Retail technology German supermarkets is changing faster than ever.

German grocery groups are investing in automation, digital systems, and smart store tools to make shopping faster and operations more efficient.

Across the country, retailers are updating stores with self-checkout lanes, electronic shelf labels, new AI tools, and modern in-store sensors.

These systems help move queues, save labour hours, and improve availability on busy days.

Technology also supports sustainability.

Energy-efficient refrigeration, smart building controls, and better logistics planning cut emissions and reduce operating costs.

As German retailers modernise, technology becomes the backbone of how stores run.

The rise of digital tools connects directly to the trends covered in our German Grocery Market Share 2025 report.

Retail consolidation gives major groups the scale to invest heavily in data, automation, and smart retail platforms.

Retail Technology German Supermarkets: Automation On The Rise

Automation has become one of the strongest shifts inside German stores.

Self-checkout systems are now common in REWE, Edeka, Kaufland, Aldi Nord, Aldi Süd, and selected Lidl stores.

These systems help customers complete small baskets quickly and reduce waiting times at peak hours.

Many stores use hybrid checkout zones.

Shoppers can choose between staffed tills, self-checkout, or quick-scan hand terminals.

This flexibility is important in Germany, where shoppers still value personal service but also appreciate faster options for small trips.

One of the most visible steps in retail technology German supermarkets is REWE’s work on cashier-less formats.

REWE has tested Just Walk Out-style technology in selected urban stores.

Cameras, sensors, and shelf-weight systems combine to track products as shoppers pick them up.

Customers scan in, shop, and leave without stopping at a till.

The system automatically charges their account after exit.

These trials show how German retailers are exploring frictionless shopping.

They are not replacing regular formats but offering alternatives for high-footfall zones and commuter locations.

Automation also reaches into the back of the store.

Stock-handling solutions such as smart trolleys, guided picking systems, and automated produce scales help reduce manual work.

Wanzl, a major German equipment provider, supports many retailers with connected carts and digital trolleys that integrate with store systems.

For Aldi and Lidl, automation mainly focuses on efficiency and speed.

Their store designs revolve around clear movement, simple planograms, and minimal shelf touches.

Digital tracking tools help employees restock faster and identify gaps early.

Automation means fewer steps, fewer errors, and better inventory visibility.

Kaufland uses automation heavily in its logistics and distribution centres.

Sorting machines, automated pallet movers, and digital routing systems help deliver goods to hundreds of hypermarkets across Germany.

These tools allow Kaufland to maintain high availability without unnecessary backroom stock.

Diebold Nixdorf, a global technology provider with strong roots in German retail, supports thousands of checkout systems across the country.

Its solutions include self-checkout, cash management, and software that links checkout zones with stock systems and store management platforms.

Automation is now part of daily store operations.

Every year, retailers extend these systems further.

Future store layouts will mix staffed experiences with more autonomous formats, depending on location and shopper need.

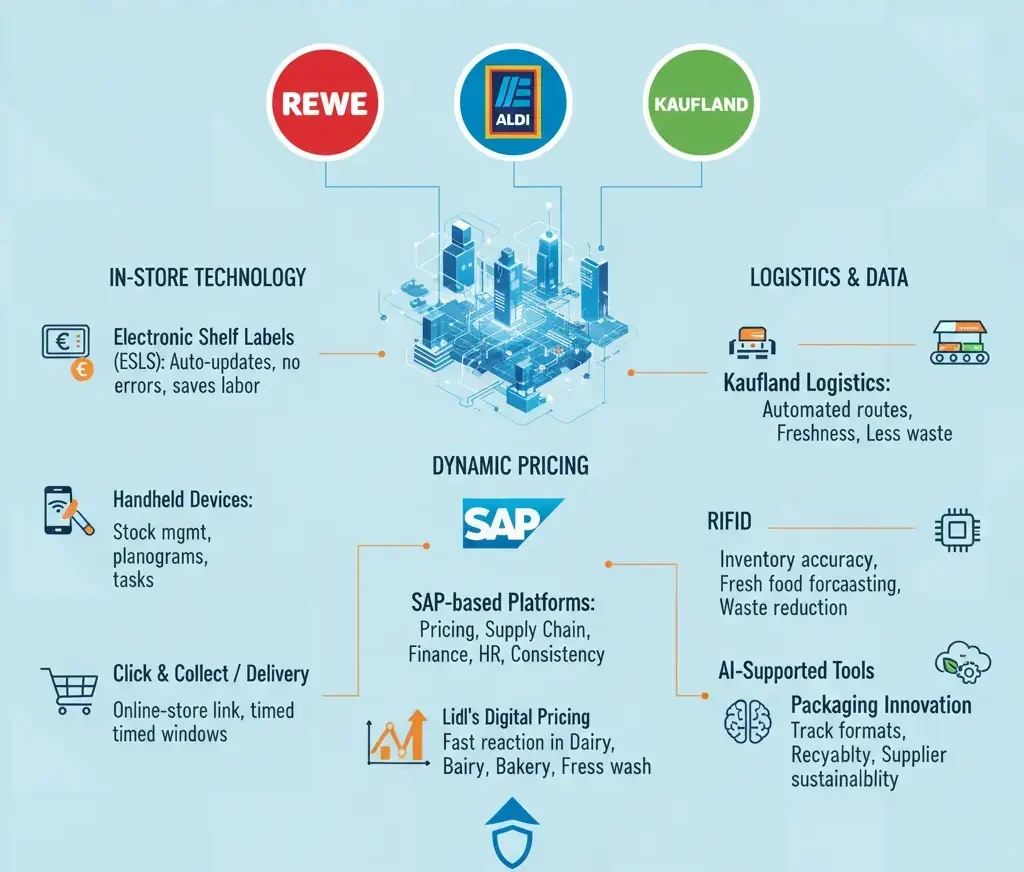

Digitalisation Across REWE, Aldi, And Kaufland

The second major wave of retail technology German supermarkets is digitalisation.

This includes data platforms, shelf-pricing technology, in-store devices, and stronger links between stores and central systems.

Electronic shelf labels (ESLs) are now widely used across Lidl, Aldi, and REWE.

ESLs replace paper price tags with digital displays.

They update automatically when promotions change, helping avoid pricing errors.

They also save huge amounts of labour time during weekly price resets.

Lidl has adopted digital pricing at scale.

The system supports dynamic pricing, category resets, and quick adjustments when cost prices move.

This helps Lidl react fast in competitive categories such as dairy, bakery, and fresh produce.

REWE invests heavily in omnichannel technology.

Its online grocery platform connects with store inventory, allowing accurate click-and-collect and home delivery.

Digital order picking, temperature-zone routing, and timed delivery windows help organise daily operations.

Aldi Süd and Aldi Nord also continue to expand their digital strategies.

Both groups use handheld devices for stock management and rely on central systems to push planograms, promotions, and compliance tasks directly to store teams.

SAP plays a major role across the sector.

Many German retailers run SAP-based platforms for pricing, supply chain planning, finance, HR, and merchandise systems.

These tools bring consistency across thousands of stores and help buyers manage large product lists.

Kaufland uses advanced logistics software to steer its distribution network.

Warehouse picking systems guide employees through optimal routes and ensure that temperature-sensitive goods move quickly.

Digitalisation keeps stock fresher and reduces waste across the hypermarket chain.

RFID (radio-frequency identification) is also gaining attention.

While not widely deployed across all categories, retailers use RFID in apparel, textiles, and certain high-value goods.

It improves inventory accuracy and speeds up stock counts.

AI-supported tools now appear across multiple departments.

Fresh food forecasting, dynamic pricing suggestions, and automated waste-reduction models help retailers balance availability and freshness.

These systems learn from sales patterns and help stores prepare for holidays, temperature swings, or local events.

Digitalisation also links closely to the topics we cover in Packaging Innovation Germany.

Better data helps track packaging formats, recyclability targets, and supplier performance on sustainability.

The rise of digital tools strengthens the whole structure of German grocery.

As covered in German Grocery Market Share 2025, the largest groups use technology to defend and expand market share, while also improving efficiency across networks.

Sustainability And Smart Energy Management

Sustainability is one of the biggest drivers of retail technology German supermarkets.

Energy systems, refrigeration controls, and smart building management all help retailers cut emissions while reducing costs.

Germany’s supermarkets operate thousands of large stores, each using significant energy for refrigeration, heating, cooling, and lighting.

Smart technology helps manage these loads more effectively.

Many REWE, Edeka, Lidl, and Aldi stores now run energy-efficient refrigeration units.

These systems use natural refrigerants, improved insulation, and automatic night blinds to keep energy use low.

Sensors measure temperature and adjust cooling levels in real time.

Smart building management systems control lighting, heating, and ventilation.

They analyse store occupancy, outdoor weather, and energy prices.

Retailers can shift energy loads, reduce peak-time usage, and optimise store comfort without manual control.

Solar panels appear on many store roofs across Germany.

They power lighting, refrigeration, and EV-charging stations, reducing reliance on the grid.

This fits the wider goals seen in our Supermarket Sustainability Germany analysis.

Kaufland’s energy strategy includes heat-recovery systems.

Waste heat from refrigeration is reused to warm parts of the store or back-office areas.

This reduces the need for conventional heating.

Aldi Nord and Aldi Süd also invest in smart metering.

These meters track real-time energy consumption and highlight opportunities to reduce waste.

Digital dashboards help store managers see where improvements are needed.

Electric vehicle charging is growing outside many supermarkets.

Retailers use smart charging stations that adjust charging speeds depending on demand.

This helps manage load balance across the site.

Waste-management technology is also improving.

Food-waste sensors track freshness, temperature shifts, and product rotation.

AI forecasting systems help order the right amount of fresh goods and suggest markdown timings for products nearing expiry.

Recycling stations inside stores rely on digital counters and compactors.

They help customers return plastic bottles, cans, or paper more easily.

This supports circular packaging goals and improved recycling performance.

Sustainability and technology are now linked.

Retailers use digital systems to track emissions, packaging progress, energy efficiency, and supplier compliance.

These tools support long-term climate goals and help meet national regulations.

Many of these themes connect directly to Packaging Innovation Germany, where packaging formats, materials, and recycling methods play a major role in retailer strategy.

As German retailers increase automation and digitalisation, sustainability technology becomes an essential part of operations — not an add-on, but part of how stores are designed from the start.

Looking Ahead: The Next Phase Of Retail Technology

The next phase of retail technology German supermarkets is already taking shape.

More advanced AI, stronger data integration, and new store formats will continue to redefine the customer experience.

AI forecasting will become more precise.

Retailers will predict demand for fresh goods with greater accuracy, reducing waste and improving stock levels.

This benefits both profitability and sustainability.

Autonomous delivery vehicles and warehouse robots will appear gradually.

While still in early stages, these technologies promise faster logistics and fewer manual steps.

They may help German retailers handle long distribution routes and increasing online demand.

In-store robotics could support shelf scanning, gap detection, and inventory accuracy.

Some European pilots already use robots to inspect aisles and transmit data to store systems.

Germany is likely to adopt these models as costs fall.

Checkout systems will evolve too.

Self-checkout will remain common, but software will improve speed and reduce false alerts.

Cash handling will grow more automated, reducing manual counting.

Digital shelf labels will cover nearly all categories in the coming years.

Dynamic pricing will allow retailers to adjust promotions in real time, especially in chilled products where shelf life matters most.

Kaufland, Lidl, and Aldi will continue to expand logistics automation.

Smarter warehousing, AI routing, and better temperature monitoring will support nationwide networks.

REWE will keep developing its frictionless store technology.

While still limited in rollout, these formats show strong potential for commuter zones, universities, and transport hubs.

For suppliers, technology means new expectations.

Retailers will ask for real-time data, digital product information, and improved traceability.

This will shape how private label manufacturers and brand suppliers work with large German groups.

The themes in this article connect closely to the wider trends documented in German Grocery Market Share 2025.

Retailers increase operational efficiency, invest in modern store formats, and use technology to build long-term competitive strength.

In the years ahead, retail technology German supermarkets will continue to expand across automation, digitalisation, logistics, and sustainability.

The future German store will be more connected, more efficient, and more data-driven — offering a smoother experience for shoppers and a stronger foundation for retailer performance.

Editor’s Note:

This article is based on verified information from retailer announcements, technology suppliers, logistics partners, and industry analysis. Sources include updates from REWE, Aldi, Lidl, Kaufland, SAP, Wanzl, Diebold Nixdorf, energy-management providers, and fresh-food technology specialists active in Germany up to Q4 2025.