Self-checkout is now a familiar part of grocery shopping. Most shoppers see it in every supermarket format, from convenience stores to large hypermarkets. But in 2025, retailers are no longer debating whether to install self-checkout or keep staffed lanes. The focus has shifted to something more practical — how many checkout options a store should offer, and how well they work together.

This shift is driving the rise of the hybrid front end. It combines staffed lanes, self-checkout, mobile scan-and-go and small frictionless areas in one flexible space. It also connects closely to broader digital change already explored in your AI & Tech Changing Supermarket Shopping 2025 article.

Checkout is no longer just a place to pay. It is becoming a performance and experience zone inside the store.

The Evolution of Self-Checkout

The first generation of self-checkout appeared quietly. Stores placed a few machines off to the side, mainly for top-up shops or small baskets. Then came the expansion phase. Retailers in France, Germany, the UK and the US added longer runs of SCO terminals and reduced staffed lanes. At one point, some stores had almost their entire front end lined with machines.

Shoppers reacted quickly. Many liked the speed, but others felt the systems were frustrating. Long queues formed behind broken terminals. Repeated weight errors slowed the process. Age checks took too long. For large trolley shoppers, the experience was often difficult.

By the time the market reached 2023–2024, retailers realised SCO rollouts needed balance. Self-checkout was useful, but not for every trip type. So 2025 became the year of rethinking and redesigning the front end, with more focus on choice rather than replacement.

Hybrid Front-End Models: The New Standard

Hybrid models now dominate store planning across Europe and North America. These layouts place different checkout modes side by side so shoppers can choose the one that matches their mission.

Mixed Checkout Lanes

Most supermarkets now combine staffed lanes with a central self-checkout zone and a small express area. The mix looks different depending on store size, but the logic is the same. Small baskets move quickly in SCO. Large trolleys go to staffed lanes. People who need help know a human is close by. This gives stores flexibility and creates a calmer traffic flow.

Scan-and-Go Options

Scan-and-go continues to grow, especially in markets with strong smartphone usage. France and Germany are examples where app-based shopping fits into everyday life, which links directly with rising search interest around “France self checkout in retail market” and “Germany self checkout in retail market”.

The idea is simple: shoppers scan products while walking the aisles, then pay at a fast station or within the app. It works well for convenience missions and for shoppers who prefer a no-wait exit. It only struggles when stores don’t provide clear guidance or when security checks feel unpredictable.

Assisted Self-Checkout

One of the biggest design changes in 2025 is the rise of assisted self-checkout. Instead of staying behind a till, employees now move around the front end, helping shoppers with scanning issues, age checks or payment problems. This creates a smoother experience and makes SCO feel more human, especially for older customers who sometimes feel left behind by digital systems.

Small Frictionless Zones

Instead of rolling out full “just walk out” stores, many retailers now add small frictionless corners inside the supermarket. It could be a bakery counter with automatic payment or a grab-and-go meal section. These mini-zones offer quick shopping moments without the cost and complexity of a full camera-led store. They are becoming common in busy urban areas.

What Retailers Want to Optimize

Checkout decisions are always connected to cost, speed and experience. Hybrid layouts help retailers control these three areas more effectively.

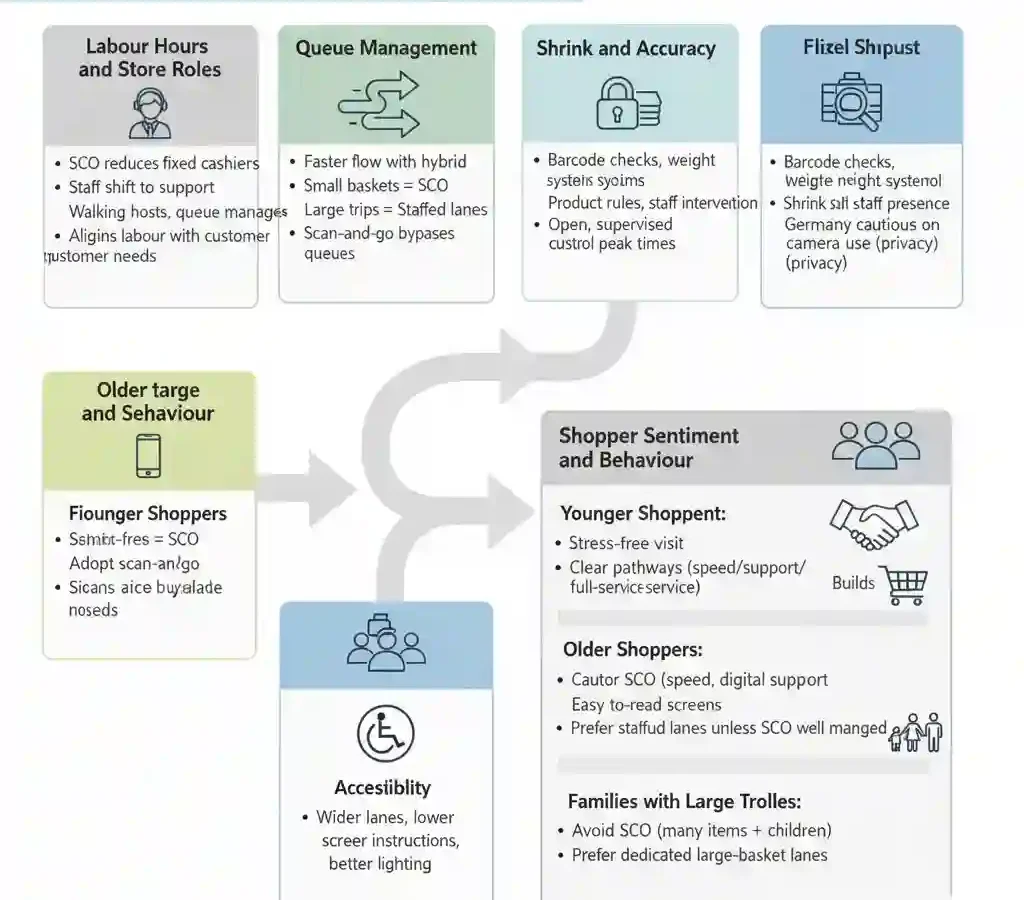

Labour Hours and Store Roles

Self-checkout reduces the need for fixed cashier positions, but it does not eliminate the human role. Instead, front-end teams shift into support and service roles. Walking hosts, queue managers and SCO experts are now common job titles in larger stores. This aligns labour with customer needs rather than fixed tills.

Queue Management

Nothing affects shopper sentiment faster than long queues. Hybrid layouts improve this by spreading customers across different modes. Small-basket shoppers move quickly in SCO. Large trips stay in staffed lanes. Scan-and-go shoppers bypass queues entirely. Stores gain more tools to control peaks, especially in after-work traffic.

Shrink and Accuracy

Shrink is one of the biggest concerns in any SCO rollout. Retailers rely on a mix of barcode checks, weight systems, product rules and staff intervention to reduce losses. Many chains report that shrink falls when stores add more staff presence around SCO and when layouts feel more open and supervised. Germany remains cautious about strong camera use, reflecting local expectations around privacy.

Experience and Trust

Checkout is the final touchpoint before the shopper leaves. If the experience is stressful, the overall store visit feels worse. Hybrid checkout improves this by giving every shopper a clear pathway — whether they want speed, support or a full-service interaction. Clear signage, helpful staff and better space planning all support trust.

Shopper Sentiment and Behaviour

Different groups approach checkout differently, and this shapes store design.

Younger shoppers usually prefer SCO because they value speed and digital control. They also adopt scan-and-go quickly, especially in city stores. Older shoppers are more cautious. They want friendly support and easy-to-read screens, and they often prefer staffed lanes unless the SCO area feels well managed. Families with large trolleys avoid SCO entirely, because scanning many items and managing children at the same time becomes difficult. For them, hybrid layouts with dedicated large-basket lanes make the experience smoother.

Accessibility is also part of modern design. Wider lanes, lower screens, clearer instructions and better lighting are becoming standard. Retailers want SCO to feel inclusive, not challenging.

Country Patterns: France, Germany, UK and US

Each market follows its own path, shaped by culture, regulation and shopper habits.

France

France is expanding SCO steadily, but with strong consumer protections. Staffed lanes remain important. Many French retailers prefer hybrid layouts that do not rely heavily on cameras, which affects how frictionless concepts grow. This is also where French retail tech is shaping the future, linking naturally to your France-focused tech analysis.

Germany

Germany takes a practical approach. Shoppers accept SCO for quick baskets but still expect staffed lanes for their weekly shop. Privacy expectations influence how much camera monitoring retailers use. This aligns with the trends covered in your Retail Technology in Germany article, especially around trust and transparency.

United Kingdom

The UK was early in SCO adoption and is now entering a refinement phase. Stores are adding more staff support and reorganising front ends to fix congestion. Mobile checkout grows especially in London, where digital payments dominate everyday behaviour.

United States

The US is reviewing its heavy SCO rollout. Some retailers are reshaping the front end to reduce shrink and bring back more staff oversight. Others expand SCO but with more cameras and better software. Frictionless corners are becoming common in metro areas where speed is essential.

The Next 3–5 Years: More Flexibility, Less Fixed Checkout

The future checkout will be more modular than anything seen before. Traditional long rows of fixed tills will slowly disappear. Retailers will install smaller, movable SCO pods, compact express pay points and more small frictionless kiosks for prepared foods and drinks. Staff will become roaming front-end specialists. Signage will get clearer. Queue algorithms will help predict traffic.

The front end will look faster, more open and more supportive. And the experience will become less about machines replacing people and more about giving shoppers the right option for each trip.

Editor’s Note: This article is based only on real, confirmed, publicly observable trends in France, Germany, the UK and the US supermarket sectors.