Retail technology did not slow down.

It did not run out of ideas.

It did not fail.

What changed is why supermarkets buy technology at all.

For more than a decade, retail technology was framed as innovation. New tools. New pilots. New concepts. New language. Conferences were built around it. Press releases depended on it. Vendor blogs thrived on it.

Inside supermarkets, that language is now quietly disappearing.

Not because technology is less important — but because innovation stopped being the right objective.

Today, retail technology exists to do one thing above all else: hold the operation together.

This article explains that shift clearly, practically, and operationally — without trend lists, without vendor promotion, and without novelty framing.

What Retail Technology Means Today

Retail technology today is infrastructure.

It is not a showcase.

It is not an experiment.

It is not a differentiator in the way it was once described.

It is the system layer that allows a supermarket business to function under constant pressure.

That pressure comes from everywhere at once:

-

Tight margins

-

Labour volatility

-

Price competition

-

Supply chain instability

-

Regulatory burden

-

Store-level execution risk

Technology is no longer asked to make retail exciting.

It is asked to make retail controllable.

Why Innovation Language Is Fading

“Innovation” sounds positive, but operationally it implies uncertainty.

Innovation suggests change before stability.

It suggests trial before standardisation.

It suggests optionality.

Modern grocery retail has no space for those assumptions.

Supermarkets operate thousands of daily decisions across hundreds or thousands of locations. Every deviation multiplies. Every exception spreads. Every failed test costs real money, not hypothetical opportunity.

As pressure increased, innovation stopped sounding ambitious and started sounding dangerous.

Retail leaders began to avoid the word not because it was wrong — but because it no longer described what they needed.

They needed systems that reduce variation, not create it.

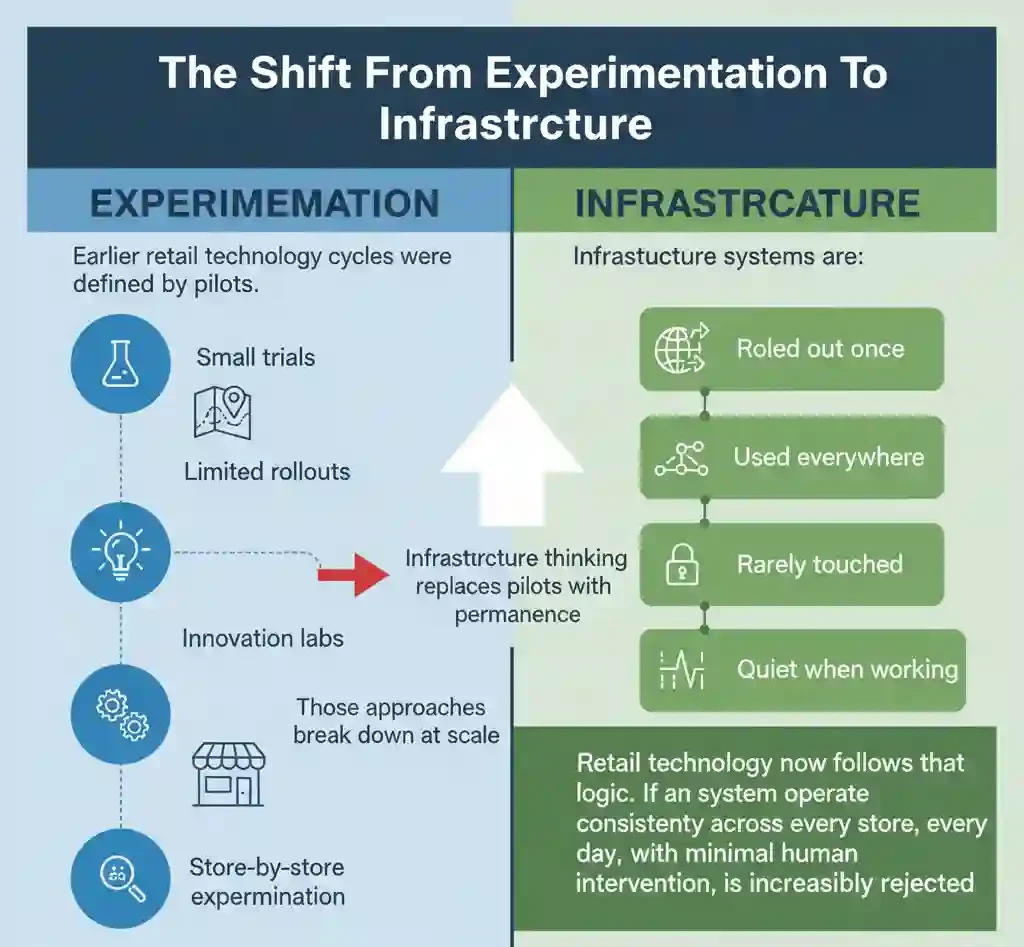

The Shift From Experimentation To Infrastructure

Earlier retail technology cycles were defined by pilots.

Small trials.

Limited rollouts.

Innovation labs.

Store-by-store experimentation.

Those approaches break down at scale.

Infrastructure thinking replaces pilots with permanence.

Infrastructure systems are:

-

Rolled out once

-

Used everywhere

-

Rarely touched

-

Quiet when working

Retail technology now follows that logic.

If a system cannot operate consistently across every store, every day, with minimal human intervention, it is increasingly rejected.

That is not a failure of creativity.

It is a recognition of reality.

Control As The New Core Objective

When supermarkets evaluate technology today, they are asking a different question than before.

They are not asking what the system can do.

They are asking what it prevents.

-

Does it prevent labour overspend?

-

Does it prevent pricing errors?

-

Does it prevent stock imbalances?

-

Does it prevent store-level deviation?

If a system does not reduce risk, it struggles to justify its cost.

Control is not a side effect.

It is the primary outcome.

Labour Control Is The Primary Driver

Labour has become the most unstable input in grocery retail.

Not just expensive — unpredictable.

Absence rates fluctuate.

Turnover remains high.

Skills are uneven.

Availability changes week to week.

Retail technology now exists to make labour behaviour visible, measurable, and adjustable.

Modern labour systems focus on:

-

Hour-by-hour demand modelling

-

Task-level workload planning

-

Automated scheduling rules

-

Productivity benchmarks across stores

This removes discretion from individual managers.

That is deliberate.

Supermarkets no longer rely on judgment alone. They rely on systems that impose structure on labour decisions.

This is not about innovation.

It is about labour exposure control.

Pricing Control Has Replaced Pricing Creativity

Pricing technology was once marketed as optimisation.

Dynamic pricing.

Personalisation.

Real-time adjustment.

Retailers learned the hard way that too much pricing freedom creates chaos.

Modern pricing systems are built around restraint.

They exist to enforce rules, not to explore options.

Key pricing control functions now include:

-

Central approval of price changes

-

Guardrails on promotional depth

-

Margin floor protection

-

Cross-store consistency checks

The aim is not to extract every possible cent.

The aim is to avoid mistakes at scale.

In grocery retail, a small pricing error repeated across hundreds of stores is far more damaging than a missed optimisation opportunity.

Inventory Control Is About Governance Not Prediction

Inventory technology was long framed as a forecasting challenge.

Better data.

Smarter models.

More precision.

Retailers now understand a more uncomfortable truth.

Most inventory problems are not forecasting failures.

They are governance failures.

Too many overrides.

Too many exceptions.

Too many local decisions.

Modern inventory systems are designed to:

-

Standardise replenishment logic

-

Limit manual intervention

-

Highlight exceptions early

-

Assign ownership clearly

The goal is not perfect forecasting.

The goal is predictable execution.

Inventory control is about discipline, not intelligence.

Loss Prevention Is Now Operational Control

Shrink is no longer treated as a standalone security issue.

It is treated as an operational signal.

Modern loss systems focus on patterns, not individuals.

They are used to identify:

-

Process breakdowns

-

Execution gaps

-

Store-level inconsistencies

-

Control failures

Retailers increasingly accept that shrink rises where control weakens.

Technology helps reveal where that is happening.

Again, this is not innovation.

It is operational containment.

Back Office Technology Now Matters More Than Store Technology

One of the clearest signs of the shift is where budgets are allocated.

Customer-facing technology still exists, but it no longer dominates.

The largest investments now sit behind the scenes:

-

Workforce management

-

Pricing engines

-

Demand planning

-

Supplier integration

-

Reporting and governance layers

These systems rarely appear in marketing material.

They rarely excite.

They are critical.

Retailers have learned that a polished front end cannot compensate for a fragile core.

Technology Is Evaluated Like Utilities

Retail technology is now evaluated the way utilities are evaluated.

Not by excitement.

By reliability.

Retailers ask:

-

Will this system still work during disruption?

-

Can it operate without constant support?

-

Does it reduce dependence on individuals?

-

Can it scale without complexity?

Systems that require frequent adjustment, explanation, or justification are increasingly rejected.

The best systems disappear into the background.

That is the goal.

Why Digital Transformation Language Lost Meaning

“Digital transformation” implies a journey with an endpoint.

Retail does not work that way.

Most supermarkets digitised core processes years ago.

What they are doing now is tightening control around them.

That includes:

-

Removing discretion

-

Reducing local variation

-

Centralising authority

-

Standardising behaviour

This is not transformation.

It is consolidation.

That is why the phrase survives in presentations but not in operational discussions.

Vendor Narratives Lag Behind Retail Reality

Many technology vendors still speak the language of innovation.

Disruption.

Reinvention.

Differentiation.

Retail buyers listen for something else.

They want to hear:

-

How labour risk is reduced

-

How pricing errors are prevented

-

How execution is standardised

-

How control improves

If those answers are vague, interest fades quickly.

This explains why many vendor-led trend articles rank well but feel disconnected from reality.

They describe what technology can do, not how retail actually operates.

Control Does Not Mean No Change

Control does not mean stagnation.

Retail technology still evolves.

Systems are replaced.

Platforms are upgraded.

Capabilities improve.

What changed is the pace and purpose of that change.

Evolution now happens slowly, deliberately, and within strict boundaries.

Nothing is allowed to destabilise the core operation.

Innovation exists — but only where it does not threaten control.

Technology As Organisational Power

There is an unspoken layer beneath all of this.

Technology redistributes power.

When labour scheduling is automated, control shifts away from store managers.

When pricing rules are centralised, autonomy disappears.

When inventory logic is enforced, discretion narrows.

This is not accidental.

Retail technology increasingly acts as a governance tool.

Understanding this explains both resistance to systems and leadership support for them.

Control always aligns with power.

Where Control Actually Shows Up

| Area | Old Framing | Current Reality |

|---|---|---|

| Labour | Empowerment tools | Exposure control |

| Pricing | Optimisation | Discipline |

| Inventory | Forecast accuracy | Governance |

| Shrink | Surveillance | Process stability |

| Data | Insight | Authority |

| Technology | Innovation | Infrastructure |

This table summarises the entire shift.

What Retail Leaders Now Optimise For

Retail leaders no longer optimise for novelty.

They optimise for:

-

Fewer surprises

-

Fewer exceptions

-

Fewer manual decisions

-

Fewer dependencies

Technology is chosen to remove fragility from the system.

Not to impress.

Why Trend Lists No Longer Help

“Top retail tech trends” articles fail because they start from the wrong premise.

They assume retailers are searching for ideas.

Most are searching for control.

They want technology that:

-

Reduces cost volatility

-

Reduces operational risk

-

Reduces human dependency

Anything else is secondary.

The Operational Reality Ahead

Retail technology will not return to an experimentation phase soon.

Margins remain thin.

Labour remains unstable.

Competition remains intense.

In that environment, control is not optional.

Technology is no longer about what is possible.

It is about what is survivable.

That is the real story of retail technology today.

Editor’s note: This article is based on long-term observation of supermarket operating models, public retail earnings commentary, and trade-level analysis of how technology is deployed inside grocery organisations. It avoids vendor promotion and trend speculation and focuses on operational reality.