deliberate choices between private label and national brands.

This article looks at what happens next. It explains why growth levels off, what operational maturity looks like for retailers, and how private label strategies are changing as the focus shifts from expansion to control, discipline, and long-term execution.

Executive Summary

Private label has entered a maturity phase defined by slower growth, SKU discipline, tier rationalisation, and higher operational standards.

Future success depends less on launching new products and more on managing ranges, margins, and execution quality.

The Thesis (Direct and Unambiguous)

Private label growth did not stall.

It completed a lifecycle phase.

What follows is not decline—but professionalisation.

Retailers that understand this will protect margins and loyalty.

Those that don’t will overextend ranges, dilute quality, and quietly lose relevance.

Understanding the Private Label Lifecycle

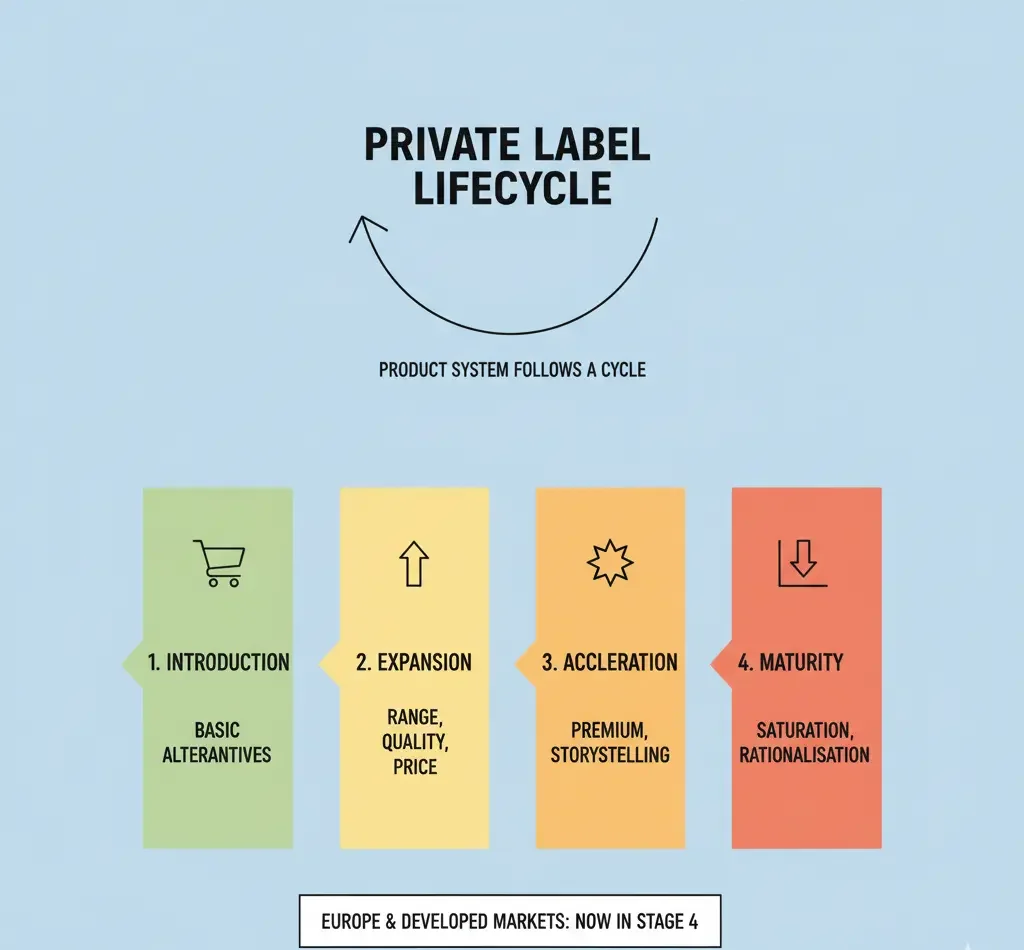

Every product system follows a lifecycle.

Private label is no different.

The Four Stages

-

Introduction – Basic alternatives to national brands

-

Expansion – Range growth, quality upgrades, price positioning

-

Acceleration – Premium tiers, brand-like storytelling, rapid SKU launches

-

Maturity – Saturation, discipline, rationalisation

Most European and developed grocery markets are now firmly in Stage 4.

Why the Maturity Phase Was Inevitable

Private label growth over the past decade was driven by structural tailwinds:

-

Cost-of-living pressure

-

Improved manufacturing capabilities

-

Retailer data advantages

-

Reduced stigma around store brands

But tailwinds don’t last forever.

Three Forces That Made Maturity Inevitable

1. Physical Shelf Limits

Shelf space did not expand with private label ambition. Something had to give.

2. Consumer Ceiling Effects

Shoppers will switch for value—but not endlessly downgrade quality or choice.

3. Operational Complexity

Every new SKU adds cost, risk, forecasting burden, and execution friction.

Growth slowed because systems reached capacity, not because demand vanished.

Who Dominates the Private Label Conversation Today

The current narrative around private label is shaped by three groups:

1. Retailer-Owned Content

-

Optimistic

-

Share-focused

-

Selective with downside risks

2. Consultants and Advisory Firms

-

Slide-heavy

-

Strategy-forward

-

Often disconnected from day-to-day store execution

3. Trade Media and Retail Blogs

-

Growth retrospectives

-

Market share reporting

-

Limited operational depth

What’s missing:

A grounded discussion of what happens after success.

The Gaps Competitors Rarely Address

Gap 1: Market Saturation Is Real

In many categories, private label has already:

-

Captured its core value-seeking shoppers

-

Established quality parity where possible

-

Filled most viable price tiers

Pushing further often means cannibalising existing private label SKUs, not winning new volume.

Gap 2: SKU Discipline Matters More Than Share

Private label teams expanded quickly.

Now they face the consequences.

Symptoms of poor SKU discipline include:

-

Overlapping pack sizes

-

Too many “me-too” premium variants

-

Seasonal SKUs that never exit

-

Marginal products kept for internal politics

This is not innovation.

It is clutter.

Gap 3: There Is a Quality Ceiling

Private label can match brands.

In some niches, it can outperform.

But not everywhere.

Categories with strong emotional, functional, or trust components still impose limits:

-

Infant nutrition

-

Medical or specialist products

-

High-sensitivity personal care

-

Highly technical food formulations

Ignoring these ceilings leads to expensive failures.

What Maturity Actually Looks Like in Practice

Maturity does not mean stagnation.

It means selectivity.

Operational Signs of a Mature Private Label Program

-

Fewer annual launches

-

Clearer tier separation

-

Faster delists of underperforming SKUs

-

Tighter supplier rosters

-

Higher expectations on consistency and supply reliability

This is what adult private label looks like.

Tiering Becomes the Core Strategic Lever

In the growth phase, tiering expanded.

In maturity, tiering stabilises.

Typical Mature Tier Structure

| Tier | Purpose | Key Risk |

|---|---|---|

| Entry | Price defense | Margin erosion |

| Core | Volume and loyalty | Range bloat |

| Premium | Differentiation | Overreach |

| Functional / Special | Targeted needs | Low velocity |

The mistake many retailers make is adding tiers instead of managing them.

Rationalisation Is Not Retreat

Rationalisation is often framed as a negative.

It isn’t.

It is capital discipline.

What Smart Rationalisation Focuses On

-

Removing SKUs with overlapping roles

-

Reducing pack-size redundancy

-

Exiting under-scaled premium experiments

-

Consolidating suppliers per category

The result is:

-

Better forecasting

-

Lower waste

-

Higher on-shelf availability

-

Stronger category clarity for shoppers

Why Fewer Launches Are a Sign of Strength

During expansion, launches signal momentum.

During maturity, restraint signals confidence.

Retailers now ask harder questions:

-

What problem does this solve?

-

Which SKU does it replace?

-

What execution cost does it add?

-

Does it deserve shelf space year-round?

If those questions don’t have clear answers, the launch shouldn’t happen.

What Retailers Are Doing Right Now

Across developed markets, leading retailers are quietly shifting focus.

Key Moves Being Made

1. Range Reviews Are Getting Tougher

Annual reviews are becoming quarterly.

Low-velocity SKUs don’t survive.

2. Supplier Bases Are Shrinking

Fewer partners.

Deeper relationships.

Higher accountability.

3. Packaging Is Being Simplified

Less novelty.

More consistency.

Lower changeover costs.

4. Price Architecture Is Being Rebalanced

Entry tiers protect traffic.

Core tiers protect margin.

The Emotional Shift Inside Retail Organisations

This phase also brings a cultural reset.

Private label teams are moving from:

-

“How fast can we grow?”

to -

“How well can we run this?”

That shift matters.

It changes hiring, KPIs, and internal influence.

What Suppliers Must Understand Now

For suppliers, maturity changes everything.

Old Growth-Phase Assumptions No Longer Hold

-

Endless SKU expansion

-

Easy line extensions

-

Fast onboarding without scale proof

Those days are over.

What Retailers Now Expect From Suppliers

1. Fewer SKUs, Higher Reliability

Consistency beats novelty.

2. Cost Transparency

Margin pressure is permanent, not cyclical.

3. Execution Discipline

Late deliveries matter more than clever ideas.

4. Willingness to Exit Gracefully

Delists are not personal.

Resistance damages relationships.

The Supplier Mistake to Avoid

Trying to replace lost growth with complexity.

-

Custom formats

-

Over-engineered specs

-

Micro-differentiation

In maturity, simplicity wins contracts.

Why This Phase Is Actually Positive

Maturity scares people because it sounds like limits.

In reality, it creates stability.

Benefits of a Mature Private Label System

-

Predictable margins

-

Lower volatility

-

Clearer shopper propositions

-

Better supplier economics

-

Fewer internal firefights

This is not the end of opportunity.

It is the end of chaos.

What Comes Next for Private Label?

Private label’s next phase focuses on discipline, range optimisation, and operational excellence rather than rapid expansion or SKU proliferation.

What Innovation Looks Like After Maturity

Innovation does not disappear.

It changes shape.

Post-Maturity Innovation Focuses On

-

Process efficiency

-

Packaging optimisation

-

Sustainability without cost inflation

-

Data-driven range decisions

-

Faster delist cycles

This is quieter innovation—but more profitable.

The Strategic Question Retailers Must Answer

Not:

“How big can private label get?”

But:

“How well can we run it at scale?”

That distinction separates leaders from followers.

The Strategic Question Suppliers Must Answer

Not:

“How many SKUs can we sell?”

But:

“How indispensable can we become?”

Reliability beats novelty in this phase.

Common Misreads of the Moment

Let’s address them directly.

“Private Label Is Losing Momentum”

No.

It is losing unsustainable acceleration.

“Brands Are Coming Back”

Only where they still earn their space.

“Premium Private Label Failed”

No.

Poorly disciplined premium failed.

What Happens Next (The Next 3–5 Years)

Expect:

-

Flat-to-modest share growth

-

Higher margin scrutiny

-

More delists than launches

-

Supplier consolidation

-

Less noise, more control

This is the adulthood phase.

Final Takeaway

Private label did not peak.

It grew up.

The next winners will not be the loudest.

They will be the most disciplined.

For retailers, that means restraint with confidence.

For suppliers, it means operational excellence over ambition.

And for the industry as a whole, this maturity phase is not a problem to solve—

It is a system to manage well.