The UK grocery market in 2025 has entered a new phase.

Prices are still high, promotions are back, and discounters are changing the rules of the game.

For retailers and suppliers, this year’s story is about scale, loyalty, and the ability to stay affordable without losing margin.

Understanding the UK grocery market share 2025 helps explain who is leading this battle and who is trying to recover.

The main supermarket players are Tesco, Sainsbury’s, Asda, Aldi, Lidl, and Morrisons.

Smaller chains such as Co-op and Iceland also play key roles in community and niche categories.

Note:

All information in this article was verified from official Kantar market-share reports (2025 12-week periods), Reuters retail updates (2025 May–August), Grocery Gazette coverage, and company annual results from Tesco, Sainsbury’s, Asda, Aldi, Lidl, Morrisons, Co-op, and Iceland.

We carefully reviewed each source before writing this news report .

UK Grocery Market Share 2025

| Retailer | Market Share % (2025) | Est. Revenue £ bn | Stores (UK) | Employees (UK) | Comment |

|---|---|---|---|---|---|

| Tesco | ≈ 28.0 % (Kantar Jul 2025) | 57–60 | 3,500 + | 340,000 + | Market leader |

| Sainsbury’s | ≈ 15.1 % | 30–32 | 1,600 | 145,000 | Strong second |

| Asda | ≈ 11.8 % | 22 | 1,100 | 145,000 | Losing share |

| Aldi | ≈ 10.9 % | 15 | 1,050 | n/a | Rising fast |

| Lidl | ≈ 8.3 % (Kantar Jun 2025) | 11 | 960 | n/a | Fastest growth |

| Morrisons | ≈ 8.4 % | 13–14 | 497 | 100,000 + | Recovery mode |

| Co-op | ≈ 5.2 % | 9–10 | 2,500 | n/a | Local strength |

| Iceland | ≈ 2.2 % | 3–4 | 830 | n/a | Frozen focus |

We learn this from : Kantar (12-week data 2025), company reports, Grocery Gazette, Reuters.

Tesco — Market Leader In 2025

Tesco remains the clear leader in the UK grocery market share 2025, holding close to 28 percent of total spend.

That’s a small but meaningful gain from the year before, when it hovered near 27.6 percent.

Its growth is driven by several factors.

First, the Tesco Clubcard Prices programme has become a permanent feature of how British shoppers buy.

Clubcard Prices are now used by most in-store shoppers, making loyalty a key sales driver. This loyalty system lets Tesco reward frequent customers and track price sensitivity across categories.

Second, Tesco’s format mix gives it flexibility.

It operates large Extra stores, mid-size supermarkets, Express convenience units, and a strong online channel.

This spread lets the retailer cover both weekly bulk shops and top-up missions.

Third, its private-label expansion is working.

Lines such as Tesco Finest and Tesco Value address both ends of the price spectrum.

This supports its position in the UK grocery market share 2025, especially as shoppers trade down from brands.

here our detailed private-label analysis.

Tesco’s challenge for 2026 will be to protect margins while keeping prices sharp.

Energy, wages, and logistics costs are still climbing.

But its scale, data insight, and supplier reach keep it ahead for now.

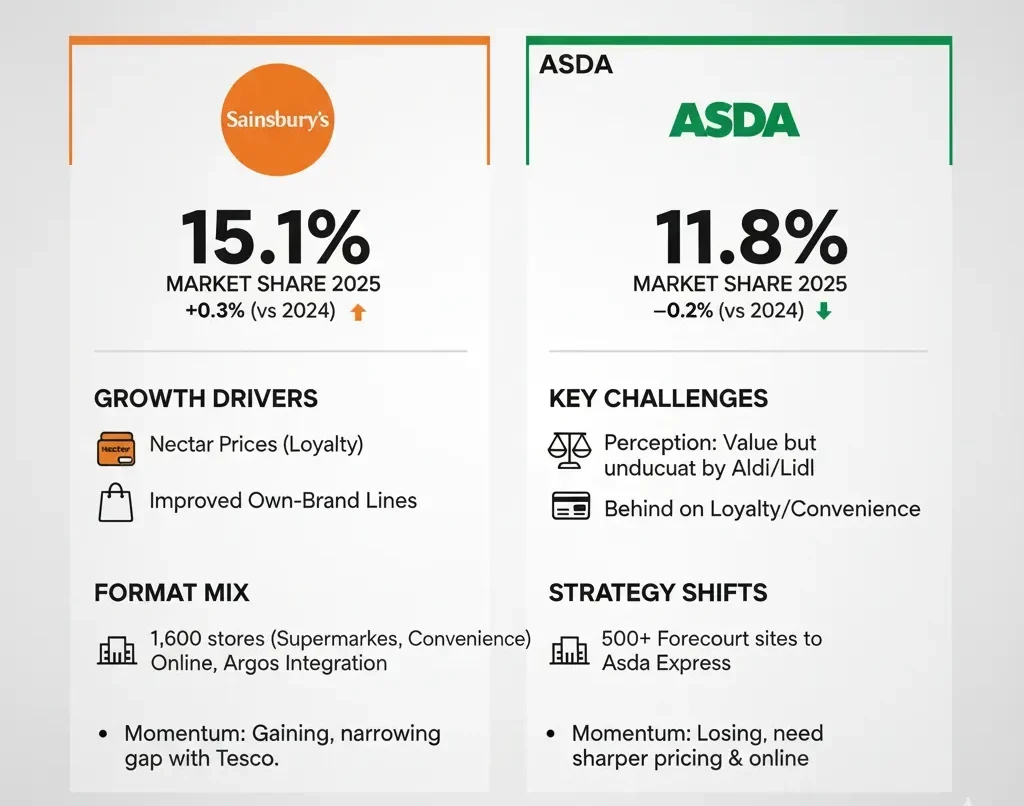

Sainsbury’s And Asda — Competing For Second Place

Sainsbury’s

Sainsbury’s holds roughly 15.1 percent of the market.

That is its strongest position in almost a decade.

Its Nectar Prices scheme mirrors Tesco’s loyalty model and has been crucial to this gain.

In 2025, Sainsbury’s also re-focused on its own-brand lines, bringing new “improved value” ranges to stores.

This mix of loyalty, value, and food quality explains its steady rise in the UK grocery market share 2025 rankings.

Sainsbury’s now runs about 1,600 stores across the UK — roughly 599 full-size supermarkets and 855 convenience branches.

Online sales continue to support growth, and its Argos integration adds cross-category appeal.

If this trend continues, Sainsbury’s could further narrow the gap with Tesco through 2026.

Asda

Asda’s share sits near 11.8 %, broadly stable compared with 2024 but below its pre-discounters peak.

That may seem small, but even a few tenths of a percent in this market represent huge turnover shifts.

Asda’s challenge lies in perception.

It is viewed as a value player, yet Aldi and Lidl undercut it.

At the same time, Tesco and Sainsbury’s beat it in loyalty data and convenience.

Its new owners have pushed to convert forecourt sites into Asda Express convenience stores.

More than 500 sites now trade under this format.

Still, the chain must clarify its long-term strategy — whether to focus on low-price grocery, digital growth, or hybrid retailing.

In the UK grocery market share 2025 context, Asda is holding its place but losing momentum.

Recovering share will require sharper price positioning and better online execution.

Aldi And Lidl — Discounters Reshaping The Market

Together, Aldi and Lidl control almost 19 percent of British grocery spend.

Their rise defines the story of the UK grocery market share 2025.

Aldi

Aldi’s share sits at 10.9 percent after another year of growth.

It continues to open 40–50 stores per year, moving toward 1,200 locations by 2026.

Most stores are uniform in size, allowing efficiency in staffing and logistics.

Aldi’s simplicity works: limited range, quick checkout, and private-label products that now account for more than 90 percent of its sales.

Its “Specialbuys” and rotating middle-aisle offers keep traffic high.

Lidl

Lidl holds about 8.1 percent market share and is the fastest-growing grocer in Britain.

It gained nearly 0.4 percentage points in 2025, according to Kantar.

Its strength lies in quality fresh produce and competitive pricing.

Both discounters rely on small stores, efficient supply chains, and loyal shoppers.

They keep costs low and pass savings straight to customers.

Their success has forced the big four to match prices on hundreds of items.

For suppliers, the shift means tighter margins and new packaging demands.

Products often require simpler designs and smaller pack sizes for discounter channels.

(See /supermarket-suppliers-uk/ for more on supplier strategy changes.)

In short, Aldi and Lidl are reshaping the UK grocery market share 2025 by teaching consumers that low price no longer means low quality.

Morrisons — Recovery And Restructuring

Morrisons’ share is around 8.4 percent.

It has not grown much, but it is trying to stabilise after several years of turbulence.

Under its private-equity ownership, the chain is closing under-performing sites and refitting core supermarkets.

Its strategy focuses on fresh food and British sourcing — areas where shoppers still trust the brand.

Morrisons owns many of its own factories and bakeries.

This vertical integration helps control costs and quality.

It also runs a wholesale arm supplying McColl’s and Amazon Fresh stores, which supports extra volume.

However, the market is unforgiving.

Discounters have taken share in Northern England and Scotland, Morrisons’ traditional base.

To compete, the retailer is introducing simpler pricing and new digital loyalty offers.

Within the UK grocery market share 2025, Morrisons sits in the middle tier — not small enough to move fast, not large enough to benefit from major scale savings.

Its recovery will depend on execution, especially as retailers sharpen sustainability goals across the sector, highlighted in our look at supermarket sustainability strategy.

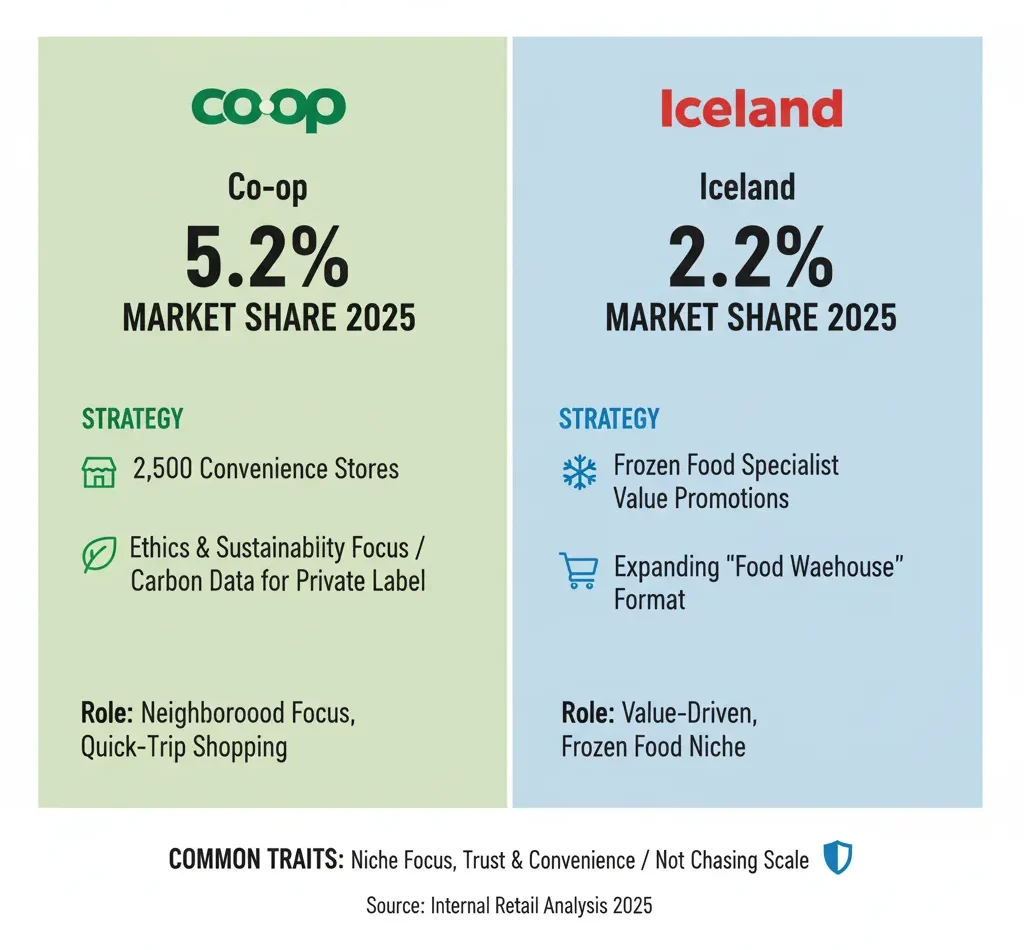

Co-op And Iceland — The Niche And Local Edge

While smaller in size, both Co-op and Iceland remain vital players in the UK grocery market share 2025.

Co-op

With 5.2 percent share, Co-op thrives in neighbourhood locations.

Its 2,500 convenience stores serve quick-trip shoppers, often in rural or urban centres with no large supermarket nearby.

Ethics and sustainability continue to shape Co-op’s image.

It was one of the first to publish full carbon data for its private label products.

(See /supermarket-sustainability-strategy/ for details on green initiatives across UK retail.)

Iceland

Iceland holds about 2.2 percent share in 2025.

The frozen-food specialist is using promotions and value packs to keep traffic steady.

Its “Food Warehouse” format, larger and cheaper than traditional Iceland stores, is expanding fast.

Both Co-op and Iceland prove that niche still matters.

They do not chase scale; they build trust and convenience.

That balance secures their place in the UK grocery market share 2025 story.

Analysis — How Shares Shifted Since 2024

Comparing 2024 and 2025 figures shows a slow but clear reshaping of UK grocery retail.

-

Tesco: Up around 0.4 percentage points to 28 percent.

-

Sainsbury’s: Up about 0.3 points to 15.1 percent.

-

Asda: Down nearly 0.9 points to 11.8 percent.

-

Aldi: Up 0.2 points to 10.9 percent.

-

Lidl: Up 0.4 points to 8.1 percent.

-

Morrisons: Flat at 8.4 percent.

-

Co-op and Iceland: Largely unchanged.

Inflation and promotion patterns are the main causes.

Grocery inflation hovered around 5 % in mid-2025 after months of easing , according to Reuters and Kantar.

This kept shoppers focused on low prices and value brands.

Private label growth has been remarkable.

Retailers report record own-label penetration, with value ranges growing fastest.

This trend directly impacts the UK grocery market share 2025, since discounters and big chains benefit the most.

Online grocery also stabilised.

Post-pandemic habits are returning slowly: more top-up shops, fewer large deliveries.

But Tesco and Sainsbury’s still hold more than half of UK online grocery volume.

For suppliers, power is concentrating in fewer hands.

Top four retailers now control over 60 percent of the market.

That means tighter negotiations and rising demands for sustainable packaging and transparent sourcing.

Why It Matters

The UK grocery market 2025 figures reveal more than competition; they show how consumer behaviour is shifting permanently.

Households are budgeting tighter.

Many shoppers have switched stores at least once in 2025 to chase cheaper baskets.

Discounters are expanding faster than ever.

Tesco and Sainsbury’s respond with price-match guarantees.

Asda and Morrisons try to defend share with loyalty apps and meal-deal pricing.

The small players focus on community value.

For manufacturers and suppliers, this reshuffle affects every level of planning — from packaging size to promotion calendars.

Working with the right retailer now depends on understanding where the volume is moving.

And in 2025, that volume is moving toward value formats, smaller packs, and private label lines.

Conclusion — Predictions For 2026

Looking ahead, 2026 will likely bring more consolidation.

Margins are tight, and only a few operators have scale big enough to absorb rising costs.

-

Tesco may aim for 30 percent market share by focusing on convenience, online growth, and private label innovation.

-

Sainsbury’s should hold steady around 15 percent and could widen its gap over Asda.

-

Asda must rebuild its price identity and could merge or partner in some logistics areas.

-

Aldi and Lidl will keep adding stores, likely surpassing 20 percent combined share by late 2026.

-

Morrisons will continue restructuring, possibly selling non-core assets to reduce debt.

-

Co-op and Iceland will focus on local loyalty and ethical positioning.

The UK market is entering a “three-block” structure:

-

Large multiples (Tesco and Sainsbury’s),

-

Discounters (Aldi and Lidl),

-

Mid-tier and niche (Morrisons, Co-op, Iceland).

Growth will depend on price perception, store access, and digital loyalty.

The companies that combine those three will win share next year.

In summary, the UK grocery market share 2025 marks the start of a more polarised industry — one where efficiency, trust, and private label decide success.