In 2025, the most popular Private Label Products in UK supermarkets sit in familiar, everyday categories: chilled ready meals, bakery, dairy, frozen foods, household cleaning and personal care.

This article looks at categories, not exact SKUs, to help retailers, suppliers and co-manufacturers understand where supermarket brands are strongest – and where national brands now face the toughest competition.

Private label is no longer just the cheap alternative.

In many aisles, own-label ranges now define the category, shape shopper expectations and set both price and quality benchmarks.

Why Private Label Favourites Matter

Knowing which categories are home to the most popular Private Label Products in UK supermarkets is more than a curiosity.

For retailers, these “hero” categories drive:

-

basket size

-

shopper loyalty

-

promotional strategy

-

range architecture across good–better–best tiers

For suppliers and co-manufacturers, they point to:

-

where capacity and investment should go

-

which product styles and pack formats are now standard

-

how far quality has moved versus branded offers

Shoppers in 2025 actively choose supermarket brands in multiple categories.

They look for value first, but they stay with private label because quality has improved and packaging looks more professional. In many stores, the visual impression is that private label is the aisle, and brands are the guests.

This is why mapping the strongest categories for Private Label Products in UK supermarkets matters. It shows where own-label has already won, where it is still gaining ground, and where brands must work harder to justify a premium.

Top Everyday Categories

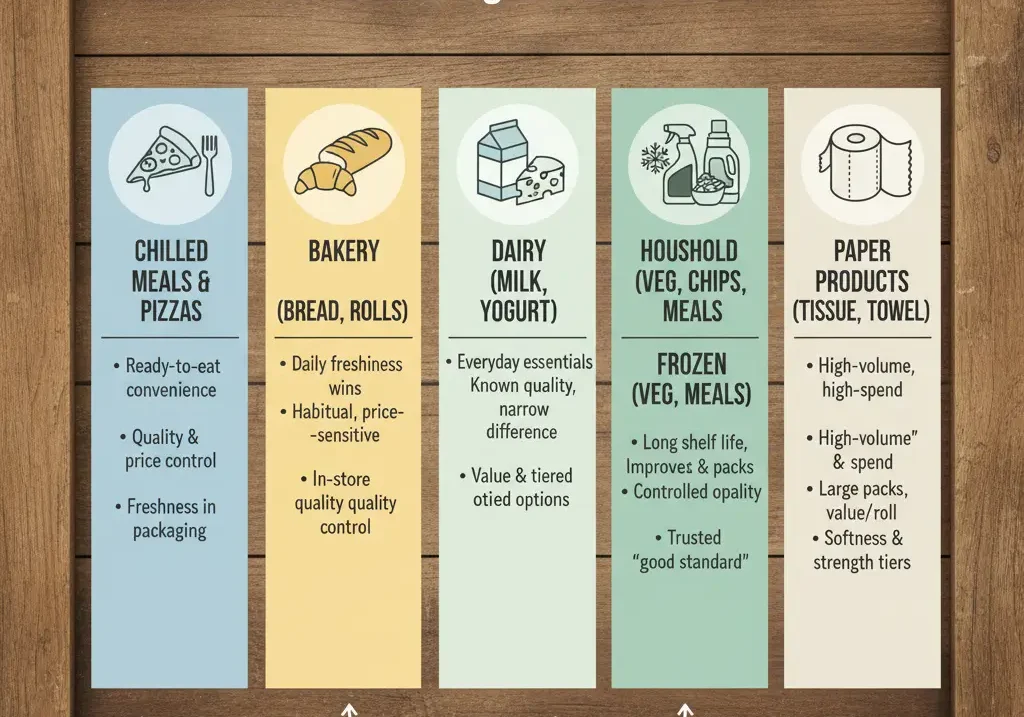

Chilled Ready Meals & Pizzas

Chilled ready meals and pizzas are among the most visible Private Label Products in UK supermarkets.

These ranges work well in private label because:

-

shoppers buy them often

-

quality is easy to judge quickly

-

supermarkets control price points and portion sizes

-

packaging design can convey freshness, health or indulgence

In 2025, both the big four grocers and discounters push own-label chilled pizzas and meals hard. The big four tend to lead on variety and premium tiers – Italian, Asian, Indian, healthier options, calorie-counted ranges. Discounters often focus on a tighter range with sharp price points, but their private-label recipes have improved significantly.

For many households, the “Friday night pizza” or “quick midweek curry” now comes from a supermarket brand, not from a big frozen or chilled brand. This is a clear example of how Private Label Products in UK ready-meal aisles have reset expectations.

Bakery (Bread, Rolls, Pastries)

Bakery is another core private-label stronghold.

Daily staples like sliced bread, rolls, baguettes and simple pastries lend themselves to supermarket brands because:

-

freshness is more important than brand name

-

buying is habitual and price-sensitive

-

in-store bakeries give retailers extra control over quality and timing

Discounters lead strongly in wrapped bread and morning goods, often using bold price communication. Big four supermarkets balance classic private-label loaves with branded lines, but shelf space for own-label has increased steadily.

At the same time, in-store bakery counters and bake-off fixtures give retailers a way to launch more premium private-label croissants, sourdoughs and speciality breads. These are still Private Label Products in there stores, but they compete with artisan-style bakeries on look and feel.

Dairy (Milk, Yogurt, Cheese Slices, Butter)

Dairy has long been one of the most important areas for Private Label Products in UK supermarkets.

Milk, basic yogurts, cheese slices, block cheese and butter tick all the boxes for strong private label penetration:

-

they are everyday essentials

-

shoppers know the product quite well

-

quality differences are narrow at mainstream price points

Most UK grocers now own a large share of dairy shelf space with their own-label lines. Discounters in particular use dairy to signal value, offering large pack sizes at low unit prices.

Big four retailers use tiered structures in dairy:

standard ranges, organic lines, lighter or high-protein yogurts, and premium continental cheeses. These tiers help them trade shoppers up without losing them to brands.

For co-manufacturers, dairy is one of the most competitive spaces for Private Label Products in UK retail. Capacity, consistency and traceability are all critical.

Frozen (Vegetables, Chips, Frozen Meals)

Frozen food has become an important home of reliable, long-lasting Private Label Products in UK supermarkets.

Key private-label favourites include:

-

frozen vegetables and mixed veg

-

chips and potato products

-

frozen pizzas and ready meals

-

frozen fish portions and coated fish

Frozen works well in private label because:

-

long shelf life supports efficient sourcing and storage

-

quality can be tightly controlled through centralised production

-

packaging gives good space for cooking instructions and usage ideas

Discounters have grown quickly in frozen, using strong private-label offers across value and mid-tier. Big four retailers respond with broader ranges, including healthier and air-fryer-friendly products.

The result is that many UK households now see private-label frozen as “good standard” rather than “cheaper backup”. Again, this is a crucial shift for the perception of Private Label Products in UK supermarkets.

Household Cleaning (Laundry, Dishwash, Surface Cleaners)

Household cleaning is one of the categories where private label used to struggle against big brands.

In 2025, that picture is changing.

Supermarket brands have built credibility in:

-

laundry liquid and powder

-

dishwasher tablets and rinse aids

-

multi-purpose sprays and floor cleaners

-

bathroom and kitchen specific cleaners

Why it works now:

-

many shoppers feel formulas are “good enough” at lower prices

-

fragrances and packaging have improved

-

refill packs and concentrated formats support sustainability claims

Discounters have been especially strong in private-label cleaning, often using bolder claims and modern packaging. Big four retailers use both value tiers and more eco-focused ranges to attract different shopper groups.

Household cleaning is now firmly part of the mix when we talk about Private Label Products in UK supermarkets, not just food categories.

Paper Products (Toilet Tissue, Kitchen Towel, Wipes)

Paper products are high-volume, high-spend categories where private label has long had a presence.

Toilet tissue, kitchen towel and household wipes have seen steady private-label growth as shoppers look for:

-

large packs

-

good price-per-roll

-

softer textures and stronger sheets

Retailers have responded with clearer segmentation:

essential basic ranges, improved “soft” or “extra strong” lines, and some premium or eco-focused options with recycled fibres or plastic-free wrapping.

Discounters often lead on price and pack size. Big four retailers focus on balancing brand choice with a strong private-label core that offers both value and soft, higher-count options.

Because these items are bulky and often bought in larger quantities, they play a key role in driving total basket values for Private Label Products in UK supermarkets.

Premium and Treat Products

Private label is no longer only about everyday basics.

Premium and “treat at home” segments are some of the fastest-growing Private Label Products in UK retail.

Key examples include:

-

chilled party food and sharing platters

-

premium ready meals with restaurant-style recipes

-

speciality cheeses and charcuterie

-

premium desserts and patisserie-style cakes

-

own-label wines, prosecco and sparkling wines

Retailers have used tiered branding to make these ranges feel aspirational. Packaging, photography and naming conventions are designed to evoke restaurant dining or special occasions.

For shoppers, this means they can trade up within private label instead of switching to premium brands. A weekend dinner might be built entirely from premium supermarket ranges – starters, mains, sides, desserts and wine – all under the retailer’s own brand.

This premiumisation trend connects with your other content on private label growth and premium tiers across Europe. It shows that Private Label Products in UK supermarkets can cover both value and indulgence at the same time.

Health and Lifestyle Favourites

A final group of strong Private Label Products in UK supermarkets comes from health and lifestyle ranges.

What used to be niche is now mainstream private label:

-

plant-based milks and yogurt alternatives

-

meat alternatives such as burgers, mince and nuggets

-

high-protein yogurts and puddings

-

low- or no-sugar snacks and soft drinks

-

free-from ranges (gluten-free, dairy-free, nut-free, egg-free)

Retailers now treat these lines as core assortment.

They sit in dedicated bays or integrated into main aisles, with clear colour coding and icons to help shoppers navigate dietary needs.

Discounters have entered plant-based and protein categories with value-focused lines, while the big four supermarkets extend their own-label wellness and lifestyle brands across multiple aisles.

This creates both opportunity and pressure for suppliers. Categories that once relied heavily on challenger brands are now open to large-scale production for private label. At the same time, retailers expect innovation – new flavours, formats and textures – not just copies of what is already on the market.

For many health-focused shoppers, these are now some of the most important Private Label Products in UK supermarkets. They choose them deliberately, not just because they are cheaper.

What This Means for Manufacturers

For manufacturers and co-packers, the pattern of Private Label Products in UK supermarkets points to a clear map of where demand is strongest.

Chilled and frozen foods, bakery, dairy, household cleaning and health-focused ranges all require:

-

reliable large-scale production

-

strong technical and quality teams

-

flexible packaging capabilities

-

the ability to support different retailer specifications

Manufacturers that specialise in these areas can build long-term partnerships with retailers, but the bar is high. Retailers expect competitive pricing, speed on new briefs, and support for sustainability goals.

There is also a risk for brand owners operating in categories where private label dominates.

If a category is heavily driven by Private Label Products in UK supermarkets, a “me-too” brand without a clear point of difference can struggle. Packaging, flavour profile, added functionality or exclusive formats may be needed to justify shelf space and a higher price.

For co-manufacturers, the opportunity is to be the engine behind both value and premium tiers. For brands, the challenge is to stand out enough that shoppers see a clear reason to pay more.

Conclusion: The Next Wave of Private Label Favourites

Looking ahead, the next wave of popular Private Label Products in UK supermarkets is likely to build on current trends:

-

functional beverages with added protein, vitamins or energy claims

-

affordable wellness products such as vitamins, supplements and simple skincare

-

more sophisticated frozen and chilled meal kits that simplify home cooking

-

low-impact, refillable or concentrated formats in cleaning and personal care

What is clear in 2025 is that private label is no longer a side story.

From ready meals and bakery to cleaning products and plant-based lines, supermarket brands now shape how UK shoppers eat, clean and treat themselves at home.

For retailers, these categories are central to price image, loyalty and brand identity.

For suppliers, they are the roadmap for investment, innovation and long-term business planning.

And for shoppers, Private Label Products in UK supermarkets have become the new normal – not just for saving money, but for getting the right mix of quality, choice and convenience week after week.