Italy is one of Europe’s largest food retail markets, but it has never been a fast adopter of retail technology.

That is not because Italian supermarkets are behind. It is because they operate in a market shaped by regional chains, smaller stores, strict labour rules, and highly price-sensitive shoppers.

In Italy, retail technology is not introduced to impress customers or investors. It is introduced only when it solves a clear operational problem.

By 2025, Italian supermarkets are modernising quietly. They are investing in systems that improve pricing accuracy, inventory control, checkout efficiency, and daily store operations. What they are not doing is chasing every global technology trend.

This article explains how retail technology is actually being used inside Italian supermarkets today, using real market data and practical examples, and why Italy’s cautious approach is proving effective.

A Supermarket Market Shaped by Structure

Food retail dominates Italy’s retail landscape. Industry data shows that food retail generates more than €120 billion in annual sales, making it the single most important retail category in the country.

At the same time, the market is highly fragmented. Italy has over 25,000 modern food retail stores, including supermarkets, discounters, small neighbourhood stores, and cash-and-carry outlets. Most of these stores are small or mid-sized, not large hypermarkets.

Supermarkets and superstores account for the largest share of food retail revenue, followed by discounters. Hypermarkets, once important, continue to decline in both store count and influence. Discounters are the only format that has consistently expanded its network in recent years.

This structure explains many of Italy’s technology choices. Systems must work across different store sizes, regions, and operating models. Solutions designed for large, standardised chains often do not fit.

Private Label Growth Is Increasing Operational Pressure

Private label has become central to Italian supermarket strategy. It is no longer limited to basic food products. Retailers now offer private label ranges across packaged food, fresh categories, household goods, and even premium segments.

This growth increases operational complexity. More private label products mean more SKUs, more promotions, and tighter margin management. Pricing errors and stock issues have a direct financial impact.

This reflects wider Italy private label development, where retailers rely on stronger internal systems to support own-brand growth without increasing waste or operational risk.

Technology plays a supporting role here. Italian retailers prioritise tools that help manage pricing accuracy, stock availability, and promotion execution rather than marketing-driven digital platforms.

Omnichannel Is Expected, Not a Differentiator

E-commerce and digital services have grown steadily in Italy over the past decade. Online shopping expanded further during the pandemic, especially in urban areas. Mobile usage is high, and digital payments are widely accepted.

By 2025, however, omnichannel is no longer a competitive advantage. It is a baseline expectation.

For food retail in particular, physical stores remain essential. Most grocery shopping still happens in person. Online ordering, apps, and loyalty programmes support stores rather than replace them.

For most Italian food retailers, technology exists to support the store — not to replace it.

Checkout Technology: Why Hybrid Solutions Work Best

Checkout is one of the most visible areas of retail technology, and also one of the most sensitive.

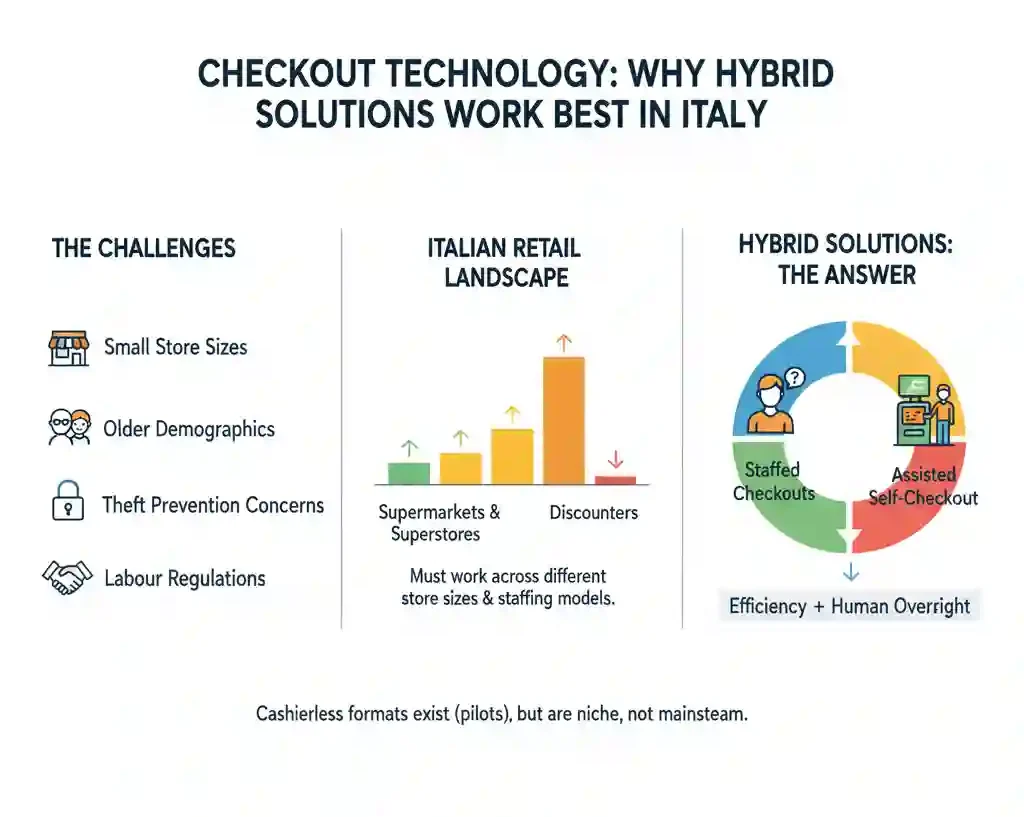

Italy has tested self-checkout systems for years, but adoption has been cautious. Full self-checkout zones are less common than in northern Europe. Several factors explain this.

Many Italian stores are small. Customer demographics skew older in many regions. Theft prevention remains a concern. Labour rules also influence how checkout areas are staffed.

Store format plays a major role. Supermarkets and superstores generate the largest share of food retail sales, while discounters continue to expand their store networks. Hypermarkets, by contrast, continue to decline.

In this environment, checkout technology must work across different store sizes and staffing models. As a result, hybrid checkout has become the preferred solution. This combines staffed checkouts with assisted self-checkout machines, allowing efficiency gains without removing human oversight.

Cashierless formats exist in Italy, mainly in small convenience pilots, but they remain niche and are not a mainstream supermarket solution.

Electronic Shelf Labels and Pricing Control

Electronic shelf labels are one of the quieter but more practical technology investments in Italian supermarkets.

Price accuracy is critical in a promotion-heavy market. Manual price changes are time-consuming and prone to error, especially for retailers operating across multiple regions with different pricing strategies.

Electronic shelf labels allow prices to be updated centrally, reduce compliance risks, and cut labour time spent on shelf maintenance. They also support faster promotional changes, which is increasingly important as private label ranges grow.

Adoption has been gradual rather than dramatic, but interest continues to grow, particularly among discount and mid-sized supermarket chains.

Gruppo Sogegross: A Practical Technology Model

Gruppo Sogegross offers a clear example of how Italian retailers approach technology.

The group operates multiple supermarket and wholesale banners across different regions. Its store network includes various formats, each with different operational needs. This makes large, rigid technology platforms difficult to manage.

Instead, the focus has been on practical systems that improve visibility and control across stores and distribution operations. These include tools that support store devices, monitor performance, and reduce operational downtime.

The aim is not to showcase technology to customers. The aim is to help staff work more efficiently and keep systems running reliably across a complex network.

This type of operational focus is increasingly common among regional Italian supermarket groups, where consistency matters more than visibility.

Back-of-Store Technology Delivers the Strongest Returns

While front-of-store technology attracts attention, many Italian retailers see the biggest returns from back-of-store systems.

Inventory visibility remains a major challenge, particularly in fresh categories. Errors in ordering or replenishment lead to waste, lost sales, and lower customer trust.

Fresh food is a core driver of footfall and revenue in Italian supermarkets. Because of this, technology investments that improve forecasting, stock accuracy, and replenishment often deliver more value than customer-facing digital features.

These challenges are closely linked to Italy fresh produce operations, where daily deliveries, seasonal variation, and quality control make efficient back-of-store systems essential.

Distribution and Supply Chain Technology in a Regional Market

Italy’s supply chain structure reflects its retail landscape. Many retailers operate regional distribution centres rather than highly centralised national hubs.

Because of this, technology investments focus on flexibility rather than full automation. Systems must support mixed store formats, varying volumes, and regional sourcing patterns.

Large-scale warehouse automation exists in some cases, but most retailers prefer step-by-step upgrades that improve visibility, coordination, and reliability without reducing flexibility.

Sustainability Technology Is Driven by Operations

Sustainability plays an important role in Italian retail, but it is mainly approached from an operational perspective.

Energy costs are a major concern. Refrigeration, lighting, and overall store energy use directly affect profitability. Technology that helps monitor and reduce consumption is widely adopted.

Natural refrigerants, energy monitoring systems, and waste-reduction tools are increasingly common. These investments are driven by regulation and cost control rather than marketing goals.

What Supermarket Buyers in Italy Want in 2025

Italian supermarket buyers are cautious and practical.

They prioritise systems that are easy to deploy, simple to use, and reliable over the long term. Training time must be short. Support must be local and responsive.

Return on investment needs to be clear and realistic. Promises of future benefits carry less weight than proven performance.

This reflects broader supermarket buying behaviour in Italy, where stability and operational fit matter more than experimentation.

What This Means for Technology Suppliers

Italy is not a fast-decision market. Relationships matter. Pilots matter. Proven results matter.

Suppliers who push complex solutions without understanding store realities often struggle. Those who adapt systems to regional needs and demonstrate value step by step build long-term partnerships.

Patience is not optional in Italy. It is part of doing business.

Conclusion: Quiet Modernisation Is Italy’s Advantage

Italy’s retail technology story is easy to misunderstand if viewed from the outside. It is not loud, experimental, or driven by hype.

Instead, Italian supermarkets modernise in ways that fit their structure. They invest where technology improves control, reliability, and cost efficiency. They avoid systems that create complexity without clear returns.

In a fragmented market built on food retail, fresh categories, and regional operations, this approach is not conservative. It is disciplined.

That discipline is why Italy’s supermarkets continue to modernise steadily, even when other markets struggle to turn innovation into real operational value.