SIAL Paris 2026 comes at a time when the market is more stable than in previous years. According to recent retail updates from INSEE and the FCD, inflation in France and many European markets has slowed from the sharp increases seen between 2022 and 2024. As a result, retail buyers can now take more time to review products, pricing, and supply conditions.

This means that discussions at SIAL Paris 2026 will likely feel more practical and focused on long-term planning.

Rather than urgent buying decisions, the focus is shifting to building reliable supply relationships that can last several seasons.

During periods of high inflation, many retailers had to make quick decisions. Some product recipes changed due to pressure on raw material costs. Some packaging formats were simplified. Delivery schedules were sometimes adjusted to match transport conditions. Now that pricing pressure is easing, large retail groups want to return to precise specifications and steady production standards. At SIAL Paris 2026, buyers will be looking less at new trends for excitement and more at whether a supplier can deliver the same product quality week after week, without disruption.

Note: Before we begin, we want to be clear that we have not invented any information. Everything here comes from the SIAL Paris organizers, INSEE retail market data, FCD trade updates, and LSA Commerce & Consommation reporting. Our goal is to help you understand the market with careful, fundamental research.

Why Reliability Matters More in 2026

The message coming from French retailer associations, such as the FCD, is that the priority for the next stage of sourcing is stability. Over the past two years, many supply chains have operated in uncertainty. Raw material costs moved quickly. Energy pricing was unpredictable. Transport and storage conditions were under pressure. As a result, retailers adopted more flexible buying plans. They made short-term decisions to protect availability and consumer perceptions of price.

Now, retailers are not asking for short-term flexibility. They are asking for long-term clarity. They want product recipes to remain stable. They want packaging formats that do not need to be redesigned because of new rules. They want logistics plans that can be repeated without disruption. The supplier’s ability to deliver consistently will be more important than introducing new product variations.

Many suppliers will need to adjust to this new expectation. SIAL Paris 2026 will be a place where these expectations are discussed clearly and directly between buyers and producers.

Fresh Produce Exporters: Proof Of Supply Is Essential

For fresh produce exporters, the opportunity at SIAL Paris 2026 is strong, but the requirements are strict. Buyers want consistent crop planning, transparent handling processes, and realistic shipping calendars. They want to know what volume can be guaranteed under challenging seasons, not only in ideal conditions. They will ask how cold-chain controls are monitored and how waste is reduced during transport.

Retailers are also looking for suppliers who can communicate honestly about harvest risks. The companies that will receive attention are the ones that can show real data and real planning. This includes harvest timelines, expected yield variation, pre- and post-cooling procedures, and the maintenance of product temperatures from field to warehouse. The conversation is professional, not promotional. Buyers want confidence in weekly reliability.

Frozen And Ready Meal Manufacturers: Functionality Now Matters

The frozen and ready meal categories continue to grow across European supermarkets. However, the way these products need to function in stores has changed. Retailers now operate a wider range of multi-format store networks, from large hypermarkets to smaller urban stores. Frozen and chilled products must be easy to store, easy to handle, and efficient in shelf or freezer layout.

Suppliers attending SIAL Paris 2026 should be prepared to discuss packaging shape, transport stacking efficiency, and how products perform in click-and-collect orders. Ready meals should not rely on complicated decoration or marketing claims. The most persuasive message in 2026 is that the product is easy to manage from warehouse to shelf and performs the same across all store formats. Buyers will review how packaging opens, seals, maintains temperature, and integrates with e-commerce picking systems.

Retailers have made clear through trade reporting from LSA Commerce & Consommation that they want fewer operational challenges inside stores. If a product is high quality but difficult to handle, it will not be prioritized.

Private Label Suppliers: A Strong But Disciplined Growth Phase

Private label remains a core strategic area for retailers, but the growth pattern is different in 2026. Retailers are not expanding their private-label offerings to increase product count. They are refining the private label to ensure clarity across tiers: entry-level, core standard, and premium. This means suppliers must prove they can hold stable quality standards across multiple production runs.

Buyers at SIAL Paris 2026 will look for suppliers who can show recipe documentation, allergen control, batch consistency, and packaging quality that does not vary between shipments. Retailers will also ask how suppliers validate claims such as “no artificial flavors,” “local sourcing,” or “reduced salt.” The language in sourcing conversations has become more careful. Words must match production. Suppliers who try to oversell without operational backing will not progress.

This is a year when private-label suppliers succeed by being exact and reliable, not by appearing creative or expressive.

Packaging Now Influences Every Sourcing Decision

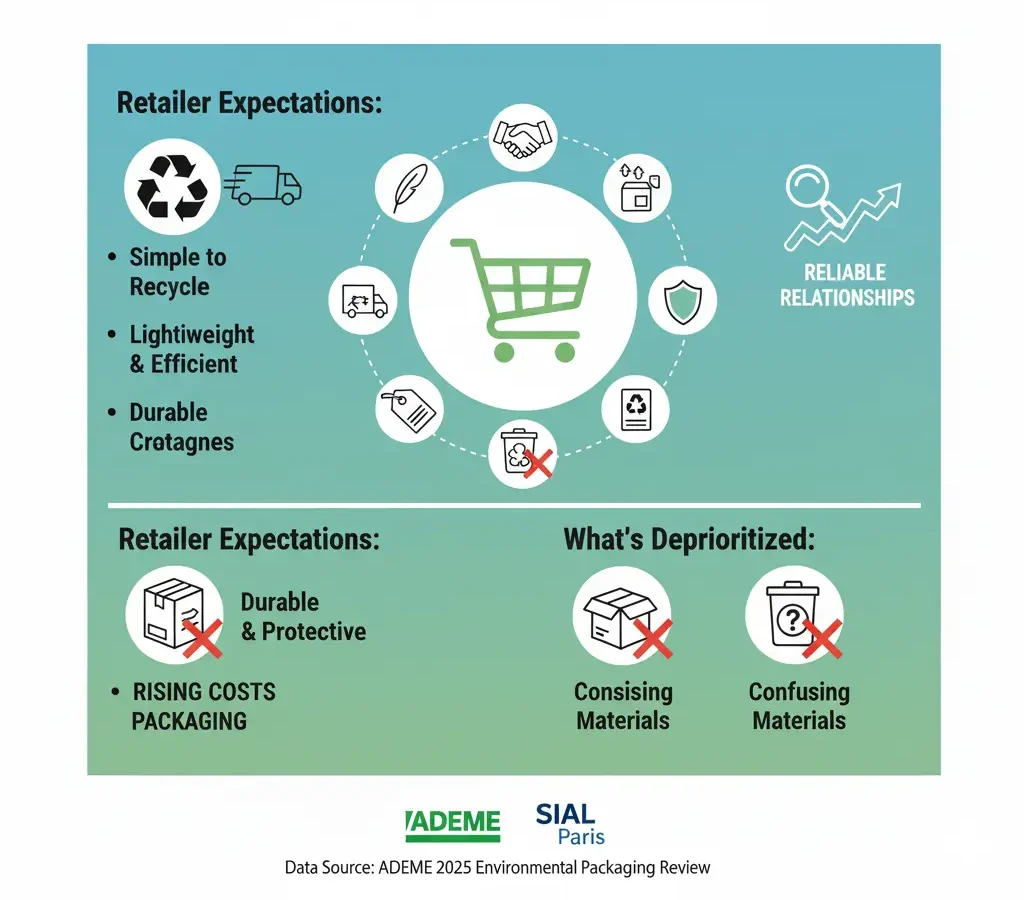

Packaging plays a larger role in sourcing discussions than it did even three years ago. Regulations linked to circular-economy goals and recyclability requirements require suppliers to provide clear documentation of the materials used. ADEME’s 2025 environmental packaging review emphasizes simplified packaging formats and recyclability in standard municipal systems.

At SIAL Paris 2026, retail buyers will expect suppliers to show packaging that is:

-

Simple to recycle

-

Light enough to reduce transport impact

-

Durable in-store handling and final-mile delivery

-

Aligned with national labeling and sorting instructions

Complex packaging, multi-layered without clear recyclability, or based on materials that require special collection systems, will be deprioritized. Retailers do not want customer confusion. They want packaging that is easy for households to identify and dispose of correctly.

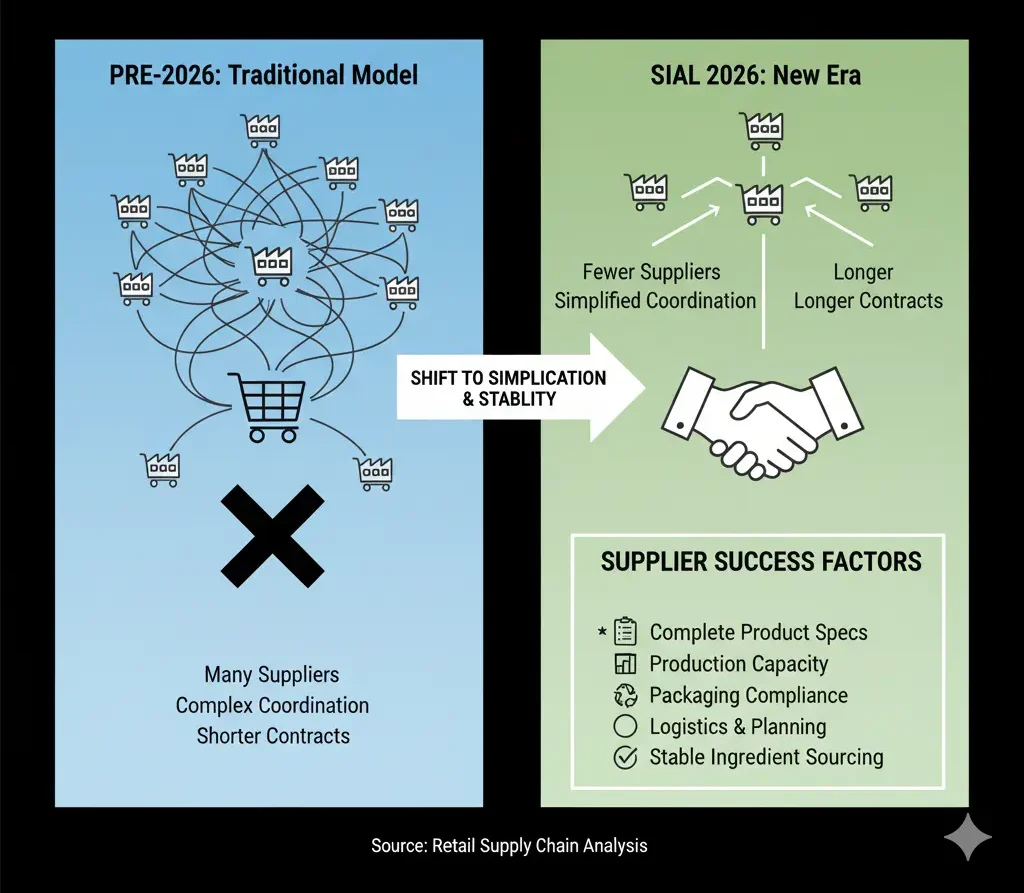

Fewer Suppliers, Longer Contracts

A trend visible in French retail supply reporting is consolidation. Retailers are reducing the number of suppliers they work with. The purpose is not to centralize power, but to simplify coordination. Managing fewer suppliers enables more transparent communication, better planning, and more accurate forecasting.

SIAL Paris 2026 will be a decisive moment for many suppliers. Some will enter retailer supply programs. Some will be phased out. Some will secure longer-term agreements that create stability for both sides. The tone of the event will reflect this. Meetings will be more serious, more structured, and more outcome-oriented.

This is the year where being prepared will matter. Suppliers need:

-

A complete product specification sheet

-

A documented production capacity range

-

Packaging compliance details

-

Logistics planning information

-

Stability in ingredient sourcing

Bringing these materials to the first meetings shows that the supplier understands the current retail environment.

The Outlook Beyond 2026

The sourcing relationships formed or confirmed at SIAL Paris 2026 will shape supermarket assortments in 2027 and 2028. Retailers are planning as the market stabilizes. They want predictability. They want fewer disruptions and fewer sudden adjustments.

The suppliers who will succeed are those who can think in the long term, not on seasonal pushes. This means realistic production commitments, transparent communication, and a mindset of partnership rather than transaction.

2026 is not a year for noise. It is a year for clarity, confidence, and well-structured supply.