Portugal’s supermarket groups are not chasing every new digital trend. In 2026, most technology investment is focused on efficiency, labour pressure, and cost control.

Retailers are spending where returns are clear. Automation, checkout speed, stock accuracy, and energy management now matter more than experimental tools.

These five retail technology moves stand out because they directly affect daily store operations and long-term competitiveness.

They show where Portugal’s supermarket sector is really changing.

Retail Technology Moves in Portugal Supermarkets (2026)

| Retailer | Technology | Purpose | Status |

|---|---|---|---|

| MC (Continente) | AI demand forecasting | Reduce waste and improve stock planning | Scaling nationally |

| Pingo Doce | Smart shelf and price automation | Improve pricing accuracy and replenishment | Rolling out |

| Lidl Portugal | Self-checkout expansion | Reduce checkout labour pressure | Active expansion |

| Auchan Portugal | Automated fulfilment picking | Speed online orders | Operational |

| Intermarché Portugal | Energy and store management systems | Cut operating costs | Network upgrade |

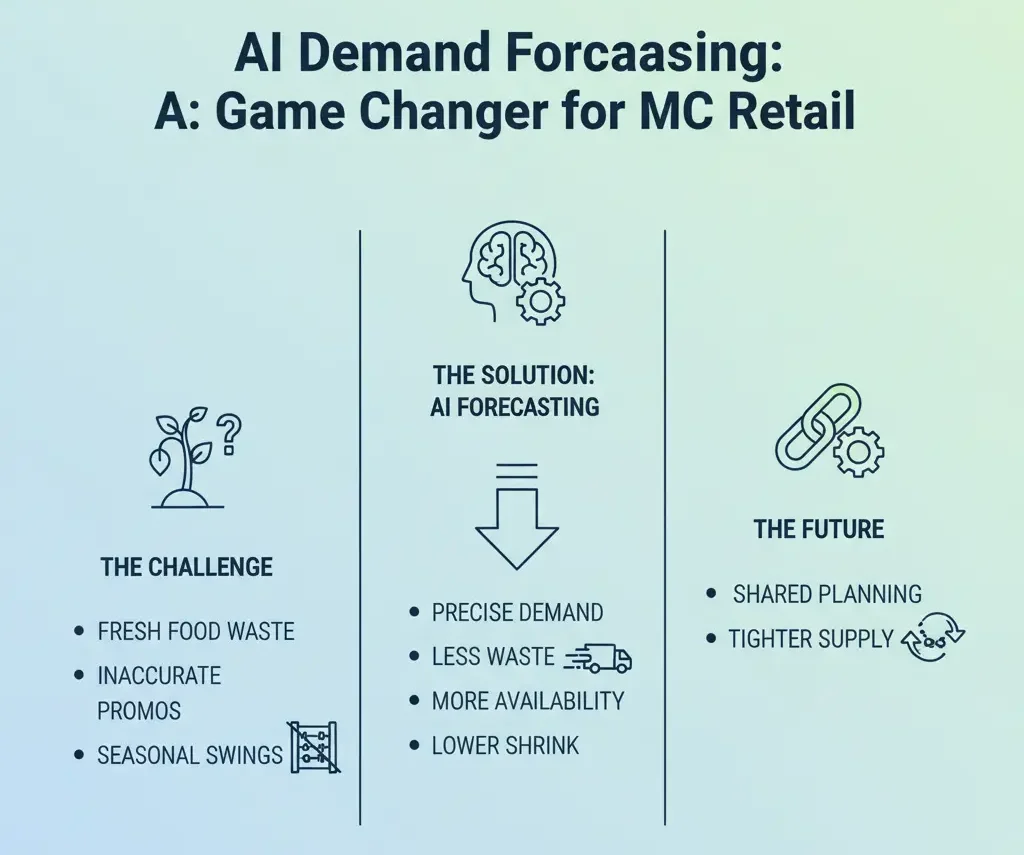

1. AI Demand Forecasting Systems

MC, the retail arm of Sonae, continues to lead Portugal in retail data investment.

Its biggest technology move is expanding AI-based demand forecasting across food categories.

Why it was implemented

Portugal supermarkets face strong pressure from:

-

Fresh food waste

-

Forecast errors during promotions

-

Seasonal demand swings

Traditional forecasting tools were no longer accurate enough for high-volume private label ranges.

What problem it solves

AI forecasting helps Continente:

-

Predict store-level demand more precisely

-

Reduce over-ordering

-

Improve fresh produce availability

-

Lower shrink levels

It also supports faster replenishment decisions across regional distribution centres.

What comes next

The next phase focuses on connecting forecasting systems with supplier planning tools.

This allows shared production planning and tighter supply coordination for private label and fresh food partners.

2. Pingo Doce Upgrades Smart Shelf and Pricing Automation

Pingo Doce is investing heavily in in-store automation rather than front-end digital features.

Its main focus is smart shelf technology and electronic price label systems.

Why it was implemented

Manual price updates remain costly and slow.

Portugal’s high promotion activity makes price accuracy a daily operational challenge.

What problem it solves

Smart shelf and digital price systems allow Pingo Doce to:

-

Update prices instantly

-

Reduce labour time on ticket changes

-

Improve compliance with promotional rules

-

Lower pricing error risk

They also support faster reaction to competitor pricing.

What comes next

Pingo Doce plans to link shelf systems with central pricing software.

This enables automatic promotion activation across hundreds of stores at the same time.

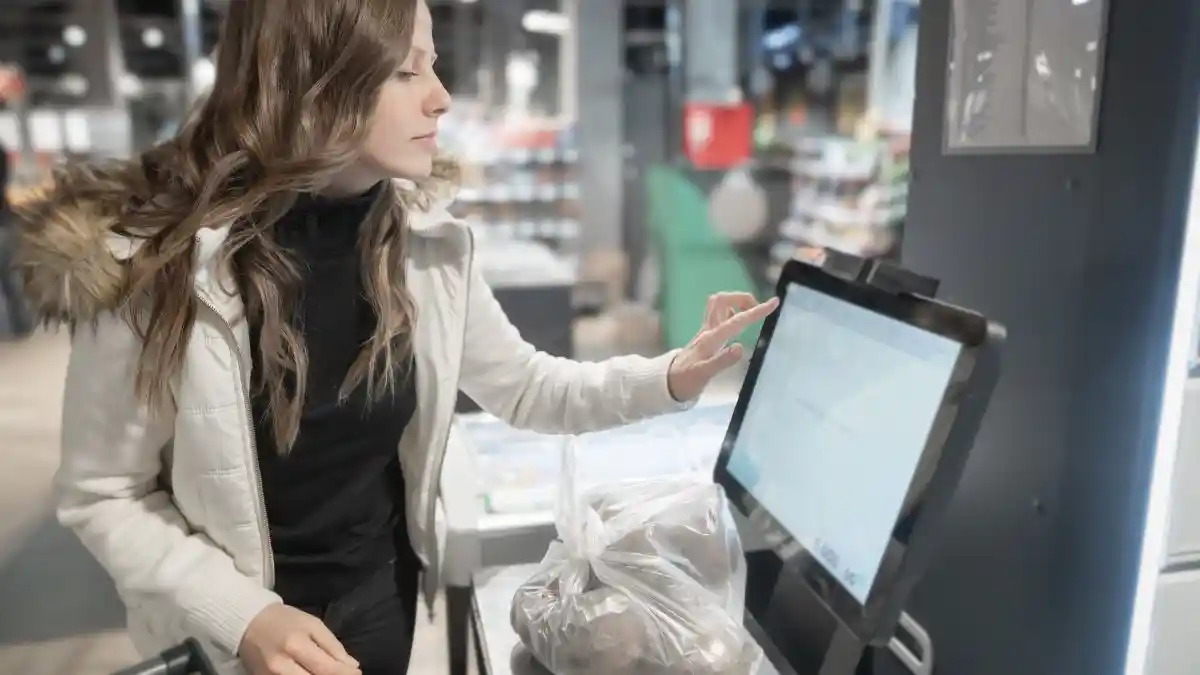

3. Lidl Portugal Accelerates Self-Checkout Rollout

Lidl is expanding self-checkout zones in many Portuguese stores.

The goal is not innovation branding. It is labour efficiency.

Why it was implemented

Portugal retail labour costs continue to rise.

Recruitment remains difficult in urban areas.

Self-checkout allows Lidl to manage peak traffic without increasing staff numbers.

What problem it solves

The system improves:

-

Checkout speed

-

Queue management

-

Labour scheduling flexibility

It also helps Lidl operate high-volume stores with smaller teams.

What comes next

Lidl is testing assisted self-checkout models.

These allow one employee to supervise multiple lanes while handling exceptions and customer support.

4. Auchan Portugal Invests In Automated Online Fulfillment

Online grocery remains a smaller channel in Portugal compared to northern Europe.

But Auchan is strengthening its fulfilment operations using automated picking technology.

Why it was implemented

Manual picking creates:

-

High labour cost per order

-

Slow preparation times

-

Inconsistent order accuracy

Automation improves scalability.

What problem it solves

Automated picking systems allow Auchan to:

-

Speed order preparation

-

Improve accuracy

-

Reduce labour intensity

-

Handle peak online demand

It also supports same-day delivery services.

What comes next

Auchan plans to integrate micro-fulfilment zones inside selected hypermarkets.

This brings online order preparation closer to customers.

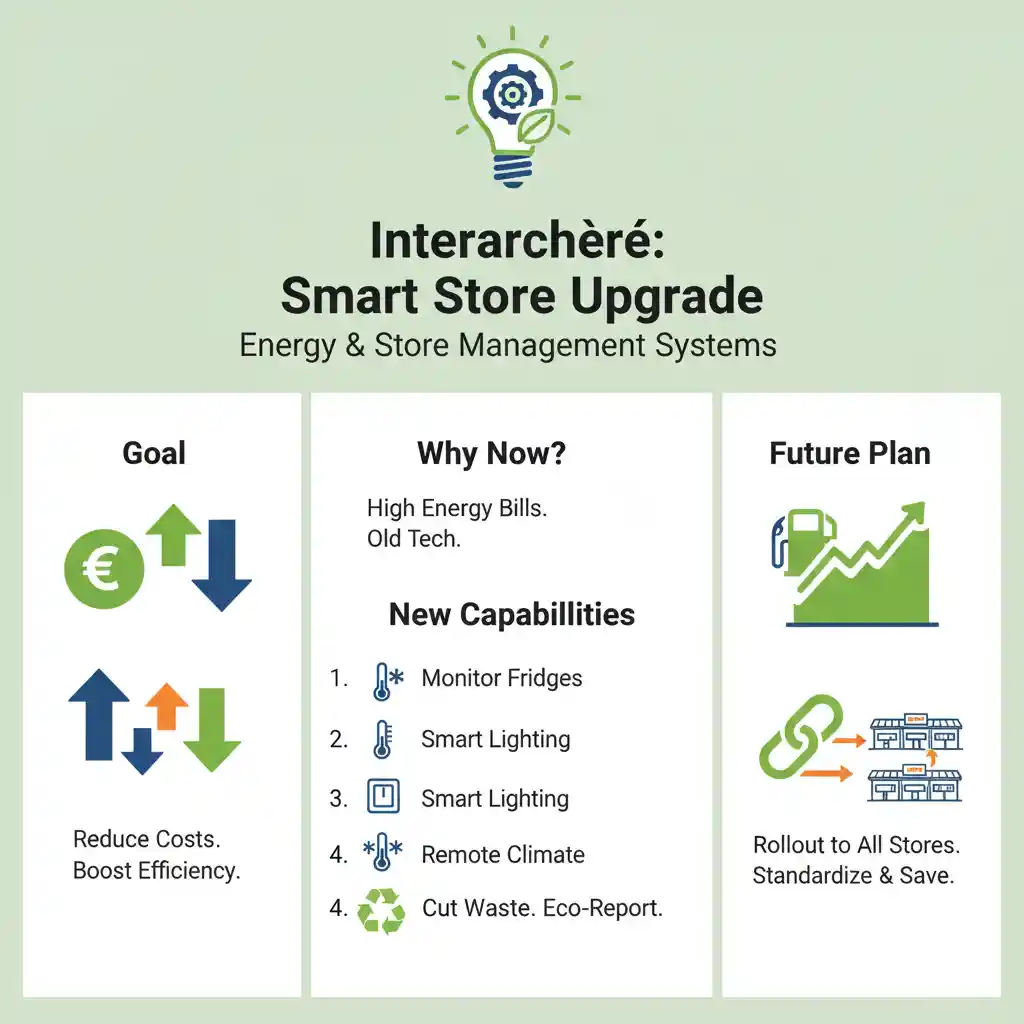

5. Intermarché Upgrades Energy and Store Management Systems

Intermarché Portugal is focusing on operational cost control.

Its technology move targets energy management and central store monitoring systems.

Why it was implemented

Energy costs remain one of the largest operating expenses for supermarkets.

Older systems did not allow real-time optimisation.

What problem it solves

New store management platforms allow Intermarché to:

-

Monitor refrigeration performance

-

Optimise lighting schedules

-

Control heating and cooling remotely

-

Reduce energy waste

This also supports sustainability reporting requirements.

What comes next

The cooperative plans to expand these systems across independent franchise stores.

Standardisation improves network-wide cost control.

What These Five Moves Reveal About Portugal’s Retail Technology Strategy

Portugal supermarkets are not following global tech hype.

They are investing where returns are measurable.

The strongest focus areas are:

-

Labour efficiency

-

Cost reduction

-

Supply chain stability

-

Energy optimisation

There is less spending on customer-facing digital experiences and more on backend operational systems.

This reflects margin pressure and competitive pricing conditions.

Why Business Impact Matters More Than Technology Labels

Many industry sites list retail technology trends without explaining real business results. Portugal’s supermarket groups focus instead on payback period, operating cost impact, staff productivity, and inventory accuracy.

Technology that does not improve these core metrics is unlikely to scale across store networks. This is why automation, demand forecasting, and energy control systems continue to dominate supermarket investment plans.

What To Expect Next In Portugal’s Supermarket Technology

Over the next two years, Portugal’s supermarkets are expected to increase adoption of centralised pricing automation, stronger supplier data integration, store robotics for back-of-house tasks, and real-time inventory visibility.

Retailers are likely to continue avoiding experimental tools that do not directly improve store economics. The overall retail technology strategy remains conservative, practical, and strongly focused on financial performance and operational efficiency.

Conclusion

Portugal’s supermarket technology strategy in 2026 is clear. Retailers are investing in systems that protect margins, reduce waste, and keep stores running efficiently.

The top five retail technology moves show a strong shift toward automation, data-driven planning, and energy control. These investments are not experimental. They are operational tools that support daily performance.

As labour pressure, energy costs, and competition continue to rise, technology will remain a core operational priority. The retailers that scale these systems fastest will hold the strongest advantage in Portugal’s supermarket market.