Asia is home to the world’s largest and fastest-growing packaging companies in 2026.

From flexible films and cartons to rigid plastics and paperboard, Asian suppliers now sit at the centre of global FMCG, food, beverage, and retail supply chains.

This article ranks the Top 10 Packaging Companies in Asia in 2026, based on scale, revenue strength, geographic reach, sustainability progress, and relevance to modern brand and retailer needs.

It is written for buyers, sourcing teams, brand owners, and industry professionals who want clear answers, not marketing claims.

Why This Ranking Matters

Asia’s packaging market is large, complex, and highly fragmented.

Hundreds of suppliers operate across the region, but only a small number have the scale, technical depth, and regional footprint to support FMCG, food, beverage, and retail supply chains consistently.

This ranking focuses on those companies.

It highlights the packaging groups that matter most in 2026 because of their production capacity, geographic reach, sustainability investment, and ability to support long-term commercial partnerships across Asia.

How this ranking was created (clear and transparent)

The ranking is based on five commercial factors, not brand hype.

Ranking criteria used

-

Revenue scale and production capacity

-

Geographic footprint across Asia

-

Packaging portfolio breadth

-

Sustainability and regulatory readiness

-

Relevance to FMCG and retail supply chains

No single metric decides the ranking.

The list reflects real market influence in 2026.

Quick comparison table (high-value snippet)

| Rank | Company | Headquarters | Core Packaging Strength |

|---|---|---|---|

| 1 | Amcor | Singapore | Flexible & rigid packaging |

| 2 | Uflex | India | Flexible films & laminates |

| 3 | SCG Packaging | Thailand | Paper, flexible, rigid |

| 4 | Oji Holdings | Japan | Paper & board |

| 5 | Toyo Seikan Group | Japan | Rigid food & beverage |

| 6 | Rengo | Japan | Corrugated & paper |

| 7 | Huhtamaki Asia | Singapore | Foodservice & flexible |

| 8 | Greatview Aseptic | China | Aseptic cartons |

| 9 | Dongwon Systems | South Korea | Flexible & metal |

| 10 | Daibochi | Malaysia | Flexible FMCG packaging |

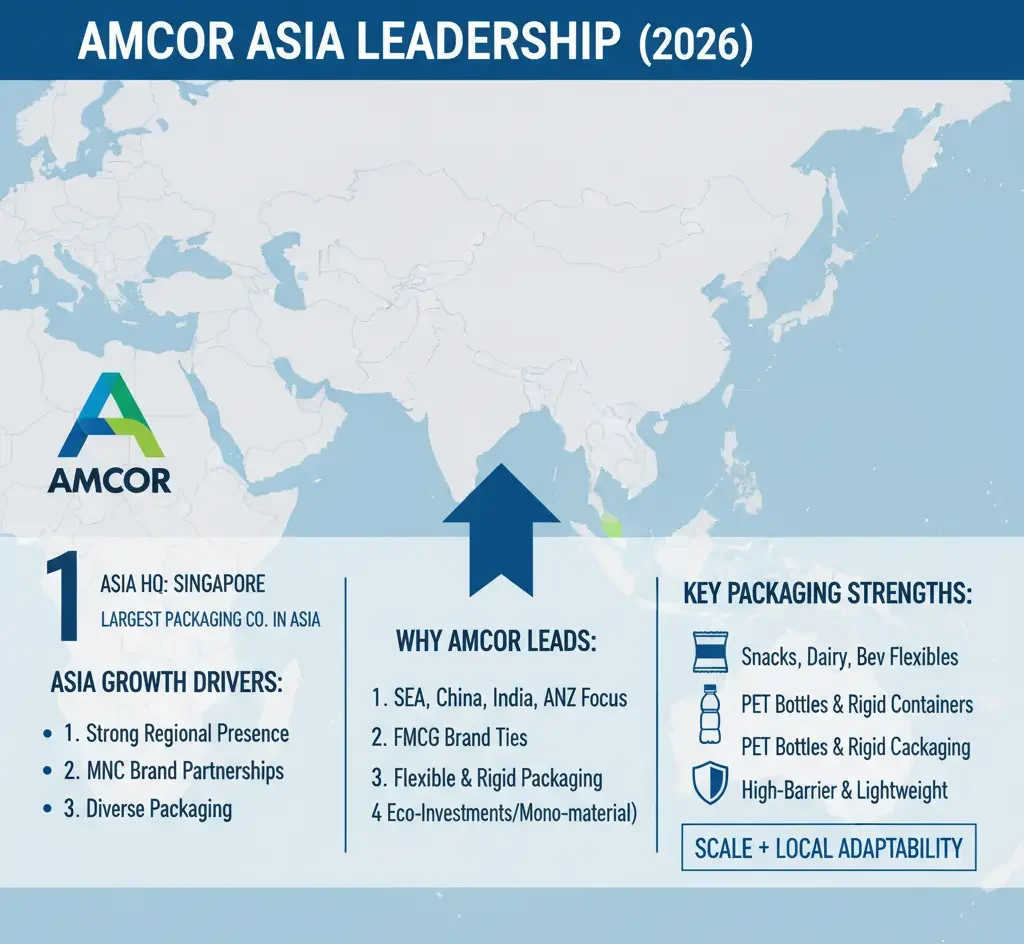

1. Amcor (Asia headquarters: Singapore)

Amcor ranks as the largest packaging company operating across Asia in 2026.

Although global in structure, Asia remains one of Amcor’s most important growth regions, serving FMCG, food, beverage, healthcare, and personal care brands.

Why Amcor leads the ranking

-

Strong presence across Southeast Asia, China, India, and Australia

-

Deep relationships with multinational FMCG brands

-

Broad portfolio covering flexible and rigid packaging

-

Heavy investment in recyclable and mono-material formats

Key packaging strengths

-

Flexible packaging for snacks, dairy, and beverages

-

PET bottles and rigid containers

-

High-barrier and lightweight solutions

Amcor’s scale allows it to meet large-volume retail demand while still adapting to local regulatory and sustainability requirements.

2. Uflex (India)

Uflex is Asia’s largest flexible packaging company by capacity and one of the most influential suppliers in emerging markets.

Headquartered in India, Uflex operates manufacturing facilities across India, Southeast Asia, the Middle East, Africa, and the Americas.

Why Uflex ranks high in 2026

-

Dominant in flexible films and laminates

-

Strong presence in value-driven FMCG categories

-

Aggressive expansion into recyclable materials

-

Trusted supplier to regional and global brands

Core markets served

-

Food and snack packaging

-

Personal care and household products

-

Beverage and dairy applications

Uflex’s strength lies in volume efficiency, making it a key partner for fast-moving consumer goods in price-sensitive markets.

3. SCG Packaging (Thailand)

SCG Packaging is one of Southeast Asia’s most diversified packaging groups.

Part of the SCG conglomerate, the company has expanded rapidly across ASEAN through acquisitions and capacity growth.

Why SCG Packaging matters

-

Strong footprint in Thailand, Vietnam, Indonesia, and Malaysia

-

Balanced portfolio across paper, flexible, and rigid packaging

-

Clear sustainability roadmap

-

Close ties with regional food and retail producers

Key packaging segments

-

Corrugated boxes

-

Flexible packaging

-

Food-grade paper solutions

SCG Packaging stands out for its regional integration, serving both local brands and export-oriented manufacturers.

4. Oji Holdings (Japan)

Oji Holdings is one of Asia’s largest paper and board packaging producers, with deep roots in Japan and expanding operations across Asia.

Strengths in 2026

-

Leadership in paper-based packaging

-

Strong compliance with food and pharmaceutical standards

-

Long-term supply relationships with Japanese and Asian brands

Oji’s focus on renewable materials keeps it highly relevant as plastic regulations tighten across Asia.

5. Toyo Seikan Group (Japan)

Toyo Seikan Group is a leader in rigid packaging for food and beverages.

Its solutions are widely used in cans, bottles, and containers for major beverage and food producers.

Core advantages

-

Precision engineering

-

Strong food safety standards

-

Innovation in lightweight metal and plastic containers

6. Rengo Co., Ltd. (Japan)

Rengo is one of Asia’s leading suppliers of corrugated and paperboard packaging, with a strong base in Japan and a growing footprint across the region.

The company plays a critical role in logistics and distribution, supplying packaging used across retail, e-commerce, food, and industrial supply chains.

Rengo’s strength lies in high-volume corrugated solutions that support transport efficiency, product protection, and shelf-ready formats for retailers.

In recent years, the company has also increased its focus on lightweight materials and recycled fibre, responding to cost pressure and tightening sustainability expectations across Asian markets.

Its scale and operational reliability make Rengo a key partner for brands and retailers that depend on consistent packaging supply at regional level.

7. Huhtamaki Asia (Singapore)

Huhtamaki’s operations in Asia make the company a key supplier of foodservice and flexible packaging across multiple markets.

The group has a strong presence in Southeast Asia, China, and India, serving quick-service restaurants, convenience food brands, and on-the-go consumption formats.

Huhtamaki is particularly well positioned in packaging for takeaway meals, cups, lids, and flexible food packs, where hygiene, consistency, and supply reliability are critical.

As demand for ready-to-eat and out-of-home food continues to grow across Asia, Huhtamaki benefits from long-term relationships with global and regional food brands.

The company has also increased its focus on fibre-based and recyclable solutions, aligning its Asian portfolio with changing regulatory and sustainability expectations.

8. Greatview Aseptic Packaging (China)

Greatview is one of Asia’s leading suppliers of aseptic carton packaging, with a strong focus on long-life food and beverage products.

Key strengths in 2026 include:

-

Specialisation in aseptic cartons for dairy, juice, and liquid nutrition

-

Strong position in China with expanding reach across Asia

-

Growing demand for shelf-stable products with longer distribution windows

-

Cost-competitive alternatives for regional and export-focused brands

-

Technical capability in food safety and aseptic filling compatibility

Greatview’s growth reflects wider changes in consumption across Asia, where demand for ambient, easy-to-store products continues to rise in both urban and secondary markets.

9. Dongwon Systems (South Korea)

Dongwon Systems is a diversified packaging supplier serving food, seafood, and FMCG brands across Asia.

Key strengths in 2026 include:

-

Strong integration with food and seafood manufacturing supply chains

-

Capabilities across flexible packaging, metal cans, and plastic containers

-

Expertise in packaging for protein, seafood, and processed food categories

-

Focus on product protection, shelf life, and transport efficiency

-

Stable demand driven by essential food categories

Dongwon Systems benefits from close links between packaging and food production, allowing it to support consistent supply and quality across regional markets.

10. Daibochi (Malaysia)

Daibochi is a major flexible packaging specialist serving FMCG brands across Southeast Asia, with manufacturing operations designed for regional scale.

Key strengths in 2026 include:

-

Strong focus on flexible packaging for food and household FMCG products

-

Regional manufacturing footprint across Southeast Asia

-

High-volume production with consistent quality standards

-

Long-term supply relationships with multinational and regional brands

-

Cost-efficient operations suited to price-sensitive consumer markets

Daibochi’s position reflects the continued importance of reliable, efficient flexible packaging suppliers in fast-moving Southeast Asian markets.

What this ranking shows about Asia’s packaging market

-

Flexible packaging dominates growth

-

Sustainability is now commercially mandatory

-

Regional scale matters more than single-market leadership

-

Retail and FMCG demand shape innovation priorities

Asia’s packaging leaders are no longer just manufacturers.

They are strategic supply partners.

What happens next

By 2027, competition among Asia’s top packaging companies will intensify around recyclability, cost efficiency, and regional resilience, as supermarkets in Asia push harder on packaging compliance and shelf-ready formats.

Companies that balance scale, compliance, and speed will continue to lead, especially those aligned with fast-moving food, beverage, and fresh produce in Asia, where packaging performance directly affects waste and margins.

Conclusion

The top packaging companies in Asia in 2026 show how much the industry has changed.

Scale still matters.

But it is no longer enough on its own.

The companies leading today are the ones that can deliver volume, meet tightening rules, and still move fast when brands or retailers change direction.

Across food, beverage, and everyday consumer goods, packaging is no longer just a cost item. It shapes shelf life, transport efficiency, and waste levels across the supply chain.

As demand grows across Asia, the gap between adaptable suppliers and slow-moving ones will widen. The companies in this list are well positioned for that shift — but the pressure to improve will not ease.

Editor’s Note

This article is based on a review of company annual reports, investor disclosures, industry data, and trade coverage from across Asia.

The ranking reflects overall market influence in 2026, not a single financial metric. Company positions may change as investments, regulations, and regional demand evolve.